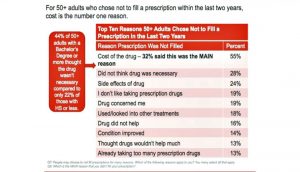

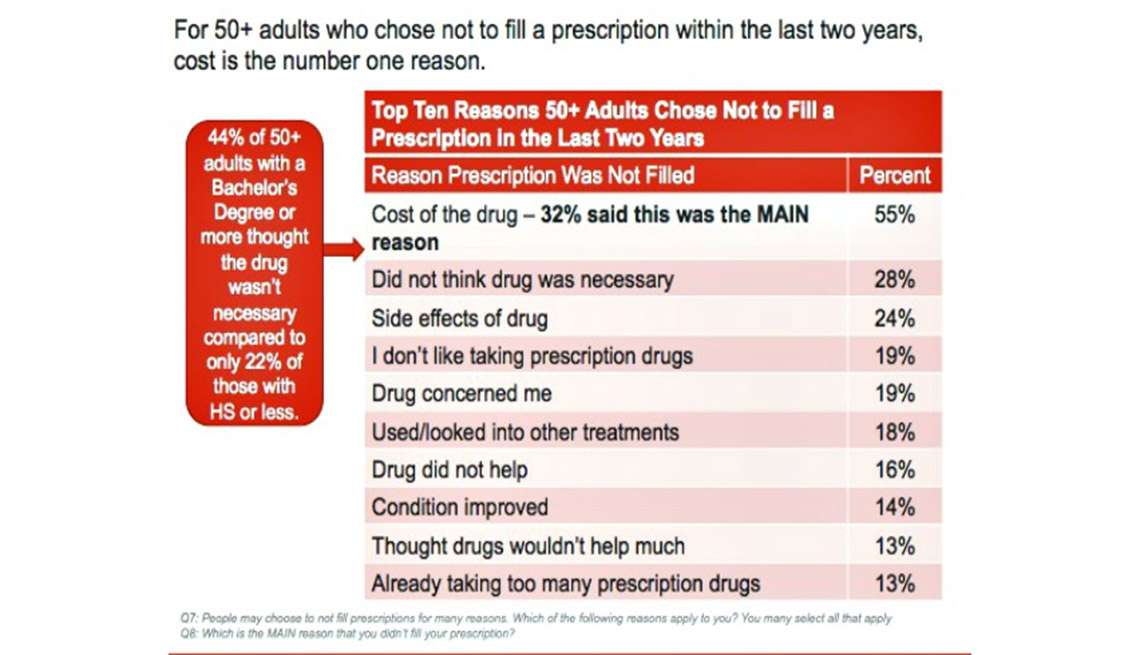

The top reason people in America over 50 don’t fill a prescription is the cost of the drug, according to the AARP 2015 Survey on Prescription Drugs.

The top reason people in America over 50 don’t fill a prescription is the cost of the drug, according to the AARP 2015 Survey on Prescription Drugs.

Eight in 10 people 50+ think the cost of prescription drugs is too high, and 4 in 10 are concerned about their ability to afford their medications. Thus, nearly all people over 50 think it’s important for politicians (especially presidential candidates) to control Rx drug costs.

Older consumers are connecting dots between the cost of their medications and direct-to-consumer prescription drug advertising: 88% of the 50+ population who have seen or heard drug ads in the past 30 days have rising out-of-pocket costs. 79% of 50+ people with rising OOP for drugs also say pharma companies spend too much money on drug ads.

Among the study’s other findings, note that:

- Three-quarters of 50+ adults take prescription medication on a regular basis; the percentage is even higher for older seniors

- Over four in ten 50+ adults are concerned about being able to afford their meds

- Eight in ten older adults say that drug companies make too much profit and should be required to explain how products are priced

- Most U.S. older adults believe it should be legal to buy prescription drugs in Canada and Europe (known as “reimportation”)

- Nine in 10 50+ adults support allowing Medicare to negotiate for lower drug prices

- Eight in ten oppose of drug companies’ delaying the availability of lower-cost generic substitutes.

AARP commissioned GfK to conduct the online survey of 1,834 adults age 50+ in December 2015.

Health Populi’s Hot Points: This week, the pharma lobby group PhRMA, the Pharmaceutical Research and Manufacturing Association, launched an ad campaign, From Hopes to Cure, featuring patient voices to promote the good work of the industry. The link provided here goes to a page on the PhRMA website under the theme of “Value.”

Health Populi’s Hot Points: This week, the pharma lobby group PhRMA, the Pharmaceutical Research and Manufacturing Association, launched an ad campaign, From Hopes to Cure, featuring patient voices to promote the good work of the industry. The link provided here goes to a page on the PhRMA website under the theme of “Value.”

This is a wise connecting-of-dots for patients, now health consumers, who are facing the prospect of higher-cost drugs for conditions that can often be cured through specialty drug therapies. The specialty drug category is the fastest-growing cost, percentage-wise, in the U.S. health care bill, which I’ve been spending more time addressing here on Health Populi. Specialty drugs could comprise as much as 17% of U.S. health care spending this year.

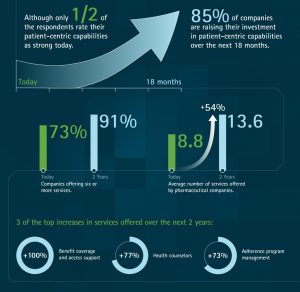

Value is in the eye of the beholder, and goes beyond cost — although for a health consumer earning an average household income of around $55,000 a year in the U.S., and retirees on fixed incomes, the cost of a specialty drug can result in medical sticker shock. Enter the role of patient services provided by pharma companies — surrounding “value around the pill” or therapy. This is the central theme in Accenture’s new report, The Patient Is IN: Pharma’s Growing Opportunity in Patient Services. As the third graphic, from the report, quantifies, companies are planning to significantly grow consumer-focused services they offer in the next two years. Virtually all pharmas Accenture studied plan to invest in patient engagement technologies over the next 18 months. The fastest-growing service areas are expected to be benefit coverage and access support, transportation, engagement insight development, health coaching, adherence management, co-pay assistance programs (tied to the first item, access), remote monitoring, affordability and reimbursement support (again, coupled with access and co-pay assistance), and nursing support.

Value is in the eye of the beholder, and goes beyond cost — although for a health consumer earning an average household income of around $55,000 a year in the U.S., and retirees on fixed incomes, the cost of a specialty drug can result in medical sticker shock. Enter the role of patient services provided by pharma companies — surrounding “value around the pill” or therapy. This is the central theme in Accenture’s new report, The Patient Is IN: Pharma’s Growing Opportunity in Patient Services. As the third graphic, from the report, quantifies, companies are planning to significantly grow consumer-focused services they offer in the next two years. Virtually all pharmas Accenture studied plan to invest in patient engagement technologies over the next 18 months. The fastest-growing service areas are expected to be benefit coverage and access support, transportation, engagement insight development, health coaching, adherence management, co-pay assistance programs (tied to the first item, access), remote monitoring, affordability and reimbursement support (again, coupled with access and co-pay assistance), and nursing support.

Accenture concludes the report with Health Populi’s top-line: “Articulating the patient and economic value of services needs to be central to healthcare professional interactions.” Pharma’s not alone in driving the medication/therapeutic value to patients: doctors and clinicians are trusted intermediaries for patients, and healthcare professionals are the front-line communicators in shared decision-making and health financial conversations with patients. Achieving healthcare value is now everybody’s business.

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for