“Compare digital health to airlines, cruise lines, and other industries” and the sector looks quite privileged, opined Matthew Holt in a discussion on a study diving deeply into the State of Digital Health, conducted by Catalyst @ Health 2.0 and sponsored by WIPFLI..

The research was conducted among 335 respondents, which included 182 digital health companies polled between November 2020 and March 2021. Digital health companies represented 60% of the sample, the other 40% of which were consulting firms, subsidiaries of providers/payers/life science companies and tech corporations, and investors.

The research was conducted among 335 respondents, which included 182 digital health companies polled between November 2020 and March 2021. Digital health companies represented 60% of the sample, the other 40% of which were consulting firms, subsidiaries of providers/payers/life science companies and tech corporations, and investors.

As Matthew called out, the digital health sector has a relatively rosy outlook in the pandemic economy. This pretty rosy assessment was confirmed by Sunny Kumar, partner at GSR Ventures, who discussed the results of the survey on a webinar launching the survey results on 11th May. Sunny talked about the “trillion-dollar revenue opportunity” in the U.S. that can support, in his words, ‘many, many, many star-ups” (yes, 3 “many’s” were uttered by Sunny in terms of digital health market optimism).

“People should be very excited about the [digital health] opportunity,” Sunny said.

The current excitement around digital health investment sometimes finds innovators being approached by investors who want to invest in them even start telling their stories to potential investor-prospects.

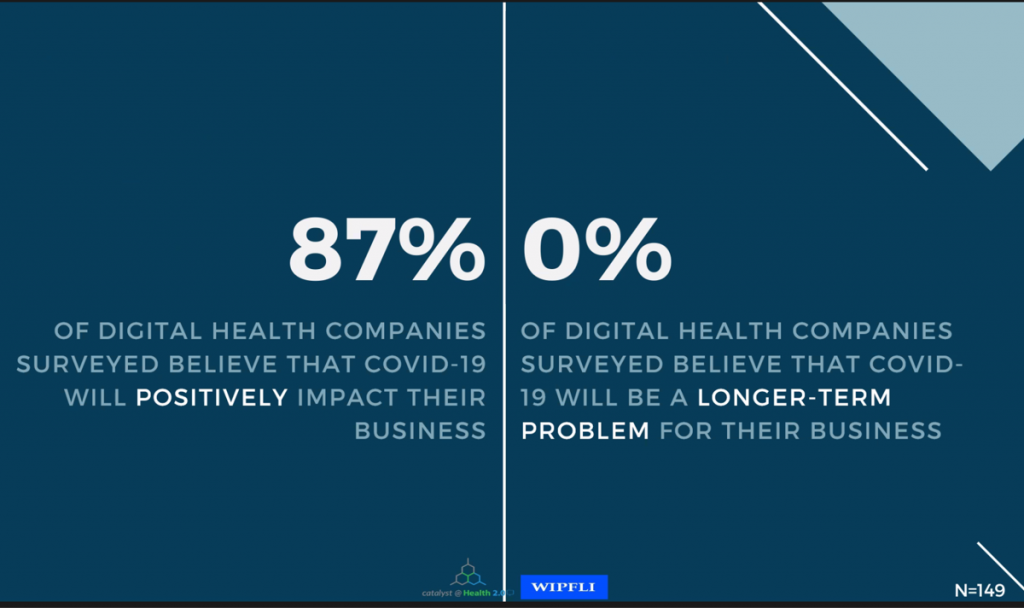

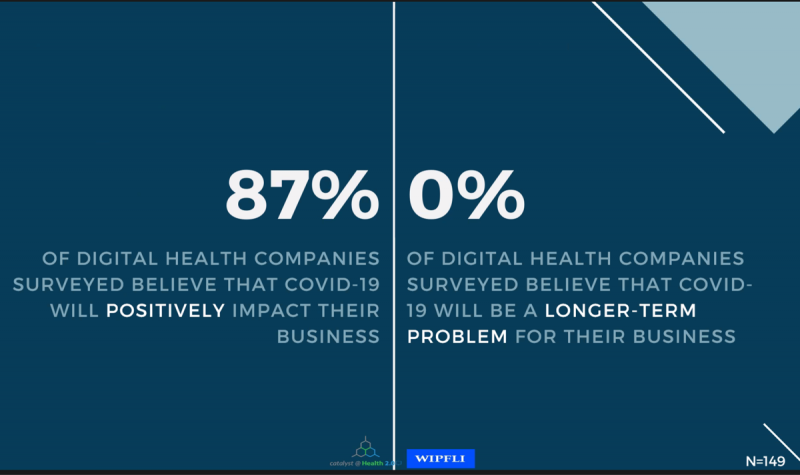

The top-line, shown in the first statement, represents the collective enthusiasm shared by digital health companies polled in the study. That is, that 9 in 10 digital health companies believe that COVID-19 will positively impact their business….and that zero, none, nil of the companies believe that COVID-19 will present longer-term problems for their businesses.

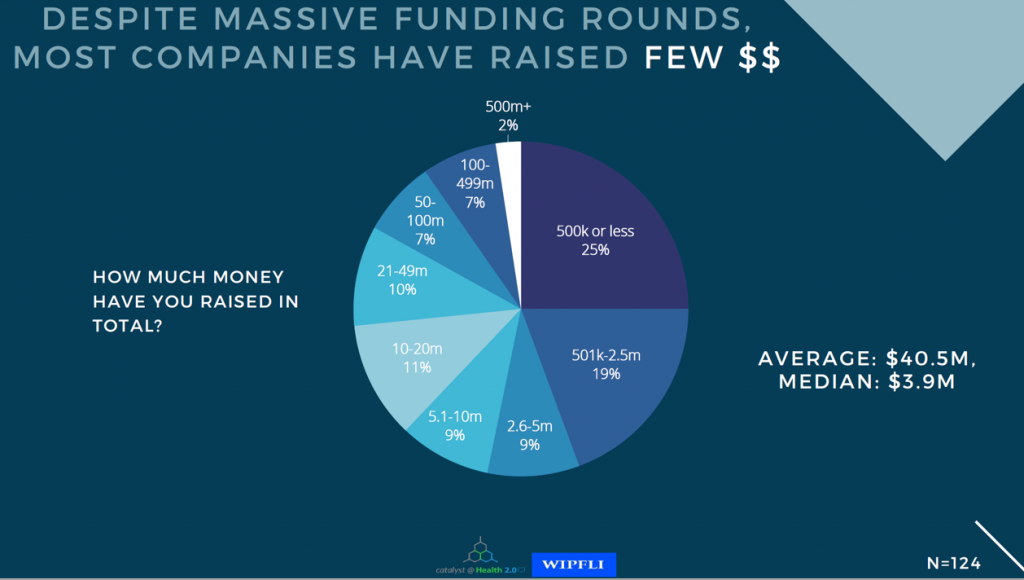

Having said that, not all companies have been attracting mega-money, the second pie chart illustrates. Only a handful (9% of the digital health companies) have garnered $100 million or more. On average, the companies raised $40.5 million, with a median of $3.9 mm.

Tempering a universally-sunny funding forecast across all digital health start-ups, Sunny explained a few key issues shaping the highly-variable funding trend: while there has been, in his word, a “flood” of new investors entering the space, but many do not have deep health-tech experience. This has spawned a bias toward products or services that have a very different profile from new-new things in their early stages. In Sunny’s explanation, investors are attracted to digital health companies that have largely “de-risked” which means they are more mature and in scaling mode.

Tempering a universally-sunny funding forecast across all digital health start-ups, Sunny explained a few key issues shaping the highly-variable funding trend: while there has been, in his word, a “flood” of new investors entering the space, but many do not have deep health-tech experience. This has spawned a bias toward products or services that have a very different profile from new-new things in their early stages. In Sunny’s explanation, investors are attracted to digital health companies that have largely “de-risked” which means they are more mature and in scaling mode.

Thus, only a few companies have achieved the huge funding rounds we’ve witnessed over the past couple of years among a handful of digital health companies, Matthew warned, weaving survey results together into a more nuanced forecast.

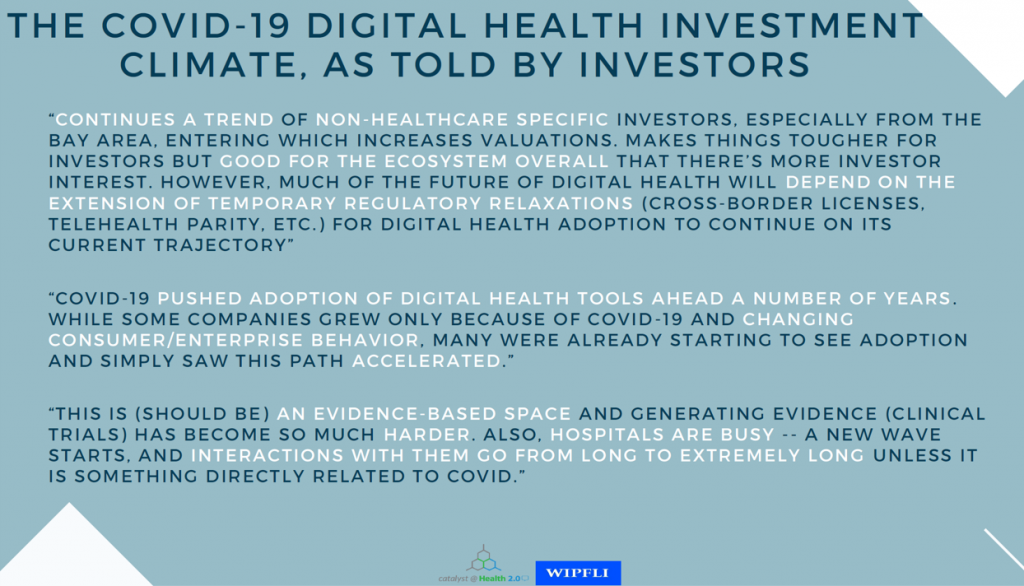

The survey report curates many colorful and insightful quotes from survey respondents, both investors and digital health companies. The third graphic from the report notes that smaller start-ups and investors don’t necessarily meet eye-to-eye. Together, these statements bolster Sunny’s and Matthew’s observations that, while COVID-19 has certainly accelerated the supply and funding side of the digital health market, it helps to be de-risked, mature with a solid demand-side story to tell, and in scale-up mode.

Health Populi’s Hot Points: One of the most intriguing findings to me was that one-third of the digital health companies were developing solutions targeted to health care consumers.

Health Populi’s Hot Points: One of the most intriguing findings to me was that one-third of the digital health companies were developing solutions targeted to health care consumers.

The second sentence on this chart from the study report brings consumers into the picture, observed by an investor:

“COVID-19 pushed adoption of digital health tools ahead a number of years while some companies grew only because of COVID-19 and changing consumer/enterprise behavior. Many were already starting to see adoption and simply saw this path accelerated.”

This week, the New England Journal of Medicine (NEJM) Catalyst team published a report this week titled Cautious Attitudes Toward Emerging Digital Technologies. This speaks from the demand side of health care providers and executives, the perfect yang to the Catalyst 2.0 “yin” survey report.

Like the State of Digital Health report, the NEJM analysis also pulled out quotes from study participants, as well as from guest “commentator,” Bob Kocher, MD, Partner with Venrock Three of the quotes provide a good summary of the “caution” that health care providers feel about digital health — even fifteen months into the coronavirus pandemic which has certainly created opportunities for digital health solutions in the public health crisis:

- “These results show that health care professionals are not early adopters and are not risk-tolerant, which is not good news if you are an entrepreneur trying to innovate and sell a product to this industry.”

- “Clinicians have this combined feeling of being overwhelmed by current technology and feeling those systems aren’t doing enough to help them care for patients.”

and intriguingly,

- “Health care professionals seem most excited about adopting consumer technologies that we already use.”

The COVID-19 pandemic inspired many consumer behavior changes, one of which was increased use of wearable tech, viewing food-as-medicine for immunity, greater attention to sleep and mental health, among others. Working-from-home, too, ushered in many more users of conference technology, and the Consumer Technology Association (home of CES) noted a spike in household purchases of various consumer-facing digital devices in 2020.

As more healthcare (beyond wellness and fitness) moves to peoples’ homes, houses morph into health hubs. The more digital health innovators consider patients-as-consumers, and especially retail consumers — their values, sense of value (if paying some or all out-of-pocket), and personal preferences — the more likely they’ll be able to tell stories to investors that are evidence-based and align with consumers’ approaches to self-care beyond the hospital walls.

Thank you FeedSpot for

Thank you FeedSpot for