“We are at a remarkable point of cancer treatment,” noted Murray Aitken, Executive Director, IQVIA Institute for Human Data Science, in a call with media this week. 2017 was a banner year of innovative drug launches in oncology, Aitken coined, with more drugs used more extensively, driving improved patient

“We are at a remarkable point of cancer treatment,” noted Murray Aitken, Executive Director, IQVIA Institute for Human Data Science, in a call with media this week. 2017 was a banner year of innovative drug launches in oncology, Aitken coined, with more drugs used more extensively, driving improved patient  for people dealing with cancer.

for people dealing with cancer.

This upbeat market description comes out of a report on Global Oncology Trends 2018 from the IQVIA Institute for Human Data Science. The subtitle of the report, “Innovation, Expansion and Disruption,” is appropriately put.

The report covers these three themes across four sections: advances in therapies, spending, pipeline and new product innovations, and an outlook through 2022.

The “innovation” and advances section discusses the 14 therapies for cancer that were launched in 2017, all targeted therapies 11 of which had breakthrough status from the FDA indicating substantial improvement over existing therapies in the market. The total number of new oncology therapies approved since 2012 hit 78 new drugs related to one or more of 24 tumor types, shown in the detailed Vitruvian Man diagram.

Aitken expects a “surge of innovation” for therapies that target both solid and liquid tumor types in the near-term. These will have clinical advances with the potential to contribute to patients’ overall survival rates based on the clinical trial data available.

Spending levels tell a financially compelling, if sobering, story, as global spending for both therapeutic purposes to treat cancer and supportive aftercare for patients rose to $133 bn in 2017 up from $96 bn in 2013, globally.

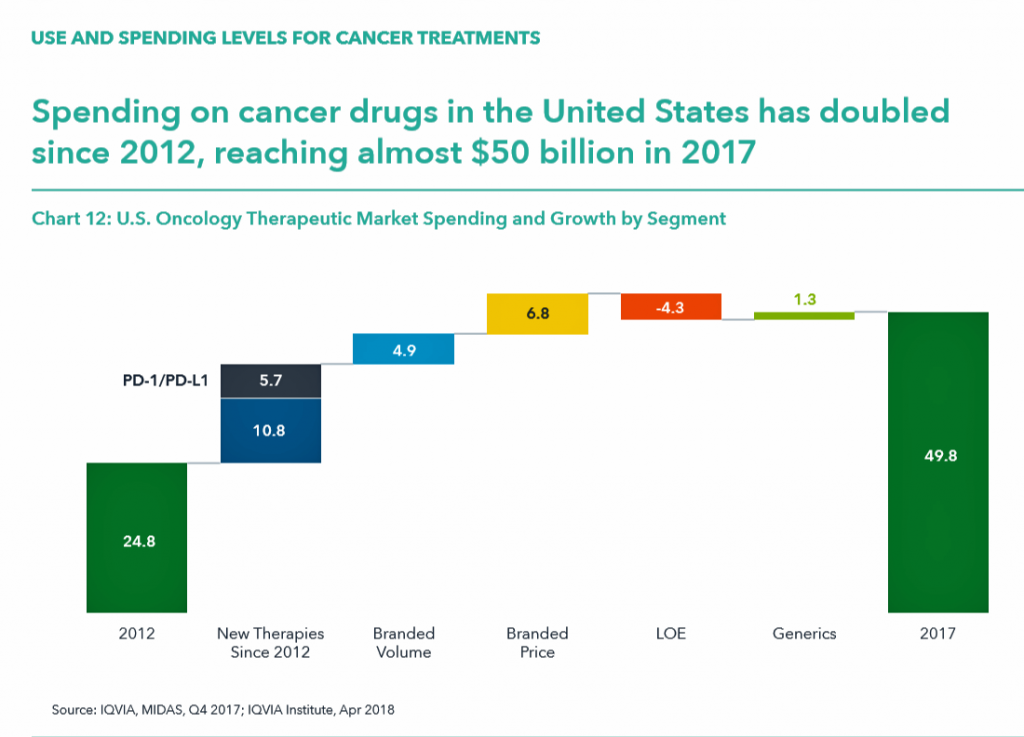

In the US, spending on oncology doubled from 2012 to 2017, to $50 bn.

The top 35 cancer drugs account for 80% of total global spending on oncology products.

Of concern is that the list prices of new drugs launched has steadily risen over the past decade. All oncology products launched in 2017 had list prices above $100,000 per year in the U.S.; the 2017 median annual cost for an oncology product exceeded $150,000, compared with $75,000 10 years ago.

As cancer drugs have advanced from a clinical profile and end-point perspective, we have also seen their list prices increase, as well. One aspect of this pricing, Aitken explained, is that 87% of oncology drugs in 2017 were used by fewer than 10,000 patients each. Small, more focused patient populations make it more difficult to scale in volume so prices can fall, the rationale goes.

This is the reality of the precision medicine field, where drugs are tailored to specific patients’ sub-type and sub-group. “What we see is relatively few patients treated with each of the drugs due to the segmentation of market,” Aitken said,

In terms of access, the US has the most open availability of oncology medicines compared with the rest of the world. “Once you get beyond 4 countries,” IQVIA’s research found, “in the rest of the world, patient populations have access to fewer of the recently launched drugs from the past 5 years.”

The pipeline of oncology innovations is at an historic high level, with over 700 molecules in late stage development (Phase 2 or later). This is up more than 60% in 2017 from a decade ago. We also see the growing adoption of biomarkers to stratify patients (to better target medicines to the “N of 1”) at 35%. There are 60 separate mechanisms now being evaluated in the immunotherapy area in Phase 1 or Phase 2 clinical trials. These are being tested against 27 different tumor types – as broad based applications for an immuno-oncology approach to cancer treatment that can better personalize treatment and lead to, hopefully, positive outcomes for longevity and quality of life for the patient dealing with cancer.

Many drugs reaching the market in 2017 had breakthrough designations. If we look to the total time from when a molecule for oncology was first patented to the time it reaches the market with a cancer indication, the median time for 2017 approvals was 14 years. That is the time lapse from recognizing the intellectual property and protection of the IP to the launch of the product.

The outlook to 2022 forecasts the global spending on oncology therapies will reach $200 bn globally. That calculates to 10 to 13% growth annually over the five-year period. The U.S. is expected to reach $100 bn of the global total – that is one-half of oncology product spending versus the rest of the world’s healthcare systems and health citizens.

Over the five years, oncology will leverage advances in technology and the use of information that is already getting baked into oncology treatment and diagnosis.

Health Populi’s Hot Points: It should be no surprise that the costs of oncology therapies will play a larger role over next decade.

Health Populi’s Hot Points: It should be no surprise that the costs of oncology therapies will play a larger role over next decade.

For context, I turn to the report, Mirror, Mirror 2017: International Comparison Reflects Flaws and Opportunities for Better U.S. Health Care from the Commonwealth Fund. This study compares health system performance across 11 developed nations, including the U.S.

Overall, U.S. health system performance across seventy-two indicators is relatively poor, especially considering America spends more money both in raw dollar terms and per person.

There are a few bright spots in U.S. health system performance, and one is with breast cancer and prostate cancer mortality.

![]()

The red-boxed area of this appendix from the Fund’s report compares American’s five-year survival rates for breast cancer and colon cancer (based on OECD 2015 data). All of the countries in the study have breast cancer survival rates in the 80-90 percent range, with the U.S. at a high of 89% along with Norway and Sweden. The lowest in this peer group was the UK at 81%,

For colon cancer, the U.S. survival rate of 64% fell more in the middle of peer country outcomes, ranging from a high of 68% in Australia to a low of 56% in the UK.

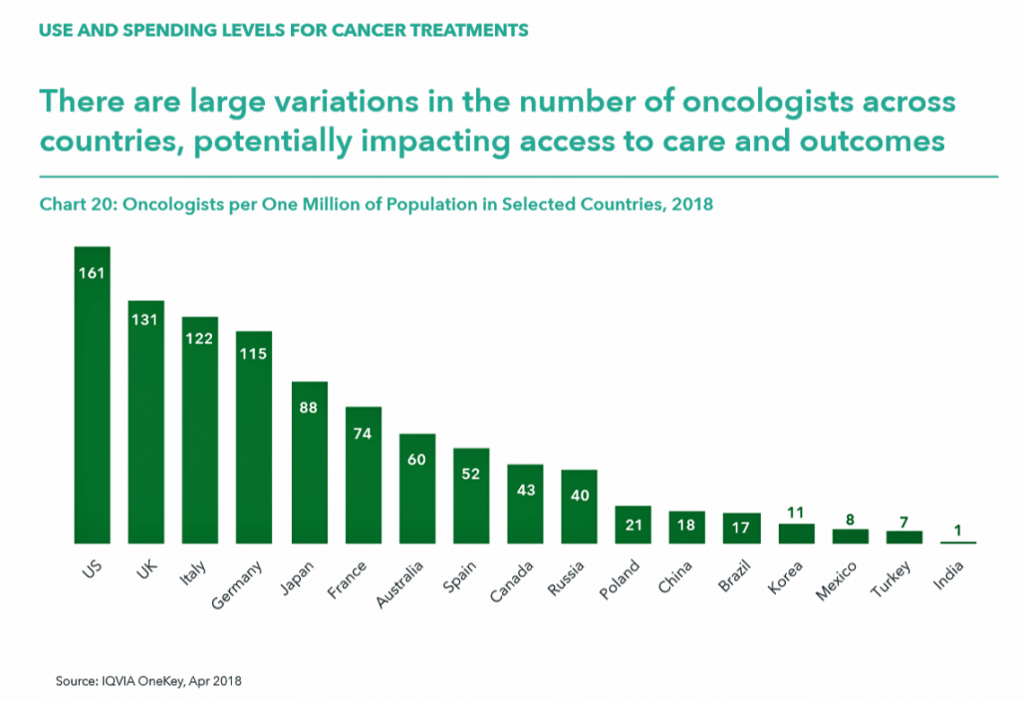

Take a look at the last chart detailing the number of oncologists across countries. Note that the U.S. has a higher rate of clinicians per 1 million population compared with the next-in-line, the UK, Italy, and Germany, with roughly one-half or fewer in Japan, France, Australia, and other nations identified by IQVIA in the report.

Take a look at the last chart detailing the number of oncologists across countries. Note that the U.S. has a higher rate of clinicians per 1 million population compared with the next-in-line, the UK, Italy, and Germany, with roughly one-half or fewer in Japan, France, Australia, and other nations identified by IQVIA in the report.

Consider that the U.S. spends more per capita on health care and has appreciably more oncologists per million health citizens, and yet outcomes for cancer are on par with other nations who spend far less on therapies and specialists to deal with the disease.

As President Trump and Secretary Azar might look to other countries to shoulder a greater financial burden of health care costs, it begs the question: who will pay for innovation in oncology, and who bears the benefits of that spending? This conversation has been elusive in the pay-for-volume health financing environment in the U.S. The U.S. has reached an unsustainable spending level on healthcare; see Health Populi‘s post yesterday on the $28,166 PPO plan for a typical U.S. working family of four.

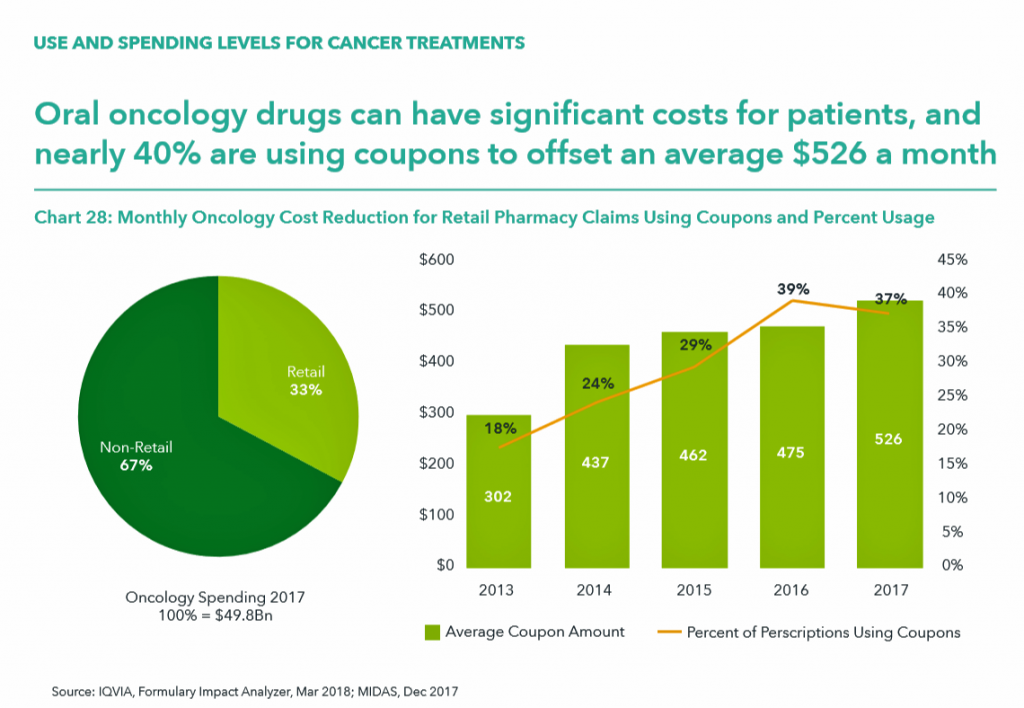

IQVIA calculated that in 2017, oral oncology drugs had significant costs for patients, with 37% of patients using coupons to offset an average cost of $526 a month. That’s $6,312, just to cover oral cancer drugs on an annual basis. [It’s important to note that Rx coupons are a uniquely American concept].

Cancer is a global scourge impacting health citizens the world over. We need a domestic U.S. conversation on the financial toxicity of new-new cancer drugs, and a global one on sharing the burden of and opportunity for financing innovation to cure cancer for all.

Thank you FeedSpot for

Thank you FeedSpot for