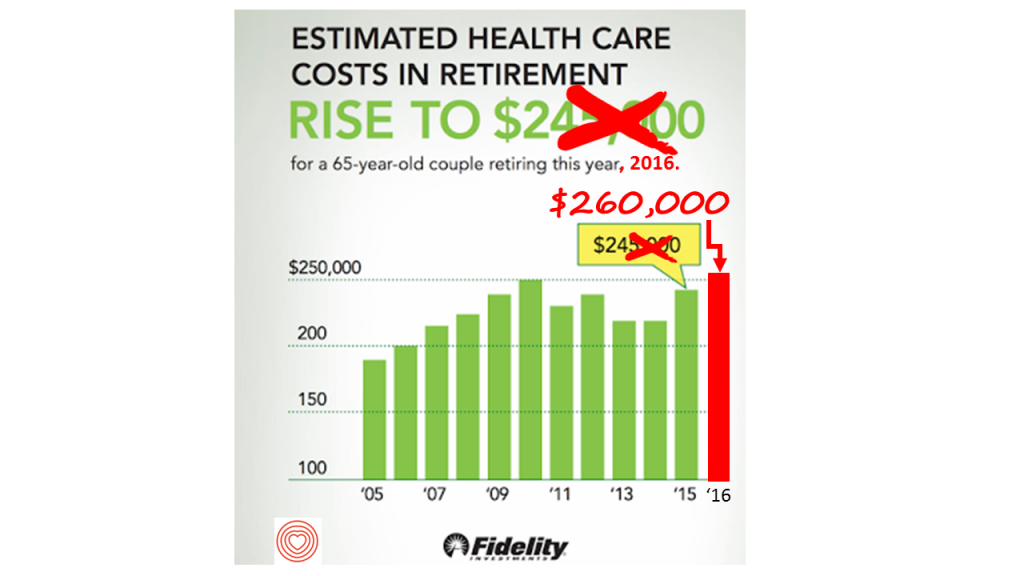

If you’re retiring in 2016, you’ll need $260,000 to cover your health care costs during your retirement years. In 2015, that number was $245,000, so retiree health care costs increased 6% in one year according to Fidelity’s Retirement Health Care Cost Estimator.

If you’re retiring in 2016, you’ll need $260,000 to cover your health care costs during your retirement years. In 2015, that number was $245,000, so retiree health care costs increased 6% in one year according to Fidelity’s Retirement Health Care Cost Estimator.

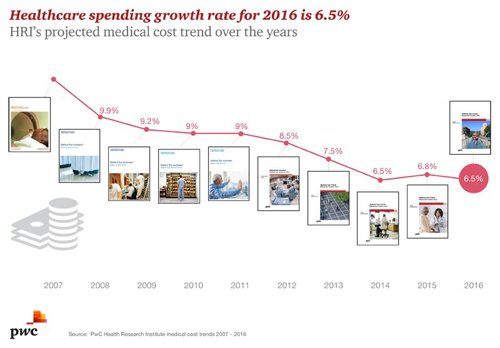

The 6% annual cost increase is exactly what the National Business Group on Health found in their recently published 2017 Health Plan Design Survey polling large employers covering health care, discussed here in Health Populi.

The 6% health care cost increases are driven primary by people using more health services and the higher costs for many medicines — specifically, specialty drugs whose costs are fast-increasing (covered here in Health Populi, The Rise and Rise of (Specialty) Prescription Drug Prices.

The $260K covers people in the U.S. retiring with traditional Medicare coverage paying insurance premiums, health service copayments and deductibles, and out-of-pocket expenses for prescription drugs.

Fidelity expects that health care spending costs will continue to increase more in the coming years — albeit more slowly than the double-digit increases of the mid-2000s.

Health Populi’s Hot Points: To save one-quarter of a million dollars as of mid-2016 would mean that a 21-year-old person starting in 1971 would have had to invest $136 a month, every month, for 45 years assuming a 5% return compounded annually.

Health Populi’s Hot Points: To save one-quarter of a million dollars as of mid-2016 would mean that a 21-year-old person starting in 1971 would have had to invest $136 a month, every month, for 45 years assuming a 5% return compounded annually.

The fact is that a 5% return is well above any sort of savings accounts or FDIC-protected investments a U.S. investor might have garnered even if they religiously put away $136 monthly for 45 years. Medical inflation, even at a “low” 6% per annum, is still significantly over general consumer price inflation which is been very low in the past several years.

Fidelity is in the investment business, and so tethered to this press release on retirement costs is a recommendation to save in Health Savings Accounts (HSAs) — with their triple-tax advantage. I am a fan of these and often discuss them in my work — recently here for the Intuit Tax and Financial Center.

The new consumer-facing retail health world in the U.S. requires us to don financial wellness hats, as healthcare money savers. The good news is that more Americans are saving more for retirement, Bankrate learned in a consumer survey finding that Americans felt greater financial security in mid-2016. Health citizens of America will need to keep that sense of savings going over the long haul to be able to pay for health care services during retirement.

The new consumer-facing retail health world in the U.S. requires us to don financial wellness hats, as healthcare money savers. The good news is that more Americans are saving more for retirement, Bankrate learned in a consumer survey finding that Americans felt greater financial security in mid-2016. Health citizens of America will need to keep that sense of savings going over the long haul to be able to pay for health care services during retirement.

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for