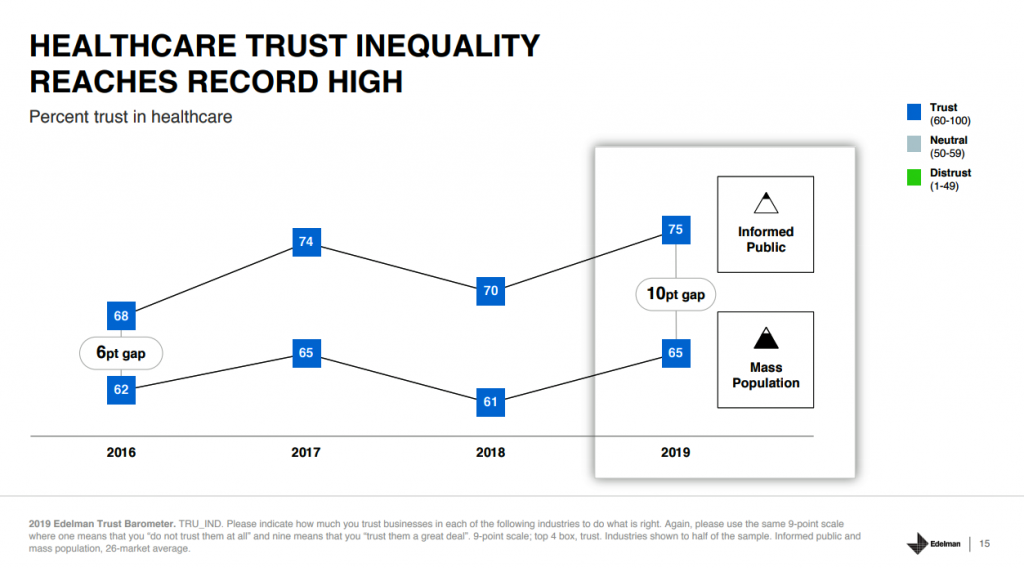

The 2019 Edelman Trust Barometer measured the biggest gap in trust for the healthcare industry between the U.S. “informed public” and the mass population.

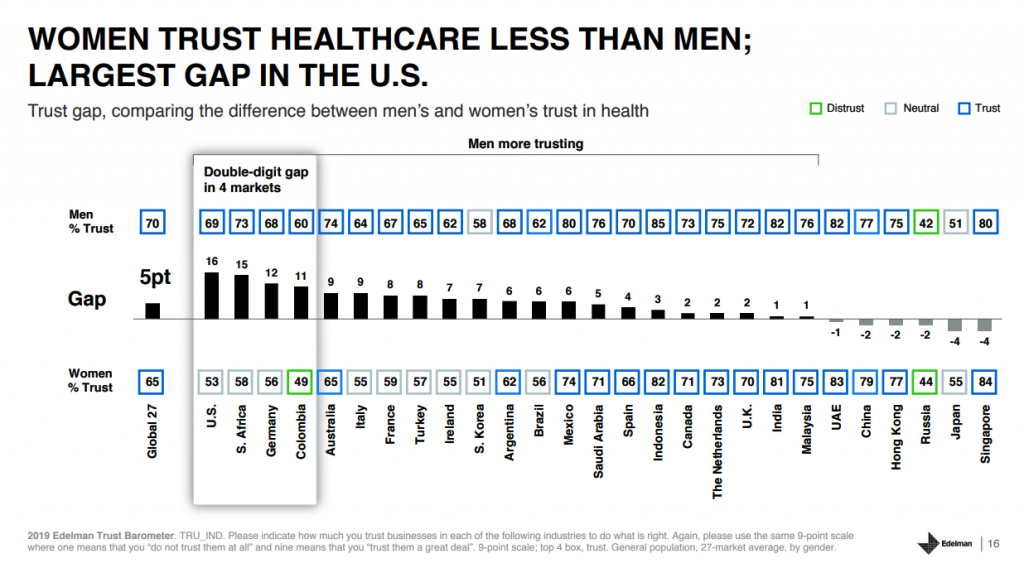

Fewer American women, too, trust the healthcare industry than men do.

“This inequality of trust may be reflective of the mass population continuing to feel left behind as compared to others, even as they recognize the advances that are being made that could benefit them. Given tone and tenor of the day, and particularly among mass population, healthcare may continue to see increasing demands for change and regulation,” Susan Isenberg, Edelman’s head of healthcare, notes in her observations of the 2019 Edelman Trust Barometer.

“This inequality of trust may be reflective of the mass population continuing to feel left behind as compared to others, even as they recognize the advances that are being made that could benefit them. Given tone and tenor of the day, and particularly among mass population, healthcare may continue to see increasing demands for change and regulation,” Susan Isenberg, Edelman’s head of healthcare, notes in her observations of the 2019 Edelman Trust Barometer.

This week, Edelman released more granular healthcare insights from the annual omnibus survey that was published during the World Economic Forum in Davos in January. I analyzed those general results with health/care implications here in Health Populi.

In this study, the healthcare industry is comprised of five segments: hospitals and clinics; pharma; biotech (separate from pharma); consumer health (e.g., over-the-counter medicines); and, health insurance.

Trust in the overall healthcare industry grew by 4 percentage points on a global basis, with a net trust score of 67 points in the Edelman Trust index. This falls behind the top-trusted industry, tech, garnering 78 points, followed by manufacturing, education and automotive at 70, and retail at 69. Healthcare’s score is marginally greater than fashion, energy, consumer packaged goods, and financial services at the bottom at 57 points.

It’s important to note differences in trust across the five healthcare industry segments — and there are big differences. Pharmaceuticals garner the lowest score at 57, compared with biotech and life sciences at 64. While hospitals and clinics have the highest index across the five sectors, there was a decline in trust for providers — whereas the other four segments enjoyed trust increases.

What might account for this drop in trust for healthcare providers? My hypothesis would include the growing high-deductible world where patients facing high-cost hospital bills, sometimes surprise bills due to lack of transparency of costs and/or out-of-network “gotchas.” In addition, there is a growing risk of cybersecurity hacks of patients’ personal health information, with stories reaching local news media on a regular basis.

Compared with other countries, Americans’ trust in hospitals/clinics is on the lower end of the spectrum, just ahead of South Africa, Germany, Turkey, Colombia and Russia. The high index marks for hospitals were found in China at the top end (at 88), Indonesia, UAE, The Netherlands, and Malaysia.

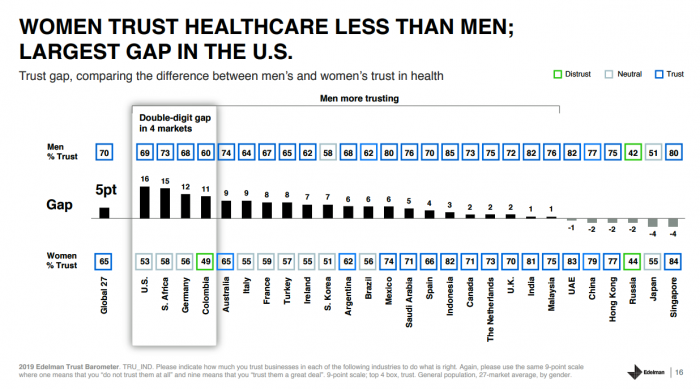

The trust-gap between women and men is striking in the U.S. Not only do fewer women trust American healthcare, but that trust gap is the largest in the world across all countries Edelman polled, shown in the second graph.

As we have noted for several years here on Health Populi, roughly equal proportions of Americans would trust digital companies and large retailers to help them manage personal health as trust health care providers.

As we have noted for several years here on Health Populi, roughly equal proportions of Americans would trust digital companies and large retailers to help them manage personal health as trust health care providers.

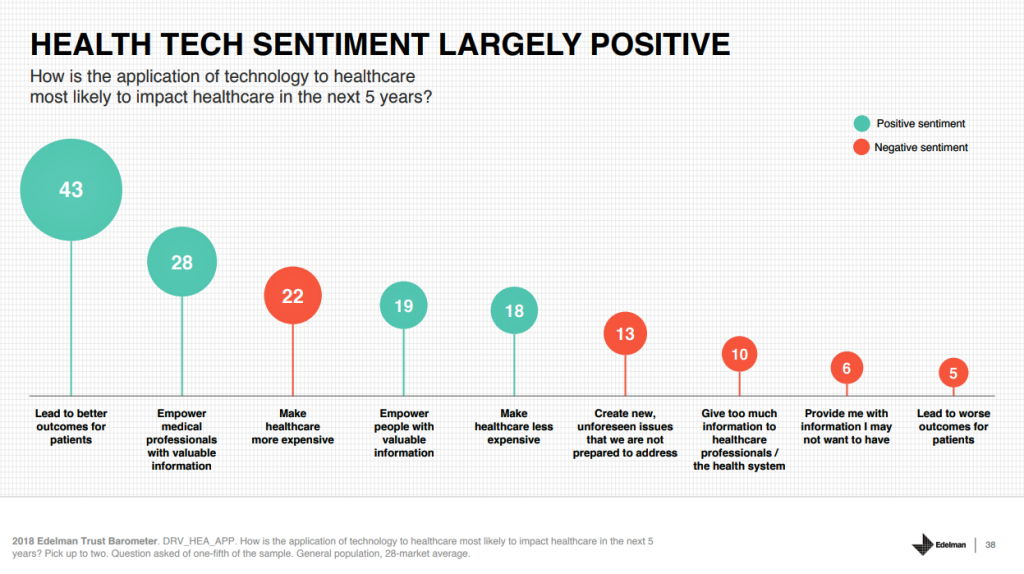

Edelman’s Trust Barometer measured consumers’ health tech sentiment, shown in the third graphic which captures peoples’ forecast on how tech will impact healthcare in the next five years. Leading to better outcomes, and empowering clinicians with useful information, could positively shape healthcare in the near term. However, tech could also make healthcare more expensive and create unforeseen issues we’re not prepared to address, consumers also expect.

Health consumers in America in the post Facebook/Cambridge Analytica era are much more attuned to privacy and cybersecurity risks of personal health data. Edelman identified three practices that would help U.S. health citizens in feeling more comfortable sharing their personal data:

- The company would place data in the most secure data protection system available

- The privacy of personal data would be guaranteed by the government, and

- The government or company or provider would guarantee that no one would ever link personal data back to “me.”

Ultimately, to earn and sustain trust with people, healthcare organizations — the five segments — should be transparent about the costs of products and services, provide balanced information about both benefits and side effects, and provide tools and support to help people manage their health.

Health Populi’s Hot Points: There is much to mine for health/care industry stakeholders in Edelman’s 2019 Trust poll at this particular moment-in-time for U.S. health consumers. The first layer concerns how trust between what Edelman segments as the “informed public” versus the mass population. There is a 10 percentage point gap between the informed public’s trust in U.S. healthcare compared with trust among the mass population.

Edelman defines the informed public as U.S. adults ages 25-64, college educated, in the top 25% of household income, who are avid, engaged consumers of media for business and public policy news.

By that definition, the informed public represents a higher socioeconomic stratum than the mass population, are more news-informed, and would likely be employed with access to employer-sponsored health insurance.

It’s no surprise, then, that trust among this U.S. population segment would run substantially higher than that among mainstream Americans.

Secondly, we see a significant gap in healthcare trust among U.S. women compared with men — the highest chasm in the world across all nations Edelman studied.

Susan Isenberg rightly pointed out in her analysis that women tend to be the “Chief Medical Officers” of their households.

I would expand that to be the “Chief Household Officers,” beyond medical and health/care issues. Women determine most health/care spending in their homes. At the same time, women have borne a “pink tax” for household goods and, indeed, healthcare prices, a topic I covered here in the Huffington Post a while ago in an essay I titled, “The Gender Disparity of Taxes: Toys, Tech and Tampons.”

Cost continues to be top-of-mind for healthcare consumers, who largely blame pharma first in the Edelman research. This data point gives further impetus to prescription drug price hearings in Congress and various proposals promulgated on Capitol Hill to address the cost of medicines.

Cost continues to be top-of-mind for healthcare consumers, who largely blame pharma first in the Edelman research. This data point gives further impetus to prescription drug price hearings in Congress and various proposals promulgated on Capitol Hill to address the cost of medicines.

I write this as I received an announcement that Amazon has begun to more visibly market PillPack, the subscription mail service for prescription drugs in convenient medication-adherence packaging.

Amazon is also piloting selling health insurance in India. As health consumers in the U.S. continue to embrace new options for sourcing, consuming and paying for health care services, from “care” to supplies like prescription drugs and food-as-medicine, we can expect people to seek trusted channels for health engagement beyond the legacy system of hospitals, traditional health plans, and pharma.

Thank you FeedSpot for

Thank you FeedSpot for