Patients, evolving into health consumers, seek a better healthcare experience. While most people are pretty satisfied with their medical care, cost and confusion reign. This is the topline finding of a study from Oliver Wyman appropriately titled, Complexity and Opportunity, a survey of U.S. health consumers’ worries and wants. Oliver Wyman collaborated on the research with the FORTUNE Knowledge Group.

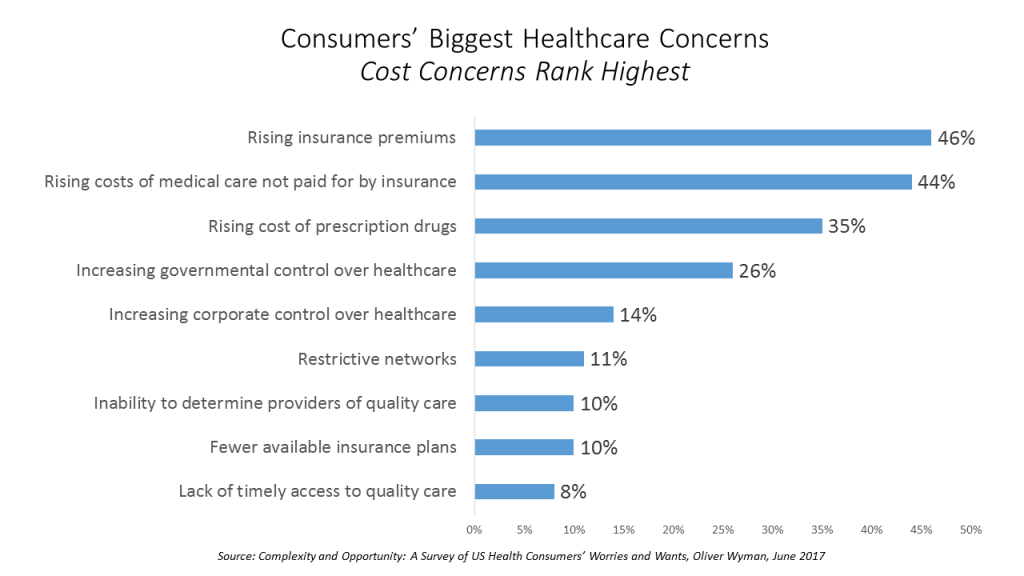

Consumers’ biggest healthcare concerns deal with costs: rising insurance premiums; greater out-of-pocket costs for care not covered by insurance; and, the growing costs of prescription drugs together rank as the top 3 healthcare concerns in this study.

After costs, consumers cite government and corporate control and restrictive networks as top issues, but ranking much lower than the top three cost concerns.

Underneath the overall theme of cost worries, there are clear differences across generations, the research learned. Two groups stand out in this research based on their interest in adopting innovative healthcare approaches: Millennials and Caregivers.

Millennials are most open to trying out new healthcare offerings and are more interested in new-new products and services. Younger people see healthcare as more “shoppable” informed by their ecommerce experiences via Amazon and Uber, for example.

This study unearthed some insights into Millennials managing chronic conditions, 60% of whom are very interested in new healthcare formats which may require out-of-pocket payments such as retail clinics, home visits by a doctor, and same-day appointments.

Caregivers, defined in the report as people responsible for the care of someone else, are much more keen in accessing additional healthcare services (34% of caregivers) than people without caregiving roles (14% of non-caregivers). Caregivers tend to be more concerned about access issues such as restrictive provider networks and lack of choice for insurance plans.

It follows, then, that caregivers were found to be more likely to be willing to pay a third party to help with medication management for their loved ones, and for the ability to contact medical professionals via a 24-hour helpline or via computer.

The survey was conducted online among 2,016 health-insured US consumers in October and November 2016.

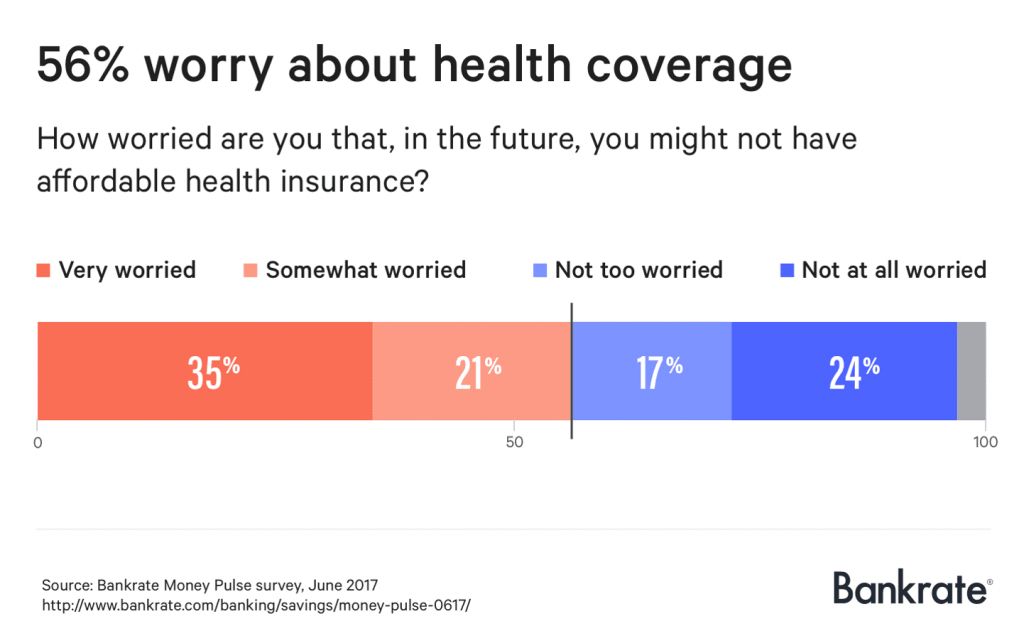

Health Populi’s Hot Points: A new survey from Bankrate published earlier this month also focuses on health consumers’ cost concerns. Over 1 in 2 people were found to be worried (35% ‘very,’ 21% ‘somewhat’) about their ability to afford health insurance in the future.

Health Populi’s Hot Points: A new survey from Bankrate published earlier this month also focuses on health consumers’ cost concerns. Over 1 in 2 people were found to be worried (35% ‘very,’ 21% ‘somewhat’) about their ability to afford health insurance in the future.

In Worried Sick About Healthcare? You’re Not Alone, Bankrate portrays a cadre of health citizens with high anxiety about health care costs. The largest group of financially unwell health consumers are the Millennials, Bankrate observed, 31% of whom said they have avoided seeking health care services due to costs.

Consumers in other generational cohorts also avoided health care due to costs, albeit in fewer numbers: 25% of Gen X, 23% of Boomers, and only 8% of the Silent Generation. The latter low number reflects the fact that most seniors in America are covered by Medicare which enjoys relatively high consumer-member satisfaction.

Patients-as-consumers are recognizing their right and financial incentive to shop for health care service when they are shoppable. This requires time and information (e.g., an unexpected medical trauma would not allow time to compare variations in provider quality and prices).

Sam Myers of Balderston Capital wrote an essay on the consumerization of health care on 5th June in TechCrunch, talking about “the new over-the-counter” medicine. Going beyond packaged medicines that have switched from brands (the classic “OTC” scenario), the new OTC segment includes direct-to-consumer lab testing, online tele-mental health consults with therapists, and new primary care models like MesDocteurs in France, Kry and MinDoktor in the Nordic nations, and PushDr. and Doctor Care Anywhere in the UK, along with Omada Health in the U.S.

In yesterday’s Health Populi, I wrote about consumers’ search for innovation in healthcare. We are seeing green shoots of such innovation of care that’s tech-enabled, coupled with high-touch. This paradigm will be one of the best practices for consumer-directed healthcare that’s truly consumer-driven and -desired.

Thank you FeedSpot for

Thank you FeedSpot for