Five years ago, in 2016, the W2O Group said that, “Relevance is reputation.” That year the firm began to study the relevance of, well, relevance for organizations especially operating in the health/care ecosystem.

2020 changed everything, the W2O team asserts, now issuing its latest look into the issue through the Relevance Quotient.

2020 changed everything, the W2O team asserts, now issuing its latest look into the issue through the Relevance Quotient.

Relevance is built on recognizing, meeting and exceeding stakeholder expectations of organizations. In the Relevance Quotient methodology, W2O Group defines key stakeholders as employees, patients (including the sick and the well, caregivers, consumers, et al), health care providers, advocacy groups, analysts and investors, policy makers, journalists and media outlets.

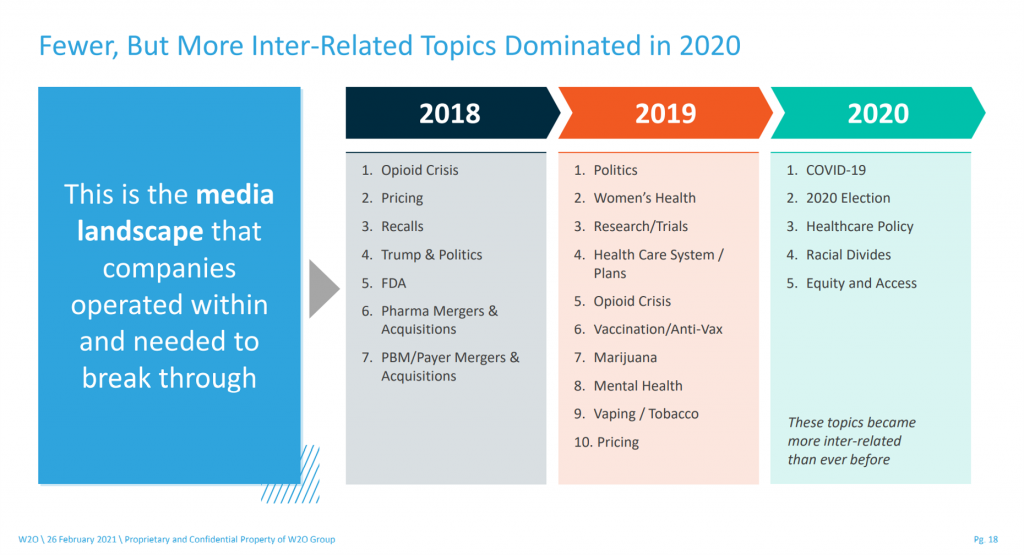

The year 2020 pushed several issues into headlines and peoples’ online searches and social network shares. Those issues were COVID-19, the 2020 Election, health care policy, racial divides, and equity and access.

W2O notes that these five issues became more-inter-related than ever, compared with previous years’ top consumer health issues. For example, in 2019, some of the big health care issues for consumers were politics (in general), women’s health, the opioid crisis, and vaping/tobacco — for which dots didn’t connect nearly as intimately as the 2020 top 5 topics.

W2O notes that these five issues became more-inter-related than ever, compared with previous years’ top consumer health issues. For example, in 2019, some of the big health care issues for consumers were politics (in general), women’s health, the opioid crisis, and vaping/tobacco — for which dots didn’t connect nearly as intimately as the 2020 top 5 topics.

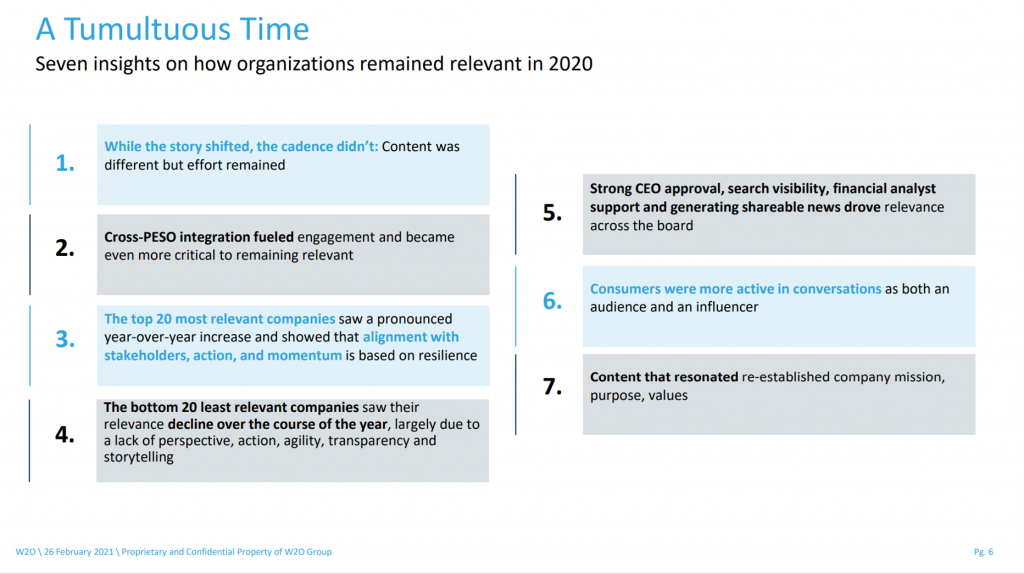

2020 was a tumultuous time, W2O describes curating seven insights on organizations who were relevant in 202o, shown in the second chart.

Among these, note that the top 20 most relevant companies demonstrated that alignment with stakeholders, action, and momentum drove relevance. The bottom 20 lacked agility, transparency, and storytelling acumen.

#7 is key: “Content that resonated [with consumers] re-established company mission, purpose, and values.”

In the report’s Anatomy of Relevant Companies, several actions also underpinned relevance: those companies that were,

In the report’s Anatomy of Relevant Companies, several actions also underpinned relevance: those companies that were,

- Willing to take action on issues,

- Intensified focus on values, purpose, ESG and diversity & inclusion,

- Transparent, empathetic, bold, open to (some) risk,

- Focused on ALL stakeholders all the time, not just shareholders, and,

- Leveraging the CEO beyond the C-suite bringing in employees as advocates.

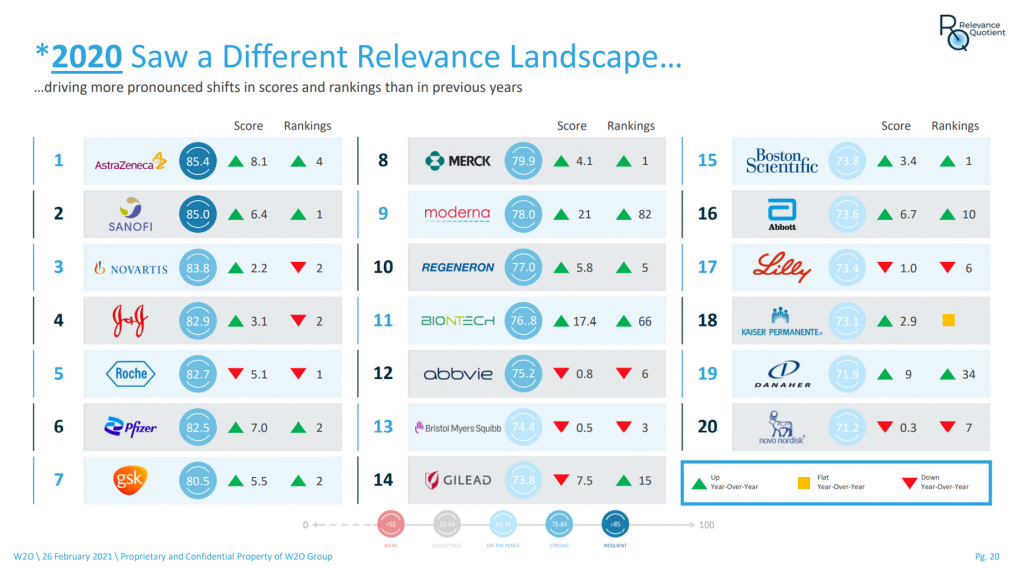

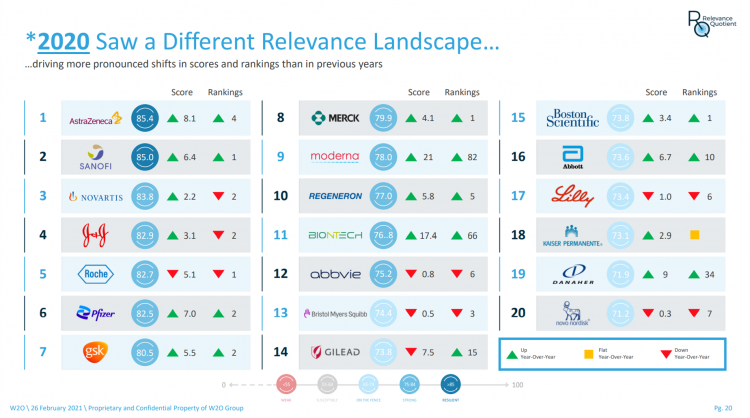

Based on this methodology and set of assumptions, W2O Group identified 20 health care companies that emerged most relevant, shown in the third graphic from the report. The top ten were:

- AstraZeneca

- Sanofi

- Novartis

- J&J

- Roche

- Pfizer

- GSK

- Merck

- Moderna

- Regeneron

These ten are all life science/pharma companies. Beyond pharma, Kaiser-Permanente the integrated payor/provider ranked #18. Medical tech companies Boston Scientific and Danaher ranked 15th and 19th among the top 20.

Health Populi’s Hot Points: Why care about “relevance” as described in this study?

Health Populi’s Hot Points: Why care about “relevance” as described in this study?

Because the gap between the top and bottom 20 companies made a big difference in terms of those companies’ stakeholders (the long list of them, identified above) perceived them for innovation, product portfolio, communications savvy, empathy, and support.

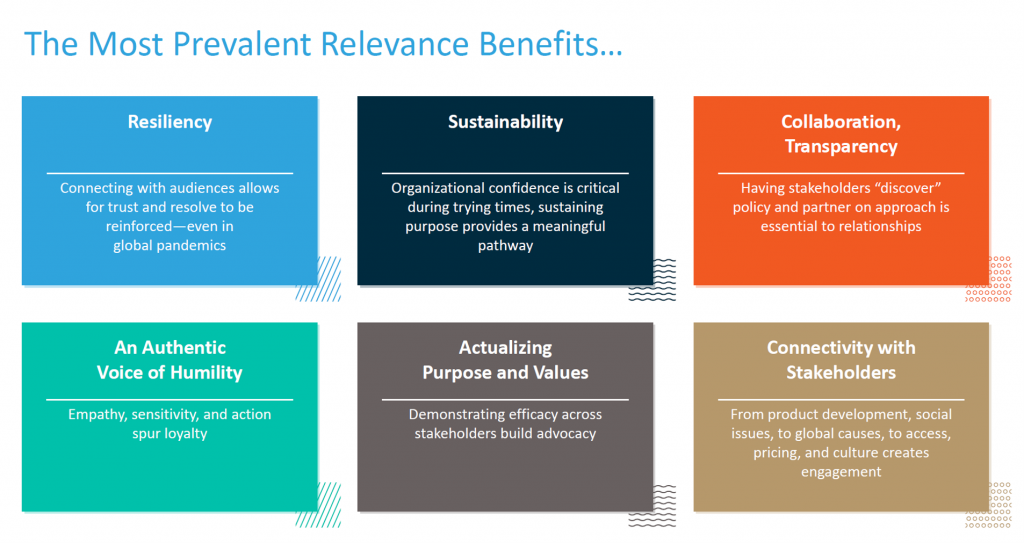

This last diagram summaries six key benefits of being relevant in the eyes of the W2O Group study: resiliency, sustainability, collaboration and transparency, authenticity/humility, actualizing purpose and values, and connectivity with stakeholders.

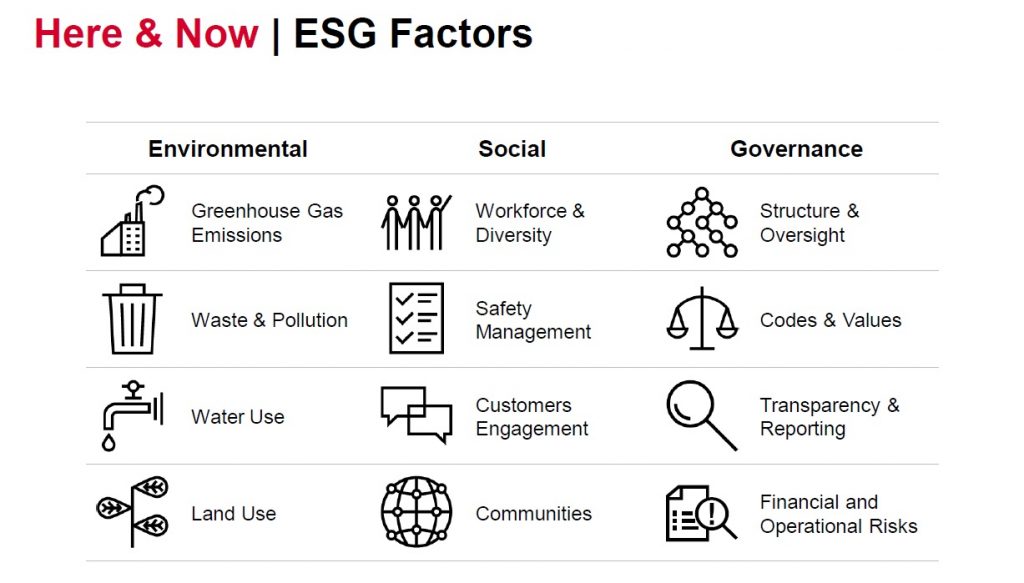

Taken together, my trend-weave opens the over-arching umbrella of ESG goals – for Environmental, Social, and Governance pillars have become strategic and impactful talking points in C-suites across all industry sectors. This includes health care.

While “ESG” was first coined in 2005, the coronavirus pandemic, the issues solidifying in 2020 shown above in the first image, and climate change converged over the past year.

While “ESG” was first coined in 2005, the coronavirus pandemic, the issues solidifying in 2020 shown above in the first image, and climate change converged over the past year.

One of the most prominent organizations working on ESG is Standard & Poors (S&P), the financial services company that assesses the credit-worthiness of organizations globally. The company has been explicitly referencing ESG factors in their ratings reports and actions since March 30, 2020 — just weeks into the coronavirus pandemic.

This diagram comes from S&P’s ESG research, illustrating examples of factors under each of the three pillars.

In a recent report on ESG in the health care sector, S&P called out “social exposure” as the most important ESG risk for health care.

On the upside for the sector’s risk exposure, health care companies tend to work on public health-good, playing what S&P termed “a crucial role for the communities they serve.”

On the downside, health care companies are in the public’s bulls’ eye regarding pricing, and this gets to lack of transparency and access challenges.

In 2021, these issues will gain, if you will, relevance for the twenty companies identified in this W2O Group study along with the entire health care ecosystem, the industry interacting with all the various stakeholders enumerated above.

Keep an eye on the “S” in ESG for health care, along with E and G. These pillars will become increasingly important for our world and our wellness–individually and for public health, locally and globally.

In full transparency and disclosure, I am an advisor to the W2O Group. FYI, I did not have a hand in this study.

Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a