Today, 7th May 2020, the U.S. Bureau of Labor Statistics announced that about 3.17 million jobs were lost in the nation in the last week. This calculated to an unemployment rate of 15.5%, an increase of 3.1% points from the previous week.

Today, 7th May 2020, the U.S. Bureau of Labor Statistics announced that about 3.17 million jobs were lost in the nation in the last week. This calculated to an unemployment rate of 15.5%, an increase of 3.1% points from the previous week.

Total jobs lost in the COVID-19 pandemic, starting from the utterance of the “P” word, has been ___ in the I.S.

The virus’s global impact has led to what IMF called the Great Lockdown, resulting in economic inertia and contraction since Asia and Europe reported the first patients diagnosed with the coronavirus. The economic impact the world over has been devastating for national economies, an impact that’s hard-hit households, job security, and in the U.S., health care security.

TransUnion has been tracking consumer-level effects on a weekly basis, and today in Health Populi with 3 mm+ claims filed for Pandemic Unemployment Assistance, I wanted to share TU’s latest analysis of U.S. consumers’ financial health in the COVID-19 pandemic. The company is assessing peoples’ economic and financial distress each week; the data discussed here was collected online among 2,057 U.S. adults the week of 27 April 2020.

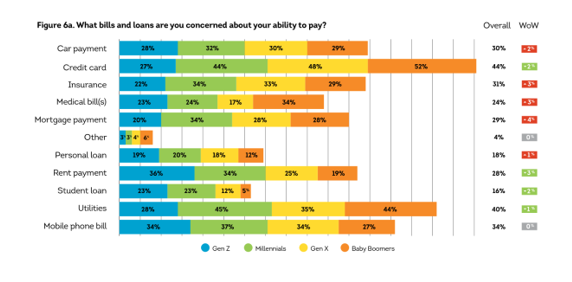

Six in 10 people in the U.S. said their household income was impacted by the pandemic, especially hard on Millennials. Consumers are concerned about their ability-to-pay for all kinds of bills, shown in the bar chart. Most concerning are credit cards, utilities, auto loans, insurance, and mobile phone bills, with mortgage and rent and medical bills (which are worrisome for 1 in 4 U.S. consumers compared with the high of 44% concerned about credit cards and 40%, utilities).

1 in 3 consumers said paying their mobile phone bill is worrisome — a sign of this pandemic, #StayHome moment where connecting to digital lives for tele-work at home, social connections via virtual platforms, and everyday life.

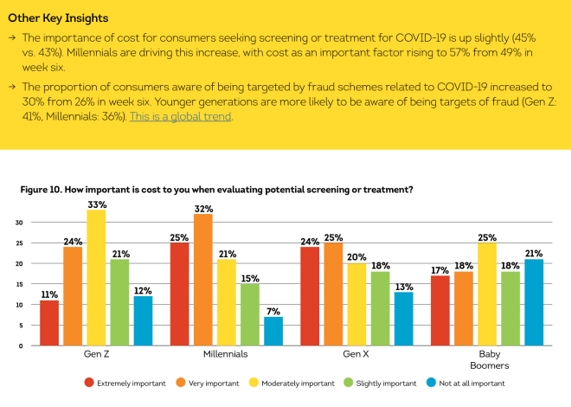

Paying for health care is still on the minds of consumers in the pandemic era. The third chart illustrates the importance of cost for screening or treatment for COVID-19, with Millennials most highly concerned about the cost of the virus. 57% of Millennials indicate the cost of care for COVID19 is extremely or very important, followed by 49% of Gen X and 35% of the youngest (Gen Z) and oldest (Boomer) cohorts in the study.

Paying for health care is still on the minds of consumers in the pandemic era. The third chart illustrates the importance of cost for screening or treatment for COVID-19, with Millennials most highly concerned about the cost of the virus. 57% of Millennials indicate the cost of care for COVID19 is extremely or very important, followed by 49% of Gen X and 35% of the youngest (Gen Z) and oldest (Boomer) cohorts in the study.

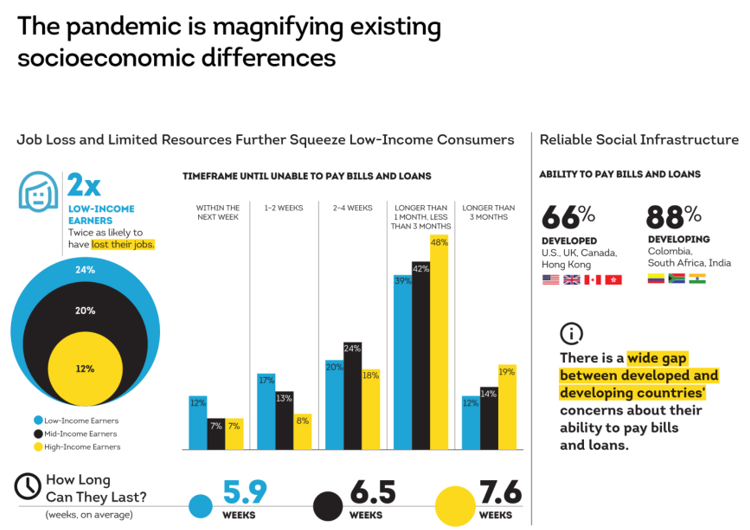

Health Populi’s Hot Points: As with the virus itself, the financial impact of the pandemic isn’t impacting consumers consistently. TransUnion points out that the pandemic is “magnifying” existing socioeconomic differences, something the company well understands through its years of addressing consumers’ financial health and credit scores.

The last chart details TransUnion’s bottom-line insight that, globally, low-income earners are twice as likely to have lost their job. Given their lower level of financial health, folks earning lower incomes would have 5.9 weeks of bandwidth until they would be unable to pay their bills.

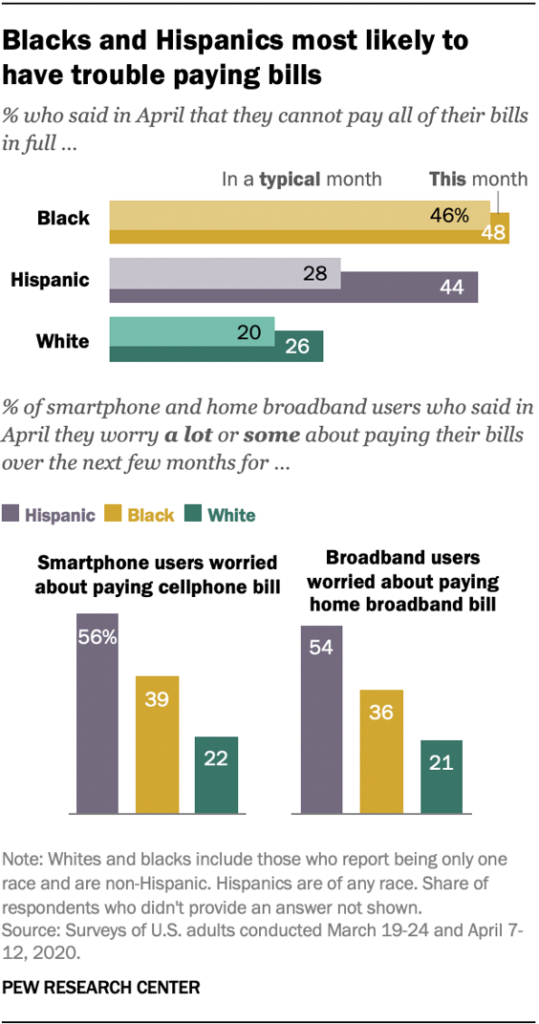

One of the big realizations in the U.S. pandemic among mainstream people who don’t work in health care or policy is that the virus has hit people of color and of lower socioeconomic status much harder in terms of mortality and health outcomes.

One of the big realizations in the U.S. pandemic among mainstream people who don’t work in health care or policy is that the virus has hit people of color and of lower socioeconomic status much harder in terms of mortality and health outcomes.

Socioeconomic status — which is underpinned by income at the base — sets the table for a person’s well-being from birth, influencing education opportunities, jobs and pay levels (including the bundling of health insurance into a “good job”), food security and health quality, environmental health (like clean air and clean water), and access to broadband connectivity where data plans may be too expensive to pay. This came through TransUnion’s data point that mobile phone bills had ability-to-pay challenges for 1 in 3 people overall.

This week, JAMA published a Viewpoint by Dr. Donald Berwick titled, “Choices for the ‘New Normal.” In the essay, Dr. Berwick, who leads the Institute for Healthcare Improvement and has spent a career in public service and academia to indeed improve health care for everyone, confessed that,

“No one can say with certainty what the consequences of this pandemic will be in 6 months, let alone 6 years or 60….Fate will not create the new normal; choices will.” He offers six “choices” to be considered for effectively addressing and solving COVID-19 in the U.S., including:

- The speed of learning

- The value of standards

- Protecting the workforce

- Virtual care

- Preparedness for threats, and

- Inequity.

This sixth choice is what TransUnion illustrates in this last chart…which Dr. Berwick calls “the worm in the heart of the world.”

“Will leaders and the public now at last commit to a firm, generous, and durable social and economic safety net?” he asks. “That would accomplish more for human health and well-being than any vaccine or miracle drug ever can,” he asserts.

COVID-19 is teaching us, ruthlessly and painfully, about our interconnectedness globally, and the uniquely American interconnectedness between health, wealth, a civil society, and public health.

Postscript 4 pm 5-7-20 — since posting this earlier today, I received a new report from the Pew Research Center including this data point — that people of color have more trouble paying for cellphone bills and home broadband costs.

Postscript 4 pm 5-7-20 — since posting this earlier today, I received a new report from the Pew Research Center including this data point — that people of color have more trouble paying for cellphone bills and home broadband costs.

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for