COVID-19 is re-shaping health care in America across many dimensions. In Shifts in Healthcare Demand, Delivery and Care During the COVID-19 Era, IQVIA presents a multi-faceted profile of the early impacts of the pandemic on U.S. health care.

COVID-19 is re-shaping health care in America across many dimensions. In Shifts in Healthcare Demand, Delivery and Care During the COVID-19 Era, IQVIA presents a multi-faceted profile of the early impacts of the pandemic on U.S. health care.

In the report, published in April 2020, IQVIA mined the company’s many data bases that track real-time data, including medical claims, flu data, sales data, oncology medical and pharmacy claims, formularies, among other sources.

Top-line, IQVIA spotted the following key shifts in U.S. health care since the start of the coronavirus pandemic:

Top-line, IQVIA spotted the following key shifts in U.S. health care since the start of the coronavirus pandemic:

- Patients’ use of health services

- Impacts on medicine use, influenced directly by COVID-19 and re-shaping demand for therapies treating chronic disease, opioids, and specialty care

- Impacts on oncology, and,

- Impacts on lab use and diagnostic services.

The report details many other aspects of health care impacts in America; this post only focuses on patient-facing health services shifts, but the entire report is well worth your review to gain a broad perspective of how COVID-19 is touching a range of aspects of U.S. health care.

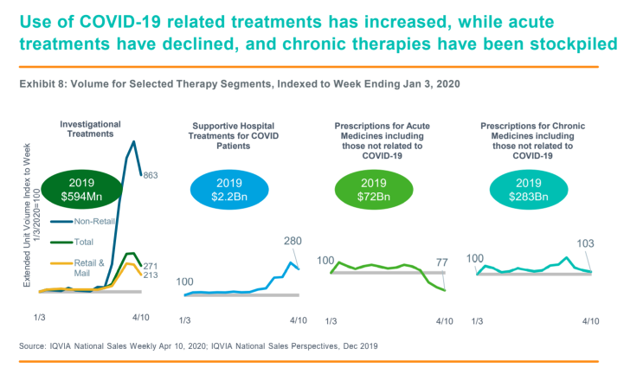

The top chart illustrates several health care delivery segments that COVID-19 disrupted starting January 3, 2020: research, hospital treatments, and prescription drugs.

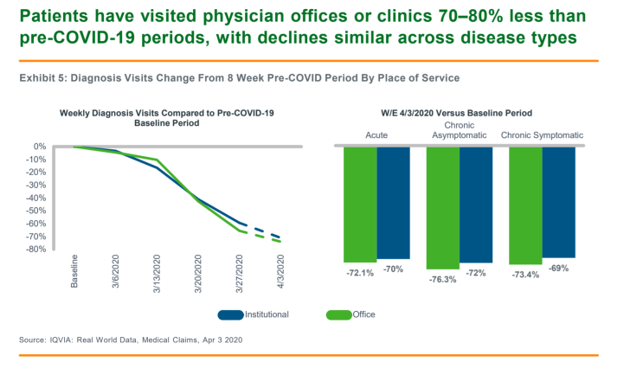

Patients’ visits to doctor’s offices and clinical labs for diagnostic tests dramatically declined since the start of the pandemic. #StayHome, shelter-in-place mandates coupled with patients’ concerns about preventing personal exposure to the coronavirus, kept people home. Overall in-person visits to doctors fell by over 70%.

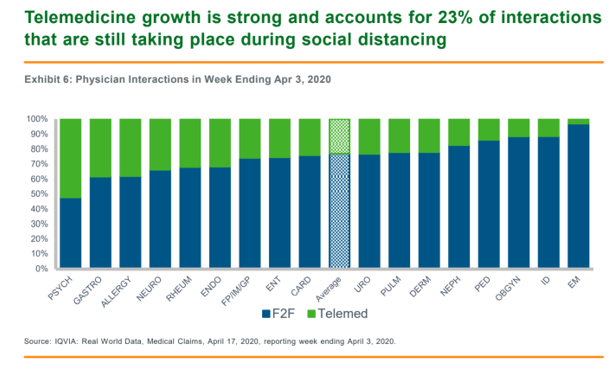

That decline in face-to-face physician visits was supplanted, in part, by hockey-stick growth for telemedicine visits. In the week of April 3, telemedicine visits with physicians comprised 1 in 4 interactions. Telehealth platforms enabled virtual visits most disruptively for mental health, GI, allergy, neurology, rheumatology, endocrinology, primary care, ENT and cardiology, as the bar chart illustrates. [For more on the telemedicine moment in the C19 era, read this analysis].

That decline in face-to-face physician visits was supplanted, in part, by hockey-stick growth for telemedicine visits. In the week of April 3, telemedicine visits with physicians comprised 1 in 4 interactions. Telehealth platforms enabled virtual visits most disruptively for mental health, GI, allergy, neurology, rheumatology, endocrinology, primary care, ENT and cardiology, as the bar chart illustrates. [For more on the telemedicine moment in the C19 era, read this analysis].

Lab tests across all sites of care sharply fell since early March, with fewer office visits and, thus, fewer diagnoses. We should be mindful that with fewer lab tests (other than COVID-19 tests where they can be accessed), a plethora of patients will have delayed diagnoses and treatments which may drive increased downstream costs and health care spending.

Health Populi’s Hot Points: Health care can learn from some of the early retail shopping insights that researchers like Nielsen and Acosta gleaned in the first quarter of 2020.

Health Populi’s Hot Points: Health care can learn from some of the early retail shopping insights that researchers like Nielsen and Acosta gleaned in the first quarter of 2020.

One is the emergence of the “pandemic pantry,” where consumers began to stockpile hygiene products and personal and household use, along with stockpiling shelf-stable foods such as tinned fish and meats, frozen vegetables and fruits, and legumes and pasta.

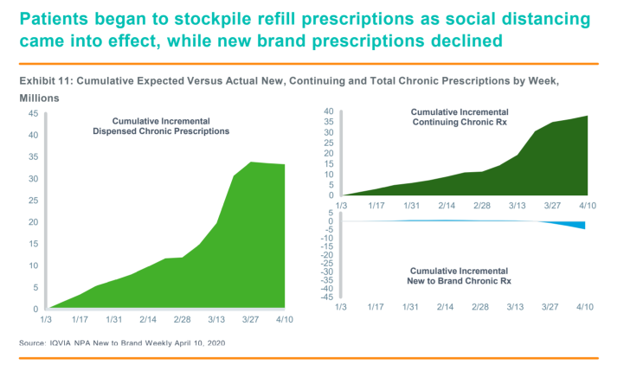

Stockpiling has come to consumers’ medicines as well, IQVIA found in its pharmacy claims data. As people initially heard about COVID-19 then began sheltering in place and practicing physical distancing, prescriptions for chronic medicine initially ratcheted up then, over a few weeks, hit a plateau once distancing took hold.

Retail pharmacy ePrescriptions grew at the same time prescribing volumes fell overall, indicating a kind of trend like telehealth adoption.

At the same time, prescriptions for new brands fell with doctors’ offices shut down or limiting patient visits.

Pre-isolation stockpiling particularly impacted several chronic conditions: hypertension, mental health, respiratory, and diabetes.

These early and dramatic shifts in patients’ expressed demand and utilization of health care services hints at what could persist “after” the pandemic — in particular, telehealth and virtual care platforms, and eRx. An eventual hard shift will depend on several factors, among them:

- How long the pandemic will last

- How cost-burdened patients will be to share in health care expenses, which will also tie to…

- When and whether unemployed people get back to work and, if so, coverage by employer-sponsored health insurance

- How satisfied (or even delighted) patients are when using virtual care options

- If, when and how patients’ personal physicians return to their office practices and how their services will be structured and priced (e.g., virtual vs. bricks-and-mortar),

among other factors.

Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a