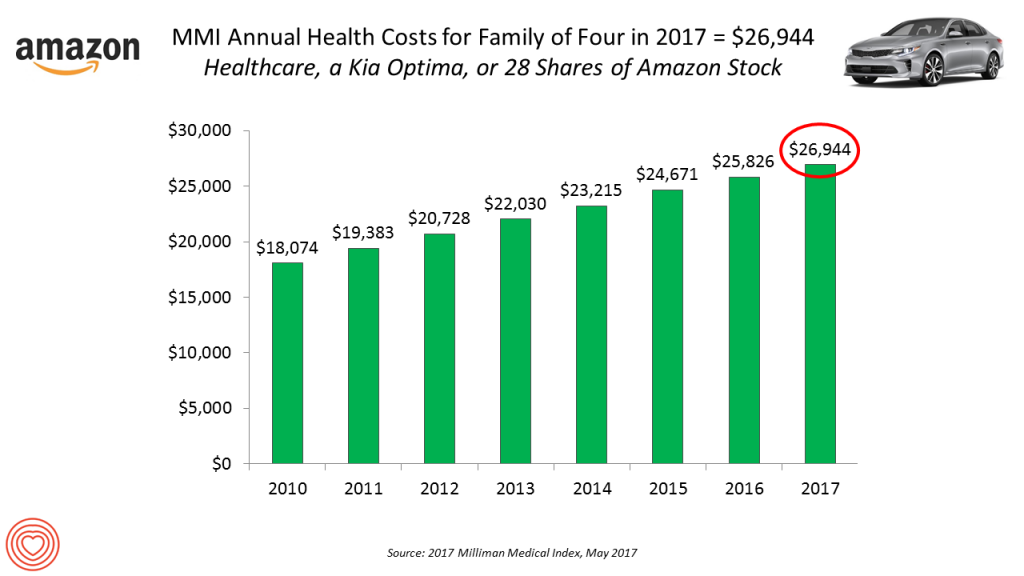

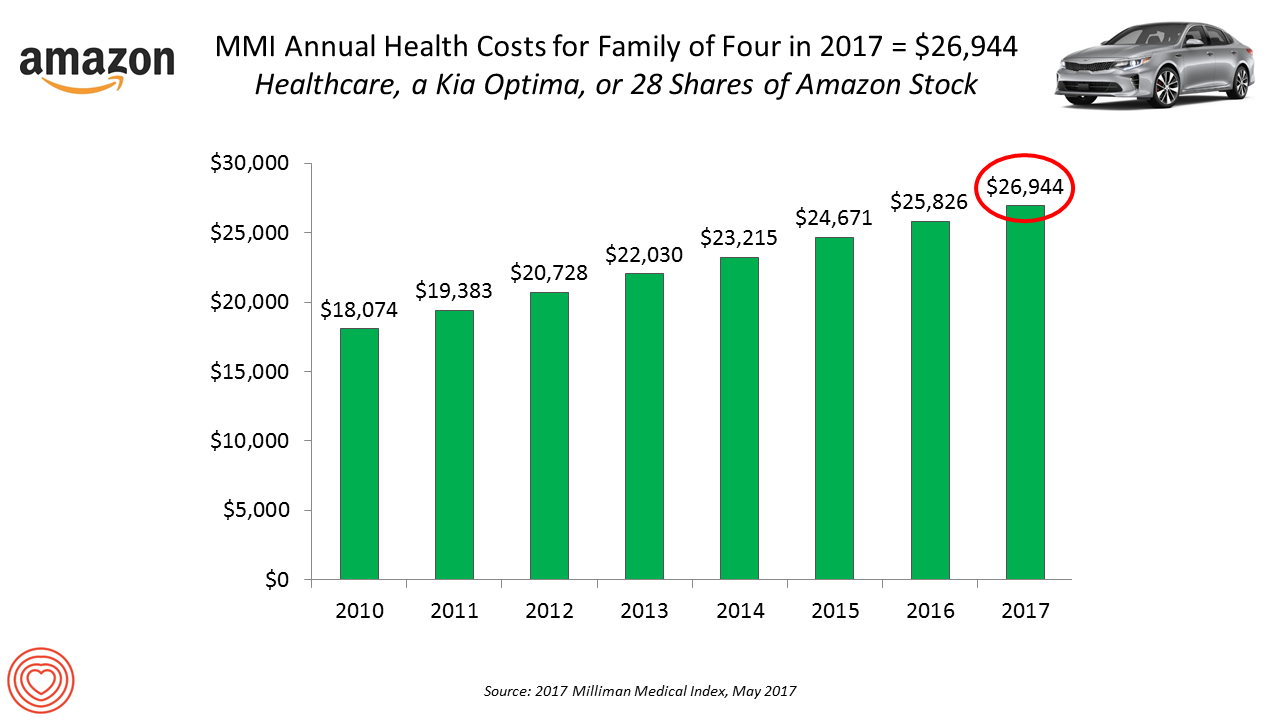

If you had $27,000 in your wallet, would you spend it on a 2017 Kia Optima sedan, 28 shares of Amazon stock, or healthcare?

$26,944 is this year’s estimate of what healthcare will cost a family of four in the U.S., based on the 2017 Milliman Medical Index (MMI). This is based on the projected total costs of healthcare for a family covered by an employer-sponsored PPO plan.

Milliman, the actuarial consulting firm, has conducted the MMI going back to 2001. I’ve watched the rise and rise of this index for years, explained annually in the Health Populi blog since its inception in 2007. (Here’s a link to last year’s coverage of the 2016 MMI).

This is one of the key numbers healthcare stakeholders should keep in mind whichever health-segment you’re in.

The components of costs in the MMI include:

- Inpatient facility care

- Outpatient facility care

- Professional services (such as visits to physicians and physical therapists)

- Pharmacy

- Other services, which covers ambulance services, durable medical equipment and supplies, prosthetics, and home care.

Spending on these five components of medical costs has shifted between 2001 and 2017. While inpatient costs remain about one-third of spending, outpatient costs having grown from 14% to 19% of total, and pharmacy spending grew from 13% to 17% of costs. The big shift happened to professional services, which comprised 40% of spending in 2001 dropping to 30% in 2017.

Prescription drug spending has “good news and bad news,” MMI writes. On the positive side of the spending ledger, rebates have grown for payers (behaving like a discount on prices) but these savings do not tend to land in consumers’/patients’ pockets. PBMs are responding, MMI expects, by bundling the rebates at the consumer’s point-of-purchase at the pharmacy to benefit people who spend the most on prescription drugs. A big driver of pharmacy costs is specialty drugs, price increases which MMI cautions to watch for inflammatory conditions, diabetes, oncology, and HIV.

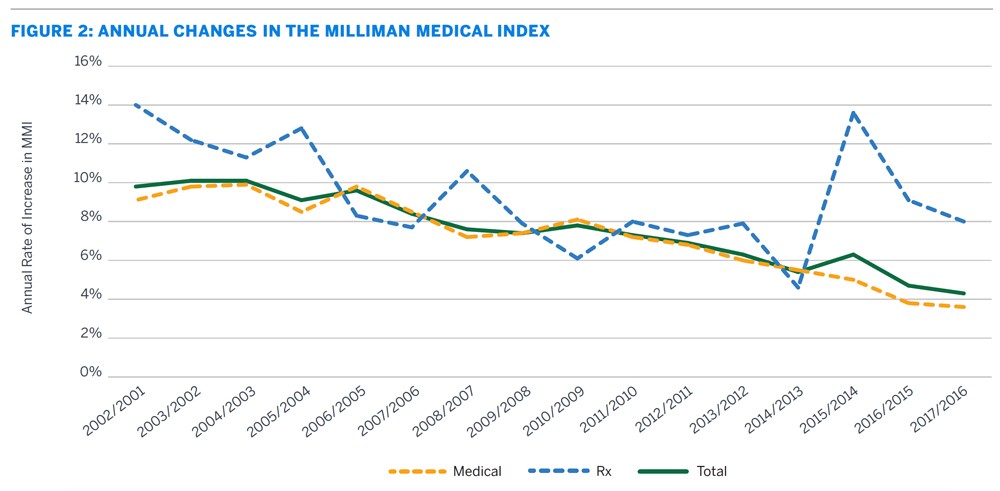

Health Populi’s Hot Points: MMI notes that medical cost increases from 2016 to 2017 hit a record low of 4.3%. However, this was on a base last year of $25,826, when consumers covered roughly 40% of costs.

Health Populi’s Hot Points: MMI notes that medical cost increases from 2016 to 2017 hit a record low of 4.3%. However, this was on a base last year of $25,826, when consumers covered roughly 40% of costs.

For consumers, the $27K is a sticker shock statistic. This year, employees covered by health insurance at work will pay a larger share of these costs amounting to 43% of the total. For the average family, that will equal $11,586. This calculates to over 20% of the median family income in America.

The $11.5K splits into $7,151 for the employee’s contribution to medical costs, and $4,534 out-of-pocket medical expenses.

Healthcare costs are the #1 pocketbook issue in America. As health plans, pharmaceutical companies, health service providers, and retail health companies ponder pricing and marketing healthcare, all stakeholders would be wise to consider peoples’ personal valuation of health care value. Customer experience must be embedded into the design, channeling, accessing and pricing of healthcare products and services to gain a health consumer’s share of wallet in 2017.

Thank you FeedSpot for

Thank you FeedSpot for