As we concluded our panel on The Wizards of Maternal Health kicking off today’s launch of the 2016 Digital Health Summit, co-located with the 2016 CES (Consumer Electronics Show) in Las Vegas, our diverse team concurred that there’s more than enough “technology” on the convention floor. The challenge now for health is to make connections between the islands of devices, and generate meaningful data and culturally contextual information and support for consumers (patients, caregivers, people) and health providers.

As we concluded our panel on The Wizards of Maternal Health kicking off today’s launch of the 2016 Digital Health Summit, co-located with the 2016 CES (Consumer Electronics Show) in Las Vegas, our diverse team concurred that there’s more than enough “technology” on the convention floor. The challenge now for health is to make connections between the islands of devices, and generate meaningful data and culturally contextual information and support for consumers (patients, caregivers, people) and health providers.

Here at the CES, it’s all about the supply side of the equation – for health, that means digital health tools, wearables, remote health monitors, personal emergency response systems (PERS – the “I’m- falling-and-I-can’t-get-up” stuff), food tracking, sleep management, and increasingly more medical-oriented tech to help people manage chronic pain, diabetes, respiratory conditions, and other more disease-targeting devices.

Again, this is the supply side. But in a well-functioning market, the demand side must be considered. That demand side is the expressed willingness among people to pay for digital health tech – and these “payors” have traditionally been health insurance plans, employers, unions, government agencies (THINK: Federal Medicare, Federal+State Medicaid, the VA, et. al.), and other health plan sponsors.

Increasingly, thought, the patient is the payor, under the growing high-deductible heath plan era for people buying insurance in health marketplaces online or paying health insurance premiums for plans offered in the workplace.

In this patient-as-payor mode, the CES supply side showcased hundreds of options of shiny new things that consumers could pay for: the newest activity trackers from Fitbit, devices and apps in the growing health data ecosystem being built by Under Armour, the pain management device developed by Quell/Neurometrix, sensor tech for babies (such as the Mimo onesie and Edwin the Duck), and even health-tech for your pet.

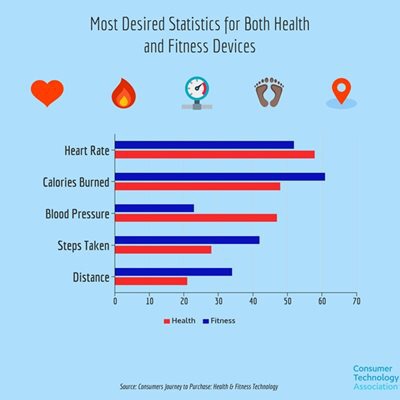

The Consumer Technology Association (CTA) has polled consumers in their latest research report, Consumers Journey to Purchase: Health & Fitness. CTA found that, while the broad category of health and fitness tech has been more popular for improving fitness than improving health, the dynamic is changing. Both segments of consumers — the health-driven and the disease-managing — want roughly the same things from their purchase of digital health tech, shown in the chart. These features include tracking stats such as blood pressure, heart rat, and sleep patterns. All people are keen on longer battery life, and food tracking.

An important finding for the healthcare side of the market is that consumers are open to sharing health data with physicians. “Consumers alrady share all their health information with medical professionals and that could be a reason why they are comfortable sharing statistics tracked regularly using health/fitness devices,” the report attests. However, consumers doubt how secure the connectivity is to share their health stats with doctors and fear data security/data breach risks. Still, most consumers believe that they can act upon their health stats effectively by extending access of their personal health information to their physicians.

Health Populi’s Hot Points: There’s another part of the demand side that must be considered as digital health tech shown at the CES looks for health provider adoption. Accenture’s latest report on the topic found that among the largest 100 U.S. hospitals, 66% offer mobile apps to patients. However, only 2% of patients are being reached by hospitals’ mobile offerings.

Health Populi’s Hot Points: There’s another part of the demand side that must be considered as digital health tech shown at the CES looks for health provider adoption. Accenture’s latest report on the topic found that among the largest 100 U.S. hospitals, 66% offer mobile apps to patients. However, only 2% of patients are being reached by hospitals’ mobile offerings.

There is, thus, a chasm between the supply and demand sides of digital health tech — and indeed, between the two key stakeholders on the demand side, consumers and their health care providers.

We come full circle, then, back to my Wizards of Maternal Health, who converge on a big theme also brainstormed last night at the Philips health care salon I attended: that it’s time for us to bridge the islands in the health care/data/consumer ecosystem.

Thank you FeedSpot for

Thank you FeedSpot for