The more health consumers use health and wellness services at retail, the greater their satisfaction and brand-love, according to a new report from J.D. Power.

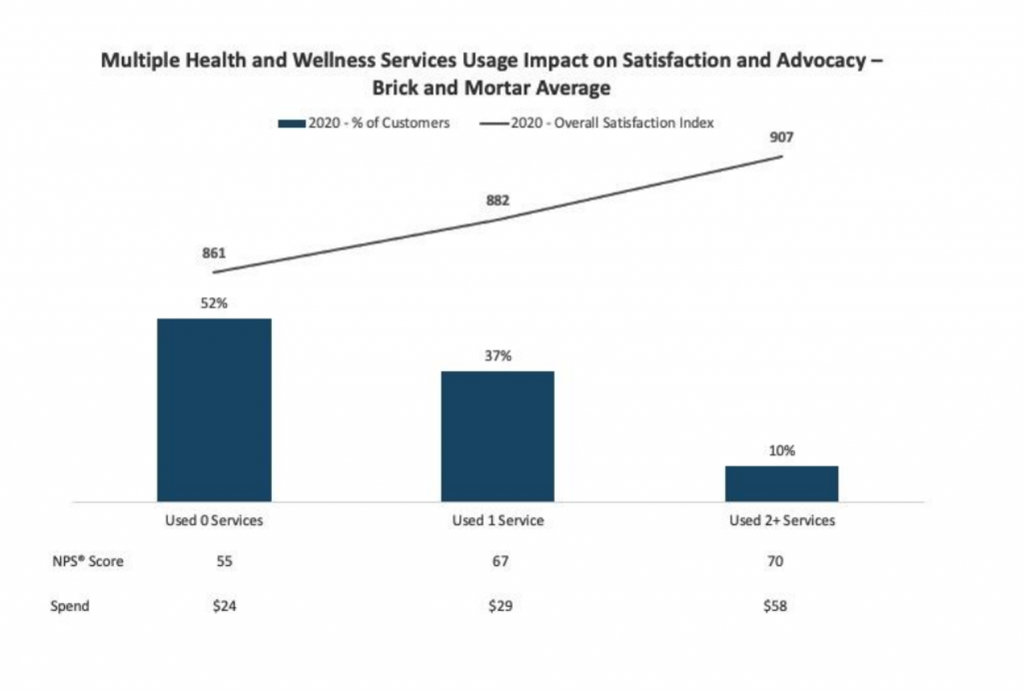

J.D. Power found that peoples’ Net Promoter Scores were higher among those folks who used at least one health and wellness service at a brick-and-mortar pharmacy, shown in the first chart. That NPS-delta was 15 points between consumers who used no services (rating an NPS of 55) versus people using at least 2 services (awarding an NPS score of 70).

J.D. Power found that peoples’ Net Promoter Scores were higher among those folks who used at least one health and wellness service at a brick-and-mortar pharmacy, shown in the first chart. That NPS-delta was 15 points between consumers who used no services (rating an NPS of 55) versus people using at least 2 services (awarding an NPS score of 70).

Consumers using more health and wellness services also spent more money at the drug store, a further motivation for retail pharmacies to take this study’s findings to heart (and strategic import).

J.D. Power’s U.S. Pharmacy Study is tracking retail pharmacy’s growth in primary care. The COVID-19 pandemic has accelerated this trend: J.D. Power calls out pharmacies’ expanding role in coronavirus vaccination efforts, as a key pillar in the Biden Administration’s coronavirus strategy is to distribute millions of vaccine doses to retail pharmacies throughout the U.S.

“The [consumer’s] ability to receive a COVID-19 vaccine in a place that carries inherent familiarity and comfort could help overcome some vaccine hesitancy,” J.D. Power expects.

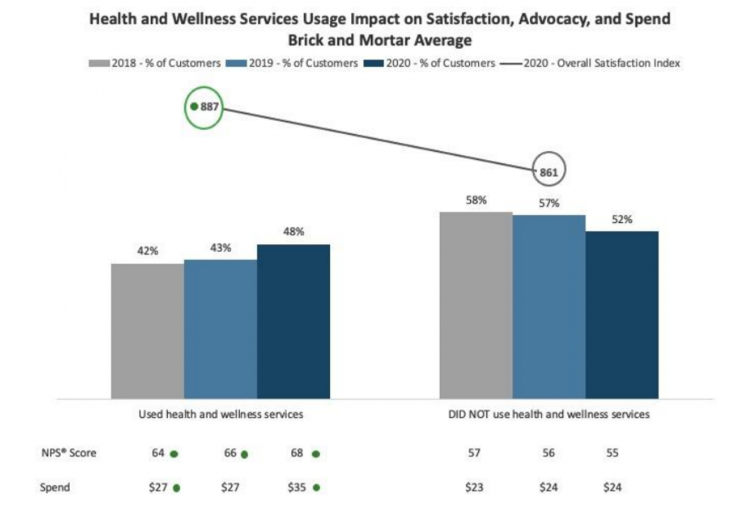

Use of health and wellness services grew from 42% of U.S. consumers in 2018 to 48% in 2020, with NPS scores among these customers increasing from 64 to 68, shown in the second chart.

Use of health and wellness services grew from 42% of U.S. consumers in 2018 to 48% in 2020, with NPS scores among these customers increasing from 64 to 68, shown in the second chart.

While that’s one-half of consumers using health and wellness at the pharmacy, that leaves another one-half of people who have not yet done so. Thus, J.D. Power believes there is still room for more retail health-and-wellness growth in the market.

There is a substantial hard-dollar reason for retail pharmacies to seek out this growth segment: J.D. Power calculated that consumers who use two or more health and wellness services spend twice as much at that pharmacy, on average.

J.D. Power ties together consumers’ growing affection and value for retail pharmacies as health-and-wellness destinations with the potential for pharmacies to bolster vaccination efforts in America.

“Not only does this have the potential to positively influence both population health and local business, it could also help the country rise to meet the greatest need in a generation,” J.D. Power envisions.

The research was conducted between September 2019 (pre-pandemic) and May 2020 among 9,077 retail pharmacy consumers.

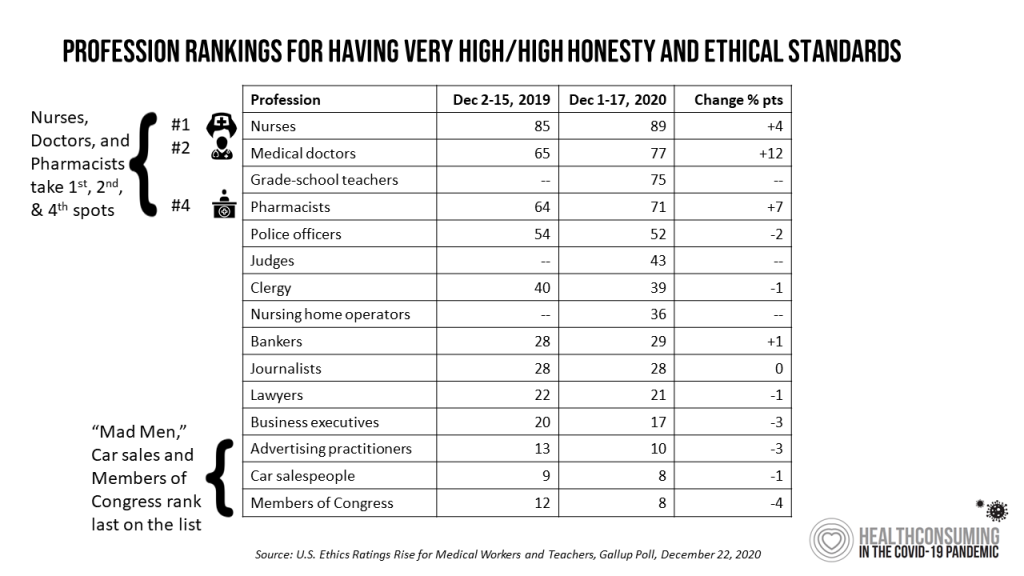

Health Populi’s Hot Points: The most recent Gallup poll on honesty and ethics in professions in the U.S. found that nurses, doctors, teachers, and pharmacists rank in the top tier of most-trusted workers in America.

Health Populi’s Hot Points: The most recent Gallup poll on honesty and ethics in professions in the U.S. found that nurses, doctors, teachers, and pharmacists rank in the top tier of most-trusted workers in America.

Pharmacists, year-after-year, rank high in this annual poll on honest and ethics.

Interestingly, the J.D. Power study discovered that in 2020, more consumers interacted with the retail pharmacy’s pharmacist than people did 2018.

Pharmacies operated as essential business from the beginning of the pandemic, becoming trusted sources for hunting-and-gathering not only medicines, but for basic needs and products. People sought products and services closer-to-home, and the pharmacist is increasingly taking on the role of trusted health advisor.

This will persist beyond the pandemic, as more patients-as-consumers seek accessible care in their communities. This is the bet of CVS Health’s Health Hub strategy, Walgreens’ investment in Village MD clinic footprint, and Rite-Aid’s emerging model for holistic health in the brick-and-mortar retail pharmacy business.

Thank you FeedSpot for

Thank you FeedSpot for