Most U.S. patients want healthcare providers to offer cost information before a procedure, and whether doctors offer financial options to help them extend payments over time.

Most U.S. patients want healthcare providers to offer cost information before a procedure, and whether doctors offer financial options to help them extend payments over time.

This is an automotive or home appliance procedure we’re talking about. It’s healthcare services, and American patients are now the third largest payors to providers in the nation. Thus, the title of a new report summarizing a consumer survey from HealthFirst notes, “It’s Never Too Soon to Communicate Pricing and Payment Options.

The study found that two-thirds of U.S. consumers would like healthcare providers to discuss financing options; however, only 18 percent of providers have spoken to patients about such financial plans. Only 8% of patients had used either zero- or low-interest financing to pay off medical bills over time, HealthFirst found.

HealthFirst also quantified that most patients are now behaving more like healthcare consumers: 86% of people check whether a provider will accept their insurance plan, 77% want to receive cost information before a procedure, 63% look for published pricing lists for common procedures, and 57% of patients say it would be important for a provider to offer no-interest financing options enabling payments over time.

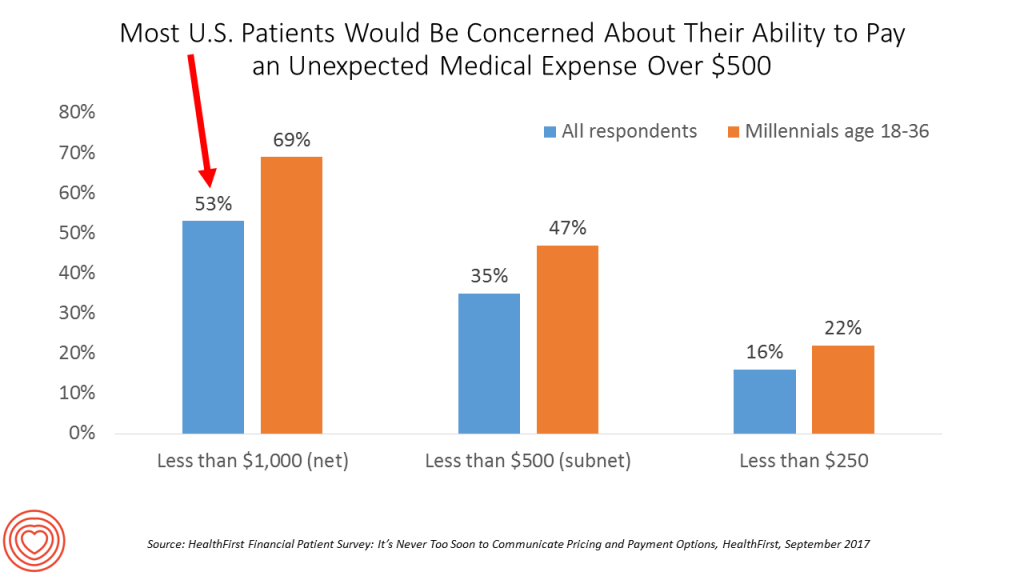

Worrying about healthcare costs impacts patients at all income levels. While, clearly, more lower-income people are concerned about their ability to pay out-of-pocket medical expenses, 1 in 4 high-income patients with $100K or more annual income are concerned about meeting their out-of-pocket costs.

Younger people are most keen to pay medical bills over time, as the bar chart illustrates. 71% of Millennials would be interested in a multi-year no interest financial option for a bill under $1,000, and nearly 50% would like that financing option for a bill under $500.

HealthFirst is a healthcare financing company extending long-term financing options to patients receiving services as over 200 U.S. healthcare providers. The company surveyed over 1,000 patients for the study.

Health Populi’s Hot Points: There’s a not-so-sweet spot somewhere between $500 and $1,000 where most U.S. patients would like to finance their out-of-pocket healthcare costs over a period of time, based on these survey results.

I’ve researched and written extensively about this issue, recently noting that healthcare is the #1 pocketbook issue in America above paying rent or a mortgage, for food, or utilities — even for the wealthiest Americans, Kaiser Family Foundation found.

There are several components to out-of-pocket costs, and they vary by person. If you are a young person diagnosed with leukemia, you may face a cost of nearly $500,000 for new CAR-T therapy (see here for my take on this). If you are a Boomer couple weighing the financial implications of retiring sooner-versus-later, you will learn that healthcare costs in retirement could run you, on average, $275,000 (not including long-term care).

If you work for a small company, your health plan deductible would likely be $2,000. In this case, based on HealthFirst’s poll, you would part of the health consumer market seeking longer-term finance of your health cost liability. Welcome to the new era of medical banking.

In the immediate term, if you work in hospital or healthcare finance, Black Book just issued its top revenue-cycle management technology tools and services ratings here. The top five include Optum (now including the Advisory Board) and Navicure among others.

Thank you FeedSpot for

Thank you FeedSpot for