In President Donald Trump’s preliminary thoughts about health care in America, the landscape would feature a mix of tax credits, health savings accounts, high-risk pool, state Medicaid block grants, and regulatory control shifting from the Federal government to the states, according to PwC’s forecast for the new year, Top health industry issues of 2017.

In President Donald Trump’s preliminary thoughts about health care in America, the landscape would feature a mix of tax credits, health savings accounts, high-risk pool, state Medicaid block grants, and regulatory control shifting from the Federal government to the states, according to PwC’s forecast for the new year, Top health industry issues of 2017.

PwC frames the 2017 top healthcare issues under the overall strategic imperative of value, with three categories:

- Adapting for value

- Innovating for value

- Building for value.

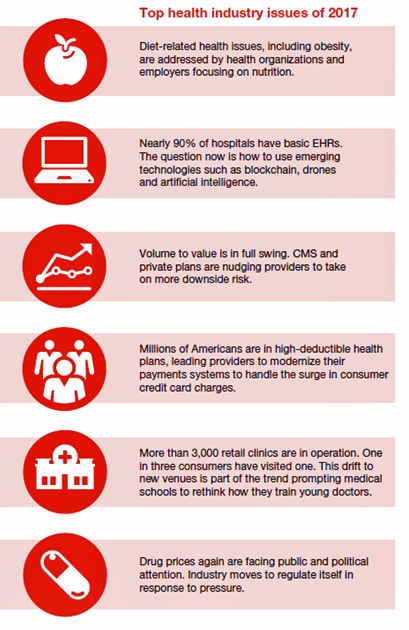

The ten top issues that will shape U.S. healthcare for the next year, PwC expects, will be:

- An uncertain fate for the Affordable Care Act

- Patients as pharma’s strategic partners

- Healthcare providers’ deeper experience and maturing with value-based payment

- Modernizing healthcare payments for consumers (with payments being a key part of the patient experience)

- Preparing for emerging technologies like artificial intelligence and blockchain

- More effectively battling infectious diseases

- Healthcare providers’ prescribing nutrition to patients

- Drug companies slowing down medicine price increases

- Collaborating between healthcare providers and fellow industry stakeholders

- Training medical students for the value-based healthcare world.

PwC expects the continued migration in U.S. health care payment from volume-to-value, spurring the consumer-driven health system market reforms already in process. Underpinning the shift to value will be technology adoption of various flavors, such as artificial intelligence, augmented reality, blockchain, drones, the Internet of Things (IoT), robots, virtual reality, and 3D printing.

Health Populi’s Hot Points: PwC is placing a strategic bet that healthcare in America will continue to move to value-based payment and outcomes will continue to evolve in the US under a President Trump. It’s a sound bet, because regardless of a President Trump or President Clinton, market forces are shaping health care on the ground. Consumers, employers and plan sponsors are all payors now, and value is in each of these payors’ lenses. The legacy healthcare system — hospitals, physicians and clinicians, suppliers such as pharma and medical device manufacturers, and health insurance plans, all — face more critical payors across-the-landscape in 2017:

- Consumers as value-payors seek control, convenience, quality, transparency, and retail-style service for their hard-won dollar to be spent on healthcare goods, services, and insurance; and,

- Employers and plan sponsors look for return-on-value, employee engagement, platforms for building a culture of health in their organizations, and indeed, data to support “people analytics,” and lower health care costs.

If, as PwC’s health political forecast works out to include the proliferaton of tax credits, health savings accounts, high-risk pools, and regulatory control shifting to the states, consumers will face a growing retail health marketplace. In that scenario, there will be growing opportunities for new entrants to provide services and thrive in such an environment, and collaborative possibilities for current healthcare players to team and serve up a better consumer health experience that patients will expect.

Thank you FeedSpot for

Thank you FeedSpot for