With a vaccine supply proliferating in the U.S. and more health citizens getting their first jabs, there’s growing optimism in America looking to the next-normal by, perhaps, July 4th holiday weekend as President Biden reads the pandemic tea leaves.

But that won’t mean Americans will be ready to return to pre-pandemic health care visits to hospital and doctor’s offices.

Now that hygiene protocols are well-established in health care providers’ settings, at least two other major consumer barriers to seeking care must be addressed: cost and access.

Now that hygiene protocols are well-established in health care providers’ settings, at least two other major consumer barriers to seeking care must be addressed: cost and access.

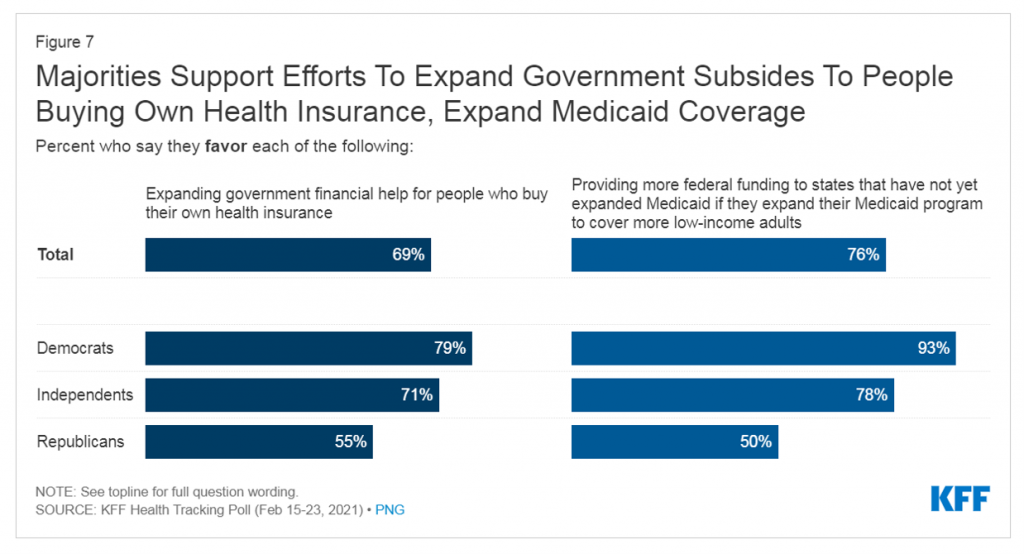

The latest (March 2021) Kaiser Family Foundation Tracking Poll learned that at least one in three Americans were recently “struggling” to pay living expenses since December 2020, with six in ten families affected by COVID-19 having lost a job or income.

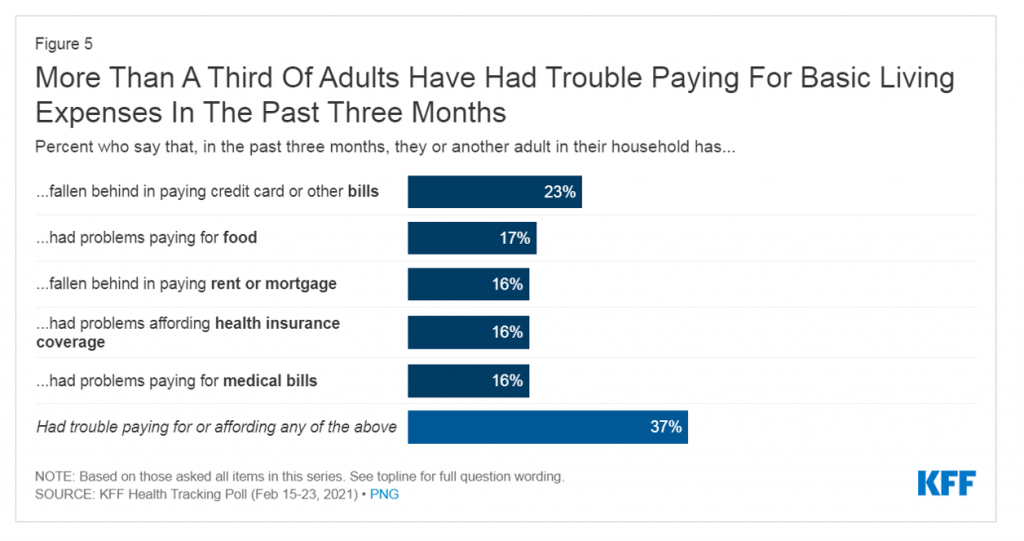

U.S. household budgets have been particularly hard-hit in paying off credit cards and bills (23%), paying for food (17%), falling behind paying rent or mortgage (16%), affording health insurance coverage (16%), and paying for medical bills (16%). As some people had trouble covering at least one of these expense line items, a total of 37% of U.S. adults had trouble affording any of these basic living expenses.

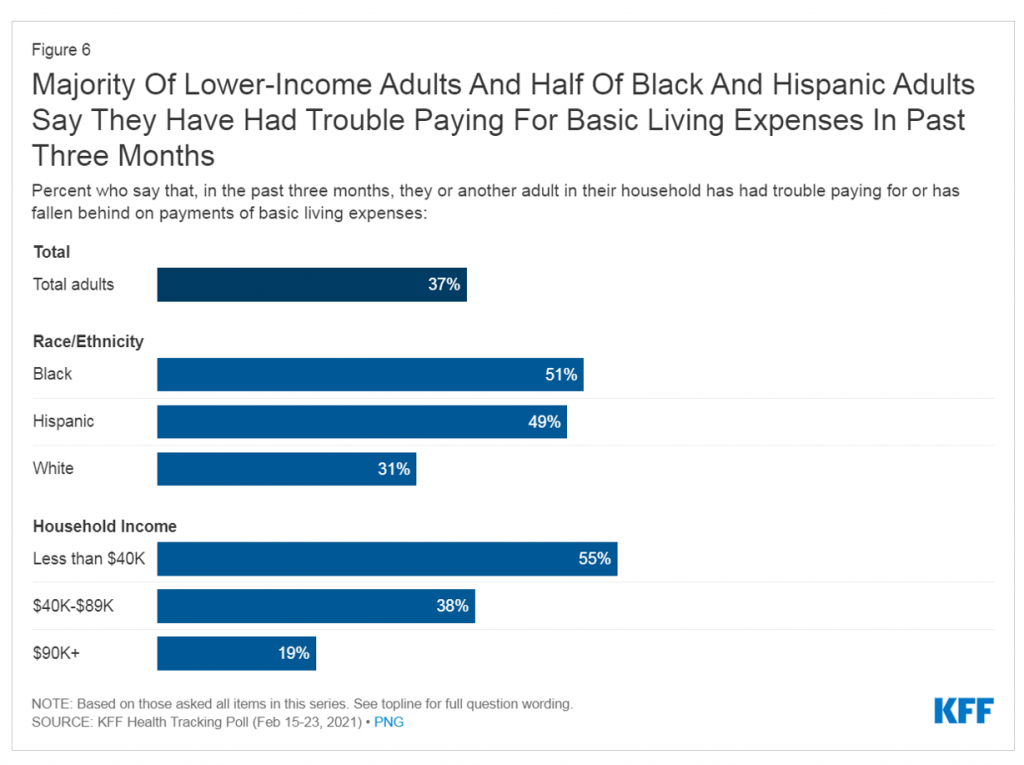

No surprise, then, that more families (55%) earning lower incomes (in this study, that would fall under $40,000 a year) had trouble paying for basic living expenses between December 2020 and mid-February 2021. Even 1 in five people with incomes above $90,000 annually had trouble meeting basic expenses.

No surprise, then, that more families (55%) earning lower incomes (in this study, that would fall under $40,000 a year) had trouble paying for basic living expenses between December 2020 and mid-February 2021. Even 1 in five people with incomes above $90,000 annually had trouble meeting basic expenses.

More people of color, Black (51%) or Hispanic (49%) had trouble paying for basic living expenses in the past three months, versus 31% of White Americans.

Underneath these racial disparities, Black and Hispanic adults were also the most likely to say their household had lost a job or income due to the coronavirus pandemic.

Job loss especially impacted younger Americans, between 18 and 49, compared with people 50 and over and Whites.

Building on the KFF findings, it’s important to add into the consumer-health-economic mix that more people delayed or forewent health care in September 2020, based on research from the Urban Institute and the Robert Wood Johnson Foundation.

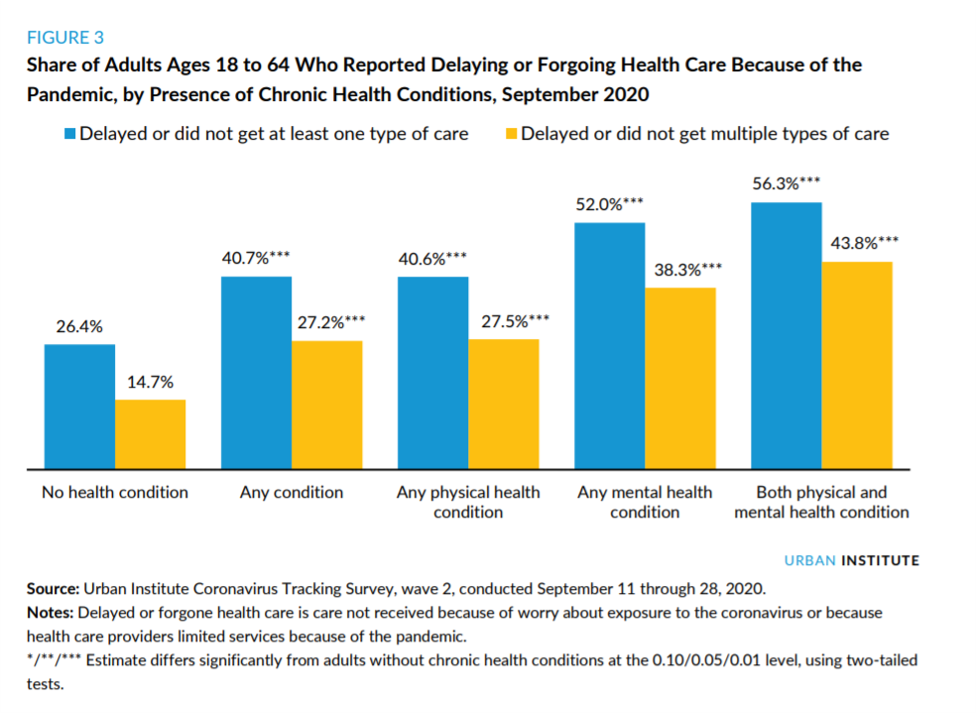

The blue-and-gold bar chart graphs the relationship between people’s health conditions and their propensity to delay or forgo health care as of September 2020 — about six months into the pandemic.

The blue-and-gold bar chart graphs the relationship between people’s health conditions and their propensity to delay or forgo health care as of September 2020 — about six months into the pandemic.

More people with both physical and mental health conditions were more likely to delay or forgo medical care: over one-half of people dealing with mental health did not get care, and 56% of people with both physical and mental health issues delayed/forewent care.

Among those people who delayed or forewent medical care, 23% said at least one of their health conditions worsened as a result of opting out of care, 15% said their ability to work was limited, and 21% said it limited their ability to perform their usual daily activities.

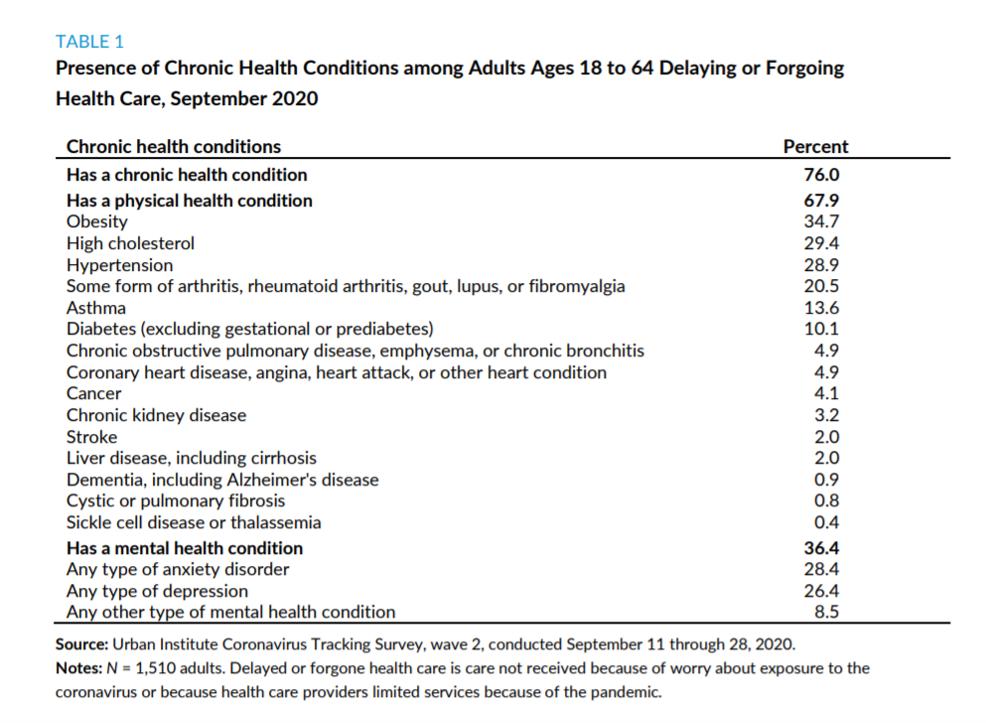

It’s important to note just which chronic health conditions were implicated in the dynamic of dealing with an ongoing health issue and delayed or foregoing medical care.

The table (marked “Table 1”) tells this part of that story.

Three in four working-age Americans were dealing with at least one chronic health condition and two-thirds of people had a physical health condition, the top-lines of the table.

Three in four working-age Americans were dealing with at least one chronic health condition and two-thirds of people had a physical health condition, the top-lines of the table.

Among the top-ranked conditions were obesity (for one-third of Americans), high cholesterol, hypertension, arthritis, asthma, and diabetes.

One-in-three people were also dealing with a mental health conditions, split roughly between anxiety disorders and depression of some type.

Considering the top three conditions, plus diabetes, conjures up metabolic syndrome and heart disease — which is an epidemic that has long-plagued public health and challenged population health in America.

A third report is useful to consider with the KFF tracking poll and the Urban Institute/RWJF study on delaying care due to chronic conditions.

That is Restoring Consumer Confidence from BDO sponsored by the American Hospital Association, which explores patients’ experience coming out of the COVID-19 pandemic.

Key takeaways from the report are that,

- Telehealth has grown and will be a robust component of health care for patients and families — not a replacement for in-person care, but a part of a continuum of care in the U.S.

- The cost of care and price transparency will continue to concern patients-as-consumers, “a growing number of whom have lost their jobs during the pandemic and with them, their health insurance,” the report calls out.

“This may steer some patients away from high-quality care settings or lead them to defer care altogether,” the report adds, bolstering what we learned from the Urban Institute/RWJF research.

Health Populi’s Hot Points: While some Americans fared financially well one year into the pandemic (discussed here in Health Populi), those at the lower segment of the K-shaped economic recovery have been made worse off through job loss, hours cut, and as AHA and BDO recognized, loss of health insurance and medical care access.

The Urban Institute and RWJF reminded us about the challenge of people diagnosed with chronic conditions delaying care. The convergence of obesity with heart health risk factors and diabetes particularly impact people of color, who have other co-existing factors under the social determinants of health umbrella.

The just-passed American Rescue Act includes several key provisions that will help to address these risks to both health care and nutrition access, through enhanced SNAP benefits, provisions for medical care, and at a household level, those $1,400 payments to help people pay for basic living expenses.

That is immediate “rescue” funding for the short-term.

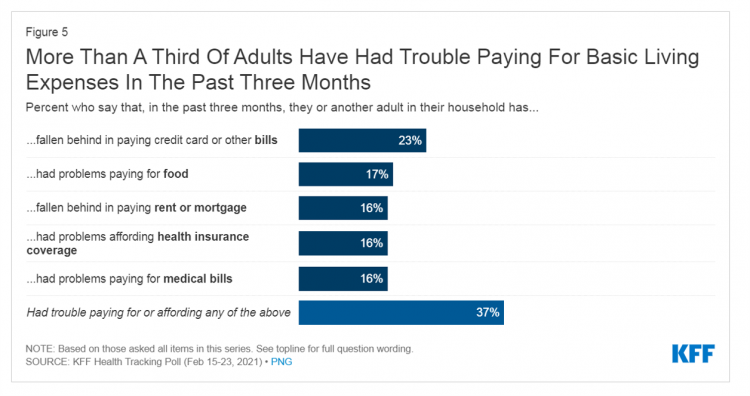

Looking forward, the Kaiser Family Foundation Tracking Poll suggests what President Biden could do to bolster the Affordable Care Act, for which he was, after all, “present at the creation” when he uttered a famous R-rated phrase to President Obama that a quiet microphone couldn’t quite cover up.

Interesting, even in this very partisan moment in the U.S., most U.S. voters support efforts to expand government subsidies for people to buy health insurance as well as for U.S. State Governors to expand Medicaid.

Interesting, even in this very partisan moment in the U.S., most U.S. voters support efforts to expand government subsidies for people to buy health insurance as well as for U.S. State Governors to expand Medicaid.

See in this last bar chart that one-half of Republicans supports both financial help for people buying into health plans as well as Medicaid expansion to cover more low-income adults.

Now that the big pandemic economic rescue legislation has been signed and getting implemented, President Biden will move on to a major infrastructure bill as well as addressing health care reform.

While Republicans inside Congress may want to block building on the ACA, most of the U.S. electorate is in favor. Doing so would help address some of the challenges we’ve explored on how cost and access are preventing millions of people with chronic conditions, lower incomes, and social determinants of health risks that exacerbate pre-existing conditions.

Now THAT would be an even bigger “F’ing deal.”

Thank you FeedSpot for

Thank you FeedSpot for