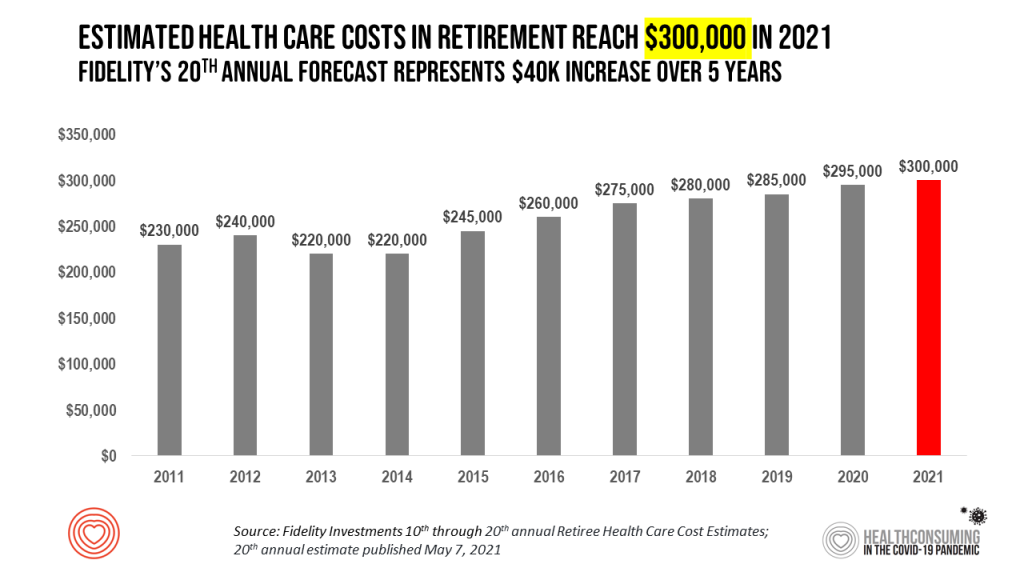

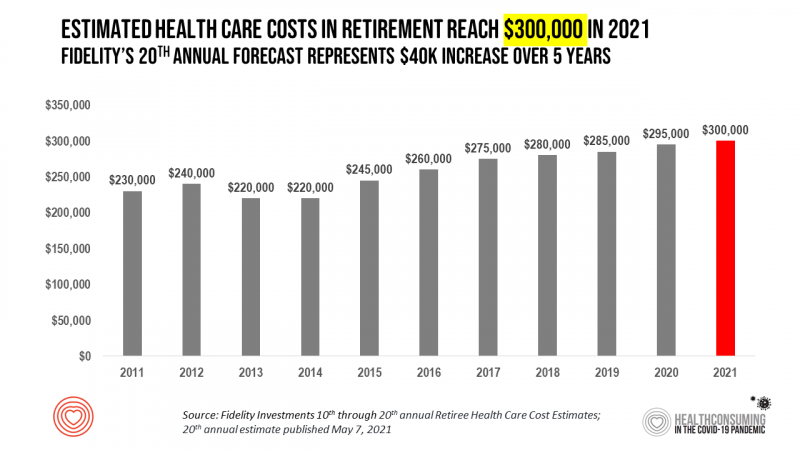

To pay for health care expenses, the average nest-egg required for a couple retiring in the U.S. in 2021 will be $300,000 according to the 20th annual Fidelity Investments Retiree Health Care Cost Estimate.

I’ve tracked this survey for over a decade here on Health Populi, and updated the annual chart shown here to reflect a $40,000 increase in retiree costs since 2016. While the rate of increase year-on-year since then has slowed, the $300,000 price-tag for retiree health care costs is a huge number few Americans have saved for.

I’ve tracked this survey for over a decade here on Health Populi, and updated the annual chart shown here to reflect a $40,000 increase in retiree costs since 2016. While the rate of increase year-on-year since then has slowed, the $300,000 price-tag for retiree health care costs is a huge number few Americans have saved for.

That $300K splits up unequally for an opposite-gender couple (in the words of Fidelity) between $157,000 for women and $143,000 for men.

Fidelity’s 2021 survey found that affording health care is the top stressor people have when thinking about retirement — yet most Americans have spent much time planning to meet those costs.

Now in the context of the post-COVID-19-pandemic era, one in five employees in the U.S. is “accelerating plans” to quit work, Fidelity learned.

Health Populi’s Hot Points: The coronavirus pandemic had at least two major toxic side effects for patients in the U.S.: mental health, anxiety, and stress; and financial stress due to the lockdown, loss of jobs or cut hours, and lack of ability for some employees (especially working women with children) to return to work without accessible, affordable childcare.

Health Populi’s Hot Points: The coronavirus pandemic had at least two major toxic side effects for patients in the U.S.: mental health, anxiety, and stress; and financial stress due to the lockdown, loss of jobs or cut hours, and lack of ability for some employees (especially working women with children) to return to work without accessible, affordable childcare.

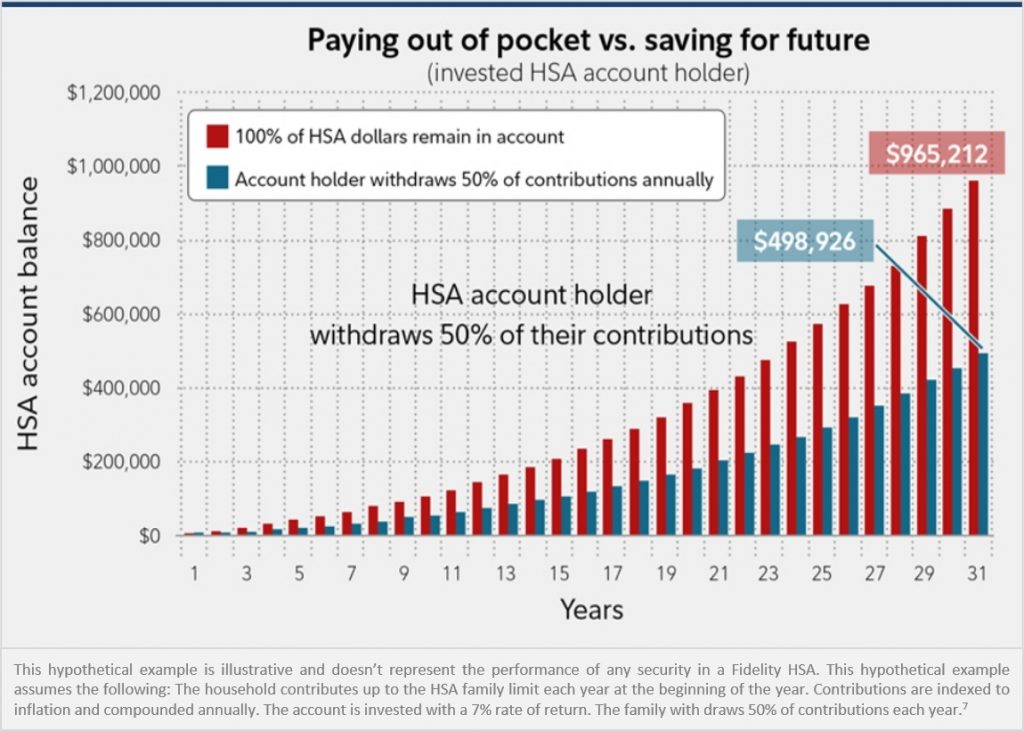

Because of the She-Cession’s impact on women in the American pandemic — that is, the economic downturn more negatively impacting women than men — Fidelity’s asymmetric split or retirement costs for women being $14,000 greater than for men has even more dramatic fiscal implications for working women who have not saved enough for health care costs in retirement. Fidelity’s objective with this study is to motivate people to save more for retirement, and specifically for health care costs via health savings accounts which have triple-tax advantages. The graphic shown here illustrates Fidelity’s forecast of financial growth for those people who invest in an HSA maximally and those who do not.

For those employees looking to fast-track retirement post-pandemic, meeting these savings will be a major financial stress in the midst of more macro household financial stress felt by millions of families in the past year. Health care finances are integrally part of household budgets, and on fixed incomes in retirement, exact an acutely felt tax on people who have under-saved.

Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a