The biggest healthcare spenders in the United States are households and the Federal government, each responsible for paying 28% of the $3.3 trillion spent in 2016.

The biggest healthcare spenders in the United States are households and the Federal government, each responsible for paying 28% of the $3.3 trillion spent in 2016.

Private business — that is, employers covering healthcare insurance — paid for 20% of healthcare costs in 2016, based on calculations from the CMS Office of the Actuary’s report on 2016 National Health Expenditures.

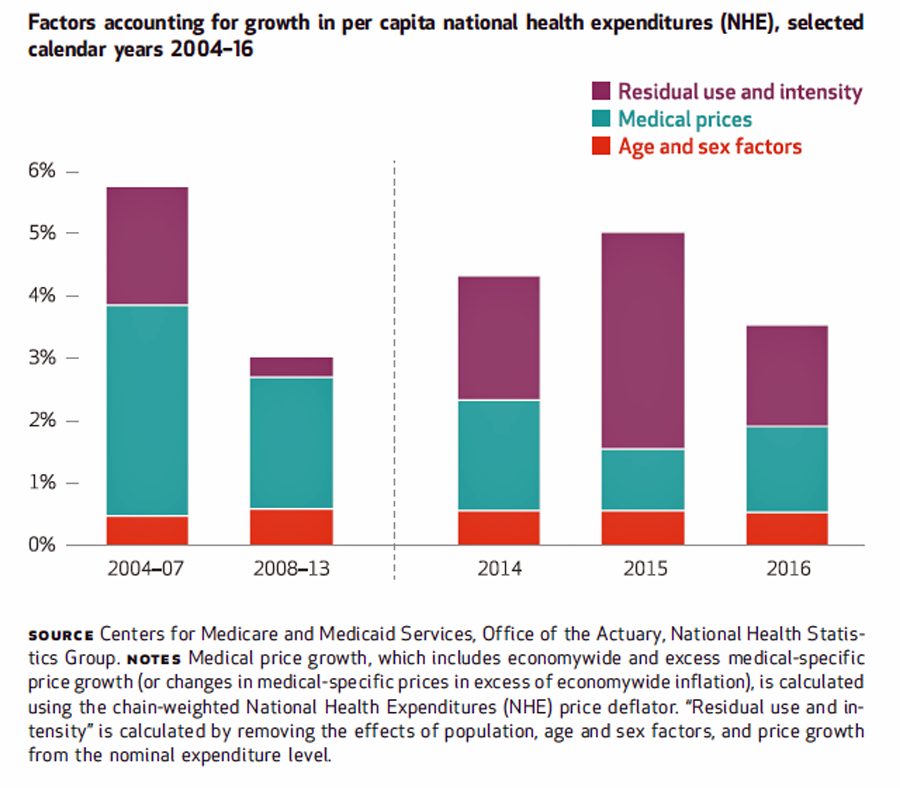

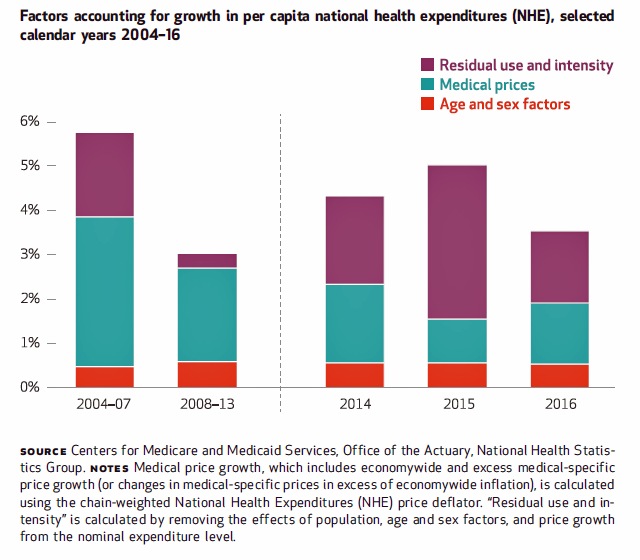

The positive spin on this report is that overall national health spending grew at a slower rate in 2016, at 4.3% after 5.8% growth in 2015. This was due to a decline in the growth rates for the use of hospitals, physicians, clinical services, and retail prescription drugs.

Healthcare consumed 17.7% of the GDP in 2016, up 0.5% points from 17.2% in 2015.

Underneath this positive top-line are some less sanguine trends, most notably on the growth of consumers’ healthcare spending. Consumers’ out-of-pocket spending grew faster in 2016 than in 2015, at a rate of 3.9% compared with 2.8% in 2015. This was the fastest rate of growth of OOP costs since 2007. The greater consumer cost burden is attributable primarily to the growth of more consumers enrolled in high-deductible health plans. Out-of-pocket costs include all direct consumer payments: copayments, deductibles, coinsurance, and spending for non-covered services by insurance plans.

Thus, consumers’ role as healthcare payor is “tied” with the Federal government’s, with each bearing 28% of national health spending.

Health Populi’s Hot Points: Dr. David Blumenthal wrote about the erosion of employer-sponsored benefits in a Commonwealth Fund brief yesterday, asserting that, “job-based health coverage provides far less protection to U.S. workers and their dependents than it once did.” The CMS 2016 NHE statistics notes the expansion of high-deductible health plans adopted by employers for covering workers.

The bar chart illustrates that while the use of healthcare services declined between 2015 and 2016, prices were responsible as a growing factor in per capita health expenditure growth. It’s ironic that today, I attended a webinar sponsored by the USC Annenberg Center for Health Journalism titled, “It’s the Prices Stupid – how sky-high prices are crippling our health care system,” discussing healthcare costs in America that are priced much higher than anywhere in the world. It’s a phrase first coined by the late, great health economist Uwe Reinhardt and colleagues in their seminal essay published in Health Affairs in 2003, It’s the Prices Stupid: Why the United States is So Different from Other Countries.

High prices and consumers’ healthcare cost exposure can nudge people (patients) to postpone or avoid care; this isn’t a new phenomenon, but in the era of high-deductibles and de facto self-insurance up to the deductible, it’s a concerning trend. Avoiding necessary care can result in greater downstream costs to the patient and the health plan, and potential worse conditions (say, a cancer moving from Stage 1 to Stage 4).

Thank you FeedSpot for

Thank you FeedSpot for