Millions of U.S. patients have more financial skin in the American health care game. But are they behaving like the “consumers” they are assumed to be as members in consumer-directed health plans?

Not so much, yet, explained John Park, Chief Strategy Officer at Alegeus, during a discussion of his company’s 2016 Healthcare Consumerism Index. This research is based on an online survey of over 1,000 U.S. healthcare consumers in April 2016.

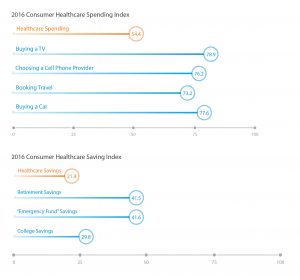

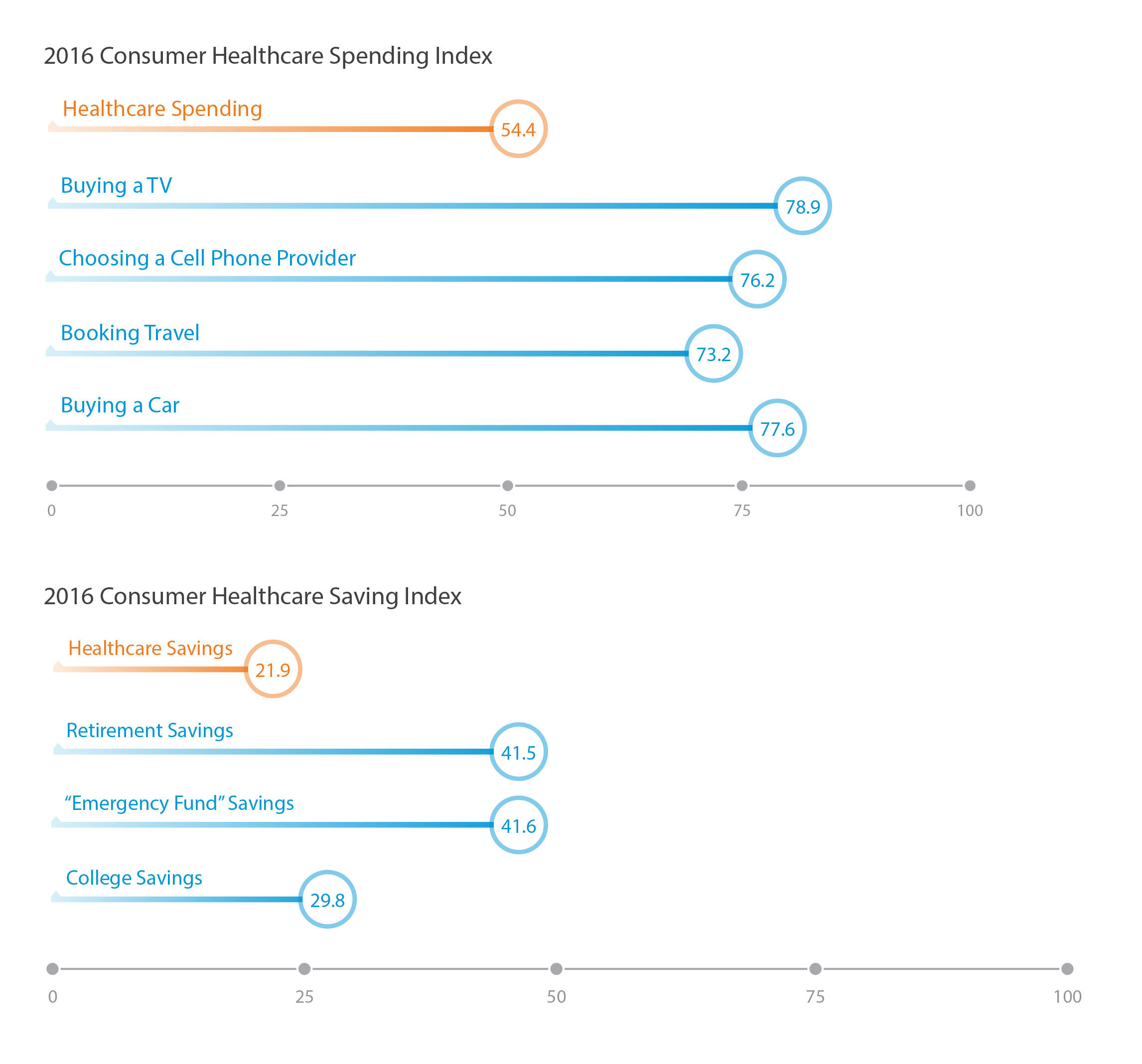

Alegeus looks at healthcare consumerism across two main dimensions: healthcare spending and healthcare saving. As the chart summarizes, consumers show greater engagement and focus on buying a TV or car, choosing a mobile phone provider, and booking travel than they do on healthcare spending. While the index statistic on consumer engagement on healthcare spending increased from 48.3 in 2015, attention to the behavior still lies well below other spending priorities.

Digging into the survey research under the health spending theme, Alegeus found that 3 in 4 consumers are focused on getting the best value for health care dollars; specifically,

- 59% of consumers research procedure effectiveness and success rates

- 54% research physician and facility quality ratings

- 54% seek second opinions on diagnosis and treatment options.

All three of these actions have increased among consumers.

U.S. consumers scored an index of 21.9 when it came to healthcare saving. When it comes to savings behavior, consumers are more focused on retirement savings and emergency fund savings (indexed virtually the same at 41.5 and 41.6, respectively), and on college savings (at 29.8). Factors underneath these savings behaviors are that,

- 69% of people aren’t confident they’ve maximized their tax benefit for healthcare savings

- 66% of consumers don’t know how much they need to save for healthcare costs this year, and

- 23% are aggressively saving for healthcare.

Alegeus notes that only 50% of consumers are making contributions toward retirement each month, which is 2x the number of consumers saving for healthcare.

That’s the description of the “demand side” for consumerism — how people are expressing their spending and saving behaviors in health care. On the supply side, note that employers are increasingly offering consumer-directed health plans to employees, with 90% offering an FSA, 44% an HSA, and 20% an HRA. Often coupled with these health savings arrangements are consumer engagement and health management programs to bolster employee participation. Health management programs are offered by 81% of companies (with over 200 employees), and 31% of companies offer these programs tied with incentives.

Alegeus recognizes that the needle is moving on consumers’ engagement in healthcare consumerism — with a long way to go, signaling a need for education, tools, and support as people assume more financial responsibility for health care costs.

Health Populi’s Hot Points: The over-arching finding of this study is that saving for healthcare costs will be a big mind-and-money shift for Americans.

Health Populi’s Hot Points: The over-arching finding of this study is that saving for healthcare costs will be a big mind-and-money shift for Americans.

The personal savings rate in the U.S. was 5.4% in April 2016 (reported for July 2016). For context, the savings was reached an all-time high of 17% in May 1975 and a low of 1.9% in July 2005.

The U.S. Bureau of Economic Analysis calculates this data point as the ratio of personal income saved to personal net disposable income during a period of time (in this case, monthly).

Let’s do some simple arithmetic for further contextualizing overall personal saving with the micro-savings categories — retirement, emergency, college and healthcare. The median family income in the U.S. in 2015 was $53, 482. Multiply that income by 5.4%, and you get a product of $2,888.

Now consider the following statistics on health care spending by consumers in the U.S.:

- The average annual health insurance premium borne by a U.S. worker in 2015 was $4,955. This premium spend was higher for workers in small firms (under 200 workers) at $5,904.

- The average annual deductible for a worker with an employer-based health plan with a deductible in 2015 was $1,318

- The average American’s prescription drug bill was $1,370 in 2014. If you were managing Hepatitis C and prescribed Gilead’s Sovaldi or Harvoni, the cost per pill (per pill) that year was 1,000 and $1,125, respectively.

The new healthcare consumer is faced with the challenge of both shopping and saving, as Alegeus points out. Shopping is enabled through transparency of information (good, useful, well-articulated information on cost, quality, and availability), tools for comparing alternatives, and a fairly frictionless market in terms of access and transportation/location. Shopping also depends on a person’s level of literacy, and that’s literacy of many flavors: general literacy, health literacy, digital literacy (how to access information online), health plan literacy (knowing what your health insurance will cover and how to effectively use the benefits), and financial literacy (knowing how to calculate, say, a 20% coinsurance for a specialty drug cost).

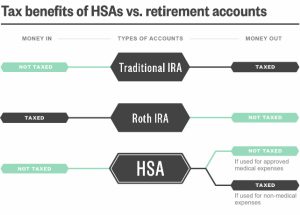

Spending literacy has to do with estimating how much to save for a health spending account –which 66% of consumers in the Alegeus poll said they don’t know how to estimate. Furthermore, 2 in 3 consumers (69%) admitted they probably weren’t maximizing their health spending accounts for maximum tax efficiency.

Spending literacy has to do with estimating how much to save for a health spending account –which 66% of consumers in the Alegeus poll said they don’t know how to estimate. Furthermore, 2 in 3 consumers (69%) admitted they probably weren’t maximizing their health spending accounts for maximum tax efficiency.

The fact that the spending account for health care is triple-tax advantaged — saving that’s pre-taxed, earns interest, and then spendable without a tax event — is largely un-known by legions of new healthcare consumers.

Alegeus’s findings show us that, indeed, we’ve only just begun to try on our healthcare consumer hats. We don’t wear them well, yet.

Thank you FeedSpot for

Thank you FeedSpot for