While Amazon and Google get lots of positive PR and media attention as major healthcare industry disruptors, don’t forget about two big “W’s,” Walgreens and Walmart, in the healthcare innovator mix.

I recently read The Four in which Scott Galloway explains the dominance of Amazon, Apple, Google and Facebook in consumers’ everyday lives. These four tech-behemoths each have their particular designs on healthcare innovation, or disruption in the eyes of, say, Epic and Cerner working on health IT systems, or GE and IBM if you’ve been pioneers in health data or big-iron information technology.

I recently read The Four in which Scott Galloway explains the dominance of Amazon, Apple, Google and Facebook in consumers’ everyday lives. These four tech-behemoths each have their particular designs on healthcare innovation, or disruption in the eyes of, say, Epic and Cerner working on health IT systems, or GE and IBM if you’ve been pioneers in health data or big-iron information technology.

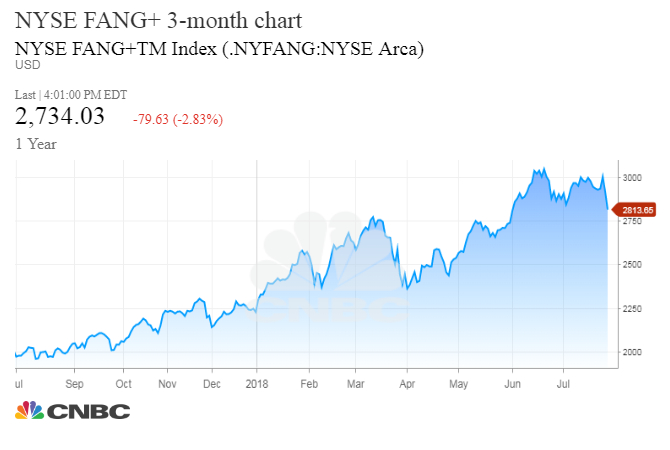

Then in the past week, the decline-and-fall of Facebook’s stock led to this morning’s headline in the Wall Street Journal’s Business & Finance section, “Big Tech Plunges Into Correction.” The topline is that the so-called FANG+ Index (including Facebook, Amazon, Netflix, Alphabet/Google, Apple, Twitter, Tesla, Nvidia, Alibaba, and Baidu) dropped yesterday with investors pulling money out of technology stocks. The “MAGA” cohort was covered in the Financial Times on 27th July, focusing on the resilience of Microsoft, Amazon, Google (Alphabet), and Apple.

Most of these companies are placing big bets in healthcare. And healthcare is complicated, President Trump recognized in late February 2017, just a few weeks after the POTUS took his seat in the Oval Office.

The complications of healthcare are, today, the opportunities to develop innovations and novel on-ramps for health care. Most of the healthcare innovation-attention at this moment is going to the Four, and to Big Tech in general. Over many years, I’ve written extensively about the continuing evolution and deepening of Amazon in healthcare, along with Apple, Facebook, and Google efforts.

To complement what we know about the Four, new announcements from Walgreens and Walmart must be mixed into the healthcare innovation mash-up that we’re tracking here at THINK-Health and in this blog.

First, to Walgreens, which has curated a talented digital health staff in the past decade. In the days when the Balance Rewards loyalty program was growing and adding health tracking to the consumer opportunity, Adam Pellegrini launched many creative and impactful digital health programs during his tenure there. He’s now at Fitbit leading efforts there to build clinical evidence and relationships to make healthcare — not just health and wellness — better.

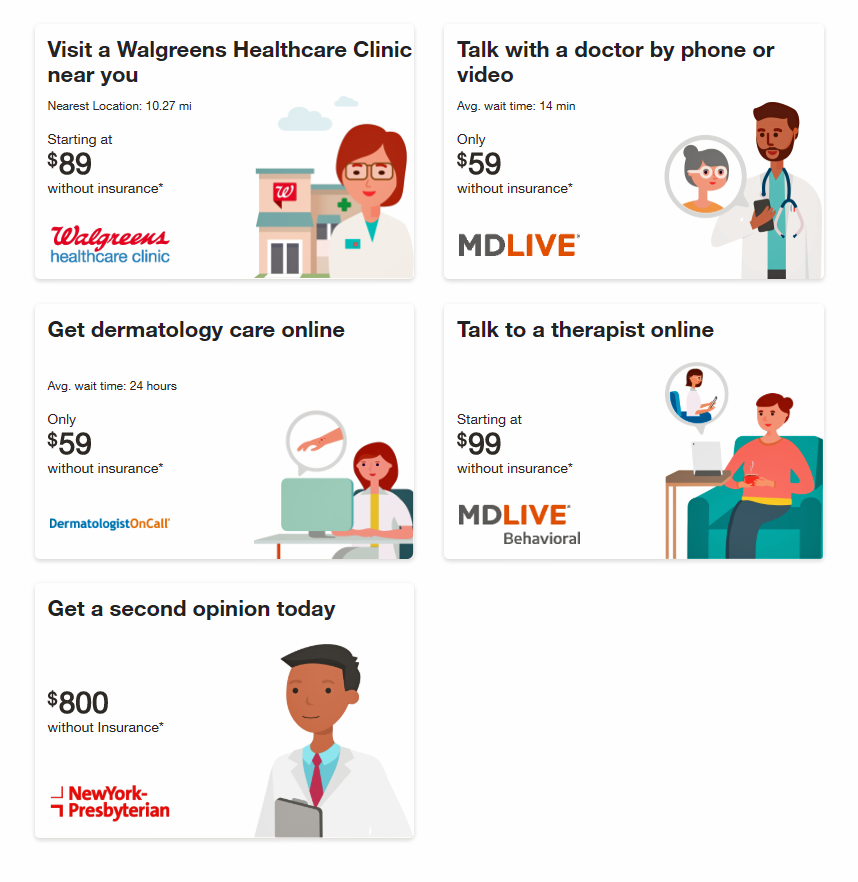

The latest news from Walgreens is their launch of Find Care Now. Think of this program as the pharmacy chain’s expansion of existing programs in telehealth, married to a ZocDoc-style platform that enables the consumer to shop for and schedule an appointment in one digital encounter. This is easy-to-access through the Walgreens mobile app.

The latest news from Walgreens is their launch of Find Care Now. Think of this program as the pharmacy chain’s expansion of existing programs in telehealth, married to a ZocDoc-style platform that enables the consumer to shop for and schedule an appointment in one digital encounter. This is easy-to-access through the Walgreens mobile app.

The 17 telehealth channel providers in Walgreens Find Care Now network include:

- Advocate Health Care, Chicago

- Baptist Health, Jacksonville, Florida

- Community Health Network, Indianapolis

- DermatologistOnCall, national online dermatology service

- Florida Hospital, Tampa

- Heal, on-demand doctor house calls in California, Washington, D.C. and Northern Virginia

- LabCorp, lab testing and diagnostics

- MDLIVE, national telehealth service

- MedExpress Urgent Care, an Optum company and provider of neighborhood medical care

- NewYork-Presbyterian Hospital in collaboration with Weill Cornell Medicine and Columbia University Irving Medical Center, New York

- Piedmont Healthcare, Atlanta

- Providence St. Joseph Health, including Providence Express Care in Portland, Oregon, and Swedish Express Care in Seattle

- SSM Health, St. Louis

- UHealth – The University of Miami Health System, Miami

- Walgreens Healthcare Clinics

- Walgreens Hearing

- Walgreens Optical.

The second graphic was generated on the Find Care Now portal based on my home ZIP code. Here, Walgreens gives me options of speaking with a doctor by phone or video for $59 via the MDLIVE service, talking with a psychotherapist for $99 via the MDLIVE Behavioral channel, getting a tele-dermatology consult for $59 cash through Dermatologist OnCall, or perhaps visiting a Walgreens healthcare clinic for some primary care starting at $89 for the visit. Note that the second opinion service served up to me is with New York-Presbyterian Hospitals, seemingly based on the location closest to my postal code (compared with, say, SSM Health in St. Louis or Baptist Health in Jacksonville, FL).

Media coverage of this story couches the Find Care Now program in terms of the Amazon’ing of health care. But that diminishes what Walgreens has already built in terms of institutional memory and health/care ethos. The company has over 78,000 healthcare service providers, including pharmacists, pharmacy technicians, nurse practitioners and other health capital. It’s a brand that 8 million consumers interact with every day, online and in any one of over 8,100 bricks-and-mortar stores located within a few miles of most Americans in all 50 U.S. states.

Media coverage of this story couches the Find Care Now program in terms of the Amazon’ing of health care. But that diminishes what Walgreens has already built in terms of institutional memory and health/care ethos. The company has over 78,000 healthcare service providers, including pharmacists, pharmacy technicians, nurse practitioners and other health capital. It’s a brand that 8 million consumers interact with every day, online and in any one of over 8,100 bricks-and-mortar stores located within a few miles of most Americans in all 50 U.S. states.

Now, let’s look to Walmart, tied with Amazon for being the place two-thirds of U.S. households shopped at retail in January and February 2018.

Walmart has made several announcements in recent weeks that further build the company’s healthcare infrastructure and prospects. The appointment of Sean Slovenski, as SVP of Health & Wellness is important because Slovenski comes from Humana, Care Innovations (GE and Intel), and Healthways — organizations that have led in healthcare innovation for many years. Humana’s an important touch point here because of Walmart’s intention to buy or closely collaborate with the health plan. Having an internal healthcare leader that already knows the Humana business and culture would help to position Walmart to more effectively merge/closely align Humana into Walmart’s overall environment and health businesses.

Another key announcement was Walmart’s relationship with Microsoft for cloud computing via MSFT’s Azure. This competes with the Amazon Web Service’s cloud business which has a lot of healthcare data in there already across the healthcare ecosystem’s segments. But don’t count out Microsoft, which has a long history serving both legacy healthcare (providers, plans, pharma) and new-new digital health programs and companies around the world. There are deep and serious healthcare chops here from which Walmart can benefit. (As a sidebar of interest, here’s Microsoft’s pitch on its website directly comparing AWS to Azure).

Another key announcement was Walmart’s relationship with Microsoft for cloud computing via MSFT’s Azure. This competes with the Amazon Web Service’s cloud business which has a lot of healthcare data in there already across the healthcare ecosystem’s segments. But don’t count out Microsoft, which has a long history serving both legacy healthcare (providers, plans, pharma) and new-new digital health programs and companies around the world. There are deep and serious healthcare chops here from which Walmart can benefit. (As a sidebar of interest, here’s Microsoft’s pitch on its website directly comparing AWS to Azure).

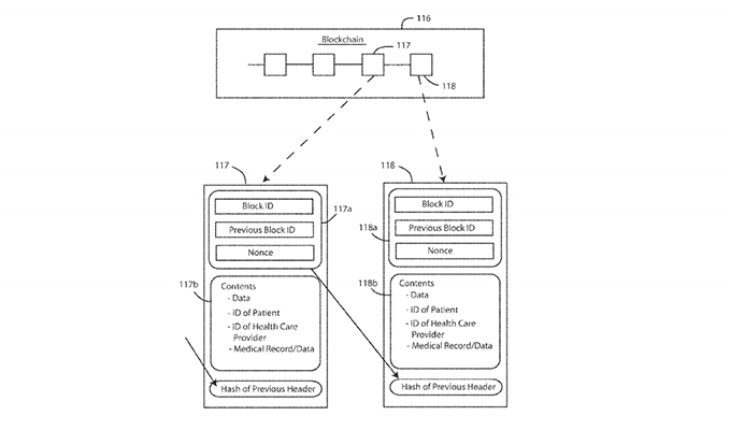

Third, Walmart filed a patent with the U.S. Patent and Trademark Office in December 2017 for an wearable device and innovation that marries blockchain technology to electronic health records (EHRs). “There is a need for a method and system for obtaining a medical record stored on the blockchain when the owner of the private key cannot readily provide the private key,” the application states.

The wearable device for storing the encrypted private key and public key for accessing the data, could be a bracelet, necklace or a ring. Two other technologies would be required to “unlock” the chain: an RFID scanner for obtaining the public key, and a biometric scanner to verify some aspect of the consumer’s identity such as a facial feature, fingerprint, or iris of the eye, for example.

These announcements from Walgreens and Walmart, among other organizations looking to improve health care by expanding access and lowering per capita costs, are coming to market more frequently. Stay tuned to Health Populi for ongoing analysis and forecasting of these projects, some motivated by Amazon and protecting existing market access, and some further out-of-the-box and the Amazon locker.

Health Populi’s Hot Points: Ultimately, expanding healthcare access, improving quality and lowering cost per patient are admirable and necessary objectives in meeting the Triple Aim — healthcare’s operational beacon for making healthcare better and more sustainable in the U.S.

Underneath these audacious goals are data, data everywhere. Thus, Microsoft’s work with Walmart, and Amazon’s clouds that collaborate with numerous healthcare stakeholders, enable “how to make healthcare better.” It’s about Big Data, places and spaces and power to store and process it, and then the ability to access what’s needed to respond to a challenge at-hand.

It’s also about the right data. As I recently wrote about here in Health Populi, not all data is good data nor all of it necessary for solving a specific challenge. That’s why collaboration is so important, and why I’m bullish on a Walmart-Humana collaboration. Walmart has, arguably, the most retail data on the most consumer/health citizens in America in one place. While there is a lot of data available from data brokers like Acxiom, CoreLogic, Experian and Nielsen, among others, that data costs a lot to access it. In my advisory work with organizations that serve this market, I have learned that such costs can be limiting factors in projects that want to address social determinants of health, but can’t afford the high cost of that data that’s so elusive — yet so important for answering real questions about real peoples’ health in real-life.

Walmart and Humana, among other collaborations, can address the challenge of the right data, right place, right time if that’s where such a project will go. Most of our healthcare challenges are lifestyle borne, with health created where we live, work, play, pray and learn. That calls for collaboration and data-sharing — the former, easier to imagine, and the latter very difficult to do based on current business models that are full of friction. Would that these new collaboratives re-imagine frictionless business based on fair play (coined “Citizen AI” in the Accenture 2018 Digital Health Tech Vision), with a relentless commitment to making healthcare better for all people.

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for