As patients have taken on more financial responsibility for first-dollar costs in high-deductible health plans and medical bills, hospitals and health care providers face growing fiscal pressures for late payments and bad debt.

Those financial pressures are on both sides of the health care payment transaction, stressing patients-as-payors and health care financial managers alike.

I’m speaking to health industry stakeholders on patients-as-payors at Cerner’s Now/Next conference today about the patient-as-payor, a person primed for engagement. That’s as in “Amazon-Primed,” which patients in their consumer lives now use as their retail experience benchmark. But consumers-as-patients don’t feel like health care today feels much like a Prime experience.

As I write this on Sunday 6th April, I segued geographically from Indianapolis and the GMDC SelfCare Summit where I convened with organizations representing retail health “front doors” to Kansas City for the Cerner meeting.

As I write this on Sunday 6th April, I segued geographically from Indianapolis and the GMDC SelfCare Summit where I convened with organizations representing retail health “front doors” to Kansas City for the Cerner meeting.

Percolating in my mind are insights delivered by Nancy Giordano of Play Big Inc. who spoke about the rise of the anxiety economy. Her remarks meshed with my talk the previous day about fiscally-challenged and value-and-experience-demanding health consumers.

Anxiety and stress are the new obesity: in 2019, more Americans were treating stress and anxiety in their families and households than dealing with overweight and obesity, according to the Hartman Group and shown in the bar chart on conditions being managed at home with natural remedies like CBD for anxiety.

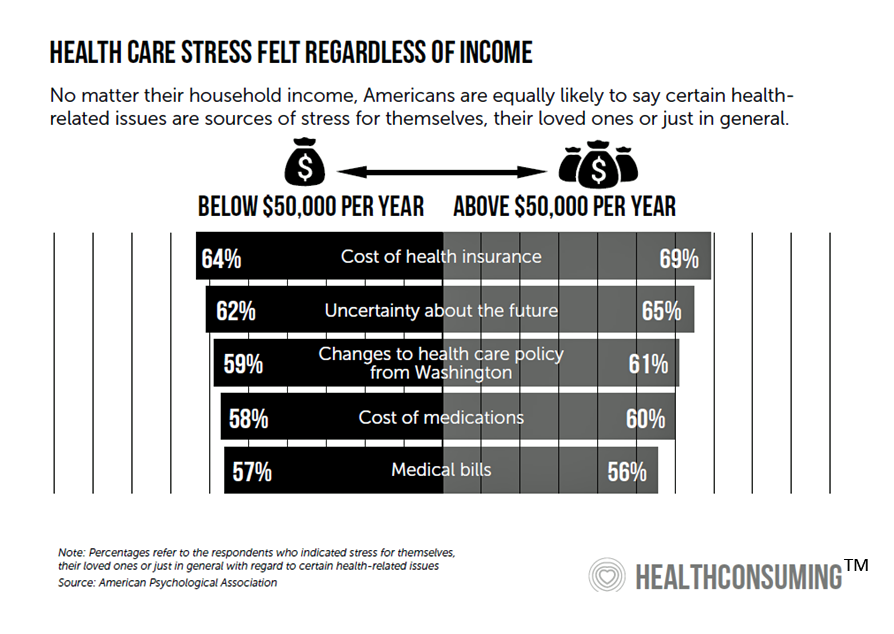

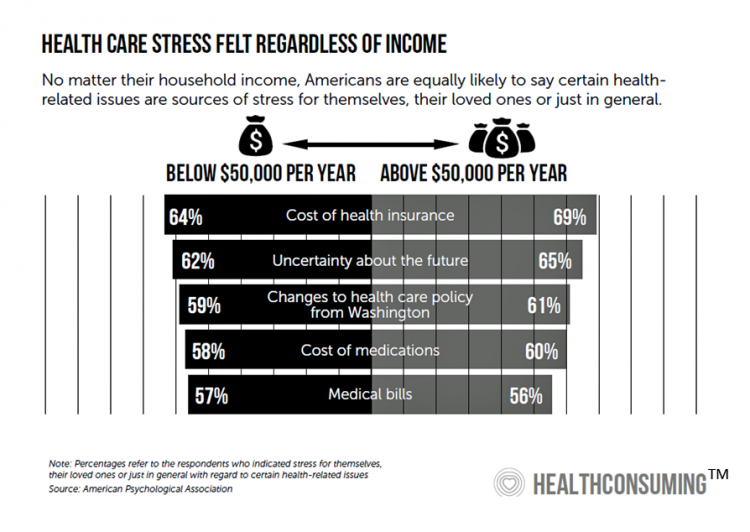

Stress in America comes from many sources. But financial stress due to health care costs is a top factor identified by the American Psychological Association (APA) in their 2018 Stress in America survey. The chart, which is featured in the “Patient is the Payor” chapter of my book, HealthConsuming, illustrates APA’s data on the issue. Regardless of household income, two in three Americans were likely to say that the cost of health insurance is a source of stress. Over one-half of people told APA that medical bills and the cost of medications were sources of stress.

We continue to connect the dots on financial stress due to health care costs and learn that by 2018, more Americans were afraid of paying for health care than of getting a serious illness. This sobering data point emerged from a consumer study published by West Health Institute and NORC in February 2018.

Let me translate this in another way using the numbers and exact question posed by the study: 40% of U.S. adults were “extremely or very afraid” of paying for care if they got seriously ill compared with 33% of U.S. adults who were “extremely or very afraid” of getting seriously ill.

Only one-third of Americans were neither afraid of getting a serious illness nor paying the medical bills from that illness.

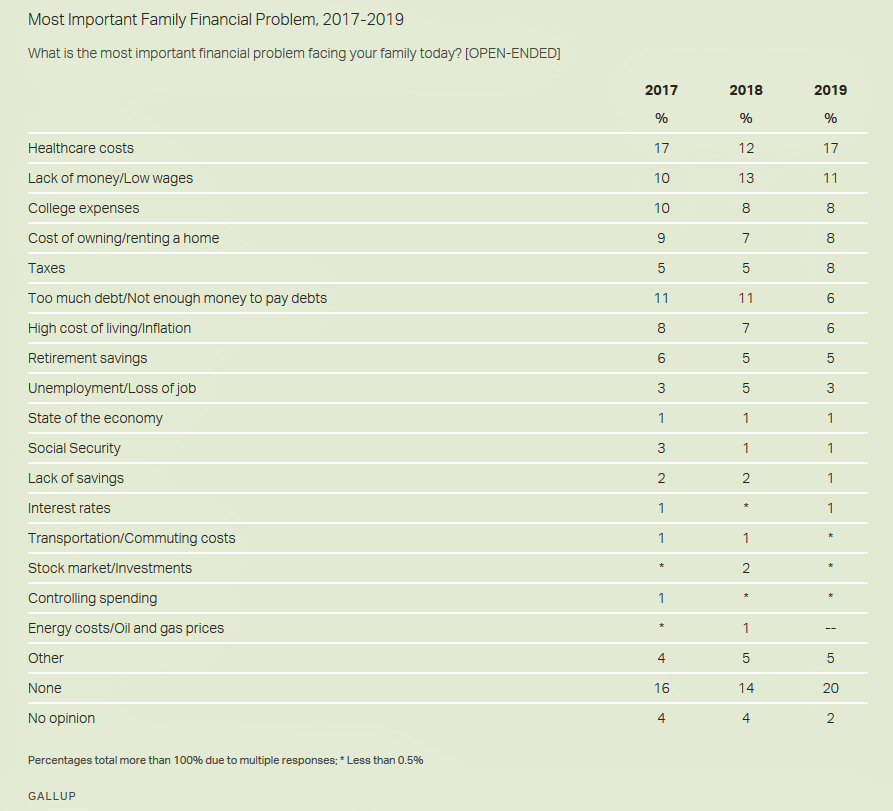

This year’s annual Gallup Poll on Americans’ financial concerns found that health care costs topped that list, ahead of lack of money or wages, the cost of higher education, the cost of a mortgage or rent, and paying taxes.

Compounding Americans’ worries about medical costs is an issue that’s getting traction on the Presidential and local campaign trails in a bi-partisan way: surprise medical bills and out-of-network costs.

Both President Trump and Democratic Presidential candidates have raised this issue. In a speech from the Roosevelt Room in the White House on May 9, 2019, President Trump said, “For too long, surprise billings…has left some patients with thousands of dollars of unexpected and unjustified charges for services they did not know anything about…And they get, what we call, a ‘surprise bill.’ Not a pleasant surprise; a very unpleasant surprise.”

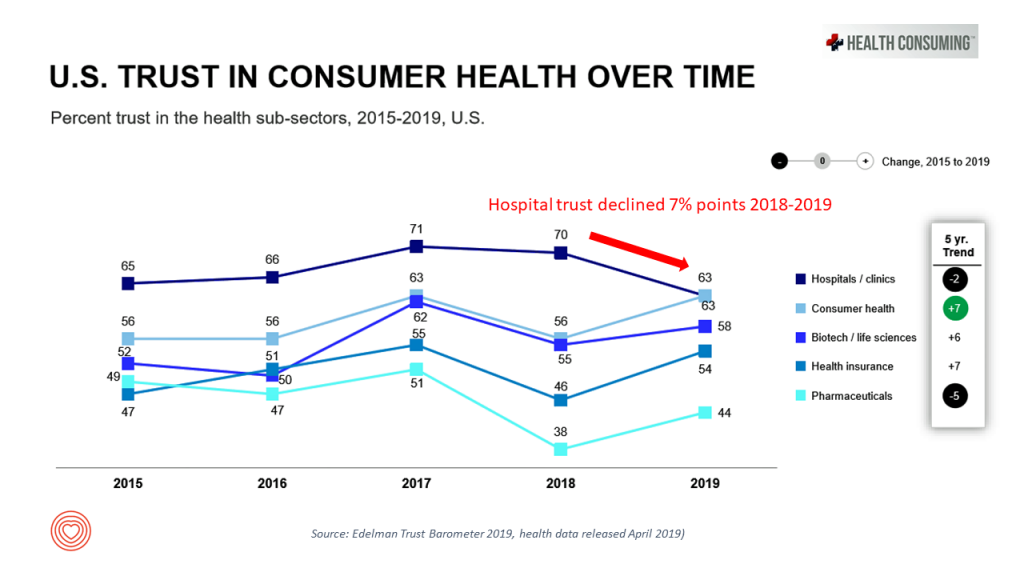

Surprise medical bills are a key factor underlying a dramatic decline in Americans’ trust in hospitals, identified in the 2019 Edelman Trust Barometer.

Look at the line graph on U.S. trust in consumer health over time, comparing peoples’ feelings of trust in hospitals compared with those for consumer health companies (e.g., over-the-counter drugs and personal care), biotech, pharma, and health insurance.

Look at the line graph on U.S. trust in consumer health over time, comparing peoples’ feelings of trust in hospitals compared with those for consumer health companies (e.g., over-the-counter drugs and personal care), biotech, pharma, and health insurance.

In Edelman’s read for 2019, consumers’ trust grew for all health care sectors in America….except among hospitals, which took a 7% dip from 2018.

This is the Age of Anxiety for hospital CFOs and people responsible for revenue cycle management. In this era, patients-as-payors are consumers in health care, seeking trustworthy engagement based on their personal values and sense of value and experience. People view health care costs as a major pocketbook issue vying with paying for housing, utilities, food and other consumer goods. That’s the call-to-action for health care providers, now a major component of the American family budget.

Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a