Health care payment responsibility continues to shift from employers to employee-patients, More of those patients are morphing into financially burdened health consumers, according to TransUnion, the credit agency and financial risk information company, in the TransUnion Healthcare Report published in June 2016.

Health care payment responsibility continues to shift from employers to employee-patients, More of those patients are morphing into financially burdened health consumers, according to TransUnion, the credit agency and financial risk information company, in the TransUnion Healthcare Report published in June 2016.

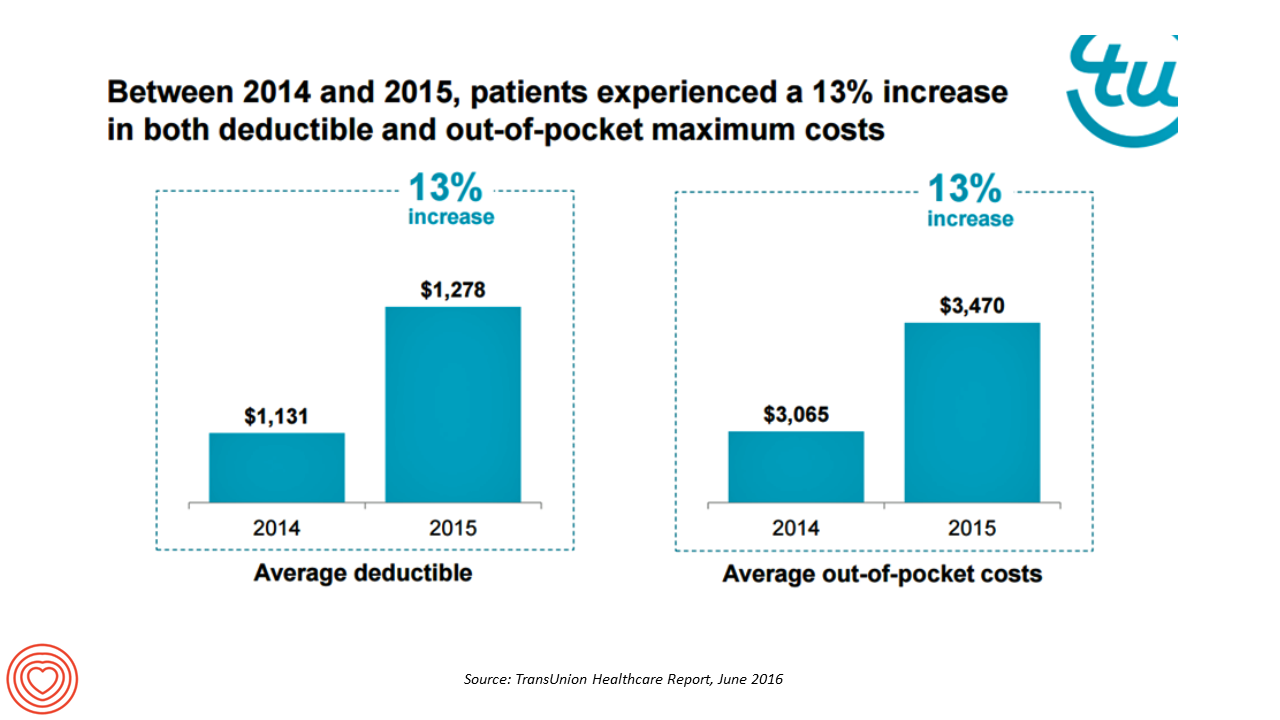

Patients saw a 13% increase in their health insurance deductible and out-of-pocket (OOP) maximum costs between 2014 and 2015. At the same time, the average base salary in the U.S. grew 3% in 2015, SHRM estimated. Thus, deductibles and OOP costs grew for consumers more than 4 times faster than the average base salary from 2014 to 2015.

In 2015, medical procedures with the highest out-of-pocket costs were:

- Dermatology, $2,451

- Orthopedic surgery, $2,405

- General surgery, $2,264

- Psychiatry and neurology, $2,198

- Plastic surgery, $2,195

- Cardiology, $2,020.

These out-of-pockets caused one-half of patients in the first quarter of 2016 to owe more than $1,000 to health care providers. 77% of patients owed over $500 to their providers in Q1-16.

Health Populi’s Hot Points: It’s noteworthy that TransUnion’s website positions the company’s mission, “to help people everywhere access the opportunities that lead to a higher quality of life.”

Financial un-wellness can lead to stress that compromises health and that quality of life, along with poor fiscal outcomes for health care providers whose CFOs are challenged with growing patient receivables and bad debt burdens.

The TransUnion survey demonstrates the opportunity for better service design and financial literacy programs that feature consumer-friendly bills, education programs on health costs and payments based on a person’s own health plan’s intricacies, and financial payback programs that suit a family’s budget. Check out the Healthcare Financial Management friendly billing project, along with Mad*Pow’s “A Bill You Can Understand” design project.

Furthermore, for employees who have the opportunity to contribute to a health savings account, effective communications should inform people of the triple-tax advantaged nature of the HSA — allowing people to invest pre-tax dollars, grow the dollars without being taxed, and withdraw the monies without a tax. Most consumers with an HSA investment opportunity still do not understand the benefit of that benefit.

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for