It takes a couple to bend the health care cost curve when you’re senior in America, according to the EBRI‘s latest study into Differences in Out-of-Pocket Health Care Expenses of Older Single and Couple Households.

It takes a couple to bend the health care cost curve when you’re senior in America, according to the EBRI‘s latest study into Differences in Out-of-Pocket Health Care Expenses of Older Single and Couple Households.

In previous research, The Employee Benefit Research Institute (EBRI) has calculated that health care expenses are the second-largest share of household expenses after home-related costs for older Americans. Health care costs consume about one-third of spending for people 60 years and older according to Credit Suisse.

But for singles, health care costs are significantly larger than for couples, EBRI’s analysis found.

The average per-person out-of-pocket spending for households ages 65+ for “recurring health services,” such as visits to doctors and dentists, and prescription drugs, were about $2,500 for both older single and couple households.

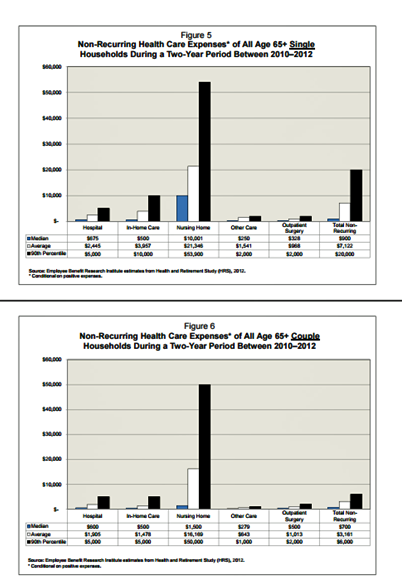

The big difference in OOP healthcare spending for older singles vs. couples comes for “non-recurring” health services — inpatient hospital stays, home care, long-term care, and outpatient surgery — especially among the oldest seniors in America. For them, couples spent $8,530 compared with $13,355 for singles.

What components of healthcare spending are most responsible for the difference? Home health care and nursing home stays.

The data used in this study were taken from the two-year period 2010-2012.

Health Populi’s Hot Points: For context, Fidelity Investments has calculated that the average couple retiring in 2015 would require $245,000 to pay for health care costs during their retirement years.

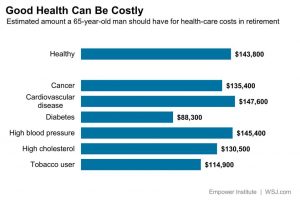

If a man is healthy and single, he’ll need about $145,000, according to Great-West Financial, shown in the second bar chart.

If a man is healthy and single, he’ll need about $145,000, according to Great-West Financial, shown in the second bar chart.

His costs could be less if he takes on a spouse, EBRI’s data suggests. That’s because the mate takes on caregiver roles, especially for home care and long-term care services that the singleton might be forced to receive in an institutional setting.

We must “value the invaluable,” AARP points out in recent research. “Family caregivers are an essential part of the social, health, and economic fabric of the U.S. But family caregiving often comes at substantial costs to the caregivers themselves, to their families, and to society. Without family-provided help, the economic cost to the U.S. health and long-term services and supports systems would skyrocket.”

The value of unpaid caregiving was $470 bn in 2013, AARP estimates. RAND put the number higher, at $522 bn, in 2014.

This represents a huge opportunity for innovation and investment, AARP states in its report on the caregiving market across six pillars:

- Daily activities like meals, home and personal care, home repair, and transportation

- Health and safety, the personal emergency response segment, diet and nutrition, and medication management

- Care coordination

- Transition support from hospital and institution continuity of care to hospice and funeral planning

- Social well-being, for community connections and digital inclusion, and

- Caregiving quality of life — already a large and growing challenge for caregiver support socially, financially and physically.

Watch for newcos Honor and Hometeam to begin to fill this breach.

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for