Millions of Americans have to work 53 weeks to cover a year’s worth of household expenses. Most Americans haven’t saved much for their retirement. Furthermore, the bullish macroeconomic outlook for the U.S. in early 2020 hasn’t translated into individual American’s optimism for their own family budgets. (Sidebar and caveat: yesterday was the fourth day in a row of the U.S. financial markets losing as much as 10% of market cap, so the global economic outlook is being revised downward by the likes of Goldman Sachs, Vanguard, and Morningstar, among other financial market prognosticators. MarketWatch called this week the worst market slide since 2008, the advent of the Great Recession).

Millions of Americans have to work 53 weeks to cover a year’s worth of household expenses. Most Americans haven’t saved much for their retirement. Furthermore, the bullish macroeconomic outlook for the U.S. in early 2020 hasn’t translated into individual American’s optimism for their own family budgets. (Sidebar and caveat: yesterday was the fourth day in a row of the U.S. financial markets losing as much as 10% of market cap, so the global economic outlook is being revised downward by the likes of Goldman Sachs, Vanguard, and Morningstar, among other financial market prognosticators. MarketWatch called this week the worst market slide since 2008, the advent of the Great Recession).

With that national and consumer financial context in mind, three new studies (two published this week) converge prompting me to weave together this post on the high-cost-of-thriving and the evolving social contract for health care in America.

These inter-related studies come from three quite-different organizations: the Manhattan Institute, a conservative think-tank; the McKinsey Global Institute, embedded in the consulting firm; and, the Transamerica Center for Retirement Studies, part of a financial services company.

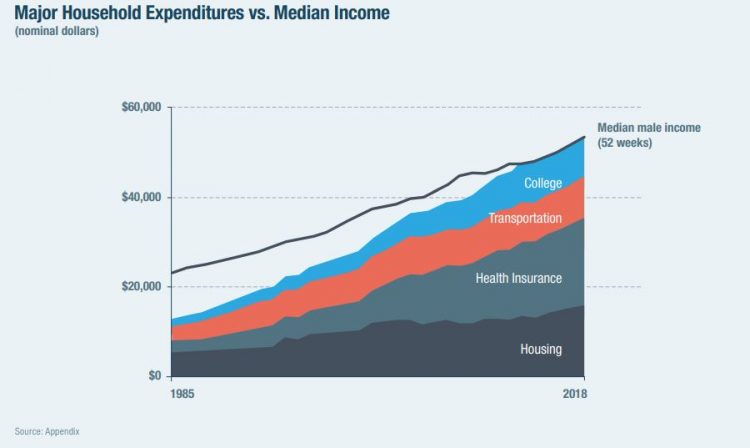

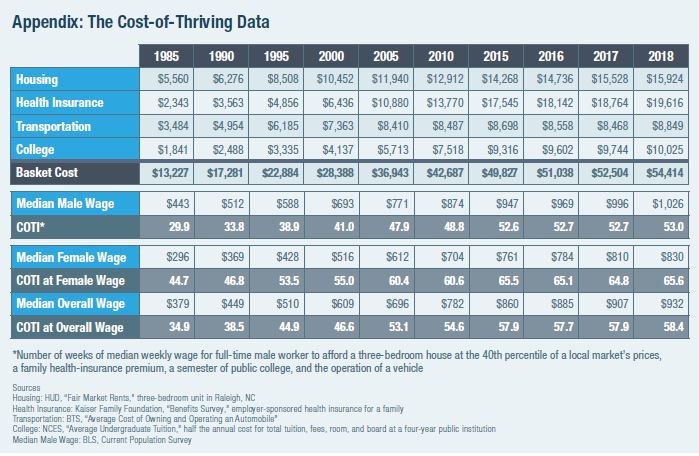

First, let’s dig into Oren Cass’s fascinating study into the cost-of-thriving, subtitled “Re-evaluating the Prosperity of the American Family.” This analysis quantifies the working American’s fiscal reality that wages have stalled and the cost-of-living increased. Those costs are shown in the household expenditure table here, illustrating that by 2018, the median household expenditures in the U.S. could barely be covered by median household income. Cass calculated that it would take 53 weeks of work to cover 52 weeks of household spending. Note how health insurance, in particular, swelled as a component of family budgets more than housing, transportation, and college education.

When it comes to those health expenses,  Cass points out that traditional medical price inflation as measured by the Bureau of Labor Statistics doesn’t jibe with the real costs borne by consumers in rising co-pays, deductibles, and cost-sharing.

Cass points out that traditional medical price inflation as measured by the Bureau of Labor Statistics doesn’t jibe with the real costs borne by consumers in rising co-pays, deductibles, and cost-sharing.

The table (Appendix: The Cost-of-Thriving Data) organizes the growing costs by household line item including housing, health insurance, transportation and college. See that health insurance line which exceeded housing in 2018 and comprised 36% of the family “market basket.”

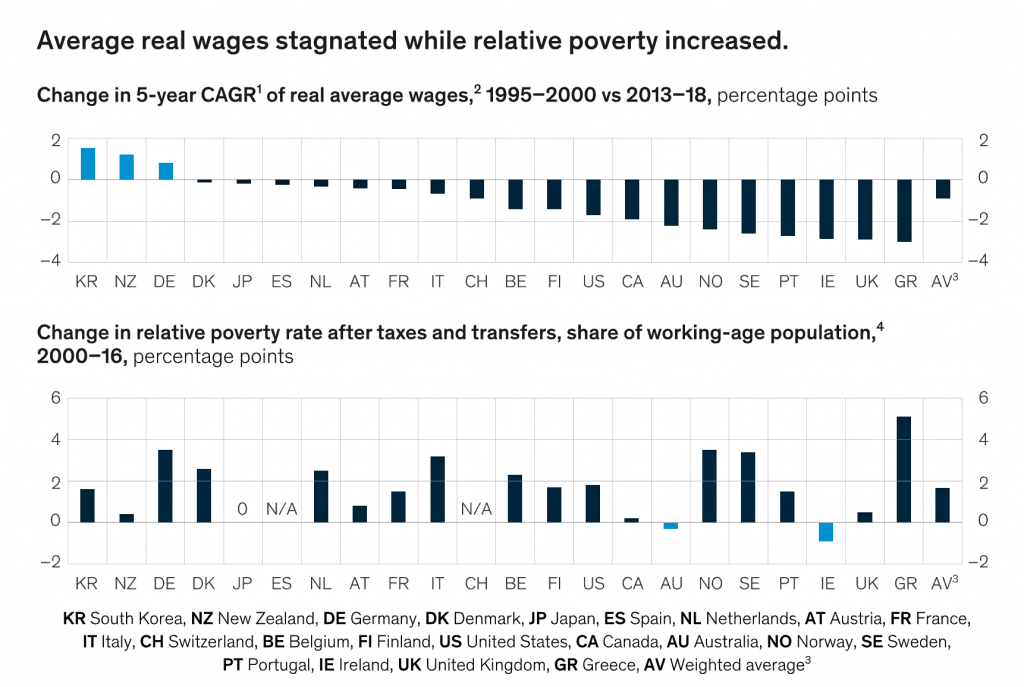

Now, let’s turn to the McKinsey report on The social contract in the 21st century. McKinsey illustrates in this bar chart the phenomenon, globally, that wage growth has stalled and poverty rates increased in the US and other wealthy countries.

The vertical bar chart documents average real wages and the growth of poverty as published in the McKinsey report. In the US, the change in the 5-year compound annual growth rate of wages fell 2% comparing 1995-2000 and 2013-18; the poverty rate grew 2 percent between 2000-16.

The vertical bar chart documents average real wages and the growth of poverty as published in the McKinsey report. In the US, the change in the 5-year compound annual growth rate of wages fell 2% comparing 1995-2000 and 2013-18; the poverty rate grew 2 percent between 2000-16.

McKinsey’s report included a chart akin to the one above from Manhattan Institute, graphically illustrating the growth of household costs with education, health care and housing fast-growing between 2002 and 2018. These costs erode and overwhelm the wage picture shown in the third vertical bar chart.

A further datapoint in the McKinsey social contract report is that over half of individuals in wealthy countries, including the U.S., did not save for old age. The statistic for the U.S. is that 46% of people had no savings for old age.

In the U.S., 23% of households had zero or negative net worth in 2017, up from 16% in 2001.

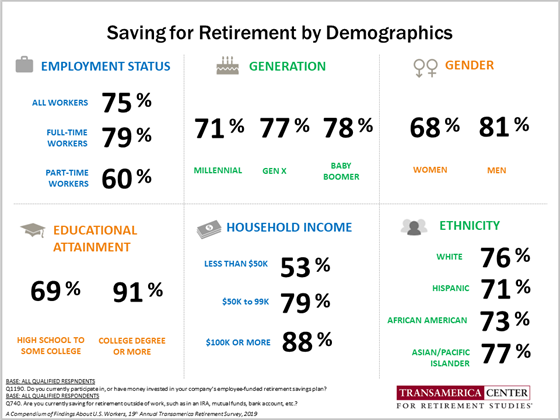

That statistic segues us to the Transamerica study on retirement, The New Social Contract: Empowering Individuals in a Transitioning World. The research calls out that consumers’ retirement concerns are declining physical health and running out of money. While increases in longevity give people the gift of more time, “we must also protect our health to fully enjoy this time,” Catherine Collinson, CEO of the Transamerica Institute explained in the press release for the study. “A new social contract for retirement is necessary as Society Security and pension plans face funding issues…due to increases in longevity…individuals faces the need to self-fund a great portion of their retirement income, often without adequate support to do so.”

This chart on saving for retirement by demographics shows that Collinson’s call for people to self-fund more retirement income is easier said than do-able — especially for women, people with less than college, and part-time workers.

“Forging a new social contract is a shared responsibility,” she asserts, with a collaboration between governments, employers, industry, nongovernmental organizations, nonprofits, academia and individuals.

Health Populi’s Hot Points: Putting the bottom-lines of these three reports together, from three very different points of view, converges on one over-arching conclusion: that health care costs, for both workers and people in retirement, have overwhelmed American households’ financial health and have impacted our physical health, as well. We’re stressed about health care costs, many foregoing care due to costs, many with retirement funds raiding them to pay for current medical spending, and others forsaking other household spending to pay for care.

Health Populi’s Hot Points: Putting the bottom-lines of these three reports together, from three very different points of view, converges on one over-arching conclusion: that health care costs, for both workers and people in retirement, have overwhelmed American households’ financial health and have impacted our physical health, as well. We’re stressed about health care costs, many foregoing care due to costs, many with retirement funds raiding them to pay for current medical spending, and others forsaking other household spending to pay for care.

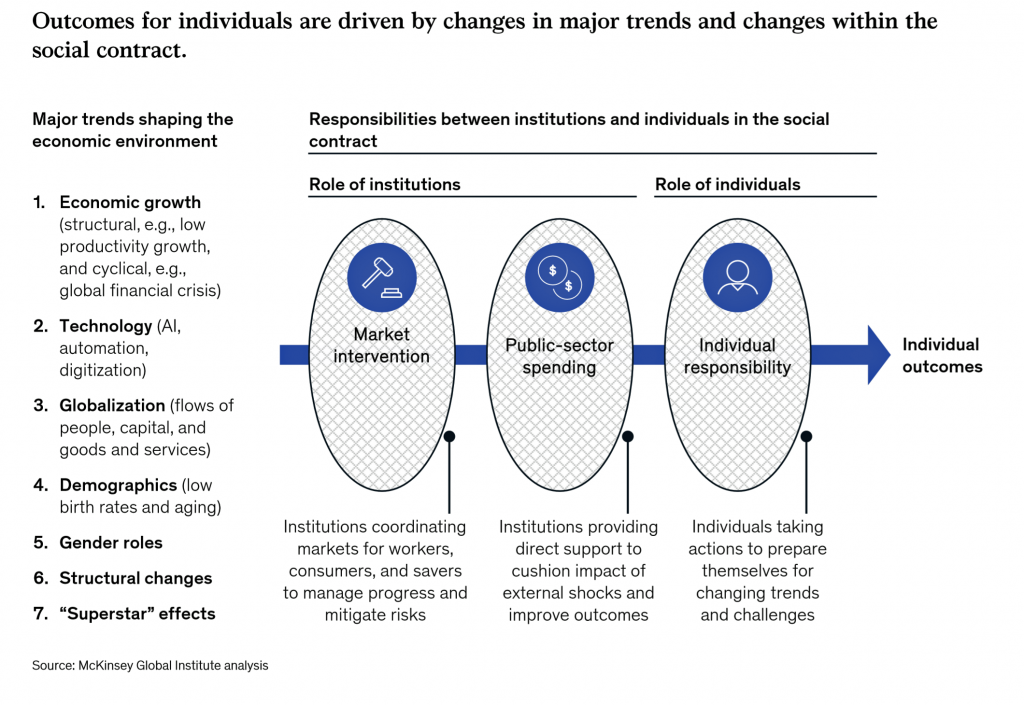

Both McKinsey and Transamerica’s research points to a “social contract,” which McKinsey diagrams in this last graphic. As Transamerica’s Collinson noted shared responsibility between different organizations, to, too, does McKinsey point to roles of institutions and individuals alike which, taken together, shape and influence individual outcomes. In this case, there are market interventions, public sector spending, and individuals risk-managing to the desired outcome.

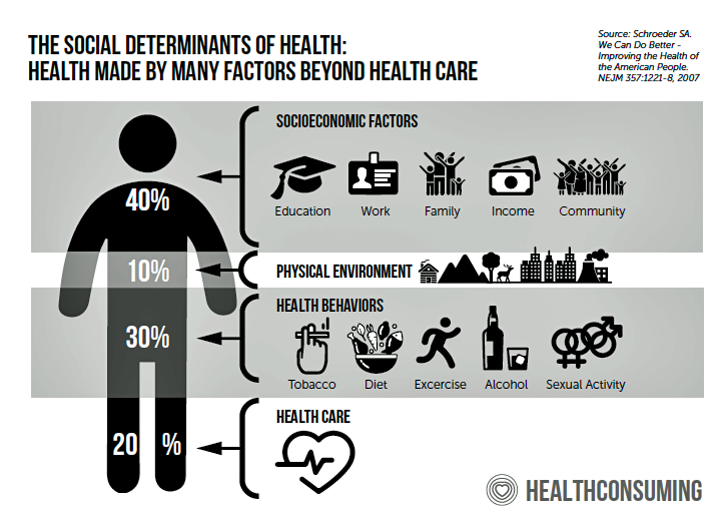

These trends and roles remind us of the social determinants of health, those factors that make health beyond health care services. Prime among these are education and work: education has been found to be an underpinning factor in the deaths of despair, early mortality due to accidental death, overdose and suicide, we learn from the brilliant if sobering work of Anne Case and Sir Angus Deaton (their book is due out in matter of weeks titled, Deaths of Despair, so stay tuned for my review).

These trends and roles remind us of the social determinants of health, those factors that make health beyond health care services. Prime among these are education and work: education has been found to be an underpinning factor in the deaths of despair, early mortality due to accidental death, overdose and suicide, we learn from the brilliant if sobering work of Anne Case and Sir Angus Deaton (their book is due out in matter of weeks titled, Deaths of Despair, so stay tuned for my review).

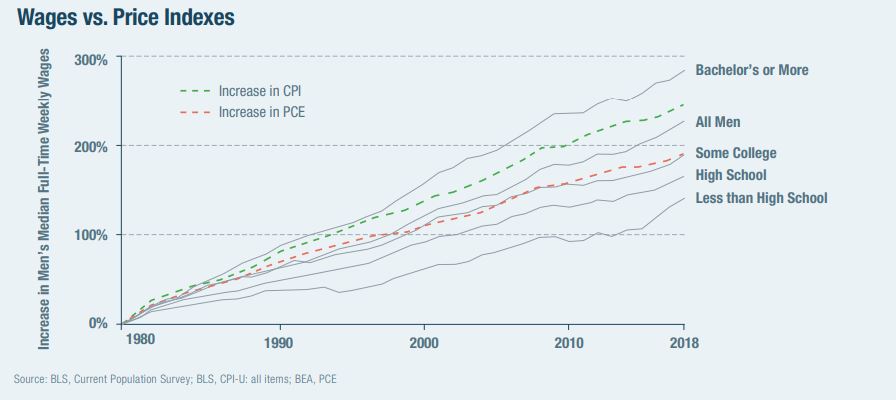

Both McKinsey and Transamerica cite (less) education as a factor in financial stress, and in the Manhattan Institute report, we also find this last chart attests to the impact education has on wages: a bachelor’s degree or more significantly, positively impacts a man’s median full-time wages. Men with less than high school earn just over one-third of those with at least a bachelor’s degree.

So we return to the social contract for health, which is rooted in financial wellness and education. This doesn’t come cheap, and it’s not free. It’s a societal choice on resource allocation for a country to decide what its values are which, then, “should” be the rationale for resource allocation. That is, government spending.

As we enter the wild-card era of corona virus in the midst of an eroded public health system and response, these studies are particularly timely…but so sobering. Because when the economy was quite bright, we took dollars away from public health and threaten to do so with the safety net and health care backbone.

Now that the likes of Goldman Sachs, Vanguard and Morningstar warn us of a virus-inspired recession…what will happen to the social contract for health and wellbeing in America when/if the national economy declines? I discussed this in a very welcome, if sobering, conversation with Dr. Eric Topol of Scripps yesterday. We put on our scenario planning hats, and brainstormed a possible future — that a COVID-19 pandemic could be one (of several) drivers toward a serious recession, national financial ill health, and a stronger call for universal health care.

Thank you FeedSpot for

Thank you FeedSpot for