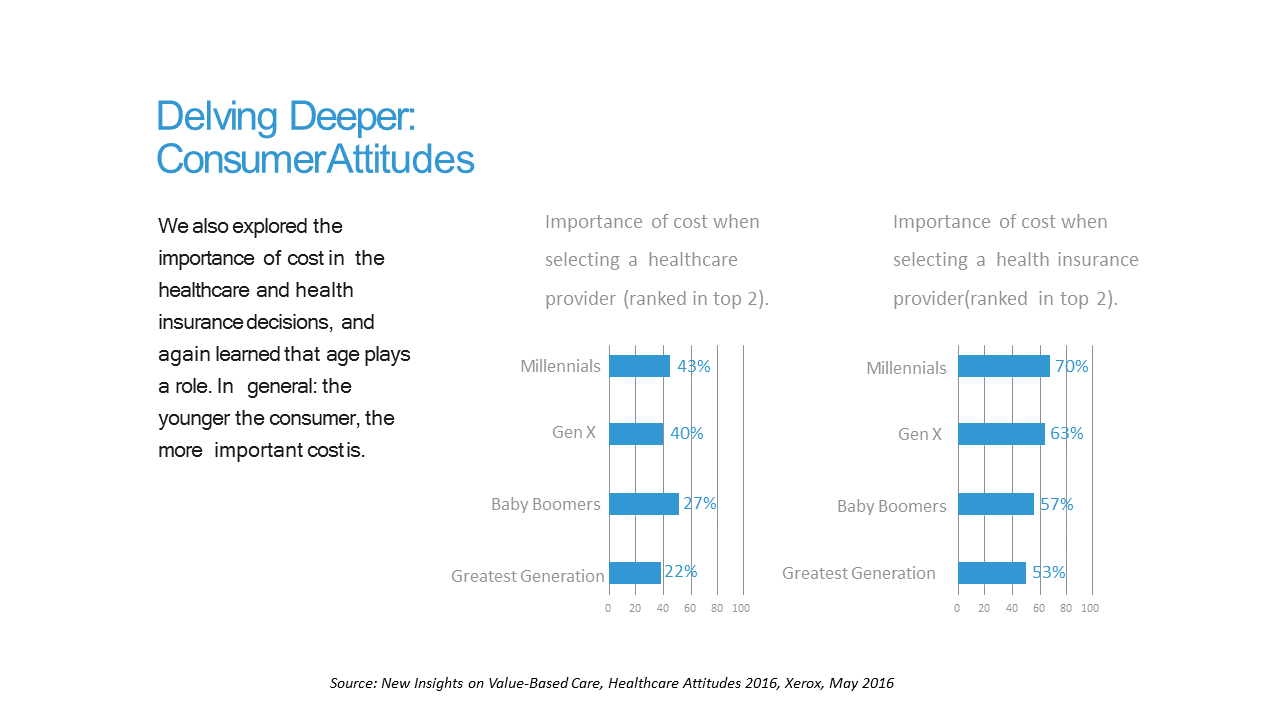

Cost ranks first among the factors of selecting health insurance for most Americans across the generations. As a result, most consumers are likely to shop around for both health providers and health plans, learned through a 2016 Xerox survey detailed in New Insights on Value-Based Care, Healthcare Attitudes 2016.

Cost ranks first among the factors of selecting health insurance for most Americans across the generations. As a result, most consumers are likely to shop around for both health providers and health plans, learned through a 2016 Xerox survey detailed in New Insights on Value-Based Care, Healthcare Attitudes 2016.

The younger the consumer, the more important costs are, Xerox’s poll found, shown in the first chart. Thus, “shopping around” is more pronounced among younger health consumers — although a majority people who belong to Boomer and Greatest Generation cohorts do shop around for both health providers and health insurance plans — 82% of Millennials and 84% of Gen X’ers shop for providers; 69% of Boomers and 56% of those in the Greatest Generation shop for providers.

Millennials and Gen X’ers are more likely to self-ration health care services due to cost than are older people, ratcheting down by age and illustrated in the second graph. While fully one-half of Millennials have delayed or not sought healthcare treatment due to cost, 39% of Boomers and 15% of Greatest Generation patients haven’t sought care due to cost.

There’s a disconnect worth noting here for Millennials and health care providers: while these younger health consumers would be more likely to limit care due to cost, they’re also the people more likely to look for encouragement from healthcare providers to making healthy lifestyle choices.

While most health consumers of all ages say access to their electronic medical records would help them be more conscious about making healthy lifestyle decisions, Millennials and Gen X’ers would be more likely to do so. Most health consumers across the generations would also “wish” that their pharmacist, health provider and plan were more connected with their personal health.

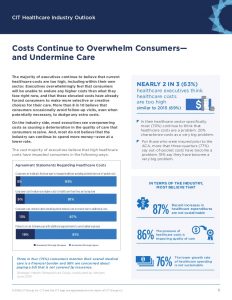

Health Populi’s Hot Points: Consumers/patients are the central noun in healthcare, and in their personal health economics are central to their healthcare lives. A CIT Harris Poll confirms that health care executives understand this, universally agreeing that consumers will be unable to endure higher costs than what they currently face. The bar chart shown in the third graphic on consumers’ costs from the CIT survey conveys health execs’ agreement that consumers are:

Health Populi’s Hot Points: Consumers/patients are the central noun in healthcare, and in their personal health economics are central to their healthcare lives. A CIT Harris Poll confirms that health care executives understand this, universally agreeing that consumers will be unable to endure higher costs than what they currently face. The bar chart shown in the third graphic on consumers’ costs from the CIT survey conveys health execs’ agreement that consumers are:

- Looking for ways to manage their healthcare spending and minimize out-of-pocket costs

- Being selective in deciding which medical care to receive due to additional costs, and

- Not following up with additional appointments to avoid added expenses.

Two-thirds of these executives say that healthcare costs are too high.

To respond to consumers’ pressing healthcare cost/rationing mode, some of the executives’ tactics will be to:

- Offer generic and low-cost pharmaceuticals

- Add wellness programs for employees

- Explore different carriers and vendors (their own “health care shopping” mode similar to consumers’)

- Offer discounts

- Bolster employee responsibility for taking care of themselves,

among others.

As value-based care becomes the new normal in U.S. healthcare, these executives will recognize that what are high costs are also profit margins for their businesses. The cost-price blame game has ensued, with 56% of these execs looking to insurance companies to lower costs, 52% looking to healthcare providers to do so, and 50% seeking pharmaceutical companies to pitch in on reducing costs.

In the meantime, consumers will continue to bear more financial risk in health care, shop around, and — among Millennials and Gen X’ers — continue to be in healthcare self-ration mode. They’ll be looking for alternatives outside of the legacy healthcare system players, who continue to play the blame game on costs.

Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a