Today is Financial Wellness Day. Do you know how financially well you are?

Today is Financial Wellness Day. Do you know how financially well you are?

Let me take a crack at that answer, even though I haven’t seen your bank account (which you may not even have as over 20% of people in the US are, as financial services companies would call you “un-banked” or “under-banked”.)

You have some level of fiscal stress, ranging from a little to a lot. You aren’t taking all of your summer vacation your employer extends to you. You’re spending around $1 in every $5 of your household budget on health care. And your sleep isn’t as high quality as it could be – an epidemic in America.

Health care costs are increasingly burdening US consumers, whose out-of-pocket spending continues to rise based on a study published today by TransUnion. 51% of US consumers owed their health providers at least $1,000 in the first quarter of 2016; 8 in 10 people owed health providers at least $500.

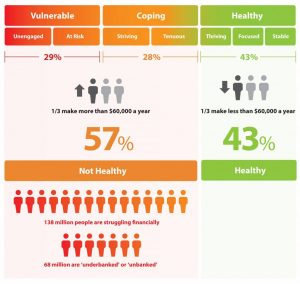

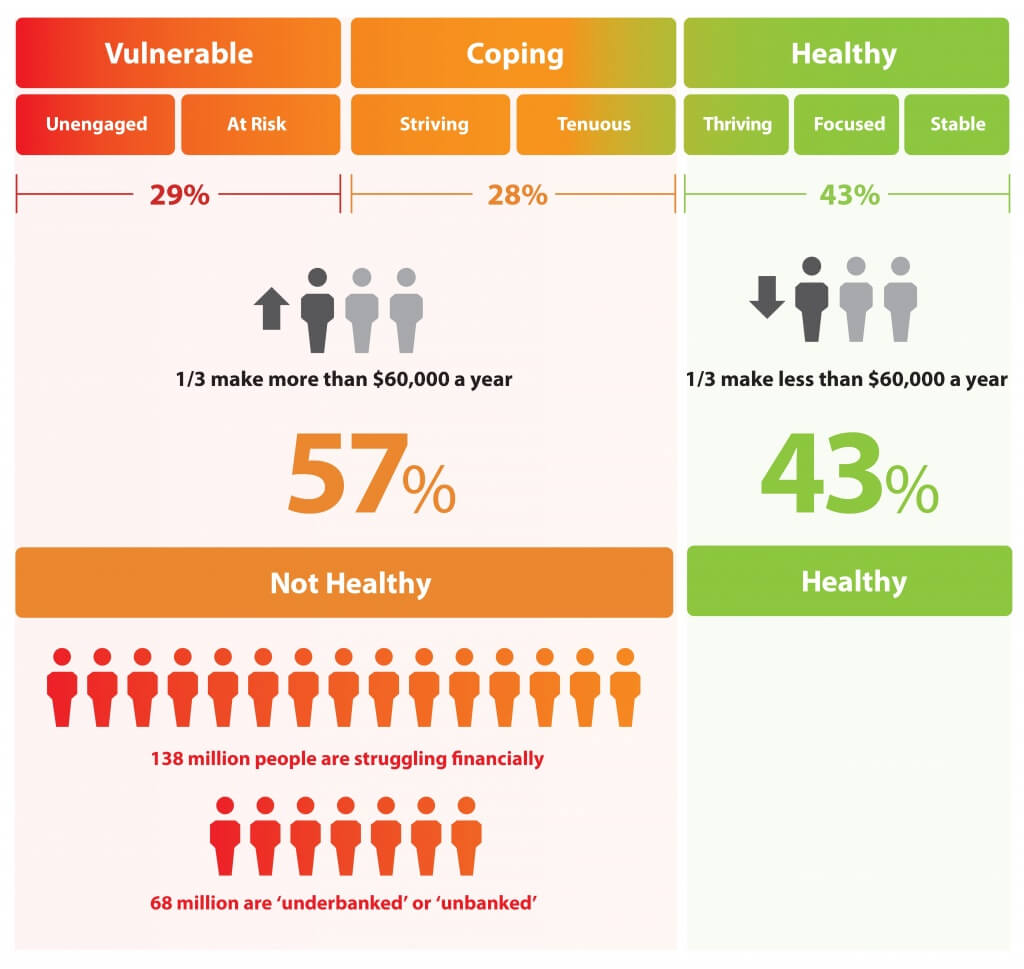

What keeps me up at night: 57% of Americans are struggling financially, according to the Center for Financial Services Innovation (CFSI).

These are some of the stats I’ve been curating to get a bead on the state of Americans’ collective fiscal wellness. The picture isn’t pretty or healthy.

CFSI has identified four segments of consumers relative to their financial health: we are either financially…

- Striving: making ends meet but not satisfied.

- Tenuous: not planning ahead for unexpected expenses or regularly budgeting.

- Un-engaged: financially un-engaged avoiding traditional financial services.

- At-risk: most likely to live paycheck to paycheck, struggling to keep up with bills.

CFSI created the Twitter hashtag #FinHealthMatters, which I will use ongoing in my writing and socializing on the topic.

Health Populi’s Hot Points: As the wordle illustrates, people associate “wellness” with many aspects of daily living (and sleeping), from intellectual to occupational, spiritual, exercise, and social.

Health Populi’s Hot Points: As the wordle illustrates, people associate “wellness” with many aspects of daily living (and sleeping), from intellectual to occupational, spiritual, exercise, and social.

The illustration is based on survey results from the Edelman Health Engagement Barometer in response to the question, “how do you define personal health and wellness?” The vast majority of people respond,

- Physical health

- Mental and emotional health

- Physical appearance, and

- Financial health.

Given that 57% of consumers in the US say they’re struggling financially, we can connect the dots and observe that over one-half of American health citizens are also unwell due to fiscal stress.

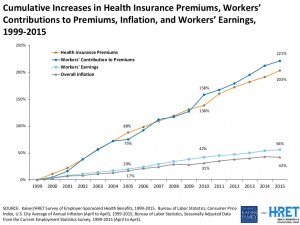

Health policies must recognize the importance of financial wellness in overall health. The irony of health care costs in America is that workers receiving health insurance at the workplace have largely traded off wage increases for health care coverage.

Health policies must recognize the importance of financial wellness in overall health. The irony of health care costs in America is that workers receiving health insurance at the workplace have largely traded off wage increases for health care coverage.

Escalating health care costs, borne by workers’ wage trade-offs, have not translated into uniformly positive health outcomes, although the US spends more on health care per person than any other country on Earth.

Financial wellness is determined by many factors: good jobs, a culture of saving, and a social safety net. Investing in the social determinants of health — fair wages, education, good food systems, connectivity, and other factors — will help to drive financial wellness in the U.S.

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a