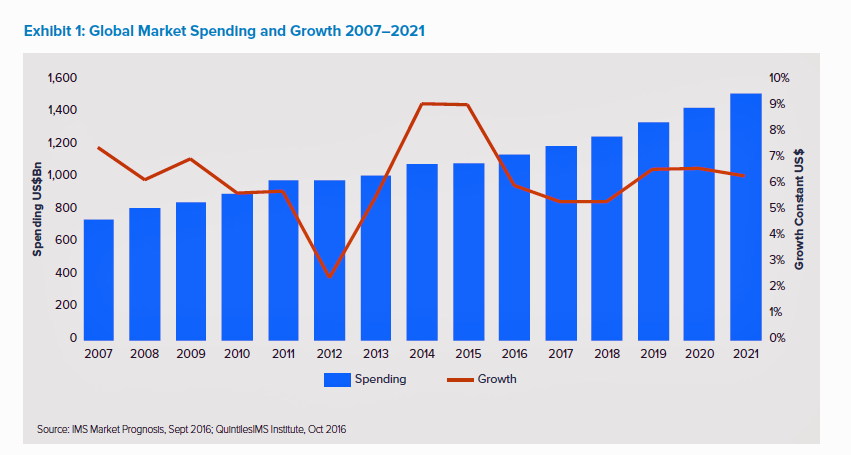

The global market for spending on medicines will high $1.5 trillion by 2021, according to the latest forecast from QuintilesIMS. Drug spending grew about 9% in the past two years, and is expected to moderate to 4 to 7 percent annually over the next five years.

The global market for spending on medicines will high $1.5 trillion by 2021, according to the latest forecast from QuintilesIMS. Drug spending grew about 9% in the past two years, and is expected to moderate to 4 to 7 percent annually over the next five years.

That dramatic 9% growth was heavily driven by new (expensive) specialty drugs to treat Hepatitis C (e.g., Harvoni and Sovaldi) and cancer therapies that hit the market in the past couple of years. There will be a “healthy level” of new innovative meds coming out of the drug pipeline in the next several years for oncology, autoimmune diseases and diabetes that will fuel growth in the developed markets.

But QuintilesIMS expects that the wealthy economies (especially those in Europe) will maintain tight constraints on drugs budgets to slow spending globally. Another key factor that should moderate global Rx spending growth is the higher impact of patent expiries in the next five years, compared with the last several years which had fewer drugs moving to generic status.

The U.S. continues to be, by far, the largest market for prescription drugs in the world, expected to account for 53% of total global growth in the next 5 years (spoiler alert: this is the hot button in the Hot Points, below). The rate of Rx spending growth in the U.S. will decline relative to the past two years of 9% growth; the forecast is 6 to 7% growth in 2016, and 6 to 9% growth through 2021 on an invoice (full) price basis. QuintilesIMS anticipates a “heightened level” of price concessions made by manufacturers in negotiations with payors (especially, rebates). The slower growth rate in the U.S. is also due to patent expirations and growing generics, along with lower prices for Hep C treatments.

China will be second largest growth market representing 12% of Rx spending growth looking to 2021. The Chinese market for prescription medicines is expected to decline in growth from a rate of 17% in the past five years to 4% over the next five years — a huge drop in the global market for medicines. This is a sober reminder of the relationship between a nation’s economic growth and healthcare spending impacts.

With over 2,000 drugs in the late stage pipeline, QuintilesIMS anticipates on average 45 new active products to be launched each year through 2021. These new meds will address unmet needs across many areas, including autoimmune conditions, cancer, central nervous system, and metabolic disease. The sheer number of cancer treatments and combinations alone and range of companies involved in their development will bring complexity to the patient care landscape to 2021, the report notes, potentially bringing dramatic improvements in both survival and tolerability.

Drug spending growth in Europe will be fairly flat as payors constrain national health care budgets: the forecast is 1 to 4% annual growth rate in the major 5 European pharma consuming countries (France, Germany, Italy, Spain and the United Kingdom). European payors are redoubling efforts to bring predictability to their national health budgeting processes for drugs, looking to limit price premiums on newly introduced drugs to market.

Health Populi’s Hot Points: The headline for U.S. health consumers is that America bears over one-half of spending growth in the world.

In the section of the report discussing trends in U.S. medicines, QuintilesIMS notes, “It is expected that manufacturers will continue to negotiate rebates and provide patient copay assistance similarly to the last few years with no major changes to the status quo, while it is also expected that rising patient exposure to costs makes these approaches even more necessary.”

The former part of the sentence is regrettable — in terms of “no major changes to the status quo.” The latter half, that “rising patient exposure to costs makes” patient assistance programs and rebates “more necessary” is an understatement.

Donald Trump has mentioned drug importation as one acceptable tactic for patients managing personal drug costs. Generic drug availability will continue to grow with more patent expirations in the next several years, to be sure.

But for patients diagnosed with conditions for which there are new specialty drugs, there’s an issue of “tolerability” which differs from the definition used earlier in this post with respect to toxicity of a drug. That is, the financial toxicity of high-cost drugs which can break a family’s finances and lead to medical bankruptcy at worst, or stressful financial unwellness that is an unwelcome side effect of being very sick in America. For more on financial toxicity, see my post, Financial Toxicity: The High Cost of Cancer Drugs in the U.S.

In the growing value-based era of healthcare financing in the U.S., drug companies should look to add value that helps patients and families manage illness as well as boost social determinants of health that mitigate the risk of an expensive drug not optimally working. These could include transportation, good nutrition (see my post on Hormel’s Vital Cuisine for a scenario), medication adherence through social connections and digital connectivity, among other tactics.

Thank you FeedSpot for

Thank you FeedSpot for