A person enrolled in a high-deductible health insurance plan is more likely to be cost-conscious than someone with traditional health insurance. Cost-consciousness behaviors including checking whether a plan covers care, asking for generic drugs versus a brand name pharmaceutical, and using online cost-tracking tools provided by health plans, according to the report, Consumer Engagement in Health Care: Findings from the 2016 EBRI/Greenwald & Associates Consumer Engagement in Health Care Survey from EBRI, the Employee Benefit Research Institute.

A high deductible is correlated with more engaged health plan members, EBRI believes based on the data.

One example: more than one-half of people enrolled in consumer-directed health plans (CDHPs) have enrolled in a health savings account, especially motivated when employers contribute money toward these accounts — a growing trend, up to 78% of CDHP enrollees in 2016 from 67% in 2015.

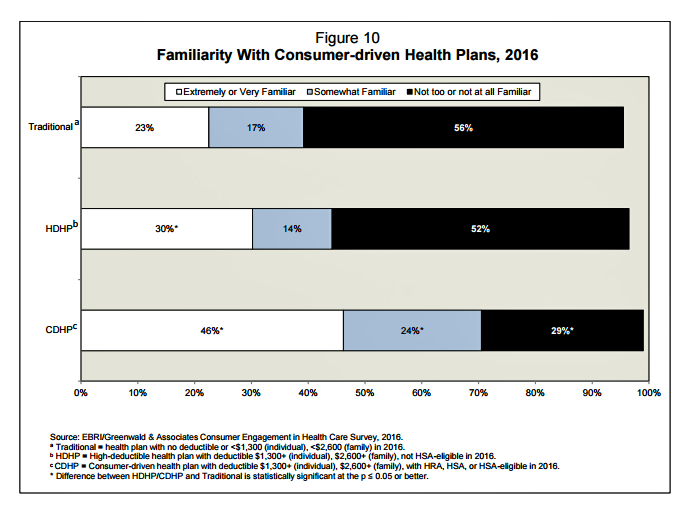

To put these trends in context, start with the overall number of 60%: that’s how many Americans under 65 years of age received health insurance from their employers in 2015. Most employers wish to continue to do so and look for ways to bend their corporate healthcare cost curves to manage ever-increasing healthcare bills. CDHPs have been a key strategy for doing so over the past decade, with increasing momentum (adoption) in the past few years. By 2016, 28% of Americans with private (commercial) insurance were enrolled in these plans. There’s growing understanding about CDHPs, the first chart shows, as people using these plans learn how to navigate them.

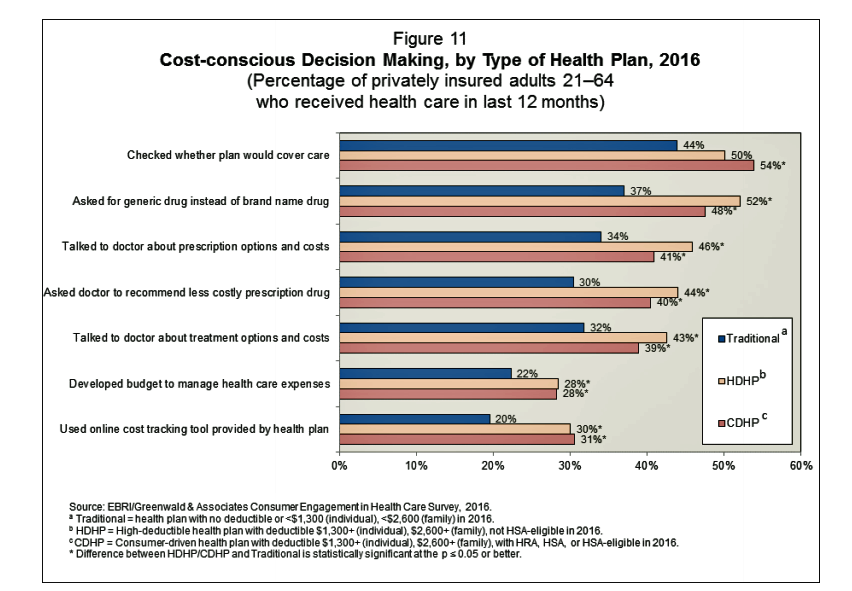

As more people belong to the CDHP “club” over time, they adopt cost-conscious behaviors, shown in the second chart. These behaviors are akin to learning how to “shop” for healthcare, such as checking for covered services, asking for lower-priced products (most especially generic drugs where they can substitute for a more expensive branded prescription product), discussing therapy options with a doctor, and developing a budget to manage health care expenses.

As more people belong to the CDHP “club” over time, they adopt cost-conscious behaviors, shown in the second chart. These behaviors are akin to learning how to “shop” for healthcare, such as checking for covered services, asking for lower-priced products (most especially generic drugs where they can substitute for a more expensive branded prescription product), discussing therapy options with a doctor, and developing a budget to manage health care expenses.

Another signpost of growing health engagement by CDHP members is their higher use of a health plan’s online benefits portal. 56% of people enrolled in CDHPs use the portal, compared with 34% of people in a traditional health plan. The portal, when well-designed with the consumer users in mind, is a channel for shopping and engagement.

In this 11th annual survey, EBRI polled 3,295 U.S. adults with private health insurance coverage online in August 2016.

Health Populi’s Hot Points: A column in this week’s US News & World Report is titled “Newly Insured Fret Over Gains Made Under US Health Care Law.” The focus of the piece is on American consumers who gained access to health insurance under the Affordable Care Act, concerned about their ability to access the health care services and products they’ve come to count on since obtaining insurance. Faye Laffitte, a home care worker diagnosed with diabetes who did not receive insurance through her job, is quoted saying, “I don’t have to worry about my health. I can afford to get the medicine and take it and be all right.”

In 2017, affordability of medicines is a worry for people covered by all types of health insurance. Most U.S. consumers would like to see Federal action on drug prices, such as allowing Medicare to negotiate with pharmaceutical companies, according to a recent Kaiser Family Foundation poll covered here in Health Populi. This week, the New York Times published a detailed analysis of various drug pricing proposals. The Times also published this article yesterday about the growing “civil war” in the pharmaceutical industry with finger-pointing between the drug companies, pharmacy benefits managers, pharmacists, and the FDA — leaving patients and physicians wondering how drug pricing actually works — a question with which even those of us in the industry lo these many years continue to wrestle.

Your tax dollars at work have contributed, constructively and helpfully, to a new “dashboard” was developed online by the Centers for Medicare and Medicaid Services (CMS) which tabulates the highest-cost drugs covered by Medicare in 2015, which you can access here.

The more people are exposed to health care costs and decisions, the more they need dashboards and portals and, most importantly, personally relevant information on what “my meds” will cost “me,” out-of-pocket. More tools are coming on-stream to empower people, now health consumers, to make sound decisions on services and products for health. This is an opportunity for innovation in this uncertain moment for U.S. healthcare reform.

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for