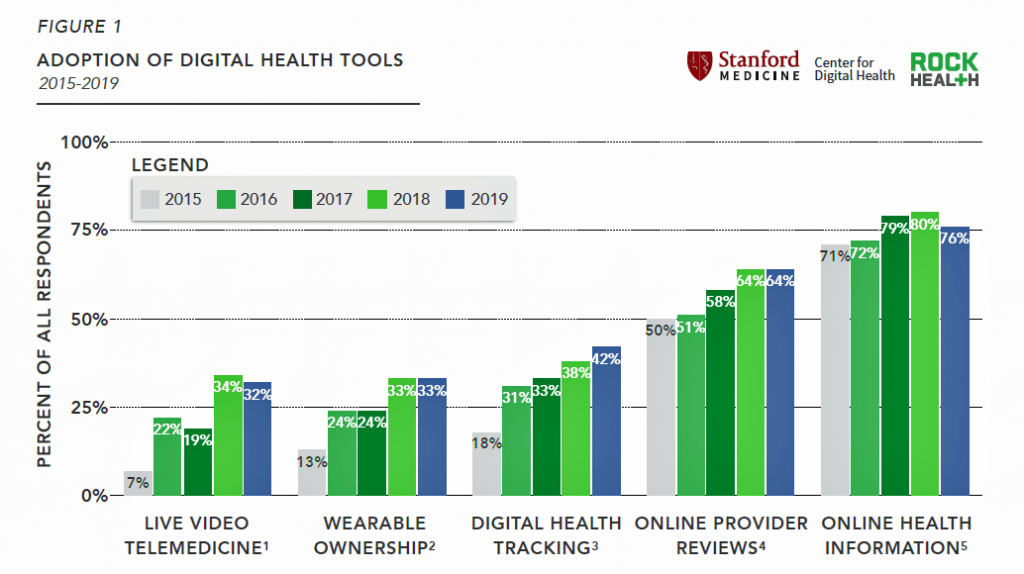

Patients searching online for health information and health care provider reviews is mainstream in 2019. Digital health tracking is now adopted by 4 in 10 U.S. consumers.

Patients searching online for health information and health care provider reviews is mainstream in 2019. Digital health tracking is now adopted by 4 in 10 U.S. consumers.

Rock Health’s Digital Health Consumer Adoption Report for 2019 was developed in collaboration with the Stanford Medicine Center for Digital Health. Rock Health’s research has tracked peoples’ use of telemedicine, wearable technology, digital health tracking, and online health information since 2015, and the results this round show relative flattening of adoption across these various tools.

Rock Health’s top-line findings were that:

- Patient-generated health data creates opportunity, and potential challenges

- Online health information is re-shaping the relationship between patients and clinicians

- U.S. consumers’ willingness to share their data depends on whom they are sharing it with.

Start with tracking: nearly 80% of people tracked at least one health metric in 2019, but nearly one-half of that tracking was done in an analog, not digital way. This was a deja vu data point for me, thinking back to Susannah Fox’s study at the Pew Research Group back in 2013 which learned that most people tracked health data “in their heads.”

![]() How not-so-far we have come, right?

How not-so-far we have come, right?

What do health trackers track, then? The second chart (Figure 3 in Rock Health’s report) illustrates the most popular consumer-tracked health metrics by health conditions of obesity, diabetes, heart disease and hypertension.

Note that the darkest green tone identifies the data for tracking via digital methods. Overall, the most common digitally-tracked metric is blood pressure, followed by weight.

The most digitized tracking was for blood sugar among people managing diabetes, at 29% of patients, followed by 24% of people tracking blood pressure digitally among people with hypertension as well as heart disease, and 23% of people dealing with obesity tracking weight digitally.

Only about 20% of people who tracked a health metric shared that data with a health care provider, Rock Health learned.

Among consumers willing to share health information, the most trusted touch point is “my physician,” with whom 86% of people said they’d share in 2017 but dropping to 73% in 2019. Second in sharing-line were “my health insurance company” and “my pharmacy” for just over one-half of consumers, a percentage which stayed fairly flat between 2017 and 2019.

The proportion of people willing to share data with research institutions fell by 44% to 34% in the two years, and with health tech companies, flat at 23% between 2018-2019.

Only one in five consumers would be willing to share their data directly with pharma companies, to Rock Health’s third point about willingness-to-share-with-whom.

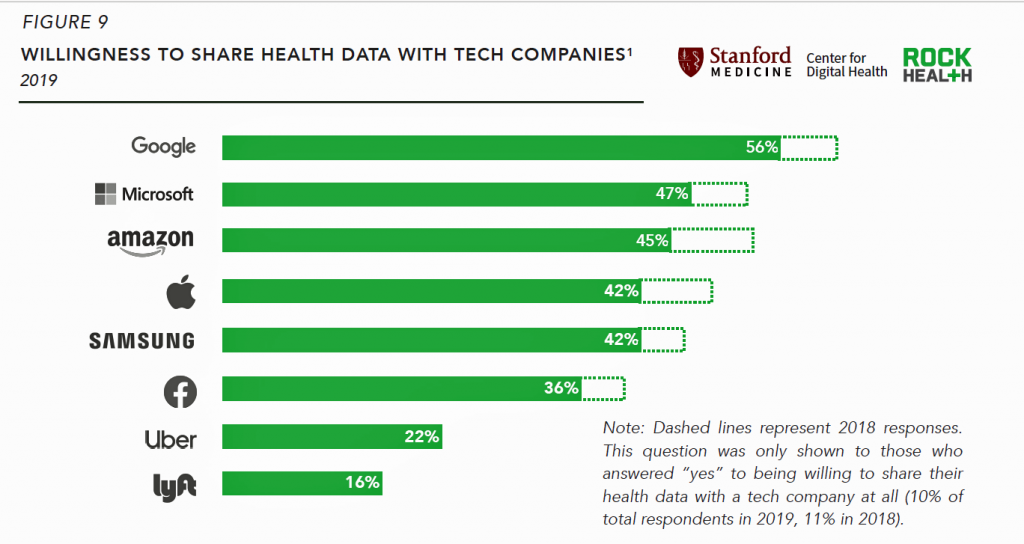

Health Populi’s Hot Points: The third chart shown here, Figure 9 from the Rock Health report, presents data on the tech companies with whom U.S. consumers would be most willing to share their health data.

This information compelled me to return to the previous responses to this question in Rock Health’s surveys starting back in the 2015 study into digital health consumer adoption.

In 2015, Google was still the top company with whom people would share data — at a percent of 10.2% of total consumers, followed by:

- 9.6% willing to share with Microsoft

- 9.2% with Apple

- 8.3% with Samsung, and

- 5.4% with Facebook.

You will quickly say, “ah! The proportion of consumers willing to share personal health information with pure-play tech companies has grown exponentially!”

True — yet the proportions have dropped between 2018 and 2019 as follows:

- Google is down 4 percentage points over the past year

- Microsoft down 4 percentage points

- Amazon down 8 points

- Apple down 7 points

- Samsung down 4 points

- Facebook down 4 points.

And this year, Rock Health added in Uber and Lyft, with whom 22% and 16% of consumers would share health data, respectively.

We see the continued evolution of health-data ecosystems, as well as the re-definitions of what a “tech company” is vis-a-vis a “health-tech company.” Clearly, with the rumors this week that Google may be looking to acquire Fitbit, Google Health would continue to grow its data mine massively through that transaction. And, as Cerner announced its collaboration with Uber Health this week, we see a health IT company expanding beyond what an EHR could be.

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a