American workers are feeling financial stress and uncertainty, struggling with health care costs, and seeking support for managing finances. 75% of employees feel financially insecure, with 60% feeling stressed about their financial situation, according to the 2016 Workplace Benefits Report, based on consumer research conducted by Bank of America Merrill Lynch.

The overall feeling of financial wellness fell between 2013 and 2015. 75% of U.S. workers don’t feel secure (34% “not very secure” and 41% “not at all secure”), with the proportion of workers identifying as “not at all secure” growing from 31% to 41%. Financial wellness was defined for this study as how well people feel they’re able to meet both future goals and present-day needs, from a high of “financially secure” (very secure) to a low of “struggling,” or not at all secure.

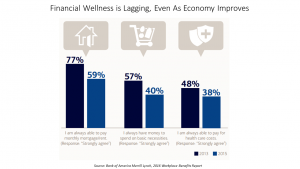

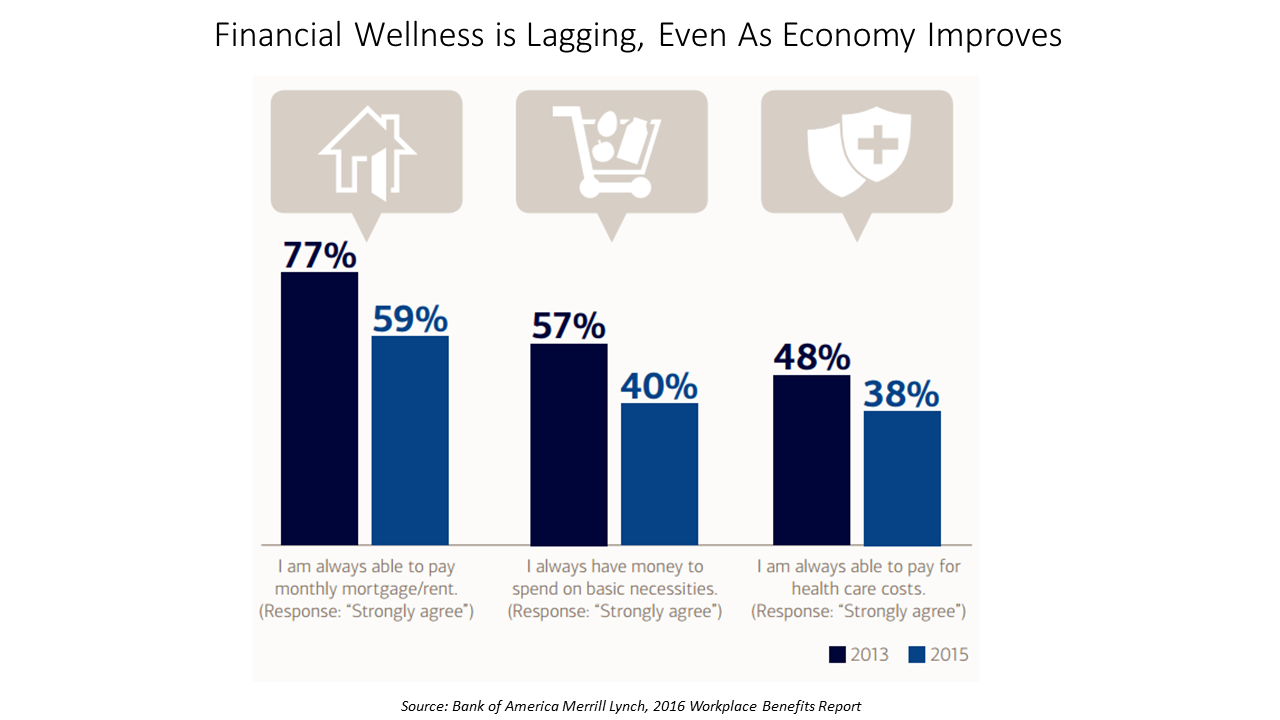

Three key measures of financial wellness declined between 2013 and 2015, even as the U.S. economy improved, shown in the first chart:

- 59% of workers said they’re always able to pay their monthly mortgage or rent in 2015, down from 77% in 2013

- 40% of people always have money to spend on basic necessities, declining from 57% in 2013

- 38% say they’re always able to pay for health care costs, falling from 48% in 2013.

Nearly 7 in 10 employees have seen increased health care costs over the past two years, highlighted in the second graphic. Furthermore, people under-estimate the amount of savings they’ll need to pay for health care in retirement. 4 in 10 workers estimate they’ll need under $500,000 in retirement savings assets. However, this is insufficient in light of projections for health costs in retirement averaging $400,000 for a couple retiring at age 65 based on HealthView Services 2015 Retirement Health Care Report.

The WBR is published annually based on a survey of 1,227 employees in 401(k) plans administered by Bank of America Merrill Lynch in October and November 2015. The poll looked at Millennials (18-34 years), Gen X (35-50 years of age), and Boomers (51-69 years old).

Health Populi’s Hot Points: Bank of America Merrill Lynch counsel employers to incorporate workers financial lives into an overall culture of health in their organizations. To do so will require companies to carefully craft benefit offerings that bring together both digital and human resources to bolster benefit programs’ ROI and engagement. While more Millennials are comfortable using online tools (65% Millennials vs. 42% Boomers), more Millennials and Gen Xers are also keen to access a one-on-one relationship with a financial professional.

BofA Merrill Lynch teach a valuable lesson here: don’t assume that younger people are all-digital, all-the-time when it comes to health and financial management. Empathy goes a long way to bolstering health and financial wellness and drive a greater ROI on benefit investments.

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a