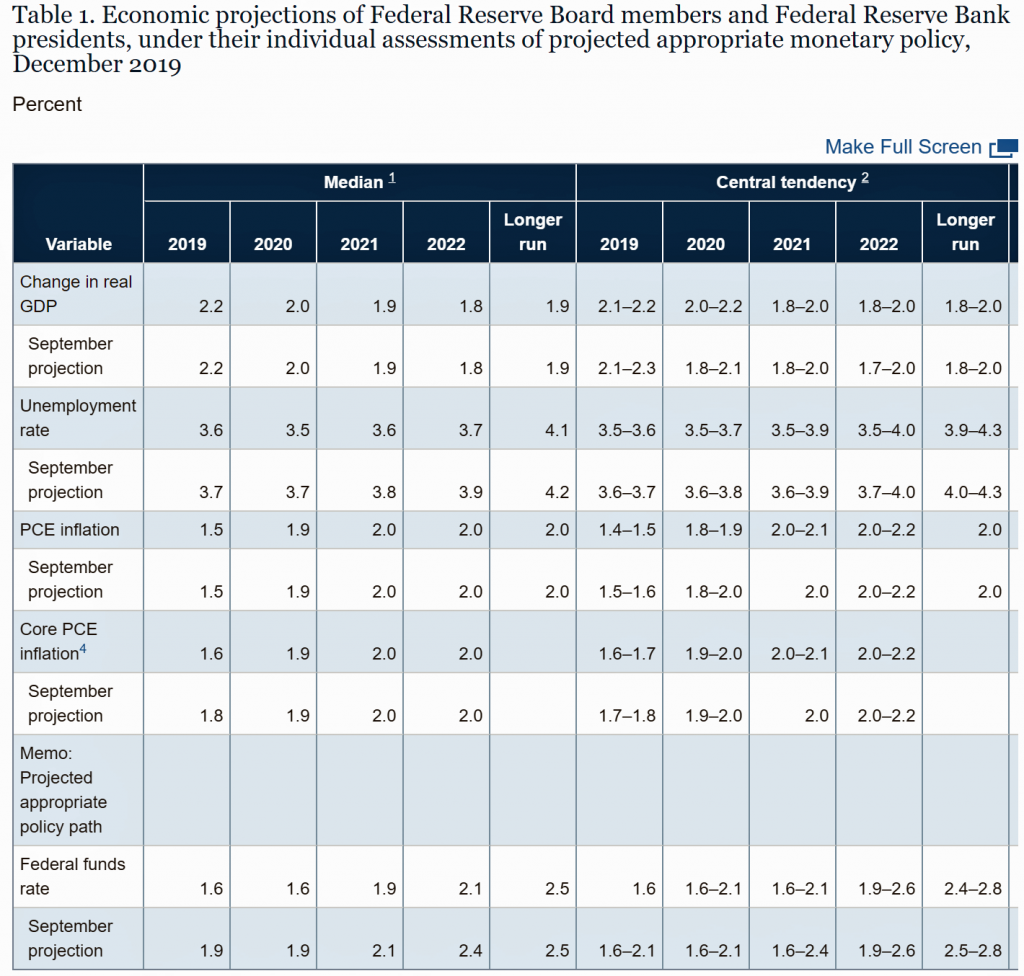

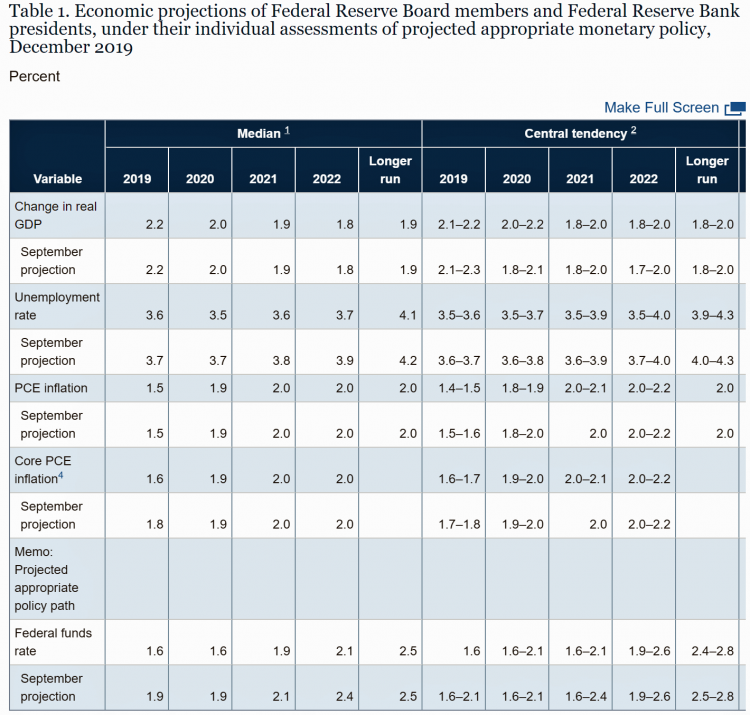

On February 12, 2020, the Chairman of the Federal Reserve Bank of the U.S. submitted the Semiannual Monetary Policy Report to Congress and testified to the Senate Banking Committee. Chairman Jerome Powell detailed the current state of the economy, discussing the state of the macroeconomy, GDP growth, unemployment, inflation, and projections for 2022 and beyond. The top line data points are shown in the first chart.

On February 12, 2020, the Chairman of the Federal Reserve Bank of the U.S. submitted the Semiannual Monetary Policy Report to Congress and testified to the Senate Banking Committee. Chairman Jerome Powell detailed the current state of the economy, discussing the state of the macroeconomy, GDP growth, unemployment, inflation, and projections for 2022 and beyond. The top line data points are shown in the first chart.

After his prepared remarks, Chairman Powell responded to questions from members of the Senate Banking Committee. Senator Ben Sasse (R-Neb.) asked him about health care costs’ impact on the national U.S. economy.

The Chairman responded pointedly: “The outcomes are perfectly average for a first-world nation, but we spend 6 percent to 7 percent of GDP more than other countries…So it’s about the delivery. That’s a lot of money that you are effectively spending and getting nothing.”

Powell further commented that other wealthy countries have been more successful at spending less on health care and delivering high-quality care. “It’s not that these benefits are fabulously generous — they’re just what people get in Western economies,” Powell observed.

Chairman Powell spoke about health care costs with Yahoo Finance in 2018: “It’s no secret: It’s been true for a long time that with our uniquely expensive healthcare delivery system and the aging of our population, we’ve been on an unsustainable fiscal path for a long time.” (H/T Business Insider)

For context, let’s review some highlights from Secretary Powell’s testimony, italicized and abridged here…

The economic expansion is well into its 11th year, and it is the longest on record. Over the second half of last year, economic activity increased at a moderate pace and the labor market strengthened further, as the economy appeared resilient to the global headwinds that had intensified last summer. Inflation has been low and stable but has continued to run below the Federal Open Market Committee’s (FOMC) symmetric 2 percent objective.

The benefits of a strong labor market have become more widely shared. People who live and work in low- and middle-income communities are finding new opportunities. Employment gains have been broad based across all racial and ethnic groups and levels of education. Wages have been rising, particularly for lower-paying jobs.

The nation faces important longer-run challenges. Labor force participation by individuals in their prime working years is at its highest rate in more than a decade. However, it remains lower than in most other advanced economies, and there are troubling labor market disparities across racial and ethnic groups and across regions of the country. In addition, although it is encouraging that productivity growth, the main engine for raising wages and living standards over the longer term, has moved up recently, productivity gains have been subpar throughout this economic expansion.

More details on Chairman Powell’s report can be found here.

Health Populi’s Hot Points: The health of the U.S. economy relies heavily on consumer spending. Let’s re-visit our Econ 101 class lecture on what makes up the Gross Domestic Product (GDP): it’s a sum of “C + G + S + (X-M),” where “C” equals consumer spending, “G” is government spending, “S” stands for savings, and “(X-M)” is the difference between spending on exports out of the country less imports in.

Health Populi’s Hot Points: The health of the U.S. economy relies heavily on consumer spending. Let’s re-visit our Econ 101 class lecture on what makes up the Gross Domestic Product (GDP): it’s a sum of “C + G + S + (X-M),” where “C” equals consumer spending, “G” is government spending, “S” stands for savings, and “(X-M)” is the difference between spending on exports out of the country less imports in.

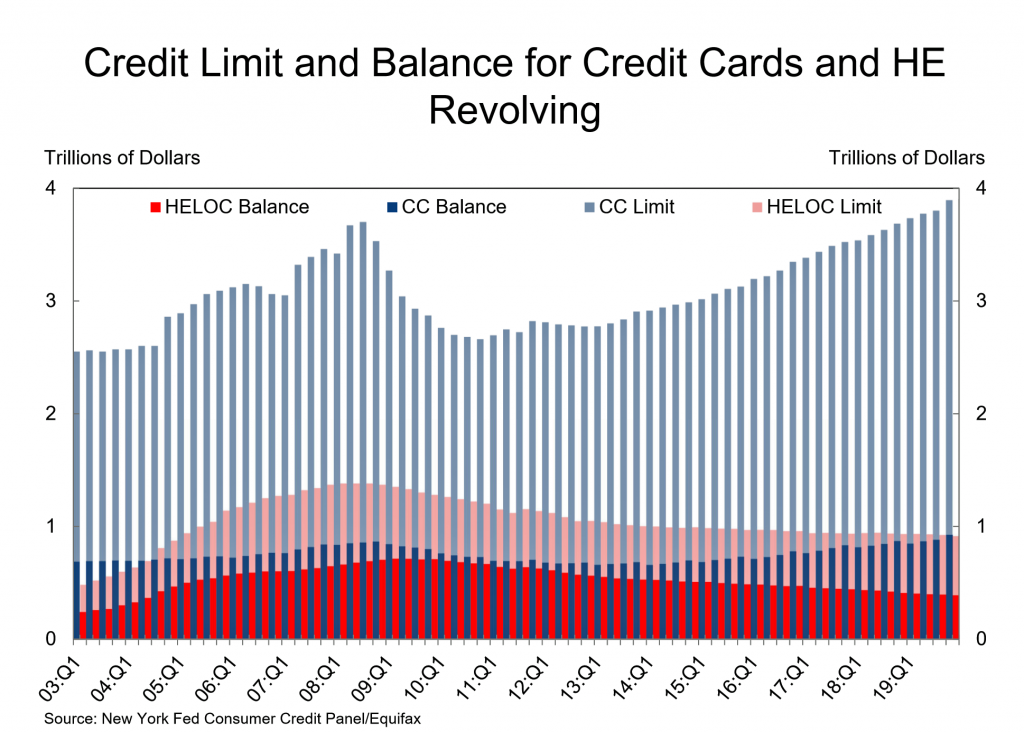

That “C” is consumer spending, which includes consumer debt. And that’s not only burdensome student loans, but a new high reached for credit card debt in America to the tune of $1 trillion reported by the Federal Reserve of New York.

Some of that credit card debt no doubt has medical bills associated with it. Furthermore, JPMorgan Chase has analyzed over 1 million accounts and found people using their tax refunds to pay for past medical spending.

Consumer debt crowds out other household spending, like households getting a new washing machine or a car, buying a new house, and saving for that “I” component — personal investment — in, say 401(ks) or health spending accounts (HSAs).

Consumer debt crowds out other household spending, like households getting a new washing machine or a car, buying a new house, and saving for that “I” component — personal investment — in, say 401(ks) or health spending accounts (HSAs).

The latest study from the Health Care Cost Institute found that the cost of an emergency room visit grew from $368 in 2014 to $503 in 2018. For context, most people in the U.S. couldn’t pay that $503 out of a current savings account.

Now return to the sage Chairman Powell with another quote from the Yahoo Finance story: “In the end, we will have to face [the unsustainable path] and the sooner the better…Also, these are the good times. This is the economy at nearly full employment. Interest rates are low — it’s a good time to be addressing these things,” asserted the man who leads the U.S. Central Bank.

Thank you FeedSpot for

Thank you FeedSpot for