Patients’ health consumer muscles continue to get a work out as more people enroll in high-deductible health plans and face sticker shock for health insurance premiums, prescription drug costs, and that thousand-dollar threshold. The 2017 Alegeus Healthcare Consumerism Index finds growth in patients’, now consumers’, interest and competence in becoming disciplined about planning, saving, and spending for healthcare.

Overall, the healthcare spending index hit 60.1 in 2017, up from 54.4 in 2016. This is a macro benchmark that represents most consumers exhibiting greater healthcare spending engagement with eyes on cost as well as adopting purchasing behaviors for healthcare.

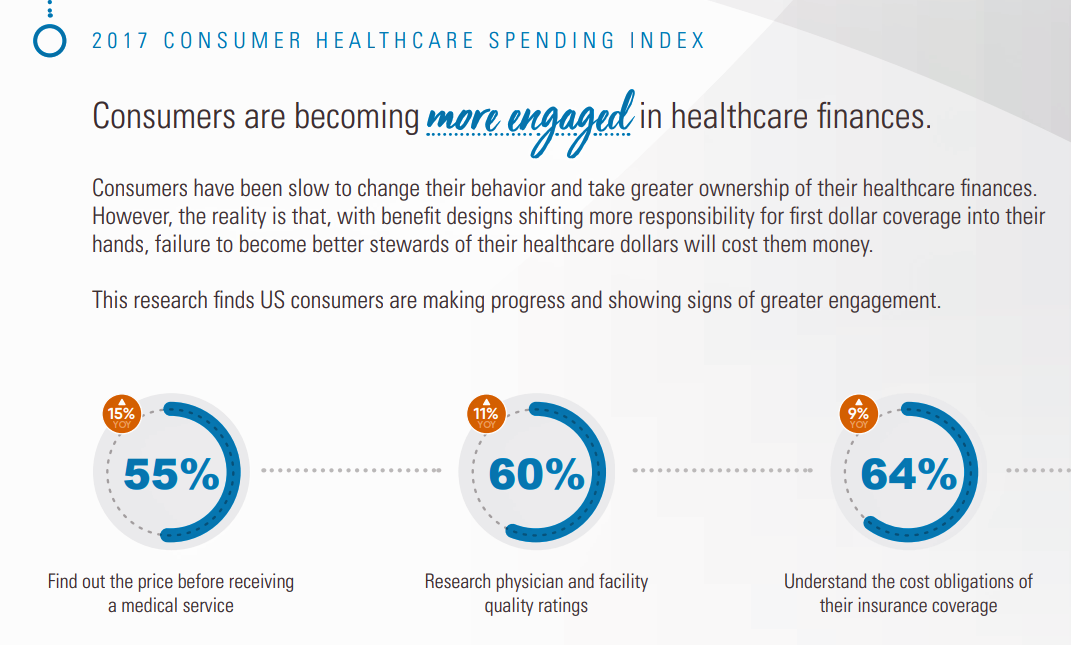

Underneath that 60.1 number are several metrics that measure consumerism: for example, the percentage of consumers seeking prices before receiving medical services increased to 55%, by 15 percentage points over the 2016 Index. This means that a majority of consumers are now looking for price information prior to getting healthcare.

A double-digit increase also occurred with consumers researching physician and facility quality ratings, growing 11 percentage points to 60%.

Two-thirds of consumers tried to understand their cost obligations on their health plan, up 9 percentage points over last year.

While the healthcare consumerism index rose from 2015, people still spend a lot more time shopping for other consumer purchases such as TVs, cars, cell phone providers, and travel, Alegeus found. By comparison, the healthcare index reached 60.1 in 2017; the TV spending index was 78.9 and the car metric, 77.6.

With high deductibles reaching into the thousands of dollars for some consumers, saving for healthcare is an important objective. How do consumers’ healthcare savings stack up versus other savings goals? They rank much lower than saving for emergencies or retirement, and come close to putting money away for college funds.

With high deductibles reaching into the thousands of dollars for some consumers, saving for healthcare is an important objective. How do consumers’ healthcare savings stack up versus other savings goals? They rank much lower than saving for emergencies or retirement, and come close to putting money away for college funds.

But it’s important to note that the healthcare saving index rose by 18% in one year, a significant growth. This, in the context of only 50% of consumers making contributions to retirement each month.

For this research, Alegeus surveyed over 1,400 U.S. healthcare consumers in September 2017.

Health Populi’s Hot Points: The U.S. spent $3.3 trillion on healthcare in 2016, we learned yesterday from the actuaries who work at the Centers for Medicare and Medicaid Services (CMS). Consumers are now the top-payor coupled with the Federal government, each of which covered 28% of that $3.3 trillion spend. Employers assumed 20% of 2016 healthcare spending. Increasingly, companies that cover health insurance are nudging workers into high-deductible health plans.

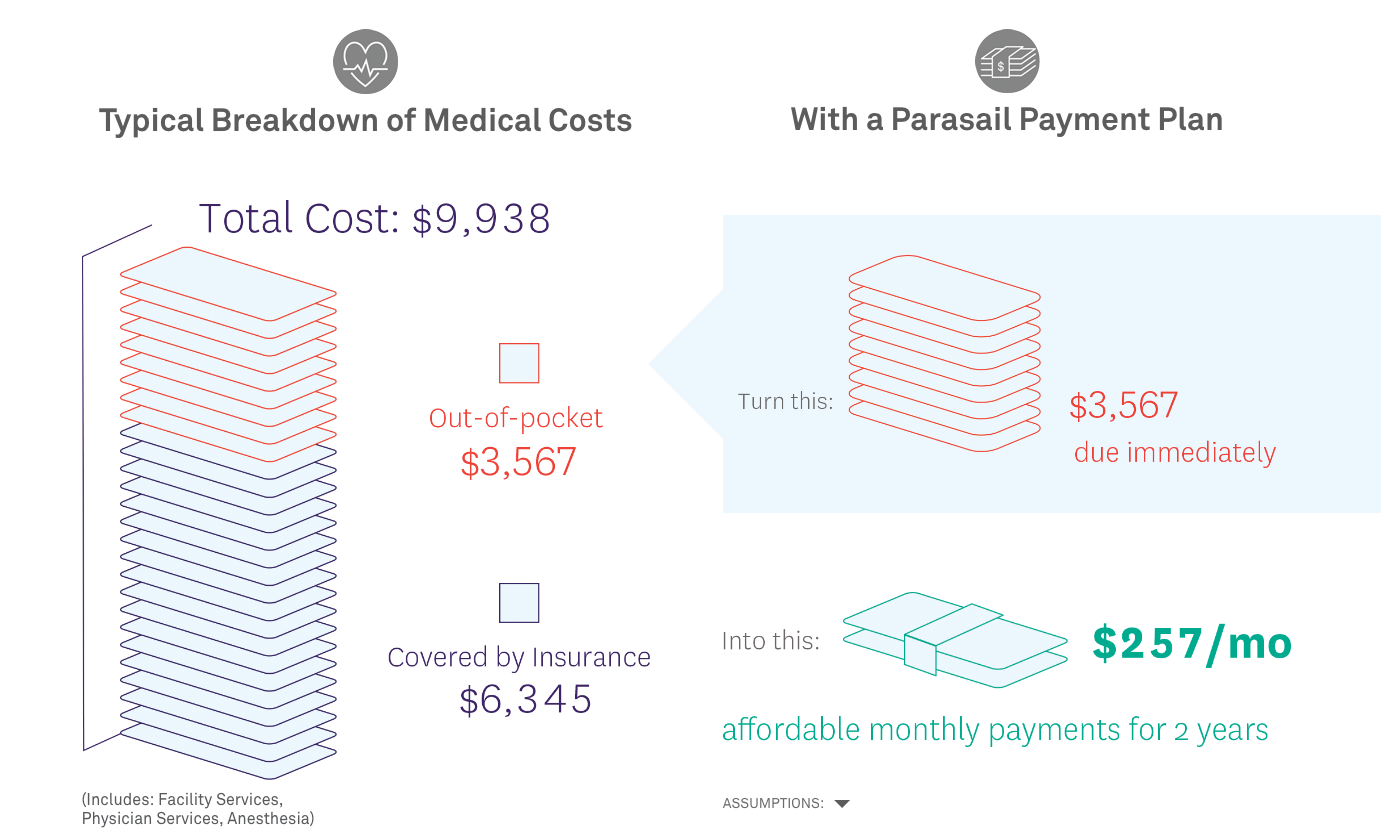

So peoples’ ability to take on the role of healthcare consumer is critical to their personal financial wellness. This week, as I was digesting the new national health expenditure numbers, I came across another news item that fit into this jigsaw puzzle that is consumer health finance: “Lively and Parasail Join Forces to Help People Afford Health Care.” This partnership enables consumers enrolled in high-deductible plans to create a Lively HSA and then get a no-interest payment plan from Parasail to cover medical bills over time in “affordable monthly payments” over 36 months with no additional interest. Providers receive immediate payment, which means the patient’s FICO score is preserved. This is an area that’s gotten some attention through the Consumer Financial Protection Board (CFPB), which has closely scrutinize the issue of medical debt. Consumer credit rating agencies recently agreed to treat medical expenses differently than other household financial line items.

So peoples’ ability to take on the role of healthcare consumer is critical to their personal financial wellness. This week, as I was digesting the new national health expenditure numbers, I came across another news item that fit into this jigsaw puzzle that is consumer health finance: “Lively and Parasail Join Forces to Help People Afford Health Care.” This partnership enables consumers enrolled in high-deductible plans to create a Lively HSA and then get a no-interest payment plan from Parasail to cover medical bills over time in “affordable monthly payments” over 36 months with no additional interest. Providers receive immediate payment, which means the patient’s FICO score is preserved. This is an area that’s gotten some attention through the Consumer Financial Protection Board (CFPB), which has closely scrutinize the issue of medical debt. Consumer credit rating agencies recently agreed to treat medical expenses differently than other household financial line items.

Peoples’ patient experience is increasingly getting bundled into their financial experience. Watch for more programs like Lively and Parasail’s to help consumers in their healthcare consumerism journeys to help manage financial health. This, while patients are managing (expensive) treatments to deal with cancers and other conditions whose cost of treatments can exceed the average American family’s income of $57,817.

Thank you FeedSpot for

Thank you FeedSpot for