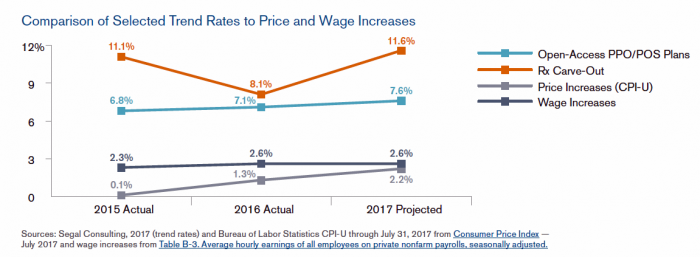

Driven by price increases, costs for the prescription drug benefit carve-out will increase 11.6% this year, based on Segal Consulting’s survey report, High Rx Cost Trends Projected to Be Lower for 2018, published today. The report is accessible on the Segal Co. website.

Driven by price increases, costs for the prescription drug benefit carve-out will increase 11.6% this year, based on Segal Consulting’s survey report, High Rx Cost Trends Projected to Be Lower for 2018, published today. The report is accessible on the Segal Co. website.

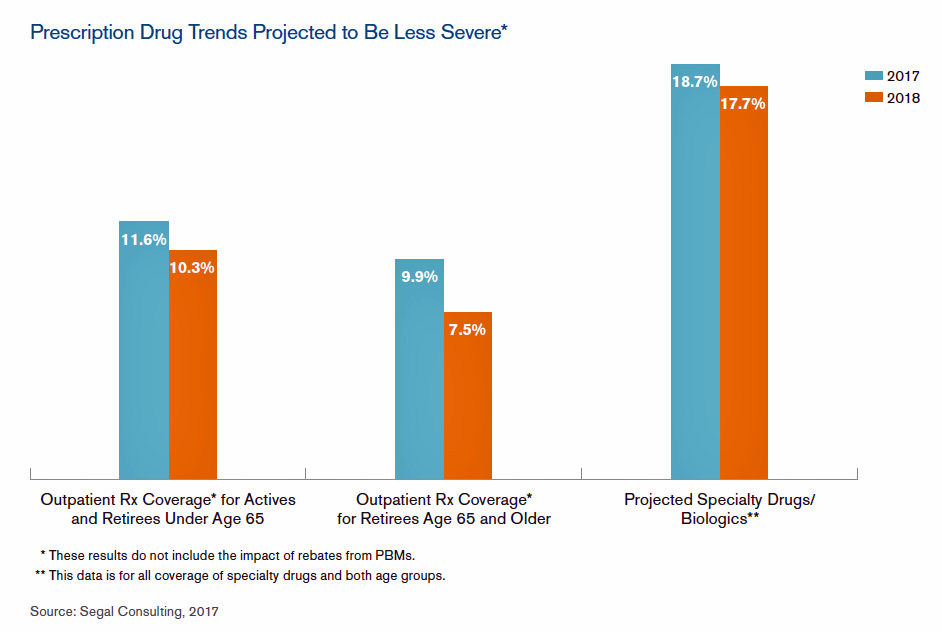

While the Segal team expects prescription drug (Rx) benefit plan cost trends to be “less severe” in 2018, Rx cost increases is a top priority for many sponsors of health plans as their rate of increase far exceeds those for inpatient hospital claims or physician expense. Drug costs continue to be the fastest-growing line item in health plans. This has resulted in greater public scrutiny and criticism of the pharma industry.

It’s price growth, not increased utilization (volume), which is driving this trend.

Specifically, cost growth for outpatient Rx coverage for active workers and retirees under 65 will increase by 10.3% in 2018, lower than the 11.6% of 2017. For specialty drugs, trend growth will be 17.7% in 2018 versus 18.7% in 2017. Segal points to the examples of Alcortin A, Aloquin and Novacort, combination medicines that treat skin conditions like eczema and atopic dermatitis. The price of non-discounted Alcortin A grew from $226 in early 2015 to over $9,500 in today’s market.

The expanded use of generic drugs has worked to tame Rx trend, but the growth of specialty drug costs will mitigate the favorable cost pressures of generics.

As more consumers take up high-deductible health plans, the theory is that people price-shop for health care goods and services. Segal recommends that plans invest more in consumer-facing programs and tools to help connect consumers to helpful, personalized information to bolster smarter prescription drug use, purchasing, and adherence.

Health Populi’s Hot Points: The Segal report mentions Epipen pricing, with a wholesale price of $100 for a two-pack in 2009 rising to $600 in 2016. The photo pictures a protest in front of Mylan’s office in New York City involving an Epipen piñata beat-up.

Health Populi’s Hot Points: The Segal report mentions Epipen pricing, with a wholesale price of $100 for a two-pack in 2009 rising to $600 in 2016. The photo pictures a protest in front of Mylan’s office in New York City involving an Epipen piñata beat-up.

High-cost drugs are a growing component in overall drug prescriptions in the U.S. While we expect emerging competition from biosimilars and generics to enter the market over time, analysts don’t expect countervailing price pressure downward the way we experienced the era of Generics 1.0.

Pharmacy benefit sponsors’ strategies for moderating drug spending will include specialty pharmacy management, more intense pharmacy management programs, contracting with value-based providers like ACOs and patient-centered medical homes, increasing financial incentives in wellness design, and adopting HDHPs. These tactics are meant to address the demand side, how patients receive services and products.

What about the supply side? That is, how pharma companies calculate prices for products, and whether, say, Medicare might be allowed to negotiate prices with suppliers the way other big payors do in other industrialized nations?

Earlier this week, Anthem, the health plan in California, expected that prescription drug costs would increase by 30% in 2018. As a result, the health insurance company proposes a 35% increase for health insurance rates in the state. This rate increase would be the highest seen in the U.S., so far, for 2018. Whether this rate will be modified, the event reminds us that pharmaceutical companies and their product prices are in the bullseye of regulator, plan purchasers, and consumers alike.

For more on the politics and economics of prescription drugs, see yesterday’s post detailing the findings of Kaiser Family Foundation’s 2017 Employer Health Benefits report, Prescription Drug Coverage at Work: Prices: Common, Complex, and Costly.

Thank you FeedSpot for

Thank you FeedSpot for