All sectors who are stakeholders in the healthcare ecosystem aren’t created equal, Accenture explains in their report, Healthcare’s future winners and losers. Observing the influx of new flavors of entrants like Amazon and Google, start-ups like Iora Health, Oscar and FetchMD, begs the question: how will legacy healthcare system players fare? Who will survive, and what will be the success factors that bolster long-term viability?

All sectors who are stakeholders in the healthcare ecosystem aren’t created equal, Accenture explains in their report, Healthcare’s future winners and losers. Observing the influx of new flavors of entrants like Amazon and Google, start-ups like Iora Health, Oscar and FetchMD, begs the question: how will legacy healthcare system players fare? Who will survive, and what will be the success factors that bolster long-term viability?

To answer that question, Accenture points to three market trends that set “new rules” in healthcare:

- Blurred lines, which are the grey areas and adjacencies between technology, service, finance, and retail

- The middle of nowhere, with digital technology driving commoditization in healthcare leaving middlemen — like PBMs, brokers, and distributors — in a precarious place (or non-place)

- Consumers are cash, betting on the scenario that the end-user of healthcare services will truly don the hat and workflow of a consumer.

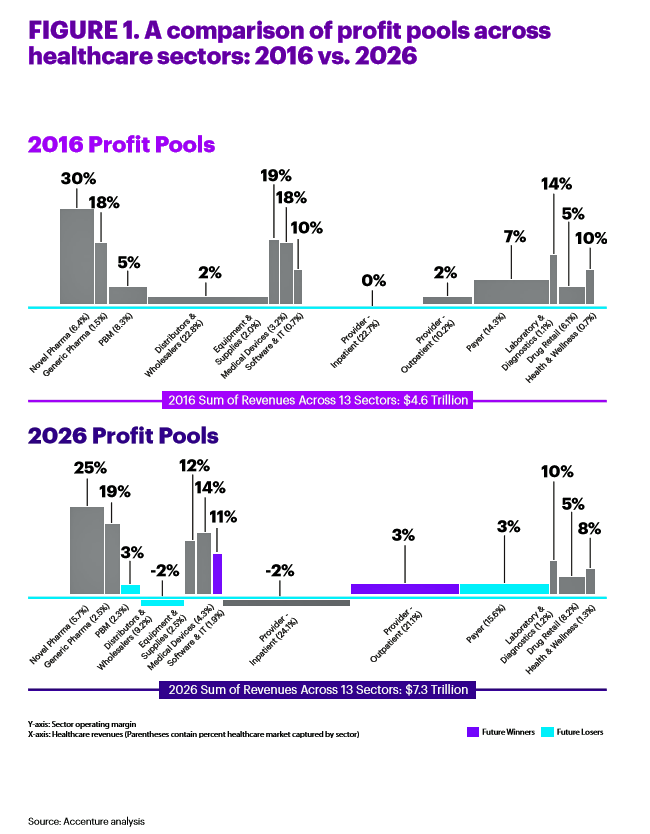

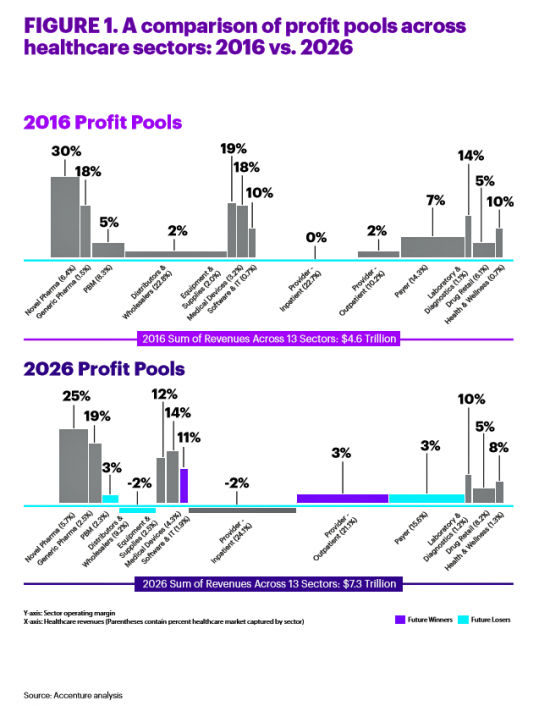

The dynamic of these three forces will lead to “shifting profit pools,” with some traditional parts of the value-chain receding and others rising — with some new players taking on greater scale and revenue opportunities.

The profit pool is the relationship between the healthcare sector’s market share and its profitability.

The bottom line: “Pharmacy benefits managers (PBMs), distributors and wholesalers, and payers will lose big in a landscape that will be unrecognizable,” Accenture warns.

The winners will be those that leverage and develop technologies that take friction out of healthcare development and delivery, while lowering costs and delighting consumers and providers. Rewards will accrue to the organizations that can scale such solutions.

Compare the 2016 profit pools to those forecasted for 2026: in the current environment, the profit pools for PBMs, distributors, and payers fall (colored in blue). Over the same decade, see who wins? Software and IT, and provider-outpatient which, Accenture posits, will be very consumer-facing and -engaging by 2026.

Some traditional healthcare sectors preserve most of their value by 2026, such as pharma and generics, along with drug retail. While there may be declining fortunes among medical device and equipment segments, lab, diagnostics, and health and wellness, there will be opportunities for those players to preserve value by responding to the key forces of IT-supported innovation, commoditization, and consumer-enchantment and value-consciousness.

Health Populi’s Hot Points: This report is all about shifting business models in healthcare, as the treasury function shifts from multi-layered transactions to flatter relationships — especially as consumers, as “cash” in this forecast, become the locus of healthcare industry profitability.

Value will be in the eye of the beholder-payer, with consumers front and center, this report suggests. If this scenario comes to fruition, then the role of the consumer’s customer experience takes on huge significance.

On that score (as in “Net Promoter Score”), check out this video from the Temkin Group which explains customer experience so well.

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for