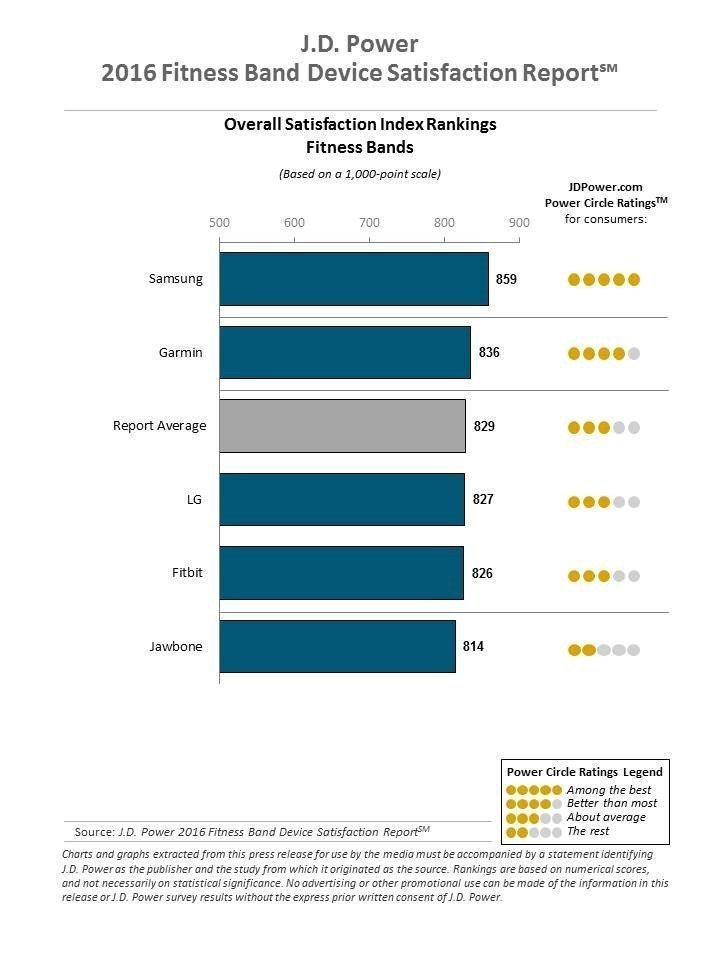

J.D. Power, the company best known for evaluating consumers’ experiences with automobiles, published its 2016 Fitness Band Device Satisfaction Report this week. The bar chart summarizes overall satisfaction with activity tracking wristbands, led by Samsung with the highest index score, followed by Garmin. Below the average index were LG, Fitbit, and Jawbone. Samsung’s top grade translates into J.D. Power’s methodology as “among the best” fitness bands, based on a 1,000 point scale.

Samsung’s high ranking was earned based on particularly strong scores for customer satisfaction in comfort, reliability, and ease of use. Garmin’s customer service was also highly rated, along with ease of use, strength/durability, and reliability.

Consumers’ fitness band purchases are most influenced by information via online shopping websites (read: Amazon far and away the top e-commerce channel for the category) and recommendations of friends and family.

J.D. Power evaluates fitness band trackers based on reliability, strength/durability, ease of use, battery life, price, variety of features, comfort, styling and appearance, display size, apps available, and customer service, in order of importance. The survey covered 2,949 consumers who purchased a fitness band in the past 12 months, fielded in May-June 2016.

Health Populi’s Hot Points: The signs that wearable technology for health and fitness is reaching the mass middle are in many places across retail touch points:

- Target has launched a connected home store concept to test shoppers’ demand for “smartening up” their living spaces

- Fossil is expanding wearable tech with “Misfit Wearables” inside

- Withings is marketing its portfolio of products in kiosks in grocers such as my local Wegmans store

- UnitedHealthcare recently announced its purpose-made tracker, the Motion, for the company’s new wellness program launched with Qualcomm.

Note that J.D. Power’s practice in telecom, media and technology did the research into fitness bands. That’s a technology focus — not a health or fitness focus. It’s the hardware, not the outcomes, that are the emphasis of this study.

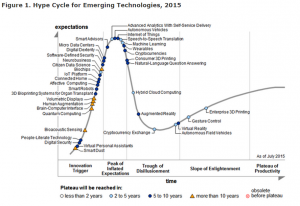

Gartner’s 2015 Hype Cycle for emerging technology shows wearables falling down from the peak of inflated expectations and into the trough of disillusionment, expecting the category to mature over the next five to ten years. This may correspond well with the growth of value-based health payments, which focus on patient outcomes. Fitbit has begun to talk with the FDA about medicalizing the company’s products, and increasingly the brand of devices appears in peer-reviewed medical journals and technology trade publications. For example, in the past month, the use of the Fitbit Aria in a breast cancer trial at Dana-Farber was featured in Wareable.

Gartner’s 2015 Hype Cycle for emerging technology shows wearables falling down from the peak of inflated expectations and into the trough of disillusionment, expecting the category to mature over the next five to ten years. This may correspond well with the growth of value-based health payments, which focus on patient outcomes. Fitbit has begun to talk with the FDA about medicalizing the company’s products, and increasingly the brand of devices appears in peer-reviewed medical journals and technology trade publications. For example, in the past month, the use of the Fitbit Aria in a breast cancer trial at Dana-Farber was featured in Wareable.

So is a fitness tracker a telecom technology, a media platform, or a medical device? It may be all three, making J.D. Power’s choice to locate this study in its telecom/media group as good as any other research division at the organization. Consumers see health engagement everywhere, from healthcare to entertainment, financial services to consumer electronics. Over the next decade, the market segment will find its fit….chaos before creation.

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for