Medical costs in America are still the top contributor to personal bankruptcy in the U.S., a risk factor in two-thirds of bankruptcies filed between 2013 and 2016. That’s a sad fiscal fact, especially as more Americans gained access to health insurance under the Affordable Care Act, according to a study published this month in the American Journal of Public Health (AJPA).

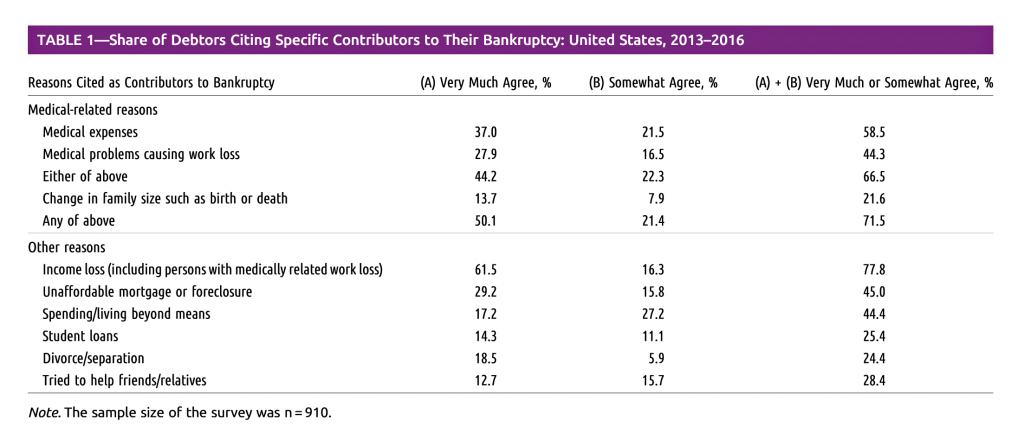

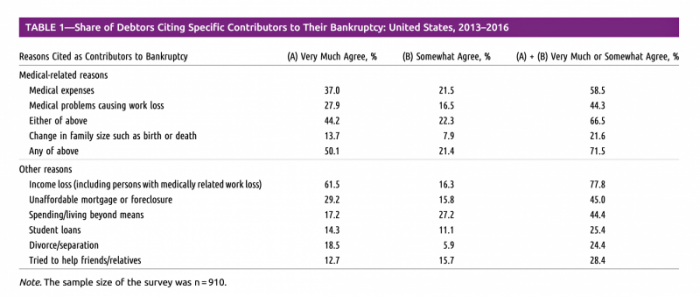

Between 2013 and 2016, about 530,000 bankruptcies were filed among U.S. families each year associated with medical reasons, illustrated in Table 1 from the study. The report, Medical Bankruptcy: Still Common Despite the Affordable Care Act, updates research from 2007 which was conducted by two of this new study’s authors, Dr. David Himmelstein and Dr. Steffie Woolhandler, along with other colleagues. In the 2007 analysis, a roughly similar proportion of U.S. bankruptcies were related to medical issues (62.7%) — thus informing the article’s title that medical bankruptcy is “still common” even after the ACA’s implementation.

The data show that medical expenses as well as medical problems that caused the loss of a job were key risks for bankruptcy in the U.S between 2013 and 2016.

Note that student loans were also a contributor to 25% of bankruptcies.

This study calls out the fact that medical costs continue to rise more quickly than wage growth and general price inflation in the U.S. While studies in the past couple of years have shown that health care costs are growing more slowly than in years prior to the start of the ACA era, costs are still growing beyond many health consumers’ ability to cover first-dollar deductibles — which are the reason for patients’ growing “skin the game” with respect to people becoming health care payors until the deductible is met…and then some, if a health plan design involves additional coinsurance and copayments for services, supplies and therapies.

This study analyzed responses from 910 completed surveys drawn from a random sample of court records from U.S. bankruptcy filers between 2013 and 2016. The original sample was 3,200, and 29.4% of debtors contacted responded to the survey.

Health Populi’s Hot Points: One of the underlying social determinants of health in America is that wealth can pre-determine health, a reality that the Robert Wood Johnson Foundation has been addressing for decades. This week, RWJF linked people on their mailing list to reports on income inequality and health, which I point you to here. The AJPH paper on medical bankruptcy has a subtext in its discussion that speaks to income inequality, noting that, “Building wealth where opportunities have been historically limited is essential for advancing health equity. Closing the wealth gap in this country will require new policies and programs at the state and national levels, and across sectors, including in education, housing, banking, and the justice system.”

Health Populi’s Hot Points: One of the underlying social determinants of health in America is that wealth can pre-determine health, a reality that the Robert Wood Johnson Foundation has been addressing for decades. This week, RWJF linked people on their mailing list to reports on income inequality and health, which I point you to here. The AJPH paper on medical bankruptcy has a subtext in its discussion that speaks to income inequality, noting that, “Building wealth where opportunities have been historically limited is essential for advancing health equity. Closing the wealth gap in this country will require new policies and programs at the state and national levels, and across sectors, including in education, housing, banking, and the justice system.”

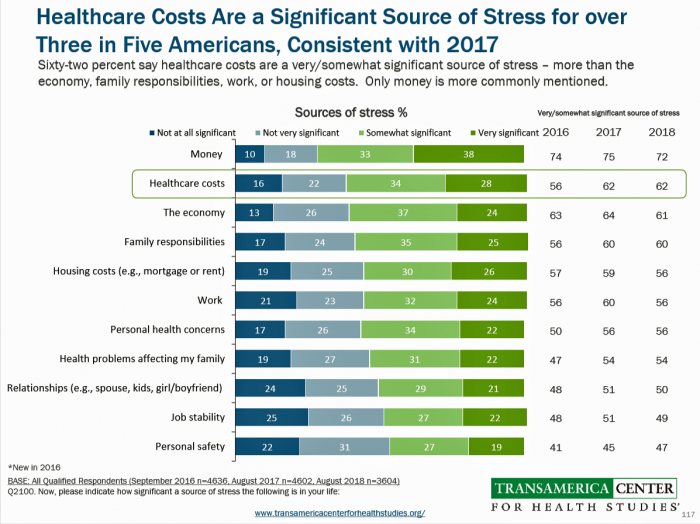

The fact is that Americans are at risk of financial toxicity and stress when it comes to health care costs, even when they may not be forced to file for personal bankruptcy. The Stress in America survey from the American Psychological Association has documented the phenomenon of financial stress and medical costs, as has other research.

The authors soberly conclude, “Although death is inevitable, good public policy can ensure that financial suffering from illness is not.”

This inspires me to remember the old saw about the certainty of “death and taxes.” It is commonly thought that Benjamin Franklin originated this phrase.

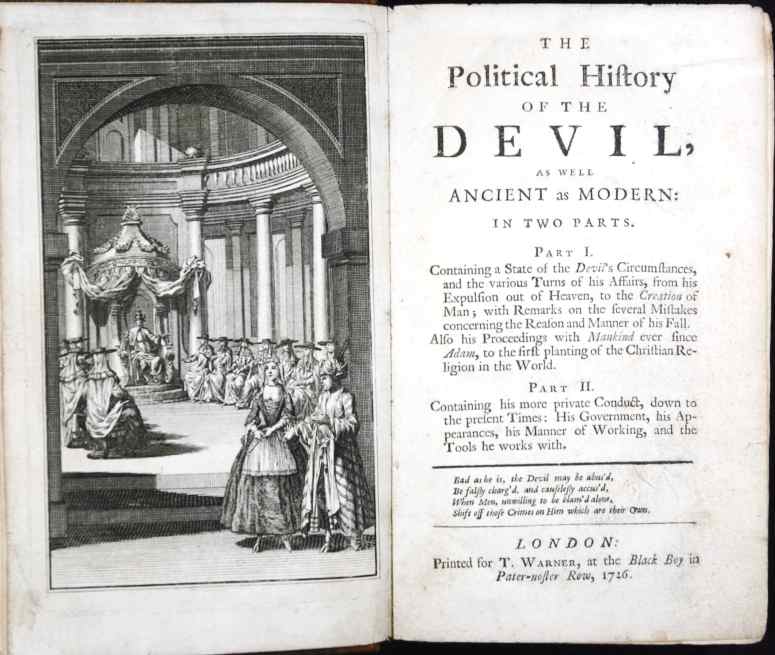

Not so: it was first coined and documented by Daniel Defoe in his book, The Political History of the Devil, in 1726. “Things as certain as death and taxes, can be more firmly believed,” Defoe wrote in this aptly-titled political treatise.

Not so: it was first coined and documented by Daniel Defoe in his book, The Political History of the Devil, in 1726. “Things as certain as death and taxes, can be more firmly believed,” Defoe wrote in this aptly-titled political treatise.

Revised conclusion, 430 pm Eastern time

In the case of the U.S. and health care costs, it’s a known-known that patients-as-payors of health care are taking on greater financial risk in the era of high deductible health plans, six-digit costs for specialty drugs, and surprise medical bills. My friend and colleague Michael Millenson reminded me today, after reading this post above-the-hot-points, that Dr. Himmelstein and team’s previous contentions that health care costs were the top reason for personal bankruptcies in the U.S. were vetted by Politifact here in a January 2019 story in collaboration with the Tampa Bay Times. This critique was animated in the State of Florida because the Speaker of the State House had raised the issue that Floridians were indeed subject to these same stats on medical spending as a risk for bankruptcy. He asserted this in the context of arguing against Medicaid expansion in the State, stumping instead for “more competition” in health care.

After a lot of research and calculations, Politifact’s conclusion was that it was “difficult to pinpoint” one specific reason Americans file for bankruptcy. They deduced that the claim from Himmelstein et al was “Half True.”

You should read the Politifact coverage to get a fuller appreciation of how difficult a measurement issue this question about the cause(s) of bankruptcy presents. I stand (half) corrected.

Thank you FeedSpot for

Thank you FeedSpot for