Today’s financial news reports and the bullish stock market generate headlines saying that the U.S. economy is riding high. President Trump forecasted in late July, “we are now on track to hit an average GDP annual growth of over 3% and it could be substantially over 3%,” Trump said. “Each point, by the way, means approximately $3 trillion and 10 million jobs. Think of that.” Indeed, unemployment is at its lowest rate in decades at 4%.

Today’s financial news reports and the bullish stock market generate headlines saying that the U.S. economy is riding high. President Trump forecasted in late July, “we are now on track to hit an average GDP annual growth of over 3% and it could be substantially over 3%,” Trump said. “Each point, by the way, means approximately $3 trillion and 10 million jobs. Think of that.” Indeed, unemployment is at its lowest rate in decades at 4%.

Today, NASDAQ reported that, “the U.S. economy stays strong as the Fed holds steady.”

For mainstream working people, though, even with a job in a high employment climate, wages have been quite flat for many years. That real-people financial reality is discussed in a “Fact Tank” essay from the Pew Research Group, For most US workers, real wages have barely budged in decades.

This has translated in benefit costs — particularly, health benefits — rising more quickly than peoples’ paychecks have kept pace.

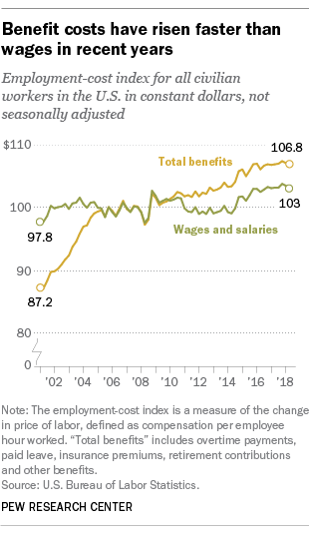

The first chart from the Pew discussion illustrates the rise of benefit costs vs. wage and salary growth, crossing lines around 2008 — when the Great Recession hit U.S. households. Then wage growth flattened for several years, until modest increases beginning in 2016. But the gap between benefits and pay remains even during America’s current positive macroeconomy.

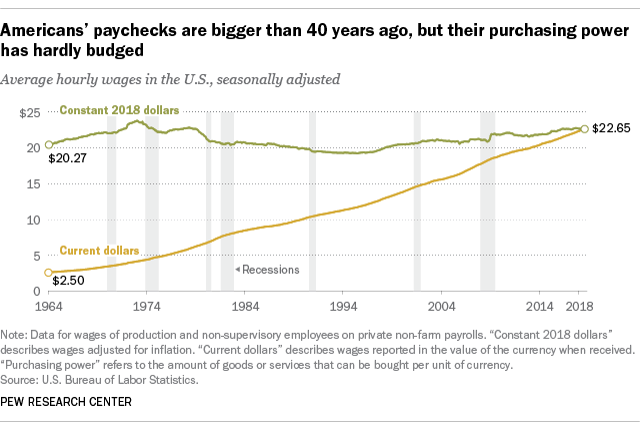

Underneath that wage story is the fact that adjusting for inflation, today’s average hourly wage is nearly equal to the purchasing power it had in 1978. Pew also calculated that median weekly earnings increased from $232 in the beginning of 1979 to $879 in 2018. But these two numbers, as far apart as they seem, actually spend equally — that is, $232 in 1979 is equal to $840 in terms of purchasing power.

Purchasing power over time is shown in the second chart.

Purchasing power over time is shown in the second chart.

Pew points out that there are many factors that may have caused this flat-lining personal economic scenario for the mass of Americans: the decline of labor unions which leveraged and negotiated workers’ financial interests upward; lagging educational attainment compared with some other nations around the world; more people in the gig economy and those not seeking jobs; and declines in manufacturing sectors with shifts toward service industries that pay lower wages.

The Bureau of Labor Statistics told us last month that wage increases that have been paid to U.S. workers have accrued largely to the top earners in America — those at the 90th percentile which garner $2,223 per week (annually equal to $115,600 a year). The 50th percentile wage was $928 a week, or $48,256 annually. (As an aside, men at the 90th percentile earned $2,492 a week, and women, $1,890).

Health Populi’s Hot Points: Of course,  one of the objectives of the Affordable Care Act was to help nudge healthcare toward affordability. The fact that wages have stayed flat for over a decade have effectively compelled employers, who wanted to provide for workers’ health insurance benefits, to stem wage growth in favor of sponsoring health insurance benefits.

one of the objectives of the Affordable Care Act was to help nudge healthcare toward affordability. The fact that wages have stayed flat for over a decade have effectively compelled employers, who wanted to provide for workers’ health insurance benefits, to stem wage growth in favor of sponsoring health insurance benefits.

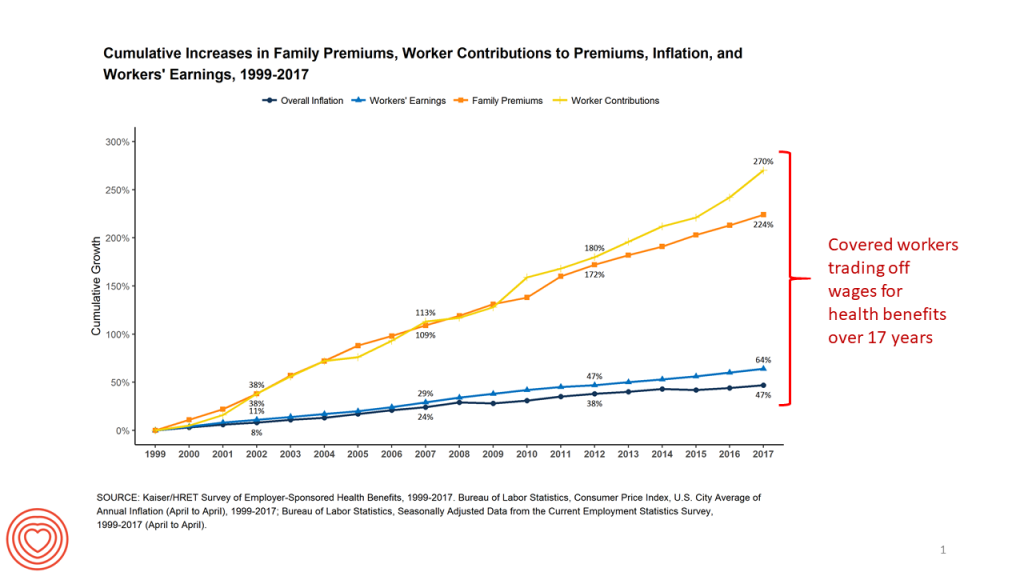

The third chart, a perennial favorite we use here on Health Populi and in our advisory work throughout the year and across lots of project types, tells that story of the wage/benefit cost tradeoff over the years.

The Pew analysis recognizes this factor, citing the BLS statistic that total benefit costs for civilian workers have risen 22.5% since 2001, compared with a 5.3% wage and salary cost increase. That’s easy arithmetic to figure, that healthcare costs in terms of benefits have grown roughly four times faster than wage growth.

So the challenge for mainstream working householders, shopping for value-priced groceries and managing utility costs and the price of filling a gas tank to get to that job — how to pay for health care?

There’s new research published by NBER on how Americans don’t seem to shop around for a lower-limb MRI imaging service, asking the question, “are health services shoppable?

There’s other evidence that people will “shop” for services that aren’t for trauma or un-shoppable, and would like to be able to find value-based healthcare based on their own healthcare objectives and consumer experience expectations. This is the challenge to the legacy healthcare system, and why more people are seeking alternative settings and service types to project manage health care, at a cost and service level that they demand. That is, if those patients-as-health-consumers can vote with their feet and pocketbook. As the patient is increasingly the payor, the financial experience is embedded into the patient experience, too.

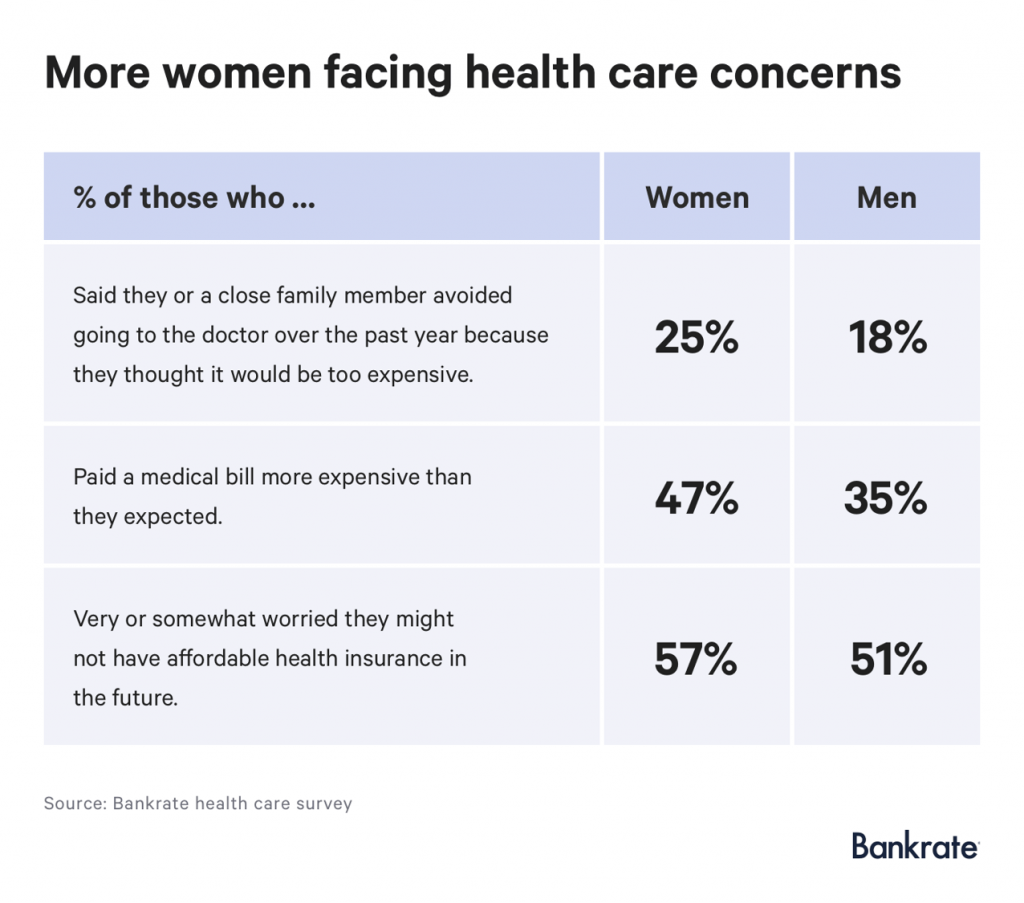

Women, who are generally the Chief Health Officers of their households, are feeling more acutely pinched by healthcare costs. I noted above that women earn less than men, even in the 90th percentile of highest incomes in America. Here’s evidence from a new Bankrate survey which had a question regarding women’s concerns about healthcare, shown in the table. More women know a family member who has avoided care due to cost, and more faced paying a medical bill that was higher than expected. This will make healthcare a voting issue for some women in the 2018 mid-term elections.

Women, who are generally the Chief Health Officers of their households, are feeling more acutely pinched by healthcare costs. I noted above that women earn less than men, even in the 90th percentile of highest incomes in America. Here’s evidence from a new Bankrate survey which had a question regarding women’s concerns about healthcare, shown in the table. More women know a family member who has avoided care due to cost, and more faced paying a medical bill that was higher than expected. This will make healthcare a voting issue for some women in the 2018 mid-term elections.

Needless to say, as the third row of data demonstrates, most of both women and men are worried they might not have affordable health plans in the future, Bankrate found.

Thank you FeedSpot for

Thank you FeedSpot for