Prescription drug costs have become a front-and-center health benefits cost issue for U.S. employers in 2015, and in 2016 the challenge will be directly addressed through more aggressive utilization management (such as step therapy and prior authorization), tools to enable prescription intentions like DUR, and targeting fraud, waste and abuse.

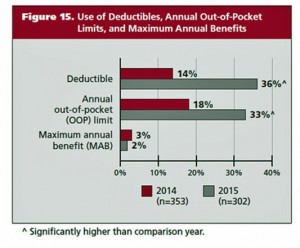

Consumers, too, will be more financially responsible for cost-sharing prescription drugs, in terms of deductibles and annual out-of-pocket limits, as described in the PBMI 2015-206 Prescription Drug Benefit Cost and Plan Design Report, sponsored by Takeda.

The Pharmacy Benefit Management Institute has published this report for 15 years, which provides neutral, detailed survey results highlighting employers’ views on prescription drug benefit plan design. This report’s research was fielded in April 2015.

The top goal for managing prescription drug benefits is, far and away, managing specialty drug cost trend, for 8 in 10 employers overall, and 9 in 10 of the larger employers. Below specialty drug cost management, other top goals for Rx benefit management include reducing inappropriate utilization (42%), improving adherence and persistency (35%), reducing drug acquisition costs (29%), and improving patient satisfaction (14%).

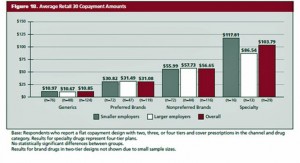

The most common plan design configuration for Rx is a 3-tier plan among 44% of employers (with fixed dollar co-pay) and 23% (with a percentage share of costs). Four-tier plans with dollar fixed co-pays are implemented by 18%, and four tiers with shared percentages (coinsurance) among 10% of employers.

Within each tear, average retail 30 day copayment amounts range from a low of nearly $11 for generics, $31 for preferred brands, $57 for nonpreferred brands, and $104 for specialty drugs.

Value-based benefit design tools are being adopted by employers for prescription drugs in 2016. These include rewards tied to participation in health risk assessments, reduced copayments for specific drug classes and health conditions, and incentives to motivate behavior change.

Health Populi’s Hot Points: PBMI notes that prescription drug benefits will be more complex for health consumers in 2016, in terms of more cost-sharing tiers, more options for consumers filling prescriptions, and narrower networks of providers. Consumers will bear more costs for medicines in 2016 and pressures from employers and plan sponsors to be more engaged, informed shoppers and users of the pharmacy.

The arrest today of Martin Shkreli, hedge fund exec who gained infamy by raising the price (“plundering”) Retrophin to pay debts, is a symbol of how specialty drug pricing is in the crosshairs of consumers, payors and healthcare providers alike. Furthermore, the demand for the Hepatitis C drugs Sovaldi and Harvoni in both Medicaid programs and the Veterans Administration adds to the media and public scrutiny of specialty drug pricing.

The American Medical Association (AMA) recently called for a ban on direct-to-consumer advertising. The AMA’s press release said, “Physicians strive to provide the best possible care to their patients, but increases in drug prices can impact the ability of physicians to offer their patients the best drug treatments. Patient care can be compromised and delayed when prescription drugs are unaffordable and subject to coverage limitations by the patient’s health plan. In a worst-case scenario, patients forego necessary treatments when drugs are too expensive.”

It’s getting clearer that in the health care ecosystem, pharma and biotech companies are on one side of this discussion, with health care providers (hospitals and physicians), payors (employers, unions), and health plans on the other. Consumers who are very sick want access to helpful medicines, but most do not believe they can afford the shared coinsurance percent amounts in benefit plans to pay for expensive prescription drugs. A key forecast point for 2016 is the growing stand-off between pharma/bio vis-a-vis the rest of the health care ecosystem. In the immediate/short term, pharma companies had best turbocharge their prescription drug access programs and bring transparency, and helpful tools for patients and doctors, to the marketplace. Longer-term (but to get going “now”), getting a handle on the true value of new-new products, and evangelizing that, will be Job 1.5.

Thank you FeedSpot for

Thank you FeedSpot for