“Self-care” took on new meaning and personal work-flows for people living in and through the coronavirus pandemic in the U.S. Acosta, the retail market research pro’s, updated our understanding consumers evolving as COVID-19 Has Elevated the Health and Wellness Trends of the Recent Years, results of a survey conducted among in May 2021.

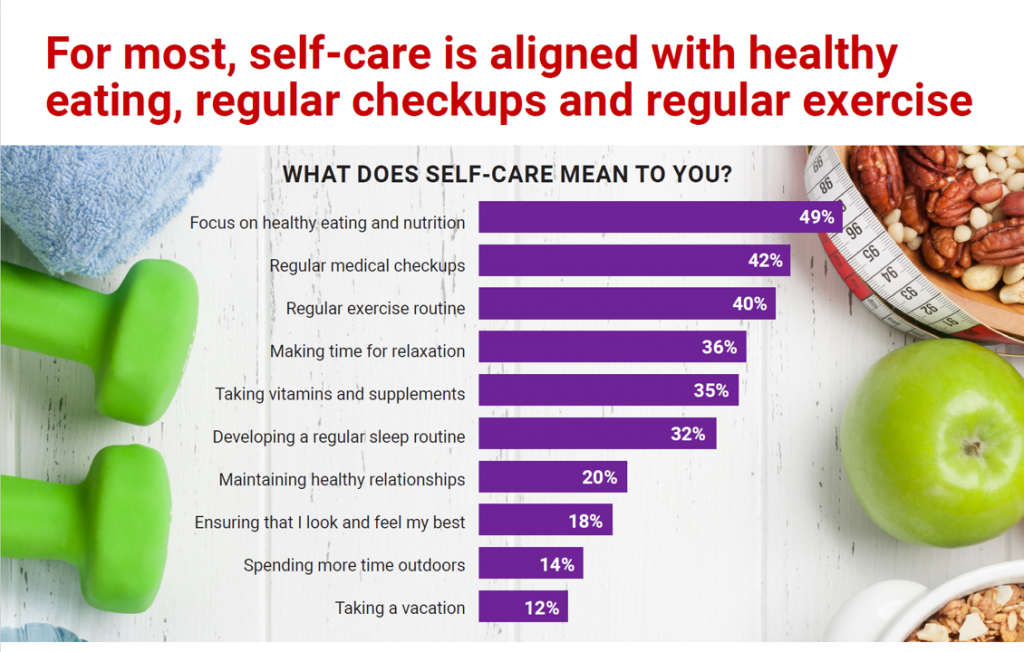

In the U.S., consumers’ take on self-care has most to do with healthy eating and nutrition (for 1 in 2 people), getting regular medical checkups (for 42%), taking exercise, relaxing, using vitamins and supplements, and getting good sleep.

In the U.S., consumers’ take on self-care has most to do with healthy eating and nutrition (for 1 in 2 people), getting regular medical checkups (for 42%), taking exercise, relaxing, using vitamins and supplements, and getting good sleep.

Healthy relationships are an integral part of self-care for one-fifth of people, along with looking and feeling “my best.”

Based on Acosta’s segmentation of consumers, two in three people are taking a proactive approach to healthy living — one in 4 people in an “active” way to live their healthiest life possible, and 40% (the largest segment among four identified by Acosta) trying to live a “balanced” life through diet and exercise — without “obsessing” about it.

It’s important to note that one in three people would like to do more to maintain health, but find it difficult to stay motivated — these are the “I Want To, But….” group of consumers.

Through the pandemic, retailers have become an even more-trusted health resource among consumers, looking to eat more fresh foods in wider varieties, fetch more over-the-counter medicines and products at retail, and get resources that help them educate themselves about health and wellness.

Through the pandemic, retailers have become an even more-trusted health resource among consumers, looking to eat more fresh foods in wider varieties, fetch more over-the-counter medicines and products at retail, and get resources that help them educate themselves about health and wellness.

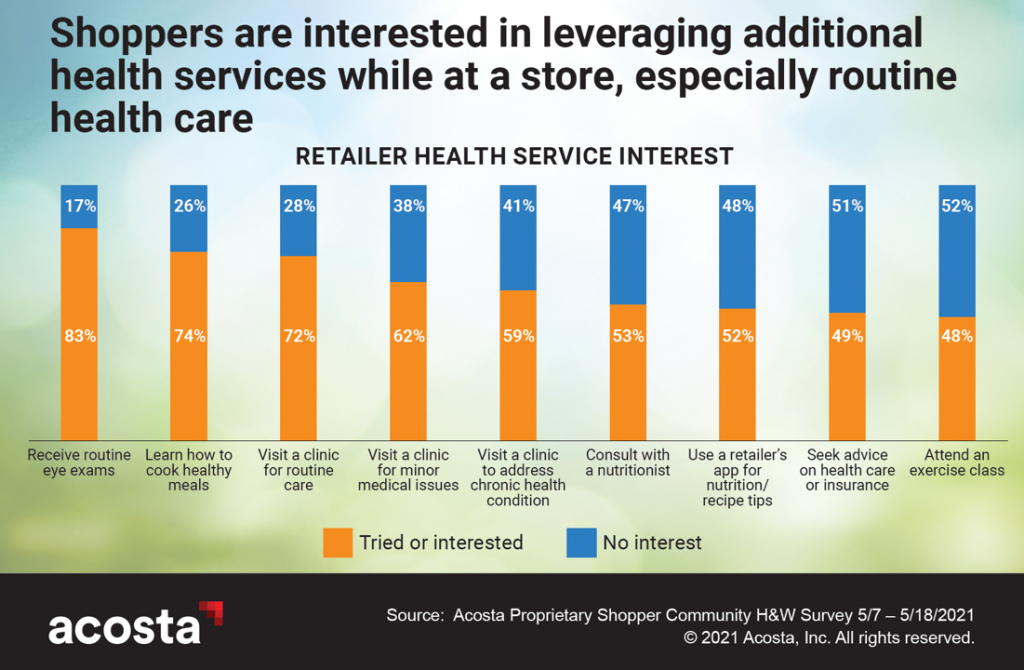

The second chart tells you that most consumers are looking to or interested in retail sites for health services — especially for vision exams, healthy food preparation education, routine care check-ups, minor medical issues, managing chronic conditions, and using the store for nutrition support both with a nutritionist and for recipe tips.

Regarding the one-half of people who would be interested in an exercise class at a retail store, note that Hy-Vee grocery began collaborating on that concept with Orangetheory fitness in 2017.

And as if on-cue with this study, Hy-Vee announced its hiring of a Chief Medical Officer on July 9th, to bolster the grocer’s health and wellness services.

Acosta recommends that retailers can capitalize on health and wellness trends driving loyalty to stores and programs built on solutions that are most meaningful to people.

Health Populi’s Hot Points: A central pillar of user-centered design is to meet people where they “are.”

Health Populi’s Hot Points: A central pillar of user-centered design is to meet people where they “are.”

And many people have been at, or are returning to, the grocery and Big Box store in this endemic phase of the COVID-19 pandemic.

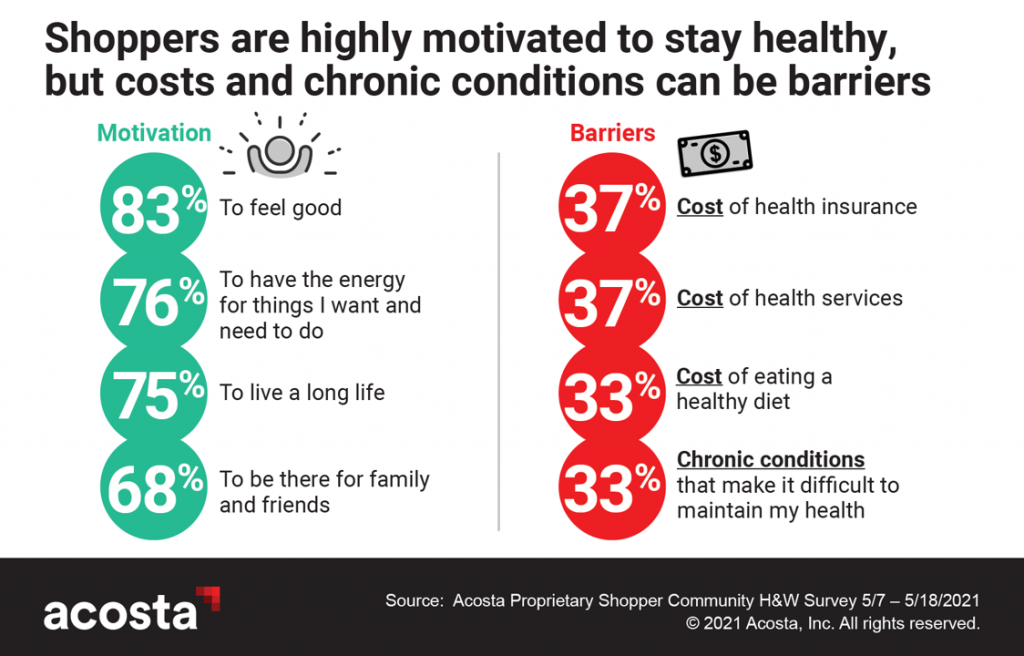

Acosta uncovered motivations to stay healthy, and barriers to health:

- Peoples’ key motivations are to feel good, to have energy to do the things we want and need to do, to live long lives, and to “be there” for family and friends; and,

- Major barriers to getting healthy and making health are the costs of health insurance, health service, and eating a healthy diet, along with one-third of people saying their chronic medical conditions make it difficult to maintain their health.

In the context of growing consumer-directed health in the U.S., I’ve been pointing to a seminal essay in JAMA titled, “Value-based payment requires valuing what matters to patients.” This viewpoint looks like ancient history based on its publication date of October 2015, but it’s more timely than ever post-pandemic.

That one-third of people attesting that chronic conditions make it difficult to maintain health is retail’s opportunity to partner with the legacy health/care stakeholders — with hospital systems, physicians and nurses in local communities, and with pharma and life science companies who are looking to add value “beyond the pill.”

That one-third of people attesting that chronic conditions make it difficult to maintain health is retail’s opportunity to partner with the legacy health/care stakeholders — with hospital systems, physicians and nurses in local communities, and with pharma and life science companies who are looking to add value “beyond the pill.”

Consumers-as-patients are seeking and hungry for help and support to get healthy and stay that way. Top health sources for information revealed in the Acosta study lead with medical professionals across all consumers — for the “Active” cohort, health-oriented websites beat medical sources, and product labels in-store are tied for expertise with medical professionals.

So this triad of medical expertise, health websites online, and product labels can be a powerful combination and collaborative strategy, marrying food-as-medicine recommendations in the store based on the evidence base for various health conditions.

This must be done in the context of cost and value, noting that costs across several dimensions are barriers to some consumers’ ability to seek healthy lifestyles and product/service purchases out-of-pocket. Tie this to my recent post on Dollar General appointing the company’s first Chief Medical Officer, and you get a sense of the supply-side Zeitgeist getting organized to meet peoples’ growing demand for self-care at and close-to-home.

Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a