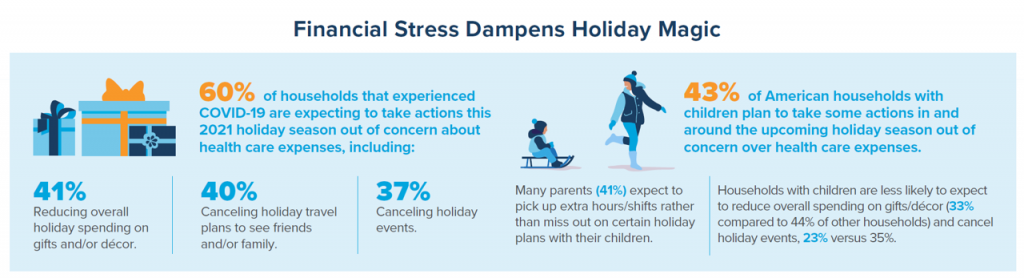

Most U.S. householders that experienced COVID-19 expect their 2021 December holidays will be impacted in terms of reducing their holiday gift or decor spending, canceling holiday travel plans to see family or friends, or canceling holiday events, according to the 2021 Aflac Health Care Issues Survey.

Aflac polled 1,003 U.S. adults in September 2021 to gauge Americans’ financial health perspectives approaching the end of Year 2 of the COVID-19 pandemic in America.

Families with children feel particularly strapped for the 2021 holiday season: while they will be less likely to reduce holiday spending, one-half are concerned about medical expenses compared with one year ago. Families with kids were more than twice as likely to add hours or shifts to their work schedules, and twice-as likely to take money out of their retirement savings/401(k).

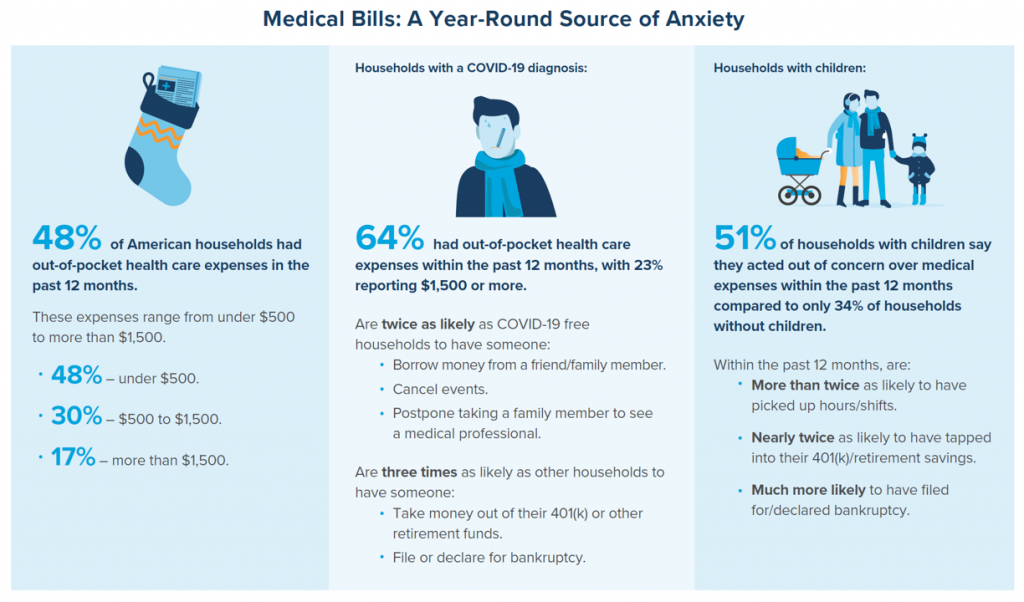

In fact, medical bill angst in America isn’t just a December holidays thing: they’re a year-round source of anxiety, Aflac found.

In fact, medical bill angst in America isn’t just a December holidays thing: they’re a year-round source of anxiety, Aflac found.

And those families impacted by COVID-19 were twice as likely to have someone borrow money from a friend or family member or postpone taking a family member to see a medical professional.

Furthermore, people in the U.S. impacted by COVID-19 in their household were three times as likely to take money out of their 401(k) retirement plan or file for/declare bankruptcy, the survey learned.

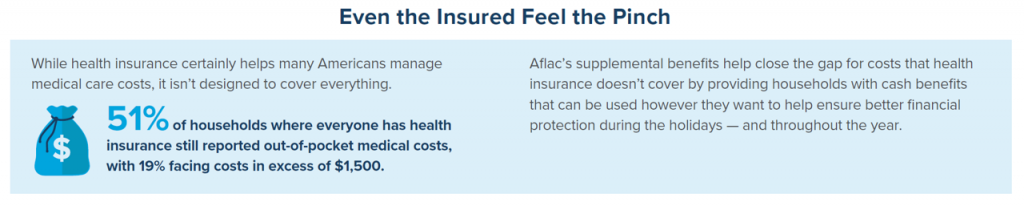

Health Populi’s Hot Points: Aflac also looked at Americans’ state of financial health comparing people who had health insurance versus those who were uninsured in 2021.

Health Populi’s Hot Points: Aflac also looked at Americans’ state of financial health comparing people who had health insurance versus those who were uninsured in 2021.

“Even the insured feel the pinch,” Aflac concluded, noting that among the one-half of households where every member had health insurance coverage, 19% generated out-of-pocket costs over $1,500.

“Prices for food and gas are rising sharply, Is health care next? Dylan Scott asks in a Vox essay published 27 November. Scott mines data from Chartis and Altarum, concluding that, indeed,

Medical inflation would ultimately end up raising costs to patients in two distinct ways. First, if providers negotiate higher payments from insurers to make up for their increasing costs, the insurer will turn around and increase premiums for its customers. But patients also feel the rising costs more directly because they are being asked to pay more money out of pocket for their health care. Deductibles and other cost-sharing have been steadily rising for the 180 million Americans enrolled in commercial health plans. At the same time, the number of Americans considered underinsured — meaning they do carry insurance but the insurance would not necessarily provide them adequate financial protection if they had a medical emergency — has been growing….They’ll end up getting squeezed from both sides.

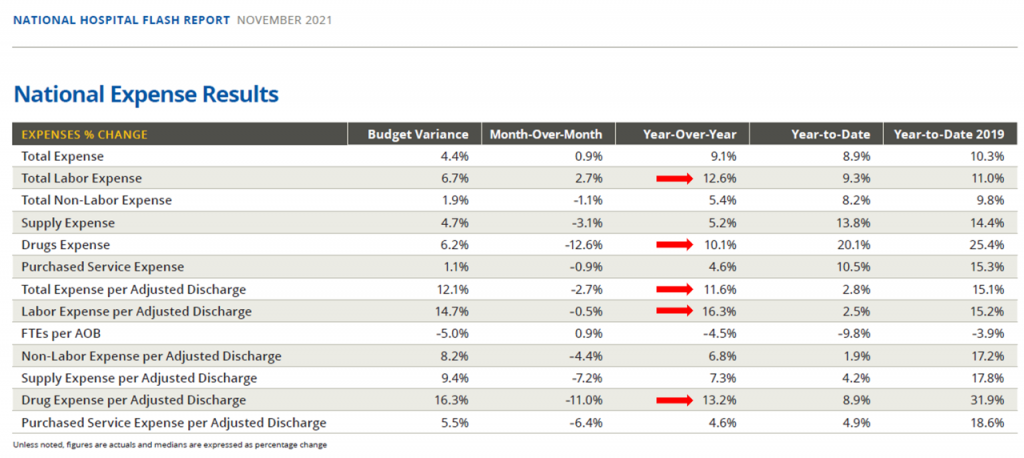

I agree, bolstering the forecast with the latest data from Kaufman Hall’s Hospital Flash Report for November 2021 (published 30th November). Their top line is that hospital margins dropped for a second month as expenses climbed year-over-year, 2020-2021.

I agree, bolstering the forecast with the latest data from Kaufman Hall’s Hospital Flash Report for November 2021 (published 30th November). Their top line is that hospital margins dropped for a second month as expenses climbed year-over-year, 2020-2021.

The last table comes from Kaufman Hall’s latest report, focusing on hospital expenses on a national U.S. basis. Note double-digit increases, year-over-year, for labor and drug expenses, both overall and per adjusted discharge.

Total expenses per adjusted discharge all-in grew by 11.6%.

This hospital expense profile reinforces Vox’s Dylan Scott’s expectation that U.S. patients could “end up getting squeezed from ‘both’ sides” — that is, from both health insurance companies and from health care providers.

Expect health care costs to remain on U.S. voters’ top-of-mind issues for health care and overall election priorities for mid-terms 2022. Both drug and medical spending in U.S. households will play larger roles in 2022 as health citizens muddle through Year 3 of the Coronavirus, USA version.

Thank you FeedSpot for

Thank you FeedSpot for