The health care section of Mary Meeker’s 334-page annual report, Internet Trends 2019, comprises 24 of those pages (270 through 293). These two dozen exhibits detail growing adoption of digital tech in health care, the growth of genomics and EHR adoption, examples of these tools from “A” (Apple) to “Z” (Zocdoc), and on the last page of that chapter, medical spending in the U.S., the highest in raw and per capita numbers versus the rest of the world.

But the most important implications for American health care aren’t found in those pages: they’re in other parts of the report addressing consumers’ digital time spent, growth of voice tech adoption, the growing use of customer data to drive insights and nudge behavior that’s highly personalized,

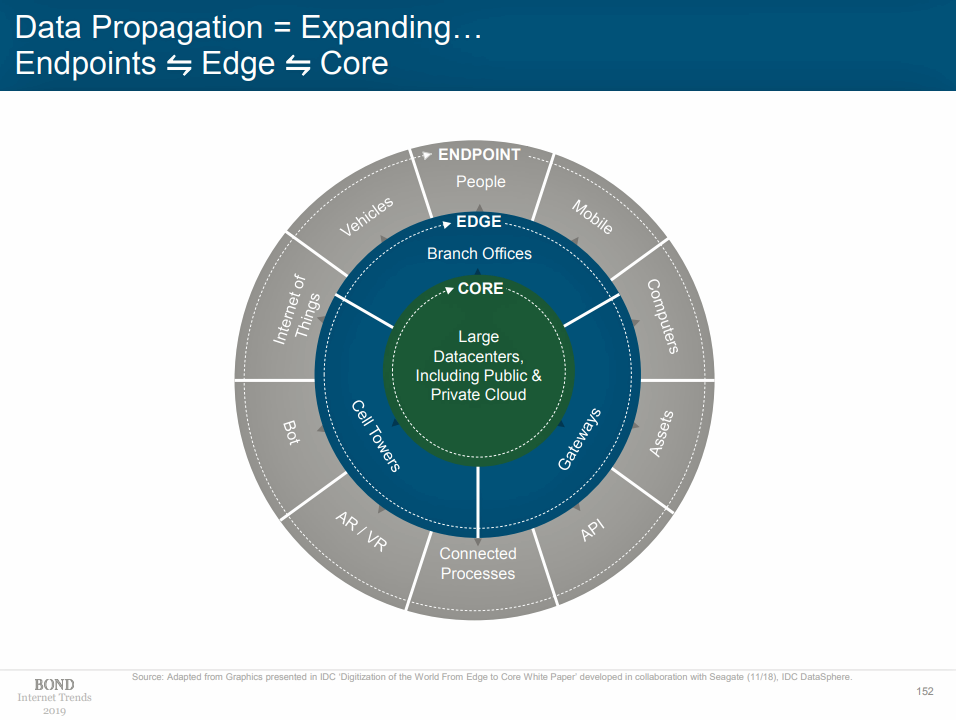

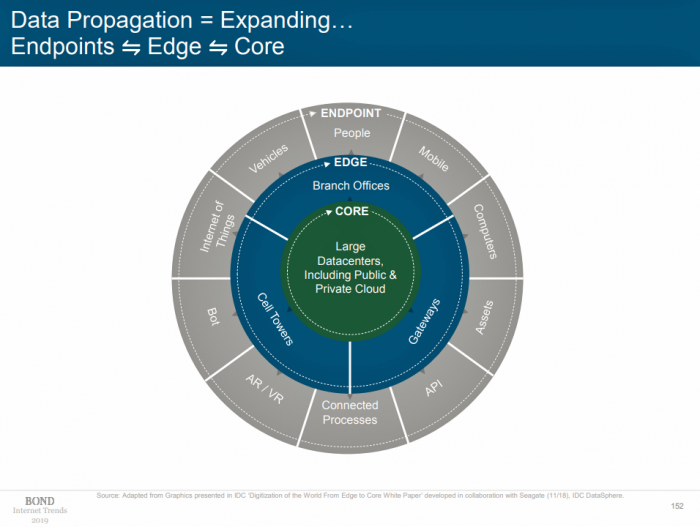

The first chart, from page 152 in the general discussion on “Data Growth,” illustrates the proliferation of data expanding from core applications out to edges. In health care, this is an underlying tectonic trend with implications for research, translation to therapies, individual treatment plans, population and public health. The outer grey circle details many of the emerging tools and sources for personal and clinical data that can be mashed up and analyzed to benefit care, drive better health outcomes and, our Health Populi Holy Grail, optimize spending. APIs, Internet of (Healthy) Things, and AR/VR among the others are getting deployed in retail channels and at home to support peoples’ health in the real world, in real time outside of the clinical setting. For health care, the application of FHIR standards helps mobilize data for better health, turbocharging this trend.

This quote from Frank Bien, CEO & President of Looker, succinctly summarizes these trends:

Data is now fundamental to how people work & the most successful companies have intelligently integrated it into everyone’s daily workflow…Data is the new application.

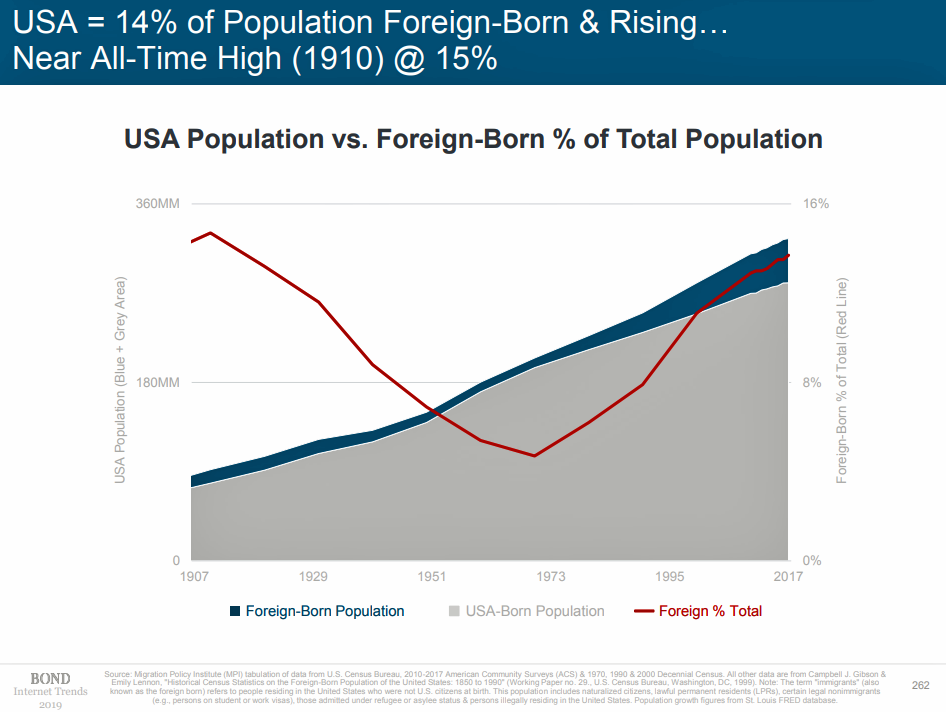

There are other data points in the report that strongly impact and shape healthcare — among them, the percent of foreign-born people as a percentage of total U.S. population. This chart, on page 262, is important for healthcare delivery because a large proportion of the healthcare labor force is indeed foreign-born — at all levels of the system, from hyper-specialists in the operating room and research labs to home health aides helping elders with activities of daily living. One in four physicians practicing in the U.S. in 2016 was foreign-born, this JAMA article published in December 2018 attested.

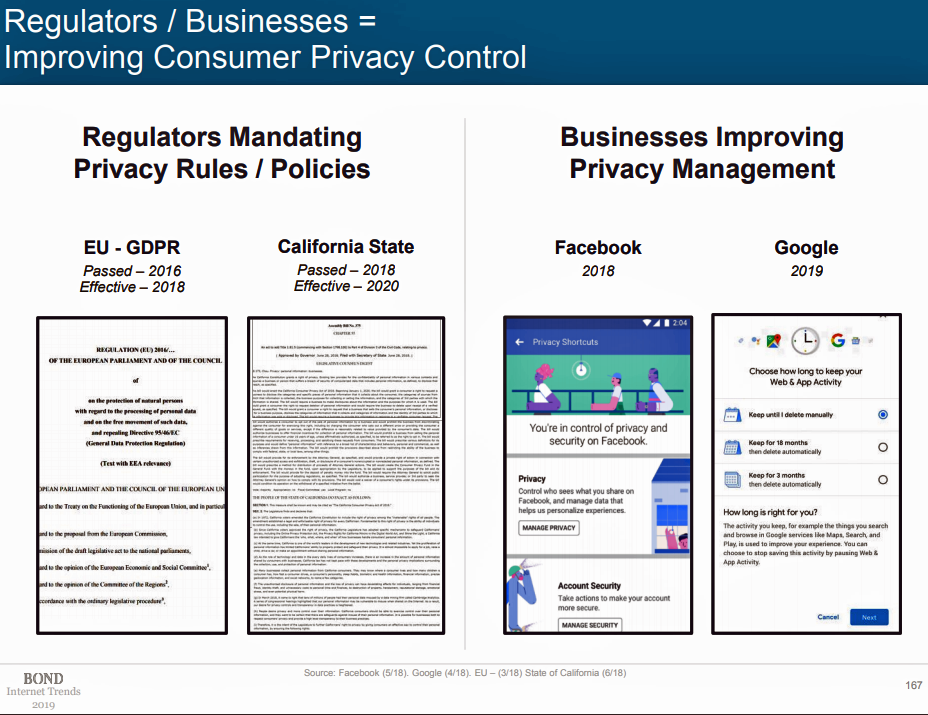

For another big impact for health, outside of the healthcare chapter, turn to the section, “Internet Usage = There Are Concerns…There is Goodness.” Consumers’ concerns about privacy of personal data are “moderating,” one chart illustrates. But then there’s the formidable challenge of medical privacy and the regulation of Big Tech companies’ use of personal data, covered in general terms on page 167 shown here. For health care privacy, Americans’ HIPAA provisions surely don’t cover personal information that informs health beyond the healthcare claim the way Europeans’ GDPR or the soon-to-be-implemented California Consumer Privacy Act of 2020 do.

The blurring of mobile and digital into overall business process is a meta-trend for the global economy, and certainly for the health care ecosystem. Increasingly, “mobile health,” “mHealth,” “telehealth” and “eHealth” are just part of normal health/care workflows and personal life flows that complement face-to-face, synchronous health care delivery. While we read a broad range of industry analysts’ reports using these nouns, their definitions vary so broadly as to be, by 2019, fairly meaningless in terms of how they quantify these markets.

I’ve covered this influential document here in Health Populi through my health economics/consumer tech lens for most years since 2011 (skipping 2012 and 2016). For some perspective on the Internet Trends reports’ implications for health/care over time, my previous posts assessing the report are linked here:

2018 – Mary Meeker on Healthcare in 2018: Connectivity, Consumerization and Costs

2017 – Digital Healthcare at the Inflection Point, a la Mary Meeker

2015 – Musings with Mary Meeker on the Digital/Health Nexus

2014 – Health Care at an Inflection Point: digital trends via Mary Meeker

2013 – The Role of Internet Technologies in Reducing Health Care Costs: Meeker Inspirations

2011 – Meeker & Murphy on Mobile – Through the Lens of Health

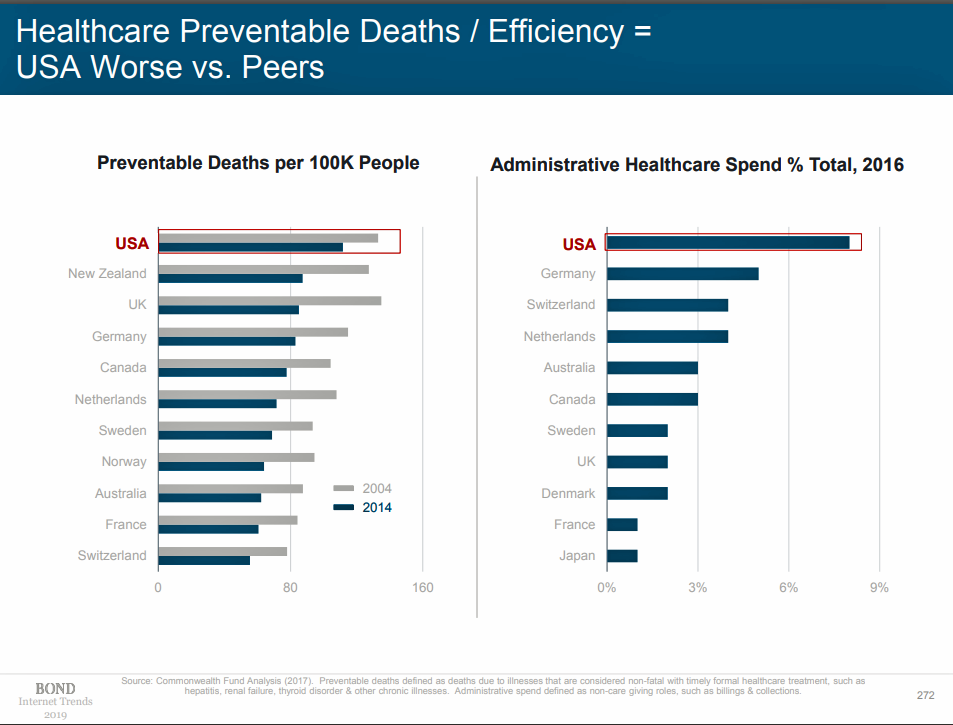

Health Populi’s Hot Points: The fourth chart, on preventable deaths, represents the poor ROI on high U.S. healthcare spending. The chart is succinctly and accurately titled, “USA Worse vs. Peers.” The U.S. spends more and gets far less a return-on-that-investment than other countries do.

Health Populi’s Hot Points: The fourth chart, on preventable deaths, represents the poor ROI on high U.S. healthcare spending. The chart is succinctly and accurately titled, “USA Worse vs. Peers.” The U.S. spends more and gets far less a return-on-that-investment than other countries do.

In my book HealthConsuming: From Health Consumer to Health Citizen, I detail the health microeconomics which explain that low return. Much of this is due to the fact that U.S. prices are greater than in fellow OECD nations: wages are higher for specialist physicians, prices for digital imaging greater, and of course prescription drug prices the highest in the world. We wait for President Trump’s administration to address this last issue with a comprehensive policy he promised in his President campaign stump speeches along with this compelling TIME magazine article he granted when he was named Person of the Year for 2017, covered here in Health Populi.

Another important contributor to higher medical spending in America is the nation’s lower proportion spend on social care — education, nutritious food supply, public transportation systems, safety baked into neighborhoods and housing, environmental standards like clean air and water (think Newark and Flint, for example). This last chart, from HealthConsuming, quantifies those relative differences in social versus healthcare spending by OECD country, with results for life expectancy for each.

While technology and data can help us improve therapies and individualized healthcare, spending more upstream on infrastructure and health baked into public policies can prevent so many of these deaths per 100,000 in the U.S. The good news is that more attention and resources are flowing to these social determinants of health, largely from private sector interests like health plans, providers, and retail health touchpoints such as grocers and pharmacies.

While technology and data can help us improve therapies and individualized healthcare, spending more upstream on infrastructure and health baked into public policies can prevent so many of these deaths per 100,000 in the U.S. The good news is that more attention and resources are flowing to these social determinants of health, largely from private sector interests like health plans, providers, and retail health touchpoints such as grocers and pharmacies.

Thank you FeedSpot for

Thank you FeedSpot for