Every company is a tech company, strategy consultants asserted over the past decade.

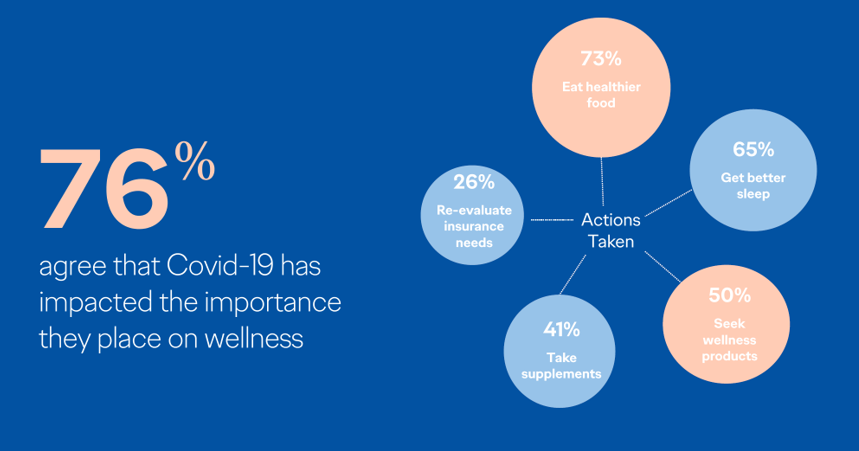

The coronavirus pandemic has revealed that every company is a health and wellness company now, at least in the eyes of consumers around the world.

In The Wellness Gap, the health and wellness team at Ogilvy explores the mindsets of consumers in 14 countries to learn peoples’ perspectives on wellness brands and how COVID-19 has impacted consumers’ priorities. A total of 7,000 interviews were conducted in April 2020, in Asia, Europe, Latin America, and North America — including 500 interviews in the U.S.

In The Wellness Gap, the health and wellness team at Ogilvy explores the mindsets of consumers in 14 countries to learn peoples’ perspectives on wellness brands and how COVID-19 has impacted consumers’ priorities. A total of 7,000 interviews were conducted in April 2020, in Asia, Europe, Latin America, and North America — including 500 interviews in the U.S.

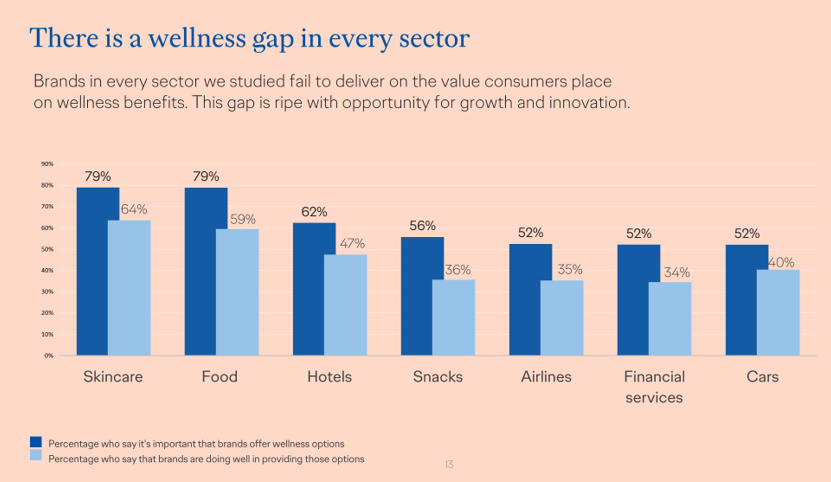

The first chart illustrates that most people see each of the seven industries studied as wellness channels, from the more obvious health-oriented categories like skincare and food to hospitality (hotels and airlines), financial services, and automotive (which I’ve covered as far back as 2007 here on Health Populi).

But consumers see gaps between sectors they see as wellness-platforms versus those providing wellness options. The largest sector wellness-gap was found in food and snacks, followed by financial services.

80% of consumers want to bolster their wellness but one-half cannot find options to do so due to three kinds of gaps: availability, which is a service consumers do not think exists; authenticity, where a wellness claim must be believable and verifiable; and, value, balancing value-for-money, good for the consumer, and good for the environment, as Ogilvy described the 3 chasms.

80% of consumers want to bolster their wellness but one-half cannot find options to do so due to three kinds of gaps: availability, which is a service consumers do not think exists; authenticity, where a wellness claim must be believable and verifiable; and, value, balancing value-for-money, good for the consumer, and good for the environment, as Ogilvy described the 3 chasms.

What is a wellness brand, anyway? There are lots of factors, as shown in the second graphic from the Ogilvy report. Majorities of people cite obvious benefits, like helping me stay in good health, putting me in a positive frame of mind, improving my sleep quality, and serving up nourishing or nutritious food.

But less medical factors are also part of wellness branding, such as helping me be more productive, promoting a sense of harmony and balance, and keeping me operating at my best, among other values.

Taken together, Ogilvy says, these branding factors bundle into four characteristics:

- Physical

- Social

- Mental, and

- Purposeful.

“The expansion of the world of wellness is not going to slow down and Covid will accelerate the phenomenon,” the Ogilvy report concludes. “Consumers want to improve their wellness, significantly.”

Health Populi’s Hot Points: The pandemic has shifted peoples’ lens from “my” wellness to “our” wellness, Ogilvy found in the data. That mindset from “my” to “our” wellness is part of my observation of a growing ethos for collective well-being called out in my book, Health Citizenship: How a virus opened up hearts and minds, published in September.

In my reading and weaving together the first six months of consumer data in the age of public health crisis, I identified five key forces re-shaping the consumer and her health: digital transformation of the person, DIY-everything (that could be done by oneself), the home as the health hub, and growing mental stress accompanied by financial un-wellness.

This fifth element is well-covered by the Ogilvy team in their look into financial wellness, noting an 18-point difference between consumers seeking wellness engagement with financial services but not getting wellness-satisfaction from the sector.

This fifth element is well-covered by the Ogilvy team in their look into financial wellness, noting an 18-point difference between consumers seeking wellness engagement with financial services but not getting wellness-satisfaction from the sector.

Ogilvy describes HSBC’s approach to bolstering consumers’ wellness mindset, launching an online Financial Wellness Center in March 2019 as a digital education platform for teaching retail banking customers financial literacy. Two examples of teaching modules that build “habits for financial wellbeing” include “how to feel in control of your everyday finances,” and “what being financially fit means.”

The COVID-19 crisis exacerbated consumers’ financial stress: in the U.S., patients’ concerns about the cost of coronavirus treatment prevented many health consumers from seeking medical care even when they experienced symptoms of the virus, a Commonwealth Fund study found in the first wave of the pandemic.

Ogilvy’s report has revealed opportunities in the growing health/care ecosystem, for both incumbent legacy healthcare providers and suppliers along with newer entrants like automobile manufacturers and the hotel industry.

That retail health ecosystem will increasingly support consumers’ self-care strategies. Peoples’ demand for these services will continue to grow through and beyond the COVID-19 era due to what Kantar’s marketing data has termed the “hangover” effects of health and hygiene, personal financial health, and peoples’ concerns about physical distancing — together, nudging health consumers to seek and make healthcare at home and closer-to-home.

Thank you FeedSpot for

Thank you FeedSpot for