The average 65-year old couple retiring in 2019 will need to have a cash nest-egg of $285,000 to cover health care and medical expenses through retirement years, Fidelity Investments calculated.

Fidelity estimates the average retiree will allocate 15% of their annual spending in retirement on medical costs.

Fidelity estimates the average retiree will allocate 15% of their annual spending in retirement on medical costs.

As if that top-line number isn’t enough to sober one up, there are two more caveats: (1) the $285K figure doesn’t include long-term care, dental services and over-the-counter medicines; and, (2) it’s an after-tax number. So depending on your tax bracket, you have to earn a whole lot more to net the $285,000 for a health care cash-stash.

Women retiring can expect to need $150,000 and men, $135,000.

Health care is creating a “retirement cost gap” for pre-retirees, Fidelity’s Steven Feinschreiber, senior vice president of the Financial Solutions Group, is quoted on the company’s website.

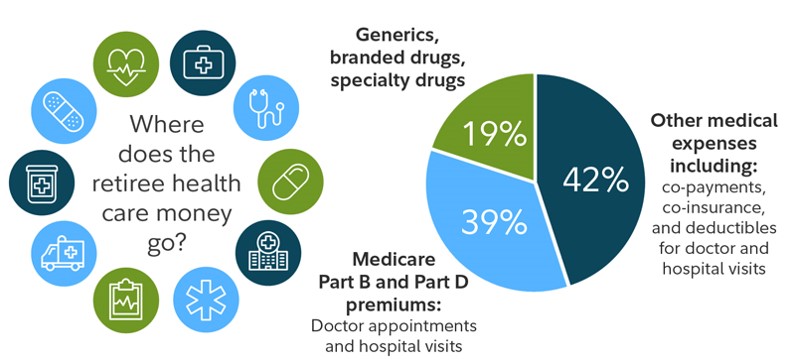

That retirement cost gap is the sticker-shock assumption that Medicare is going to cover all health care expenses in retirement. But the first chart tells the story about where retiree health care money currently goes: to insurance premiums and prescription drugs, and out-of-pocket payments for services (copays, coinsurance, and deductibles).

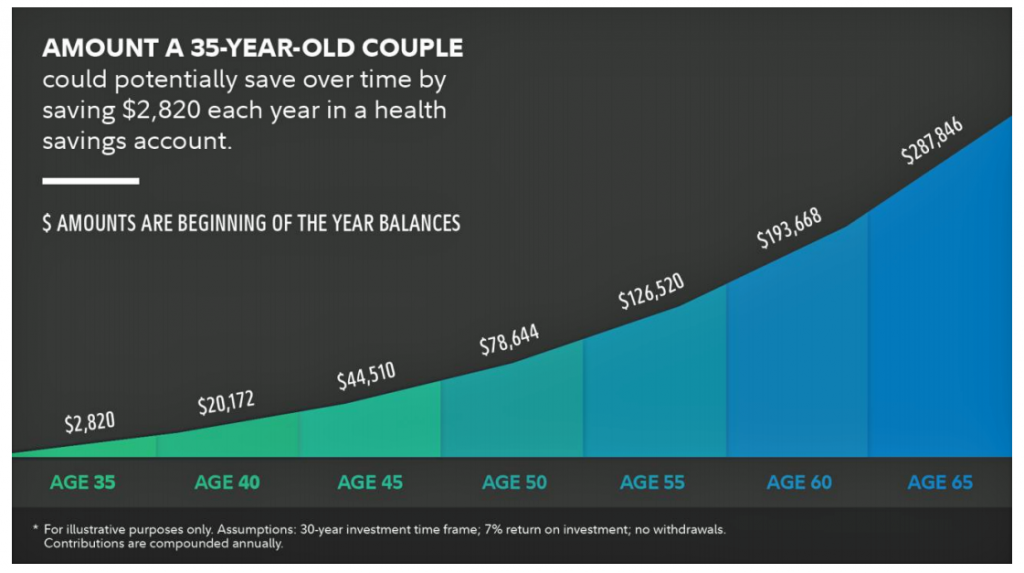

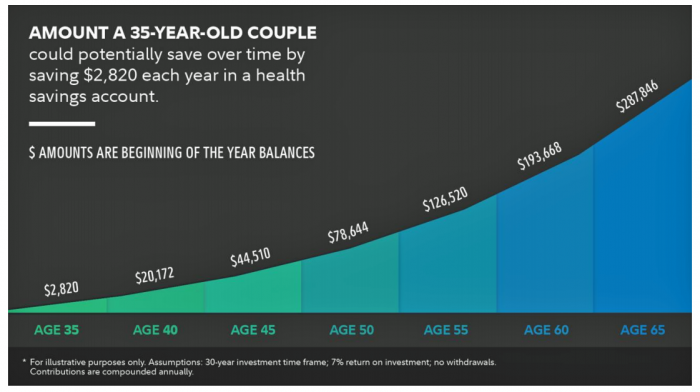

Fidelity presents the financial challenge, then offers a solution with a scenario for a 35-year old couple. Fidelity, which is in the business of fostering people investing in health and medical savings accounts and 401(k) retirement plans, gives the advice that the couple allocate $2,820 a year from age 35 to 65. At that point, the account would reach $287,846, based on a set of assumptions including a 7% rate of return per annum and no withdraws along the way. That accumulated savings is graphed in the second chart over the thirty-year savings timeframe, illustrating the time value of money.

Fidelity presents the financial challenge, then offers a solution with a scenario for a 35-year old couple. Fidelity, which is in the business of fostering people investing in health and medical savings accounts and 401(k) retirement plans, gives the advice that the couple allocate $2,820 a year from age 35 to 65. At that point, the account would reach $287,846, based on a set of assumptions including a 7% rate of return per annum and no withdraws along the way. That accumulated savings is graphed in the second chart over the thirty-year savings timeframe, illustrating the time value of money.

Here’s the method behind the $285,000 calculation, for those who want to kick tires on Fidelity’s other assumptions: the estimate is based on the 65-year old couple with life expectancies consistent with the Society of Actuaries RP-2014 Healthy Annuitant rates using the Mortality Improvements Scale MP-2016. The estimate is an average, but could be greater or lesser depending on the couple’s health status, area of residence [recognizing that a) health care cost bases vary across U.S. geographies and (b) our ZIP codes and place of living matters when it comes to health and healthcare access], and longevity. The $285K also assumes the couple doesn’t have employer-sponsored retiree health care coverage and qualifies for “Original Medicare” (not Medicare Advantage, for example). And, it bears repeating, that no long-term care costs are added into this number.

Health Populi’s Hot Points: “Let’s think of health and wealth as steps to the same goal,” an ad campaign from Transamerica, a Fidelity competitor, advises. “Be Well. Build Health,” is the four word mantra of this ad.

Health Populi’s Hot Points: “Let’s think of health and wealth as steps to the same goal,” an ad campaign from Transamerica, a Fidelity competitor, advises. “Be Well. Build Health,” is the four word mantra of this ad.

The good news is that if we are mindful and lucky, we can make health, identify and address risks, and live as long a life as possible. One of those risks is financial, so being well and building wealth are tightly coupled for living long and well in America.

The average 401(k) balance as of the fourth quarter 2018 was $95,600, according to Fidelity, shown in the green bar chart and the horizontal blue line. Balances varied by age group, peaking with the 60-69 year cohort as we can assume this is the decade where folks start their retirement journey and begin to withdraw funds from their 401(k) accounts. The high-line for ages 60 to 69 was $182,100, and for ages 70 and over, $171,400.

The average 401(k) balance as of the fourth quarter 2018 was $95,600, according to Fidelity, shown in the green bar chart and the horizontal blue line. Balances varied by age group, peaking with the 60-69 year cohort as we can assume this is the decade where folks start their retirement journey and begin to withdraw funds from their 401(k) accounts. The high-line for ages 60 to 69 was $182,100, and for ages 70 and over, $171,400.

To state the obvious, these people hadn’t saved enough, in Fidelity’s own calculation, for medical costs in retirement comparing these asset numbers to the $285K average estimate.

Let’s assume that each member of a couple retiring at 65 accumulated $182,100, for a total of $364,200. That’s the best case scenario. Carving out the $285K for medical spending, that would leave this wealth-saving couple a net of $79,200 to spend on everything else in retirement: housing, food, utilities…oh, and long-term care.

Those annual long-term care costs in 2018 were $48,000 for assisted living, $89,000 for a semi-private nursing home room, $18,720 for adult day care, $50,336 for a home health aide, and $48,048 for homemaker services, according to Genworth.

Joe Coughlin, the Founder and Director of the MIT Agelab, has useful advice here: “Investing in your health is just as critical as investing in your retirement.”

And vice versa — they’re one and the same. We must be mindful in the search for a sustainable health care reform plan in America that if it’s building on top of the “Original Medicare” plan, we re-imagine just where and how services are delivered. The current Medicare workflow won’t sustain an influx of new enrollees who could be better served in lower-cost, community-based and retail service touchpoints.

Grateful to Gregg Malkary for inviting me to join his podcast

Grateful to Gregg Malkary for inviting me to join his podcast  This conversation with Lynn Hanessian, chief strategist at Edelman, rings truer in today's context than on the day we recorded it. We're

This conversation with Lynn Hanessian, chief strategist at Edelman, rings truer in today's context than on the day we recorded it. We're