As the coronavirus crisis stretched from weeks into months, now over one year since being defined as a pandemic, U.S. consumers have made significant investments into their homes for working, educating students, cooking, and working out.

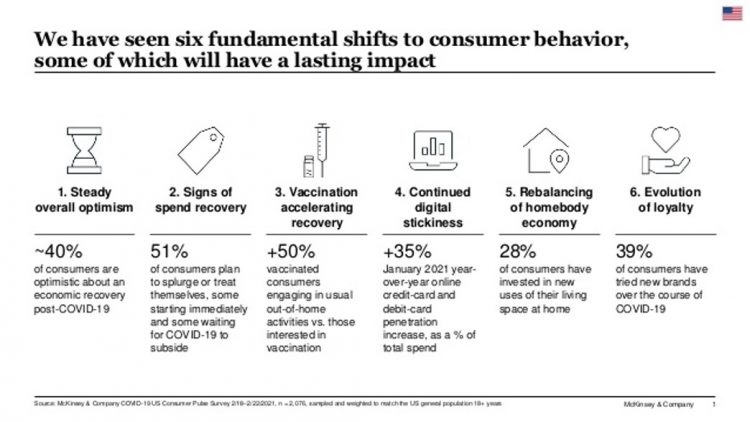

Welcome to the “rebalancing of the homebody economy,” in the words of McKinsey, out with new data on consumer sentiment during the coronavirus crisis.

The continued penetration of vaccines-into-arms in the U.S. is fanning optimism in terms of household economics, personal spending — especially on experiences that get folks “out” of the house.

The continued penetration of vaccines-into-arms in the U.S. is fanning optimism in terms of household economics, personal spending — especially on experiences that get folks “out” of the house.

Still, the Homebody Economy will persist even post-COVID, with a growing realization that “home” has become a safe haven for many life-flows — with continued investments planned in 2021 for home renovations as well as luxury goods.

Vaccination makes a big impact on a consumer’s mindset for spending and going out – on the outlook for a return to normal.

McKinsey found that people who have been vaccinated have a higher intent-to-spend, especially for restaurants, in-person services (like hair salons), and out-of-home entertainment– movies, concerts.

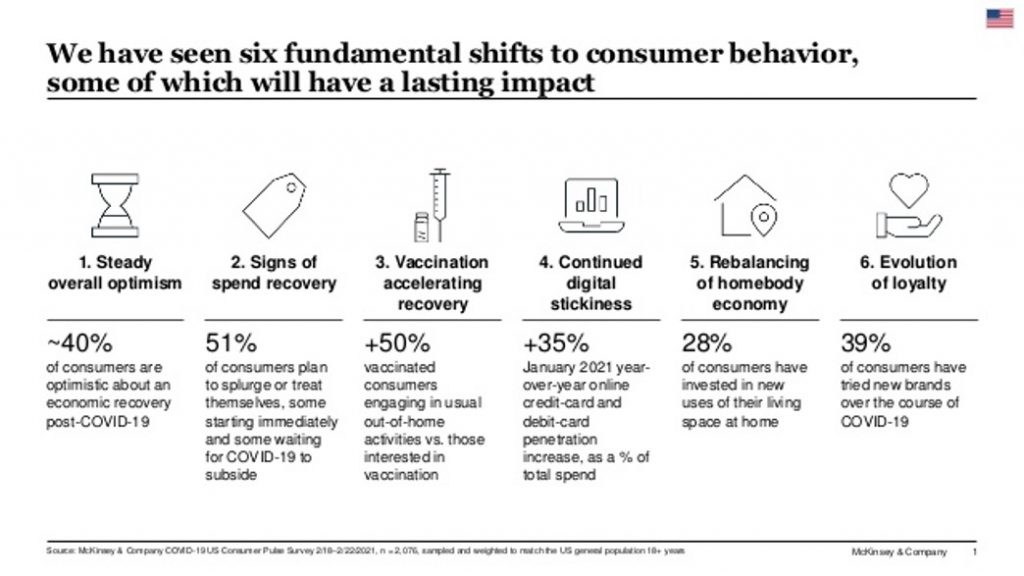

Among the six fundamental shifts McKinsey observed in U.S. consumers, continued digital stickiness will have a continued impact in daily life, from contactless payments to in-home entertainment and digital wellness engagement, post-COVID-19.

Among the six fundamental shifts McKinsey observed in U.S. consumers, continued digital stickiness will have a continued impact in daily life, from contactless payments to in-home entertainment and digital wellness engagement, post-COVID-19.

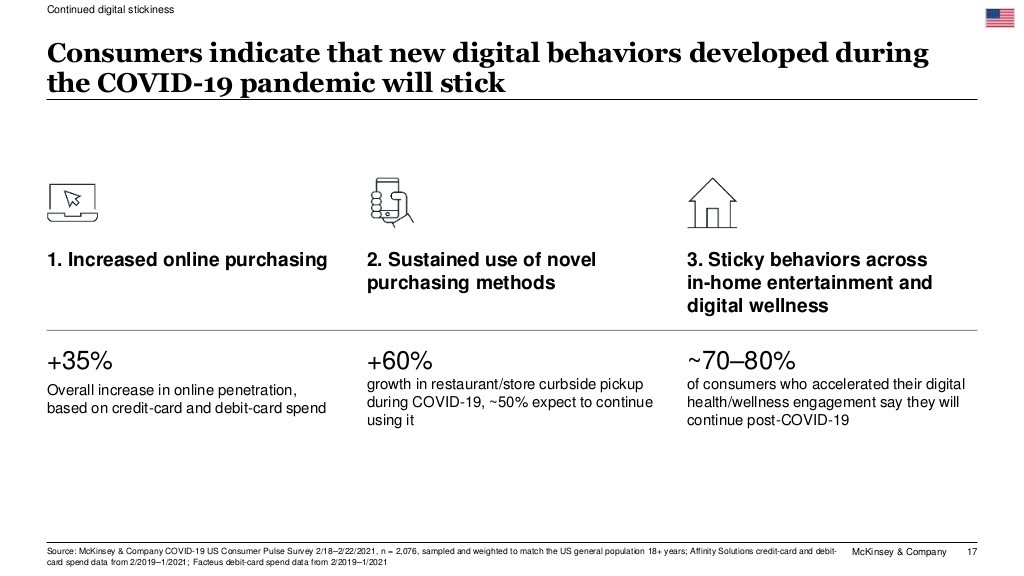

On the pure purchasing front, consumers flocked en masse to online purchasing, from Amazon to fast-growing Walmart, Target, and online stores and CPG brands shifting more to direct-to-consumer from company warehouses.

Curbside pickup expanded from restaurants as a lifeline to keep kitchens and staff occupied, as well as retail brick-and-mortar stores offering delivery to the car. One-half of U.S. consumers expect to continue patronage at the curbside.

And for digital wellness, about 3 in 4 U.S. consumers say they will use virtual platforms and apps post-COVID.

This analysis was based on data generated through McKinsey’s COVID-19 US Consumer Pulse Survey conducted in mid-February 2021 among 2,000+ U.S. adults.

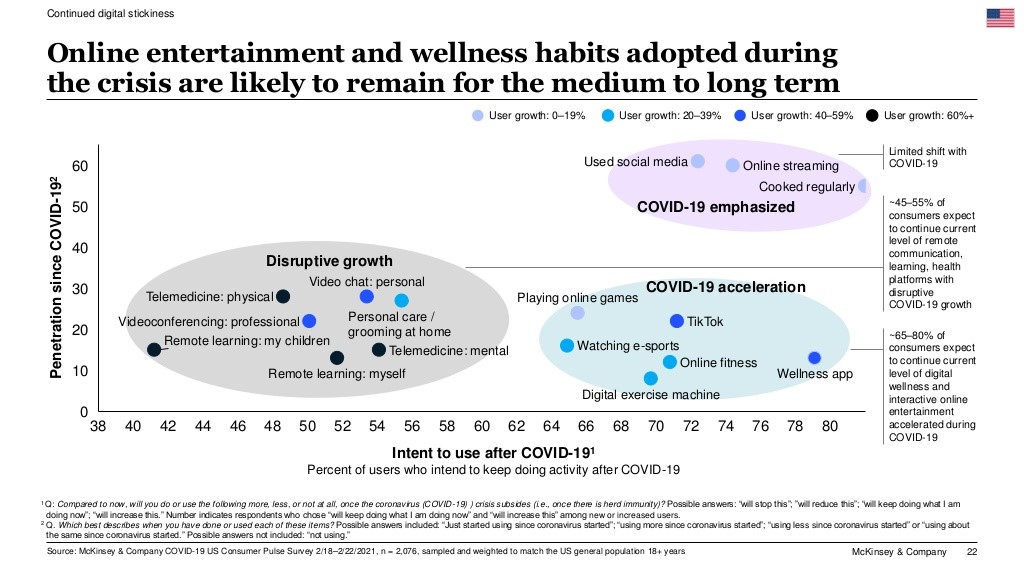

Health Populi’s Hot Points: The third chart illustrates McKinsey’s findings on U.S. consumers’ “digital stickiness,” illustrating which consumer behaviors saw disruptive growth, acceleration, or emphasis during the COVID-19 pandemic as of mid-February 2021.

Consumer use of wellness and fitness via digital formats accelerated during COVID-19, shown in the blue oval. McKinsey foresees well over two-thirds of Americans intending to leverage digital platforms “after” the virus is controlled.

Looking at the disruptive oval (grey), see telemedicine broken into physical and mental — with intent to use physical telemedicine post-COVID-19 among 50% of U.S. consumers, and for mental/behavioral health by some 54% of people. User growth rates for both telemedicine segments are forecasted over 60%.

Looking at the disruptive oval (grey), see telemedicine broken into physical and mental — with intent to use physical telemedicine post-COVID-19 among 50% of U.S. consumers, and for mental/behavioral health by some 54% of people. User growth rates for both telemedicine segments are forecasted over 60%.

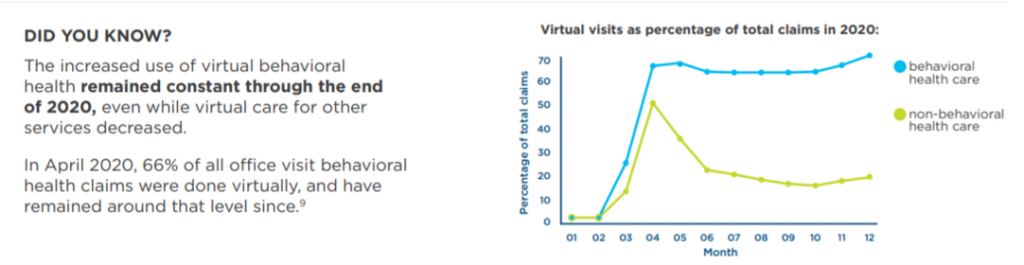

As a real-world evidence point on telemedicine for mental health, we point to a report from Cigna out last week attesting to the hockey-stick growth of tele-behavioral health at the start of the pandemic and persisting through 2020, shown in the last chart. (An added detail of Cigna’s claims data for the growing adoption of telehealth for behavioral health was that women used at higher rates than men across all age and ethnic groups).

In another signal from last week, Ginger announced a new round of $100 million of financing to advance its tele-behavioral health business, which I covered last April 2020 here in Health Populi.

We will continue to collect evidence (clinical, cost-effectiveness, and preference data) on the home’s continued evolution as consumers’ preferred hub for health/care, wellness, and fitness. McKinsey’s post-COVID bet is on growth across all three segments.

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for