Self-care in health goes back thousands of years. Reading from Hippocrates’ Corpus about food and clean air’s role in health sounds contemporary today. And even in our most cynical moments, we can all hearken back to our grandmothers’ kitchen table wisdom for dealing with skin issues, the flu, and broken hearts.

The annual conference of the Consumer Healthcare Products Association (CHPA) convened this week, and I was grateful to attend and speak on the evolving retail health landscape yesterday. Gary Downing, CEO of Clarion Brands and Chairman of the CHPA Board, kicked off the first day with a nostalgic look back at his father’s truck, which motored between mom-and-pop stores in Dad’s work as a “rack jobber.” This was a family business run by mom and dad, started after World War II. Dad owned the “rack” in his clients’ stores and filled that shelf with whatever over-the-counter products the store needed replacing based on shoppers’ demands.

Gary looked back at that era, realizing his father’s understanding of consumer needs at retail. Then Gary looked forward at the evolution of self-care – the theme of this year’s annual conference.

Since George Washington curated a list of medicines for his troops, in search of tinctures and oils for dealing with the harsh environment and challenging battlegrounds, to today’s challenges of ecommerce and new products like CBD oils disrupting today’s marketplace, the concept of self-care continues to evolve.

Key issues facing the industry in 2019 and into the next few years range from regulation of dietary supplements and the role of CBD in self-care, the omni-channel consumer, ecommerce vs. bricks-and-mortar, trust, and wrestling with consumer privacy.

To meet the future, Scott Melville, CEO of CHPA, described the organization’s 2020 project which is determining the categories the Association should represent. Remember that the CHPA has a 138-year old heritage. For the organization’s 2020 vision, there are three category pillars in sight: over-the-counter (OTC) drugs (the core mission for over a century), dietary supplements, and consumer medical devices (think: the CES digital health aisles, and beyond).

To meet the future, Scott Melville, CEO of CHPA, described the organization’s 2020 project which is determining the categories the Association should represent. Remember that the CHPA has a 138-year old heritage. For the organization’s 2020 vision, there are three category pillars in sight: over-the-counter (OTC) drugs (the core mission for over a century), dietary supplements, and consumer medical devices (think: the CES digital health aisles, and beyond).

Among Scott’s many insightful comments, one really resonated with me and my health-economics mindset: on the growing presence of value-based insurance design in the U.S. Scott called out the work of Nicholas Bagley at University of Michigan (my alma mater – Go Blue!). The goal of VBID is to align costs and outcomes in health care in terms of paying for what brings value. “Value-based insurance design is the holy grail, at least for new drugs,” Nicholas was quoted in the New York Times. “But we wouldn’t want to pay a value-based price for aspirin. Doing so would cause us to pay a lot more for it than we do today.”

The point here is that private-label aspirin costs about five cents per tablet. But the value that little pill brings to a person-patient-consumer-payor is much greater than a nickel.

“Does that mean that politicians and consumers will argue they should cost more?” Scott rhetorically asked.

Well, no, Scott pragmatically answered.

The point is that the consumer healthcare industry has to do a better job communicating the value provided by these products.

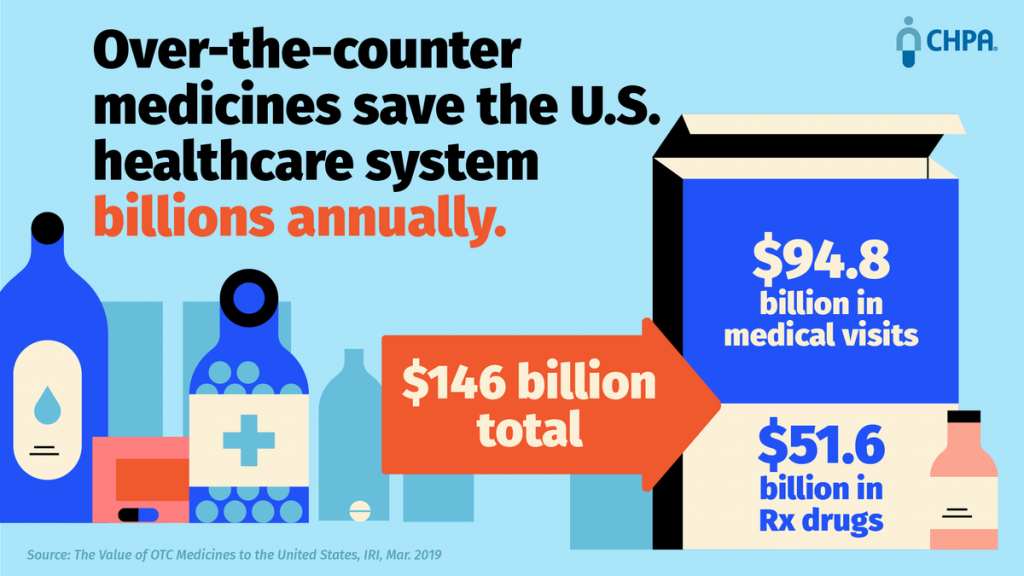

CHPA released a new study this week into the value of OTC meds. The report calculates that these products save the U.S. health care system $94.8 billion in medical visits and reduce reliance on prescription drugs by a $51.6 billion savings. That totals $146 billion. The bottom line: each dollar spent on OTCs saves over $7 in the U.S. medical system in terms of direct costs.

Indirect costs are an additional layer of value: for companies, workers using OTC meds generate $34 billion in workplace productivity benefits. Payors have begun to recognize the value of nudging consumers toward over-the-counter products under Medicare Advantage plans. For example, Anthem and Walmart introduced the Healthy Benefits program, a card that covers $50 to $330 of OTC spending per quarter depending on the plan.

Here’s a video that talks about some of these findings – with the tagline, “Don’t waste your day feeling sick. Use your sick days for more serious stuff.”

Next up in the agenda was the presentation of the Ivan D. Combe Lifetime Achievement Award. You know Combe and his family’s company by the helpful, engaging brands they’ve brought us over the years like Just for Men, Seabond, and Vagisil. It’s this last brand that sponsored the reception and public launch of the WE initiative to support the professional growth and sustainability of female leaders in the consumer healthcare industry. Keech Combe Shetty, granddaughter of Ivan and Co-CEO of Combe, bolstered the importance of women’s leadership in the health care industry as both a role model and supporter. If you follow the Vagisil brand and others in the Combe portfolio, you will see the company’s support of women’s health, engagement and empowerment.

Next up in the agenda was the presentation of the Ivan D. Combe Lifetime Achievement Award. You know Combe and his family’s company by the helpful, engaging brands they’ve brought us over the years like Just for Men, Seabond, and Vagisil. It’s this last brand that sponsored the reception and public launch of the WE initiative to support the professional growth and sustainability of female leaders in the consumer healthcare industry. Keech Combe Shetty, granddaughter of Ivan and Co-CEO of Combe, bolstered the importance of women’s leadership in the health care industry as both a role model and supporter. If you follow the Vagisil brand and others in the Combe portfolio, you will see the company’s support of women’s health, engagement and empowerment.

Timothy Hayes was given the Combe Award for his many years in the consumer health business. Interestingly, importantly, I noted that Tim began his career at Quaker Oats. I found this intriguing due to the consumers’ increasing engagement with food-as-medicine, which featured prominently in IRI’s research discussed next at the conference.

To that point, IRI’s Kristin Hornberger presented new data on retail health market performance in 2018. “It’s challenging out there,” she began, with store growth at only one to two percent in the year. “We have to get better at reaching consumers and shoppers,” Kristin recommended.

Consumer health as a category was $45 billion in 2018, growing at 2.1%. Prescription drug growth at retail was 5.5%, so consumer health lagged. Some specific consumer health brands and categories were faster-growing than others: Garden of Life, Sambucol, Pedialyte, Nature’s Truth, among them.

Nutritionals had a rebound after a slower 2017, growing 4.2% in 2018. In contrast, healthcare excluding nutritionals grew only 1.5%. What has been driving nutritionals growth is consumers’ interest in managing disease states, focusing on bolstering immunity, brain health, beauty, protein and meal replacement, and managing Inflammation.

Kristin unpacked the trend, noting three key factors underneath consumer health’s slow growth in 2018: a less severe cold and flu season, limited product innovation in 2018 (with virtually no Rx to OTC switch), and a growth of private labels outpacing more expensive brands for vitamins, sleep aids, antacids, support devices, and first aid.

But there are green shoots for consumer healthcare retail growth in 2019: the exploding sales of CBD and hemp-based products; greater self-care among consumers, with 34% more people actively practicing more care at home over the past year; and, brands taking a stand for sustainability, responsibility, and community support (think: TOMS and Warby-Parker coming to consumer products and health/care retailers).

As an example, Kristin pointed to the Tylenol #WeCare campaign, shown in this video:

IRI’s Nishat Mehta tag-teamed with Kristin, discussing the growth and importance of influencer campaigns and new marketing modes. Nishat noted that the “death of television” discussed in mass media is highly over-rated. In fact, media is fragmenting, but TV has mass scale when strategically used. “It’s an ‘and,’ not an ‘or,’” Nishat believes, in terms of being where the consumer is: which is very often streaming TV.

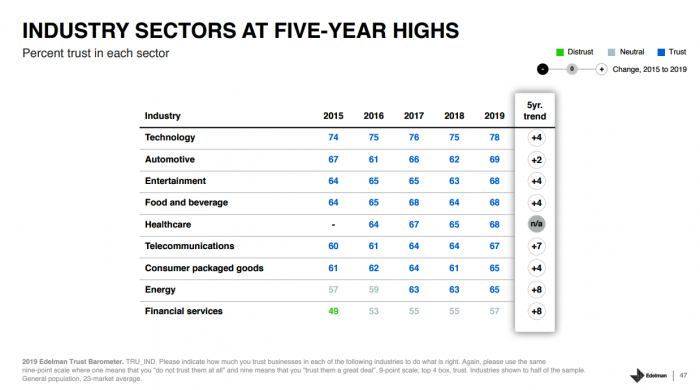

Edelman followed IRI’s informative session, discussing one of my favorite studies each year: the Trust Barometer, which I wrote about in January 2019 discussing this year’s finding that the Employer is the most trusted organizational touchpoint among global consumers. This is an important shift away from trusting “people like me” and peers – as Employers are engendering a sense of familiarity with authority (for facts and information), explained Jenn Hoker.

Edelman followed IRI’s informative session, discussing one of my favorite studies each year: the Trust Barometer, which I wrote about in January 2019 discussing this year’s finding that the Employer is the most trusted organizational touchpoint among global consumers. This is an important shift away from trusting “people like me” and peers – as Employers are engendering a sense of familiarity with authority (for facts and information), explained Jenn Hoker.

I was particularly keen to take in Courtney Gray Haupt’s presentation of data through the lens of healthcare, which will be published in full soon. I’ll cover that in detail, as I did last year in Health Populi.

The growth in health care trust was 8 points up this year, an impactful finding in that in 2018, there was a plummet in trust for health care. Globally, health care trust hit 67, and in the US, 61.

Edelman’s health industry segments for this study are pharma, consumer health, insurance, biotech/life science, and hospitals.

U.S. consumer trust across all of these segments increased – except, surprisingly, for hospitals, which fell 7 points. Consumer health went opposite, up 7 points, biotech up 3, insurance up 8, pharma up 6.

Peter Segall rounded out the Edelman trio, providing a larger context for health companies to consider in their communications strategies. He noted that 56% of consumers trust media on consumer health, but 66% trust the credibility of information from health companies.

“Tell your health tech story,” Peter urged. Consumers are “Missourian” in that they want industry to show they the data and research on a personal level. “People need to impute personal benefits,” he explained, encouraging us to, “know your audience…and know how your audience knows you.”

Ultimately, the objective must be to be transparent and balanced in every way, especially in using medical data.

My talk on the evolving retail health landscape immediately followed the Edelman panel. Through the health economic lens, I discussed the patient morphing into a consumer and payor, and what that portends for the consumer health/care industry in terms of opportunities and threats. In particular, health@retail does indeed require transparency and respect for a person’s values in a growing value-based environment. We should be mindful that with the patient-as-payor, value means understanding what mainstream people value. And we must communicate that value on a personal basis to that N=1 consumer in health.

Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a