In a matter of several weeks, people living in the U.S. have endured massive personal social, emotional, physical and fiscal disruption due to the COVID-19 pandemic. State mandates to shelter at home, the adoption of wearing face masks and covers in public, and re-making dining tables and dens into home-working spaces for kids in school or parents telecommuting, American homes have morphed into petri dishes of people undergoing dramatic changes in a very short time.

A new report from PwC looks at peoples’ changes in health behaviors in the first two months of the pandemic, asking whether these changes will stick “after” the pandemic fades.

A new report from PwC looks at peoples’ changes in health behaviors in the first two months of the pandemic, asking whether these changes will stick “after” the pandemic fades.

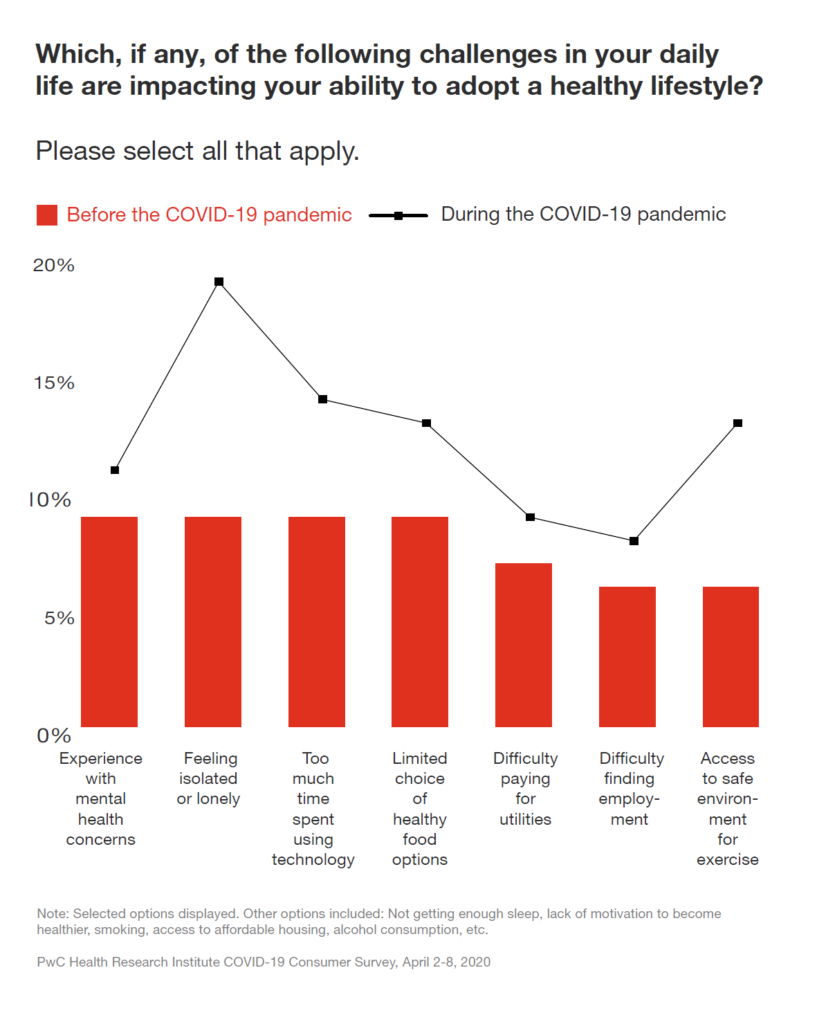

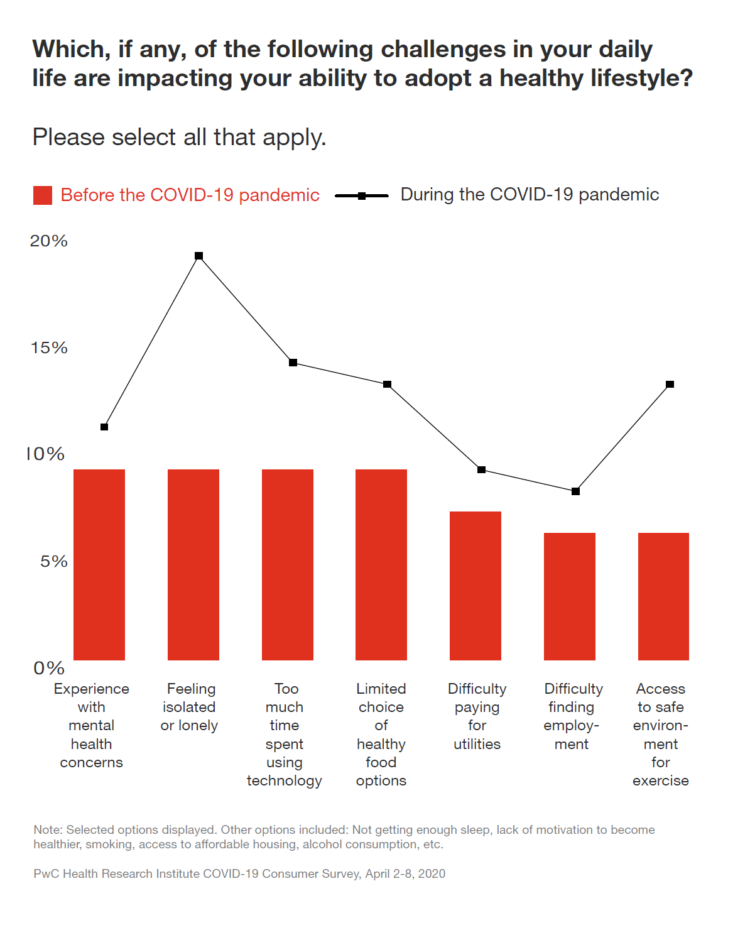

PwC compared peoples’ challenges in daily life preventing them for adopting a healthy lifestyle. Before the pandemic, the top obstacles to healthy living were mental health concerns, feeling isolated, too much time spent using technology, and a limited choice of healthy food options. Once the pandemic hit, “feeling isolated or lonely” spiked up, followed by access to a safe environment for exercise, too much time on technology, and that limited choice of healthy food.

But feeling isolated was surely the most impacted health risk, as the dotted line in the first chart graphs.

The usual challenges people felt in daily life for their physical and mental health blur into a person’s financial health — which impacts personal health/medical spending. 22% of health consumers told PwC they’re adjusting spending on medications, and 31% on healthcare visits. The latter has translated into doctors’ medical practices seeing less traffic/visits, and thus, less patient revenue, significantly impacting some PCPs’ and specialists’ businesses in the first quarter of 2020 and will do so well into the second quarter and beyond.

“Getting consumers to come back for care may depend on how much trust the health system can build with them over the next few months,” PwC notes in the report.

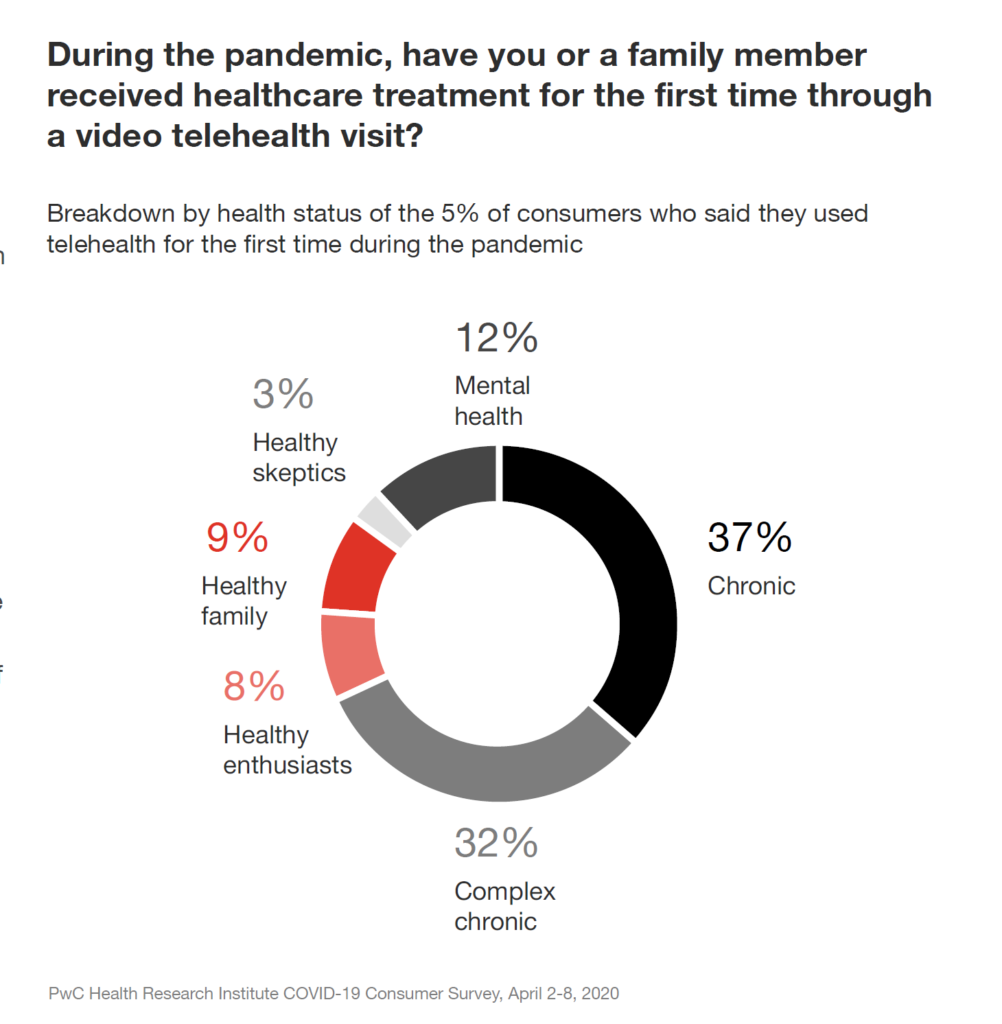

One healthcare flow consumers and clinicians have adopted in the COVID-19 pandemic is telehealth. Media covered “virtual queues” of patients waiting to “see” doctors via telemedicine channels in the earliest days of the coronavirus in Washington state, New York, New Jersey, and other hot spots in the early phase of the pandemic.

One healthcare flow consumers and clinicians have adopted in the COVID-19 pandemic is telehealth. Media covered “virtual queues” of patients waiting to “see” doctors via telemedicine channels in the earliest days of the coronavirus in Washington state, New York, New Jersey, and other hot spots in the early phase of the pandemic.

The circle chart graphs what occasioned consumers’ visits telehealth visits for the first time in the pandemic. People dealing with chronic conditions (single and complex) comprised two-thirds of the first-visits, followed by 12% of people using virtual channels for mental health.

While telehealth has become a popular benefit in employer-sponsored health insurance plans, PwC found that 10% of consumers said their companies were offering new telehealth options post-pandemic.

One-third of employers in this study expanded work-from-home, 19% information for dealing with the pandemic, 17% expanding sick leave, and 15% of companies offered more flexibility for caring for dependents.

Health Populi’s Hot Points: Another aspect of life is transforming in this pandemic journey across all of us: the nature of trust across the many touchpoints of our lives. Edelman has tracked eroding trust with institutions for the past several years. Those on the losing-trust roster have been governments, media, and of late, “each other” in terms of social networks and political/social chasms across the world.

Health Populi’s Hot Points: Another aspect of life is transforming in this pandemic journey across all of us: the nature of trust across the many touchpoints of our lives. Edelman has tracked eroding trust with institutions for the past several years. Those on the losing-trust roster have been governments, media, and of late, “each other” in terms of social networks and political/social chasms across the world.

Last year, the Edelman Trust Barometer found that consumers’ trust was highest with “my employer,” and in 2020, consumers seek competence and ethics from organizations and individuals wherever we can find those features.

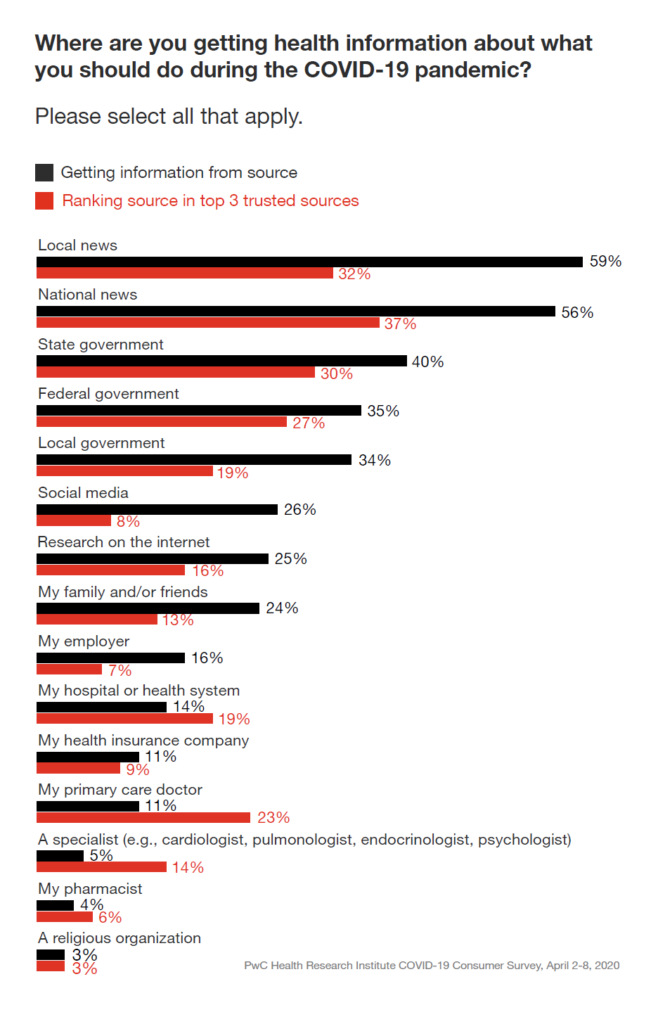

In the COVID-19 era in the U.S., PwC found that the top sources for gathering health information were first, local news, followed by national news and the State government (ahead of the Federal government by 5 percentage points and local government by 6 points). These details and differences are shown in the bar chart.

In terms of trusted sources, these top three channels were also the most-trusted, albeit with far fewer fans. Primary care doctors were trusted by one-in-four people, but only sought as an information source by 1-in-10. Hospitals were marginally more likely sought for health information in the pandemic, and health plans and pharmacists even less so.

“Health system communication with patients tends to be transaction,” PwC observes in the report.

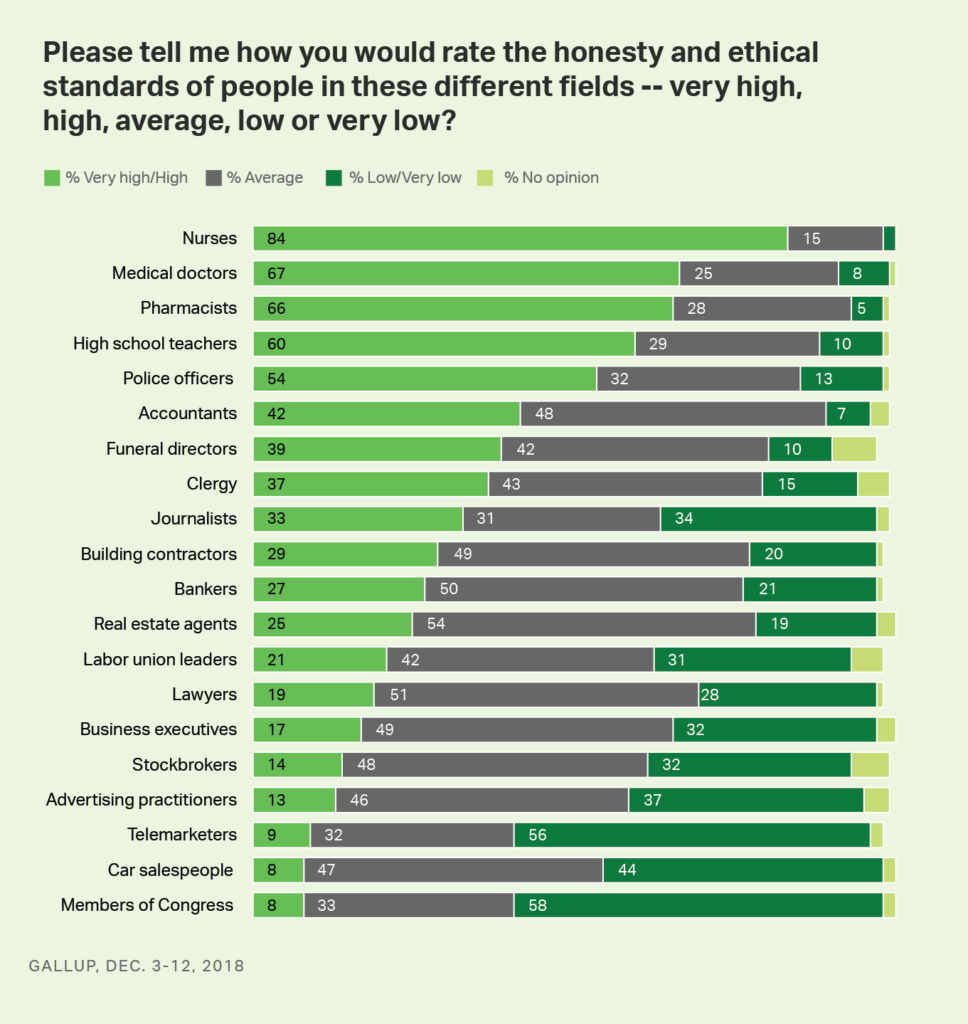

I must note once again the ethical/trusted human capital inherent in physicians, nurses and pharmacists, perennially found by Gallup in its annual survey on honesty and ethics in U.S. professions.

Our doctors and nurses are on the front-line of the “war” on COVID-19. These heroes of health care human capital were already in the depths of depression and burnout early in 2020, as learned by the annual Medscape study on the issue.

Our doctors and nurses are on the front-line of the “war” on COVID-19. These heroes of health care human capital were already in the depths of depression and burnout early in 2020, as learned by the annual Medscape study on the issue.

The coronavirus has only exacerbated U.S. clinicians’ well-being. The latest, heartbreaking example of this is the suicide of Dr. Lorna Breen, an ER doctor working in New York City and surviving COVID-19. She took her life last weekend at her family’s home in Virginia.

As her father, a fellow physician, told the New York Times, “She tried to do her job, and it killed her.”

The PwC study asks how our health behavior now in the midst of the COVID-19 pandemic might persist. Surely, the epidemic of mental health after the current virus pandemic — with the marked spiking up of feeling isolated or lonely, and experiencing mental health concerns — will be with us long after a vaccine is discovered. This will be even more true for clinicians who have been supporting patients in ICUs, ERs, and clinics across America.

We’ll need a whole lot of services, especially enabled through telehealth and virtual channels, to help us deal with our anxiety, depression and stress ongoing. Optum, part of UnitedHealthcare, announced yesterday their intention to acquire AbleTo, one of the most mature tele-mental health providers. This will be part of the new normal for health care in America — and justifiably so.

Thank you FeedSpot for

Thank you FeedSpot for