As patients now assume the role of health consumer, they rationally expect retail-level experiences with greater first-dollar payment for health insurance, health care services and medical products like prescription drugs.

As patients now assume the role of health consumer, they rationally expect retail-level experiences with greater first-dollar payment for health insurance, health care services and medical products like prescription drugs.

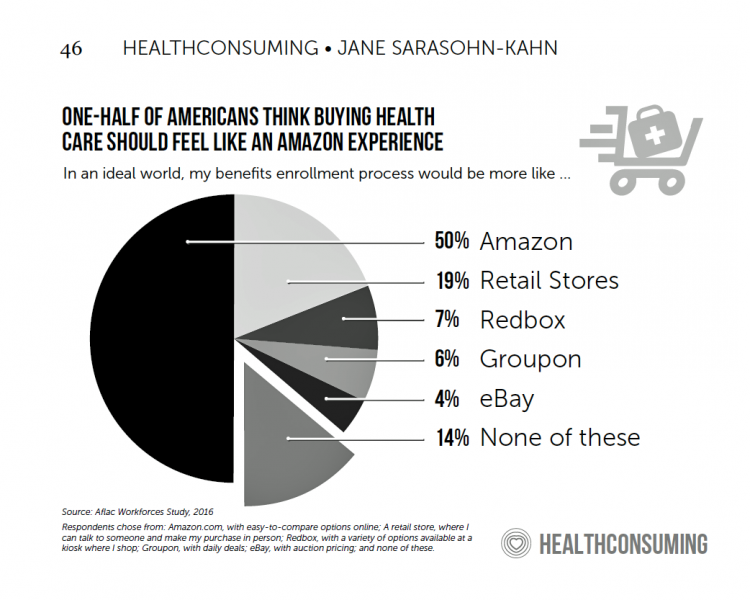

Consumers know what good retail looks and feels like, and are focusing that experiential lens on health care, Aflac found when their Workforces Survey polled Americans on their desirable health insurance shopping experience. One in two people said it should feel, “like Amazon,” and another 20% of folks said, “like retail.”

Chapter 3 of HealthConsuming is titled, “How Amazon Has Primed Health Consumers,” and explains this re-shaping of patient expectations. Here’s a snippet from the chapter, noting that, “Health consumers are hungry for Amazon’s brand of transparency, convenience, and streamlined interactions for medical care. The Amazon Prime-ing of the U.S. consumer has raised peoples’ expectations of what health care services could be: personalized, customized, anticipatory, immediate or on-schedule, and convenient – where we live, work, play, pray, learn and even drive.”

People trust Amazon for a desirable retail experiences.

People trust Amazon for a desirable retail experiences.

The pie chart from Aflac’s research illustrates the Amazon + Retail Store data point. Another survey to which I refer in HealthConsuming by Market Strategies learned that a plurality of consumers also trusted Amazon as a platform for healthcare products and services.

The company has been multi-tasking a broad range of tactics throughout the health care ecosystem. Every publicly traded market segment Amazon has touched has had moments of shattering stock prices.

In the past couple of months, Amazon announced many health-related plans and developments, including:

- Accepting medical and health savings accounts (HSAs) to pay for consumer health products like over-the-counter drugs.

- Developing Alexa-skills that are HIPAA-compliant to bolster users’ personal health information privacy collaborating with Atrium Health, Boston Children’s Hospital, CIGNA, Express Scripts, Livongo Health, and Providence St. Joseph Health. In each instance, the developer organizations see voice as the next frontier for conveniently accessing health care services.

- Marketing PillPack, the subscription prescription drug service, to consumers, with the subtext that this may be Amazon Prime-eligible.

- Naming the Amazon-JPM-Berkshire Hathaway venture in health care organization “Haven,” and announcing plans to hire staff in New York City.

- Expanding Alexa skills to join the growing tele-mental health supply side.

- Launching a private label skin care line, Belei, covered in Allure magazine here. (The name is a combo of “believe” and “beauty,” and the disruptive ingredient with this beauty brand is that no product exceeds $40.

Jim Cramer of CNBC’s Mad Money has been studying up on digital health, recently recommending that Apple buy Epic, the health IT behemoth. (See more on that recommendation, and subsequent social media frenzy, here on Health Populi). This month, he recommended that companies and investors need to study Amazon as a sort of “Death Star” in how the company re-defines industries — whether movies or music, retail or….health care.

Jim Cramer of CNBC’s Mad Money has been studying up on digital health, recently recommending that Apple buy Epic, the health IT behemoth. (See more on that recommendation, and subsequent social media frenzy, here on Health Populi). This month, he recommended that companies and investors need to study Amazon as a sort of “Death Star” in how the company re-defines industries — whether movies or music, retail or….health care.

For health consumers, Amazon’s multi-tasking efforts are re-shaping health care service delivery and channeling.

Most importantly, in this immediate moment, Amazon has re-shaped patients as health consumers — our expectations for what is possible in health care delivery, price transparency, peer-to-peer advice, and convenience.

In tomorrow’s Health Populi, we’ll dive into a third key theme in HealthConsuming: that’s what we know-we-know about ZIP codes, food, deaths of despair, and the social determinants of health. Where we live portends how healthy we are…and why spending on social care is key to addressing health and longer life spans…the personal health version of surviving a death star.

On Thursday, my post will raise Amazon’s role in health/care again, looking more deeply into the promise of digital health and the perils of privacy for health, retail, and other personal data. Amazon isn’t just about convenient delivery of health care “things.” It’s about the data generated by those transactions, which help to construct profiles on you and me. Using such profiles can be very helpful for health, if that’s the intent of the data-miner. But as the Financial Times pointed out today in an op-ed written by its editorial board, “Platform companies from Amazon to Google to Apple are getting deep into the healthcare field, allowing us to do everything from communicate with doctors to check on prescriptions. The privacy implications are troubling….they are [also] surveilling consumers at the same time — gathering, analysing and, in many cases, selling sensitive data. In many countries, personal healthcare data are subject to strict regulation. In the US, the Health Insurance Portability and Accountability Act (HIPAA) imposes criminal and civil penalties for breaching confidentiality of healthcare data. But the rules apply only to entities covered by HIPAA such as healthcare plans and providers, or clearing houses that process healthcare claims.”

Stay tuned to tomorrow’s post, on social determinants of health and social spending. By Friday, the dots will converge on the topic of morphing from health consumers to health citizens.

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a