In the U.S. each year between 2006 and 2016, employees’ healthcare cost sharing grew 4.5%. In that decade, Americans’ median wages rose 1.8% a year, PwC notes in their annual report, Medical cost trend: Behind the numbers 2020 from the firm’s Health Research Institute.

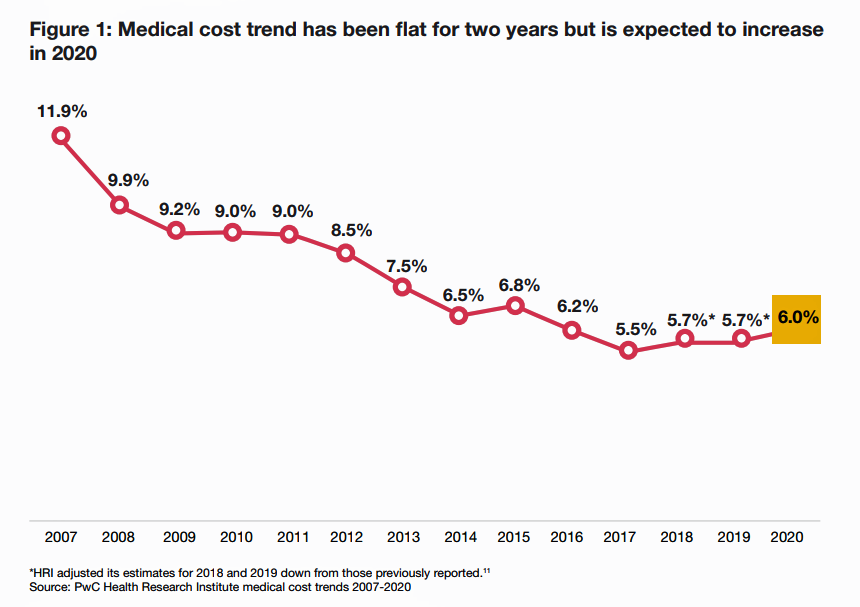

Medical cost trend is the projected percent growth in healthcare costs over a year based on an equivalent benefit package from one year to the next. As the first chart shows, trend will grow 6% from 2019 to 2020. This is an increase of 0.3 percentage points up from 5.7% for 2019, which was flat from the previous year. That costs are inching up are concerning to employers providing health benefits, who have become dissatisfied with efforts to contain health spending, PwC learned from its survey research.

This has led to what HRI coins an emergence of “employer activists.” Among this vanguard of companies PwC HRI cites are Haven, the trifecta-alliance of Amazon-Berkshire Hathaway-JPMorgan, and the Health Transformation Alliance of 50 companies among them 3M, Pitney Bowes, and Verizon — along with many healthcare organizations including but not limited to Kaiser Permanente, Advocate Health Care, Amgen, Medtronic, OhioHealth, Quest Diagnostics, Sharp HealthCare, and Walgreens.

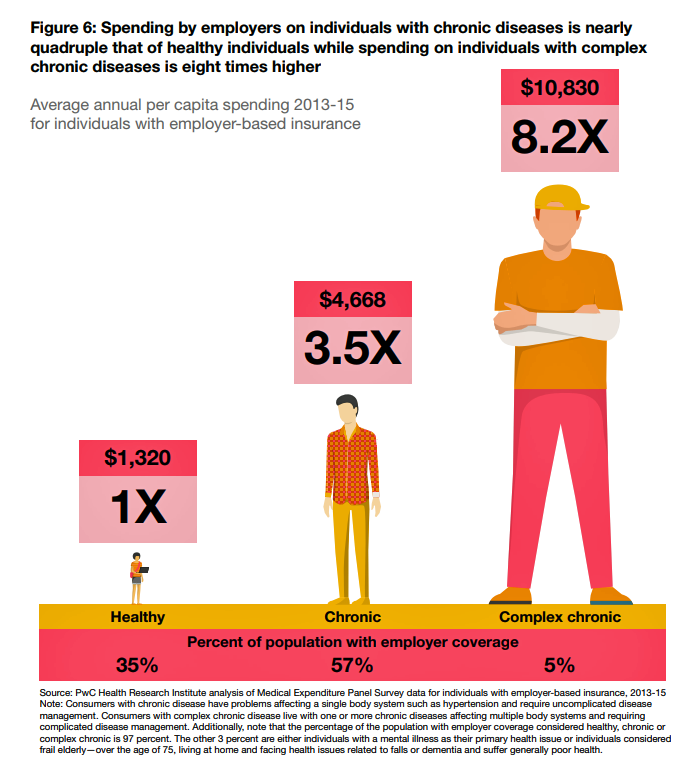

One of employers’ key challenges in moderating healthcare costs is the burden of chronic disease among workers. Employers’ healthcare spending on individuals with chronic diseases is nearly four-times that for healthy workers, shown in the second graphic from the report.

Average annual spending for a healthy worker ran $1,320 between 2013 and 2015. A person with a chronic condition cost 3.5 times that, nearly $5,000. And, for an employee with complex conditions, spending was over eight times greater than for a healthy employee.

A key co-morbidity that the report calls out is mental illness. HRIs research found an inflection growth point among employers offering health benefit programs addressing mental health and depression between 2016 and 2017 — growing from 44% of companies offering in 2016 to 66% in 2017 — that’s 50% growth year-on-year between 2016-17. Not that in 2018, 75% of employers offered these programs.

But on the supply side, just because employers may have offered mental health services, and with good intentions, the majority of employees did not take advantage of these services. Eight in ten employees did not seek mental health treatment; HRI’s employee survey found that 8% of those who did not seek treatment felt they should have done so.

Among people who didn’t take advantage of mental health care, one-half thought they could “handle it on their own,” 35% couldn’t afford paying for the services, and 29% didn’t know where to go.

The cost of a co-morbidity of mental illness coupled with a complex chronic illness is sticker-shocking for a company. Consider that healthy employee per capita annual cost of $1,320:

- An employee with a mental illness and no chronic condition cost $3,063

- An employee with chronic illness coupled with mental illness cost $7,104

- An employee with a complex chronic illness and mental illness cost $14,885.

To help bend their corporate healthcare cost curves, employers are nudging covered workers to lower-cost settings, both onsite and away from the workplace. At worksite clinics, 43% of employers offer physical exams and urgent care, 36% do annual preventive exams, and 11% offer chronic care management.

For employer insights, HRI’s research included interviews with health industry executives representing 95 million insured employees and dependents, along with PwC’s 2019 Health and Well-being Touchstone Survey of 550 employers. On the consumer side, HRI conducted a national survey among 2,500 U.S. adults.

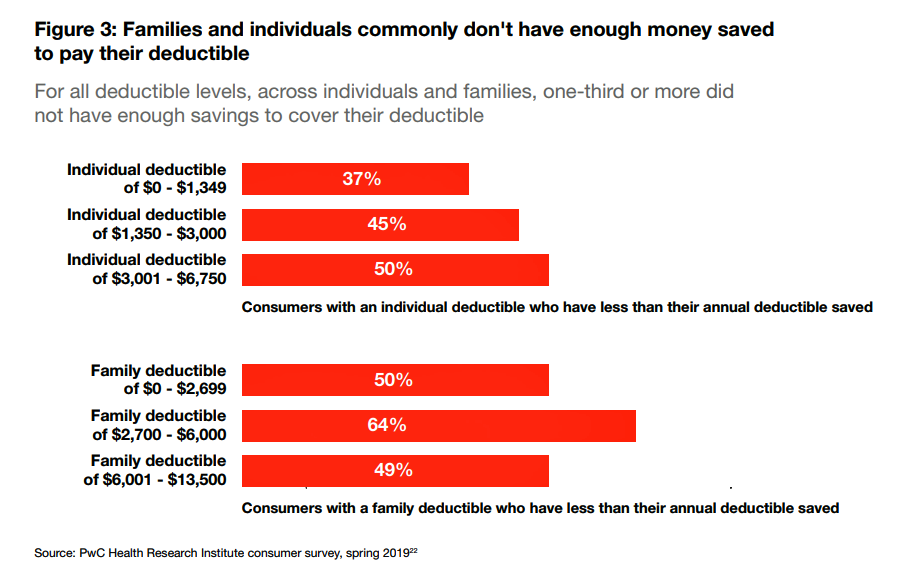

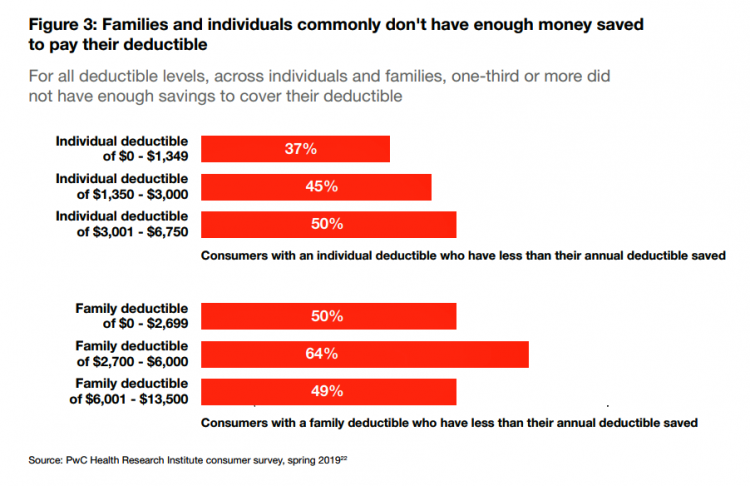

Health Populi’s Hot Points: Patients have become major payors as they enroll in high-deductible health plans, and this was the other lens on HRI’s survey findings. The third graphic from the report summarizes results from PwC’s consumer poll, finding that at least one-third of covered employees could not cover their deductible with savings.

Health Populi’s Hot Points: Patients have become major payors as they enroll in high-deductible health plans, and this was the other lens on HRI’s survey findings. The third graphic from the report summarizes results from PwC’s consumer poll, finding that at least one-third of covered employees could not cover their deductible with savings.

Consumers’ ability to cover a deductible varied with the level of a deductible: one-half of individuals with a deductible over $3,000 could not cover it with savings. Neither could one-half of families cover a deductible at all from savings, even at the lowest level deductible polled of $0 to $2,699.

This scenario has led to HRI’s observation that, “Deductibles dampen utilization and spending as employees feel the pain.” In my own words, this is self-rationing health care due to cost. “Employees often don’t understand their financial exposure with high deductible plans….[patients] may be surprised to return for a sick visit to the same doctor who provides their preventive care only to walk away with a bill,” the report explains.

Four in ten consumers enrolled in a high-deductible plan that HRI polled said they were dissatisfied with their deductible.

In my book, HealthConsuming: From Health Consumer to Health Citizen, I discuss the emergence of the patient-as-the-payor lost, confused and feeling broke and dis-empowered in the land of high-deductibles.

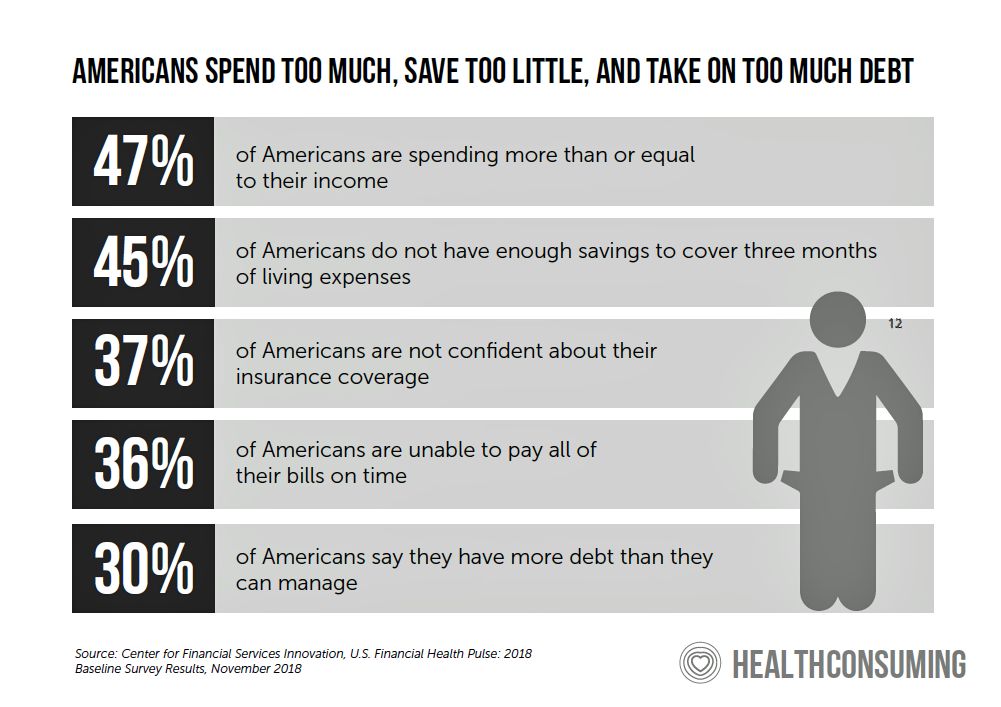

Americans spend too much, save too little, and take on too much debt — which is the title of this last chart which comes out of HealthConsuming, featuring recent data from the Center for Financial Services Innovation. Nearly one-half of Americans spend more than they earn — thus living on credit. At the same time, savings wouldn’t cover three months of living expenses for one in two people in the U.S. And one-third of Americans say they have more debt than they can manage.

No wonder, then, that a plurality of PwC HRI’s consumers polled were “dissatisfied” with their deductible.

Note that stress is compounded by financial worries, which I also note in HealthConsuming as the new normal for Americans with respect to health care costs and mental health. Whether one is of higher or lower income, dealing with health care costs is a stressor for people in America.

The PwC HRI report concludes with a summary of universal healthcare as a “thing to watch.” The paragraph asserts, “It is no surprise that there are a number of universal healthcare proposals on the table…universal healthcare is gaining traction and is something to watch as we approach the 2020 presidential election.”

I couldn’t agree more as I expect both employers and mainstream Americans to become more activist with respect to health care reform.

Grateful to Gregg Malkary for inviting me to join his podcast

Grateful to Gregg Malkary for inviting me to join his podcast  This conversation with Lynn Hanessian, chief strategist at Edelman, rings truer in today's context than on the day we recorded it. We're

This conversation with Lynn Hanessian, chief strategist at Edelman, rings truer in today's context than on the day we recorded it. We're