Four in five U.S. adults say lowering the cost of health care in America should be high priority for the next American president, according to a poll from The Commonwealth Fund and NBC News.

Health care costs continue to be a top issue on American voters’ minds in this 2020 Presidential election year, this survey confirms.

Health care costs continue to be a top issue on American voters’ minds in this 2020 Presidential election year, this survey confirms.

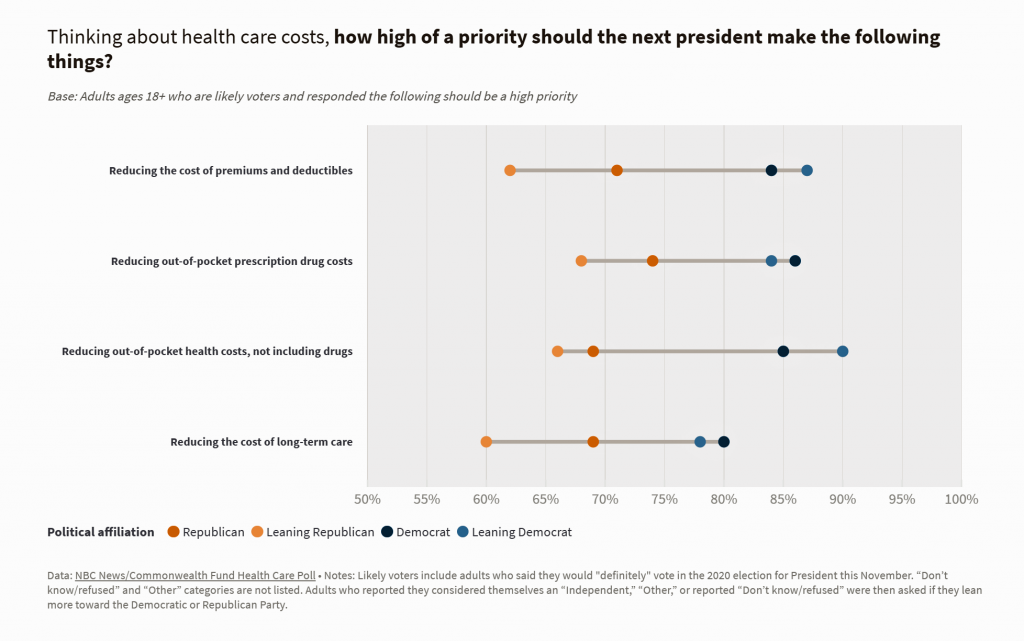

The first chart illustrates that lowering health care costs is a priority that crosses political parties. This is true for all flavors of health care costs, including health insurance deductibles and premiums, out-of-pocket costs for prescription drugs, and the cost of long-term care.

While the vast majority of Democrats — roughly 9 in 10 — prioritize lowering health care costs for the next President — over 60% of Republicans feel that way, too.

In the short run, looking into the next 12 months, one-third of Americans are worried about the amount they will pay for health insurance premiums and deductibles. This varies from a high of 33% of Democrats to 25% of Republicans (and 27% Leaning Republican).

In the short run, looking into the next 12 months, one-third of Americans are worried about the amount they will pay for health insurance premiums and deductibles. This varies from a high of 33% of Democrats to 25% of Republicans (and 27% Leaning Republican).

Across the various types of personal health care spending, more Hispanic people and people earning less than $50,000 a year are concerned about medical costs.

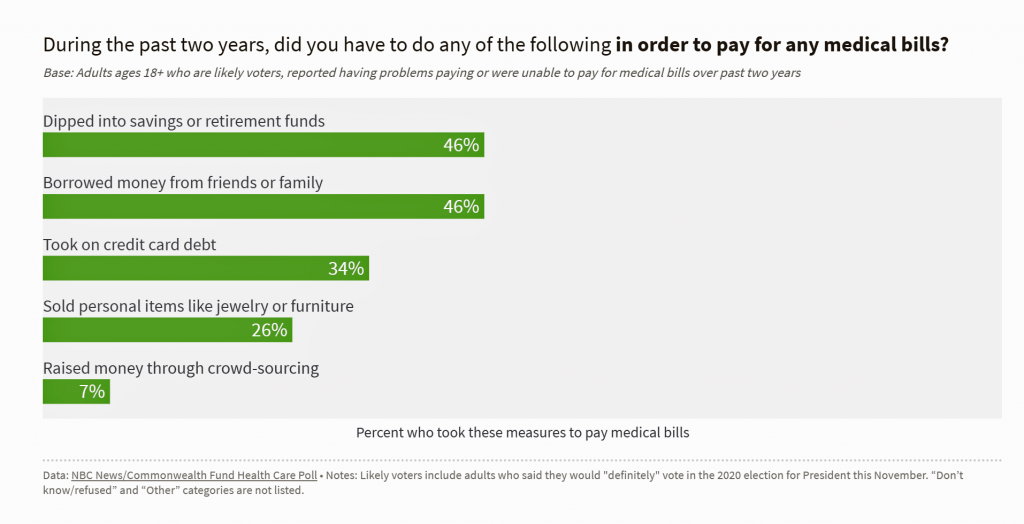

Note the second chart from the CMWF/NBC News study that nearly one-half of Americans have “dipped into savings or retirement funds” to pay for medical bills, and another half have borrowed from friends and family to cover healthcare expenses. This is especially concerning because people set up their 401(k) plans for spending during retirement and in the future — not for current health care spending, for which health savings accounts (HSAs) were designed. [As an important sidebar for context, Fidelity Investments estimates that a couple retiring in 2019 would need $285,000 for health care costs in retirement, not including long-term care expenses, to cover expenses that Medicare would not reimburse].

One-in-four people also sold personal items, like jewelry or furniture, to get cash for health spending.

Health Populi’s Hot Points: In the United States, health care costs are tightly bound into peoples’ overall household budgets and finances. This concept has underpinned Health Populi since I wrote the first post in this blog in September 2007 on the cost of health care, featuring this picture from Tom’s Shell characterizing the high costs of petrol at the pump in the midst of the oil crisis.

Health Populi’s Hot Points: In the United States, health care costs are tightly bound into peoples’ overall household budgets and finances. This concept has underpinned Health Populi since I wrote the first post in this blog in September 2007 on the cost of health care, featuring this picture from Tom’s Shell characterizing the high costs of petrol at the pump in the midst of the oil crisis.

Health care costs now feel like this to folks like those feeling the acute pinch of medical costs in 2020.

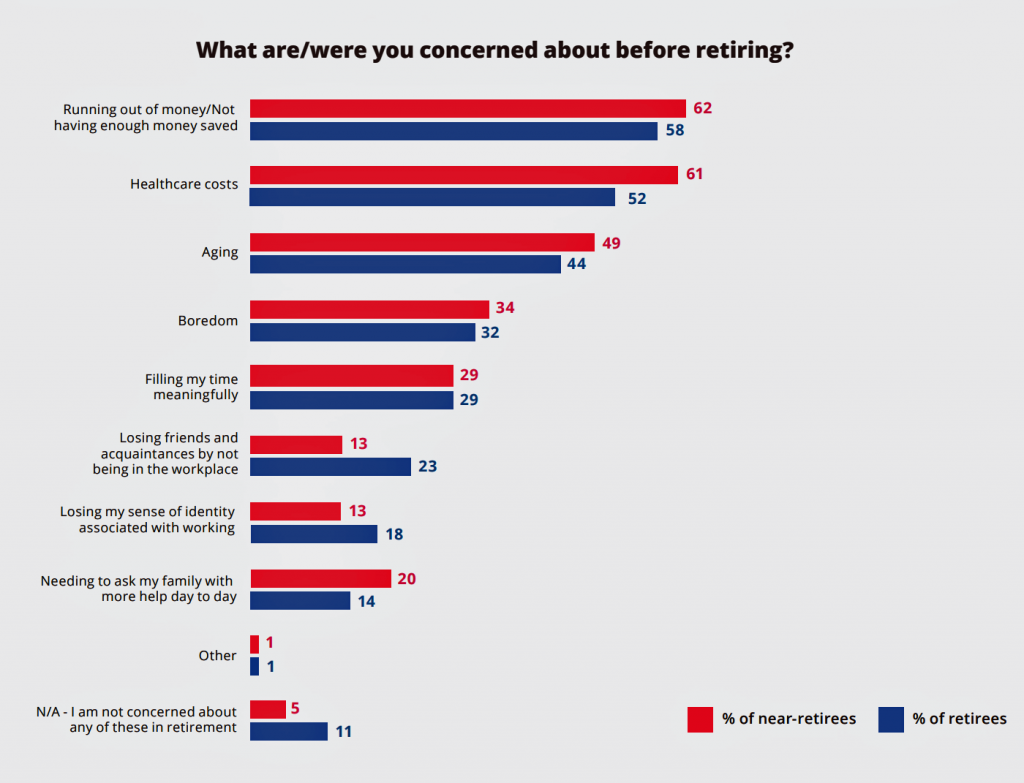

Check out this last graphic from a February 2020 report from the Empower Institute, part of Great-West Life & Annuity. Called Rethink, Rewire, Retire, the research polled 2,001 U.S. adults between 4t and 75 years of age, including 629 “near-retriees” and 1,372 retirees, to gauge their perspectives on retirement, working, and finances in older age.

The top two concerns for most Americans nearing retirement were “running out of money/insufficient savings” and healthcare costs.

The top two concerns for most Americans nearing retirement were “running out of money/insufficient savings” and healthcare costs.

These two issues are blurring into one for U.S. health consumers, whose define overall holistic health as physical and mental wellbeing along with financial wellbeing.

And so it’s déjà vu all over again as we look nostalgically back at Tom’s Shell’s sign — knowing that our health care costs literally can cost us an arm or a leg.

Thank you FeedSpot for

Thank you FeedSpot for