Most U.S. hospitals have not put consumerism into action, a new report from KaufmanHall and Caden’s Consulting asserts from the second paragraph. Patient experience is the highest priority, but has the biggest capability gap for hospitals, the report calls out.

Most U.S. hospitals have not put consumerism into action, a new report from KaufmanHall and Caden’s Consulting asserts from the second paragraph. Patient experience is the highest priority, but has the biggest capability gap for hospitals, the report calls out.

KaufmanHall surveyed 1,000 hospital and health system executives in 100 organizations to gauge their perspectives on health consumers and the hospital’s business.

KaufmanHall points out several barriers for hospitals working to be consumer-centered:

- Internal/institutional resistance to change

- Lack of urgency

- Competing priorities

- Skepticism

- Lack of clarity (vis-a-vis strategic plan)

- Lack of data and analytics.

The key areas identified for consumer centricity are:

- Organization (who on the executive team is responsible for consumer insights?)

- Consumer insights (what activities or decisions inform the organization on consumers?)

- Patient experience (who is responsible for this, and what aspects of patient experience does the organization use consumer research to inform?)

- Products, services and pricing (which care delivery models and innovations have been developed based on insights, and how is pricing determined?).

While 69% of hospital execs said consumerism is an above-average priority, only 23% have a capability to develop consumer insights, and 16% have the capability to activate strategies based on those insights.

Health Populi’s Hot Points: This report underscores the chasm between health care providers and consumers when it comes to the key challenge the new consumer-patient faces: how much will it cost “me,” and what am I getting for that spend in terms of quality and probably outcomes?

Health Populi’s Hot Points: This report underscores the chasm between health care providers and consumers when it comes to the key challenge the new consumer-patient faces: how much will it cost “me,” and what am I getting for that spend in terms of quality and probably outcomes?

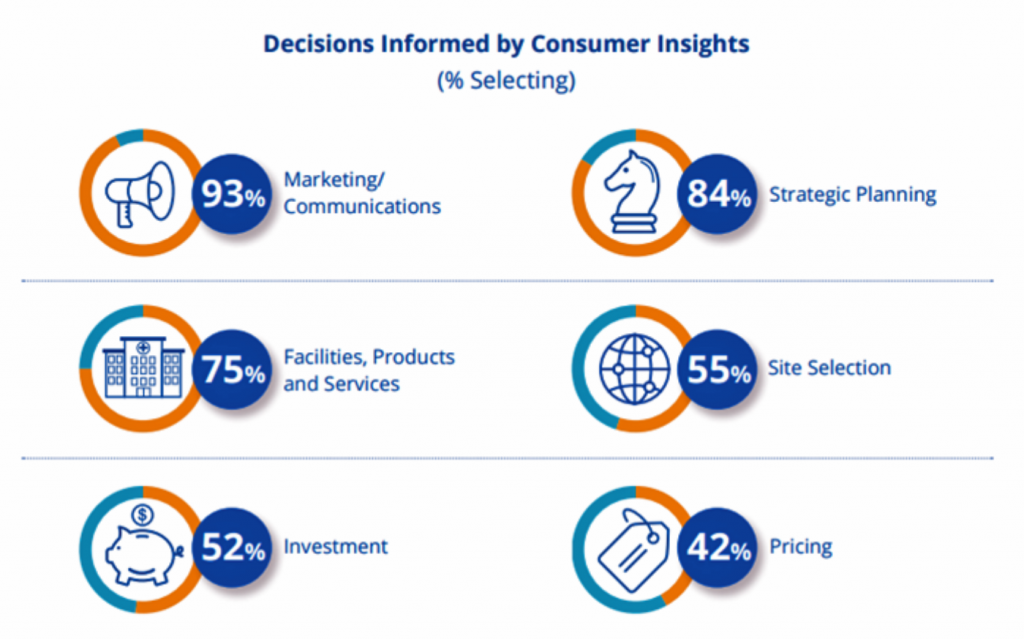

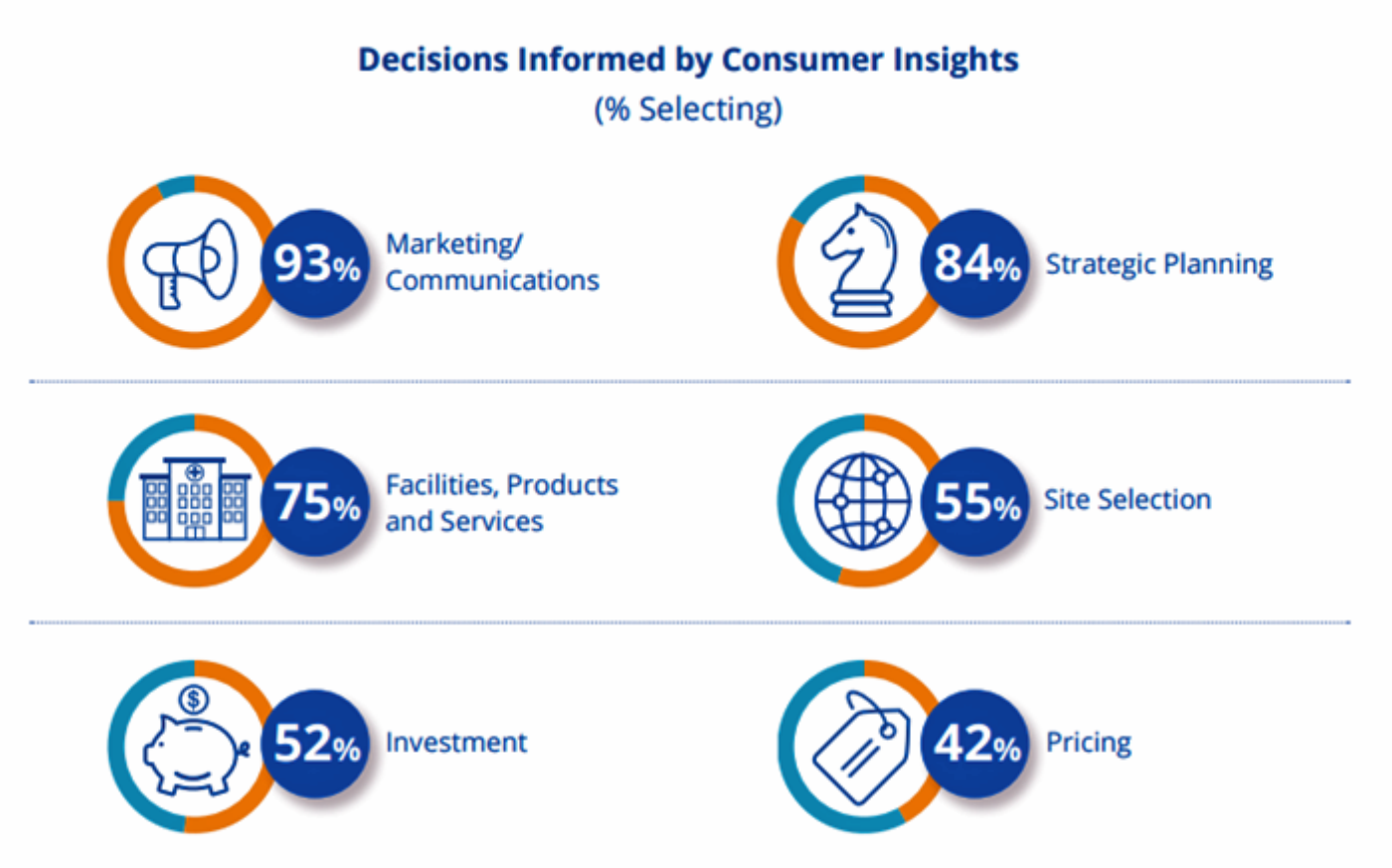

Currently, consumer insights inform mostly hospitals’ marketing and communications, strategic plans, and product offerings. “Pricing” is the last area hospital managers see being informed by consumer research.

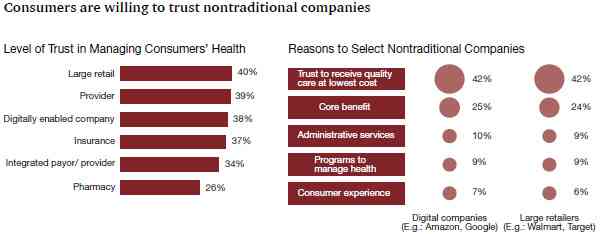

Yet it’s ultimately price, especially the direct out-of-pocket cost to the consumer, that’s top-of-mind for that consumer, illustrated by the bar chart from a PwC/Strategy& survey pictured here in the Hot Points. When asked what kinds of organizations consumers trust to help them manage health, about the same percentage of people cite healthcare providers as name large retailers or digitally-enabled companies.

Why would this be the case? Because consumers’ daily life-flow benefits from Amazon Prime two-day (or same-day in Prime Now markets), and quick access via search for products, services, hotel rooms, and mortgage interest rates and approvals. The value proposition for these retail choices is also pretty clear.

For health care? Not. So while the majority of hospitals say it’s very difficult to initiate, this survey found, consumers want access to that information as they try to rationally manage a high-deductible health plan, HSA dollars, or health services @retail costs. Hospitals: please try harder. Convene a patient leadership committee and start the bring the end-use customer into the dialogue. That way, you can start to converge on value-based pricing that reflects what consumers actually value.

Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a