While American workers appreciate the benefits they receive at work, people are concerned about health care costs. And consumers’ collective response to rising health care costs is changing the way they use health care services and products, like prescription drugs. Furthermore, 6 in 10 U.S. health citizens rank healthcare as poor (27%) or fair (33%).

While American workers appreciate the benefits they receive at work, people are concerned about health care costs. And consumers’ collective response to rising health care costs is changing the way they use health care services and products, like prescription drugs. Furthermore, 6 in 10 U.S. health citizens rank healthcare as poor (27%) or fair (33%).

This sober profile on healthcare consumers emerges out of survey research conducted by EBRI (the Employee Benefit Research Institute), analyzed in the report Workers Like Their Benefits, Are Confident of Future Availability, But Dissatisfied With the Health Care System and Pessimistic About Future Access and Affordability.

Today, only 32% of workers are confident they can afford health care without financial hardship, falling to 25% of people looking out to the next ten years.

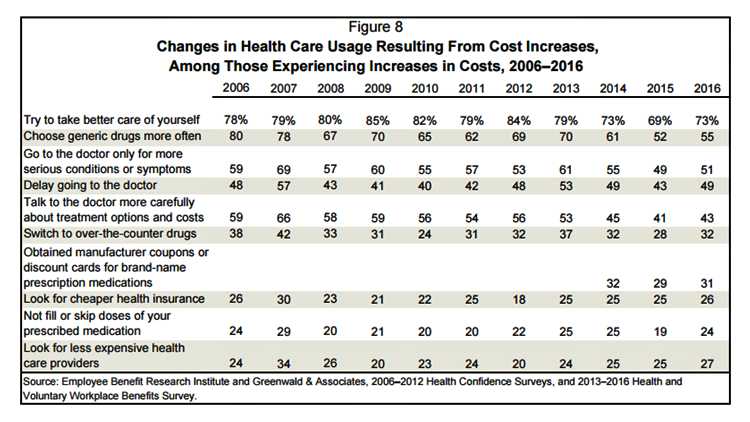

Workers with health insurance who face increasing costs are changing the way they use the health care system. Three-quarters (73%) say increased costs lead them to take better care of themselves. 55% of people are choosing generic drugs more often, one-half go to the doctor only for serious conditions or symptoms, and 49% delaying going to the doctor at all.

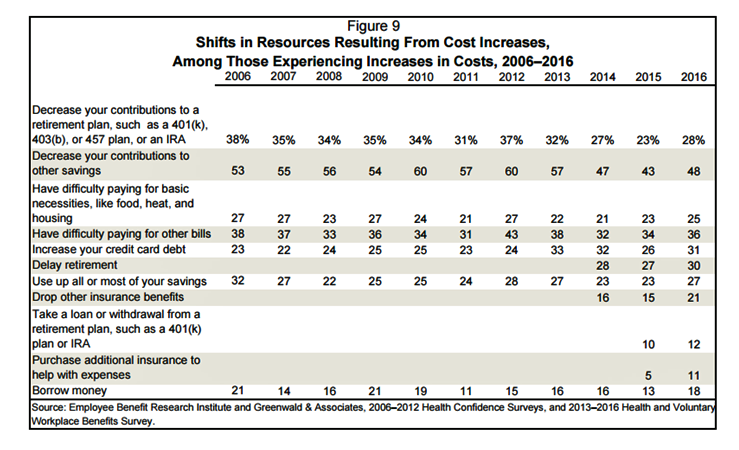

Current (rising) healthcare costs have begun to impact future retirement savings portfolios in several respects; among workers experiencing increases in healthcare costs in 2016:

Current (rising) healthcare costs have begun to impact future retirement savings portfolios in several respects; among workers experiencing increases in healthcare costs in 2016:

- 48% decreased contributions to savings (in general)

- 36% of people had difficulty paying for other bills

- 31% increased credit card debt

- 30% will delay retirement

- 28% decreased contributions to a retirement plan (e.g., 401[k], 403[b], 457 plan, or IRA)

- 27% of people used up all or most of their savings

- 18% borrowed money to pay for health care.

EBRI surveyed 1,500 U.S. workers age 21-64 years in June 2016 via an online survey.

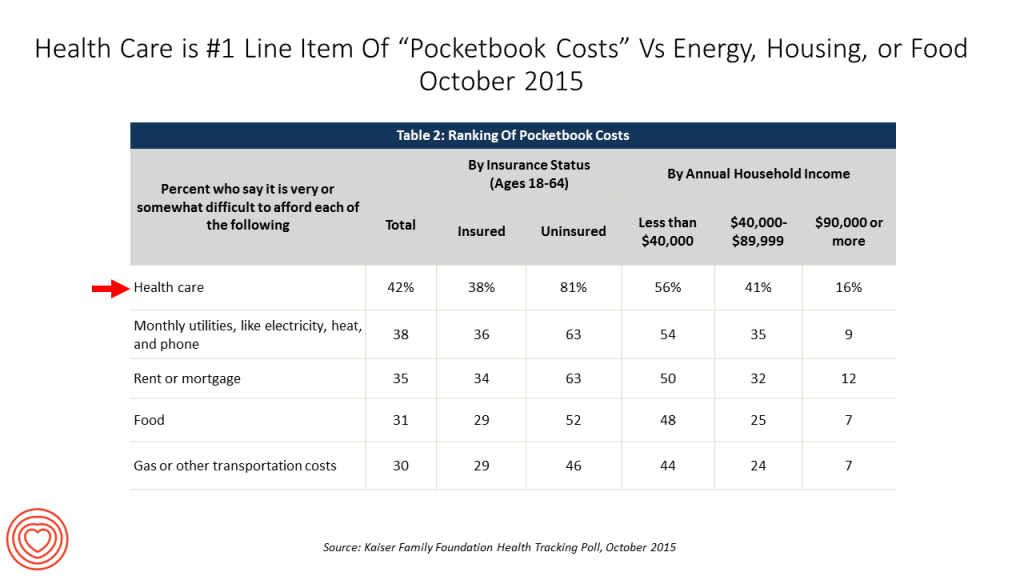

Health Populi’s Hot Points: The Affordable Care Act has greatly increased the number of people in the U.S. who are insured, and these newly-insured have gained access to more preventive care services, coverage for pre-existing conditions, and other benefits that health consumers value. However, for most U.S. health citizens, the costs of health care are forcing people to reallocate household spending categories away from traditional line items like food, mortgage, and utilities to health care.

Health Populi’s Hot Points: The Affordable Care Act has greatly increased the number of people in the U.S. who are insured, and these newly-insured have gained access to more preventive care services, coverage for pre-existing conditions, and other benefits that health consumers value. However, for most U.S. health citizens, the costs of health care are forcing people to reallocate household spending categories away from traditional line items like food, mortgage, and utilities to health care.

Health care emerged as the top “pocketbook” issue for American families exactly one year ago when the Kaiser Family Foundation polled U.S. adults on their ability to afford health care versus other household spending categories. Drug prices topped the specific healthcare cost concerns Americans cited in this KFF poll.

Today’s Boston Globe features an important assessment on the looming healthcare crisis, written by Jeffrey Sachs, who leads the Earth Institute. {Jeff was also the first person in my life encouraging me to take my first economics course when he visited the campus of University of Michigan as he was attending Harvard as an undergraduate student at the time).

To deal with the trifecta of forces driving the healthcare crisis in America, Jeff offers practical solutions addressing:

- Costs (THINK: prescription drug pricing especially when it comes to specialty drugs and medicines in public health)

- Health disparities (THINK: infant and maternal mortality in the U.S., which we covered on my panel at the 2016 CES in January 2016 featuring Dick Gephardt, the team from Square Roots, et al.)

- Public health crises (THINK: Zika, HIV/AIDS which is growing in prevalence among younger people, and obesity).

As Americans are today, already, robbing their future savings for retirement (which also covers future health spending in senior years) to pay for current health spending, we are already living in a healthcare crisis.

Gil Bashe, Chair Global Health and Purpose with FINN Partners,

Gil Bashe, Chair Global Health and Purpose with FINN Partners,  Grateful to Gregg Malkary for inviting me to join his podcast

Grateful to Gregg Malkary for inviting me to join his podcast